- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Long Call & Long Put: How to Trade with Long Call & Long Put?

By HDFC SKY | Updated at: Sep 15, 2025 08:51 PM IST

Derivative trading offers immense earning potential, provided the trader adopts the right trading strategy. There are several such strategies used by traders on a daily basis, depending upon their views on the market movement.

The long Call and Long Put Option strategy is the most basic and widely used among several available by traders or investors to hedge their position. Similar to stock buying and selling, the Long Call and Long Put Option strategy is used for realising gains by a trader with a long or short view of the market or an individual stock.

The investment involved in this strategy revolves around the contract lot size (in the case of indices – Nifty & Bank Nifty, the lot size is 50 and 25, respectively, while for individual stocks it varies) and the losses are limited to the premium paid while entering the trade. Earnings potentials are immense as on a given day, they can rise in multiples. However, the trader runs the risk of losing the entire premium if the trade is left uncovered. Let’s dwell in detail and understand how.

Long Call

For most first-time traders buying a call option has been a favourite trading strategy. Most traders are optimistic about tomorrow in general and about the financial markets in particular. No wonder, they see prices going up and buying a call is a logical outcome. Let us see how it works:

When to initiate?

When a trader expects the price of an underlying security to go up, he may prefer to purchase a call option. The trader has a positive view of the underlying for a specific time period.

Why initiate?

A trader keen on benefitting from the upward movement in the stock price without committing a large pool of capital may look at this strategy. This strategy allows the trader to take exposure to stocks by paying a small premium. It brings in leverage, which makes it attractive. Otherwise, the trader has to pay in full for all the shares he wants to buy. The premium so paid gives the call option buyer a right but not the obligation to purchase the underlying security at the strike price of the option.

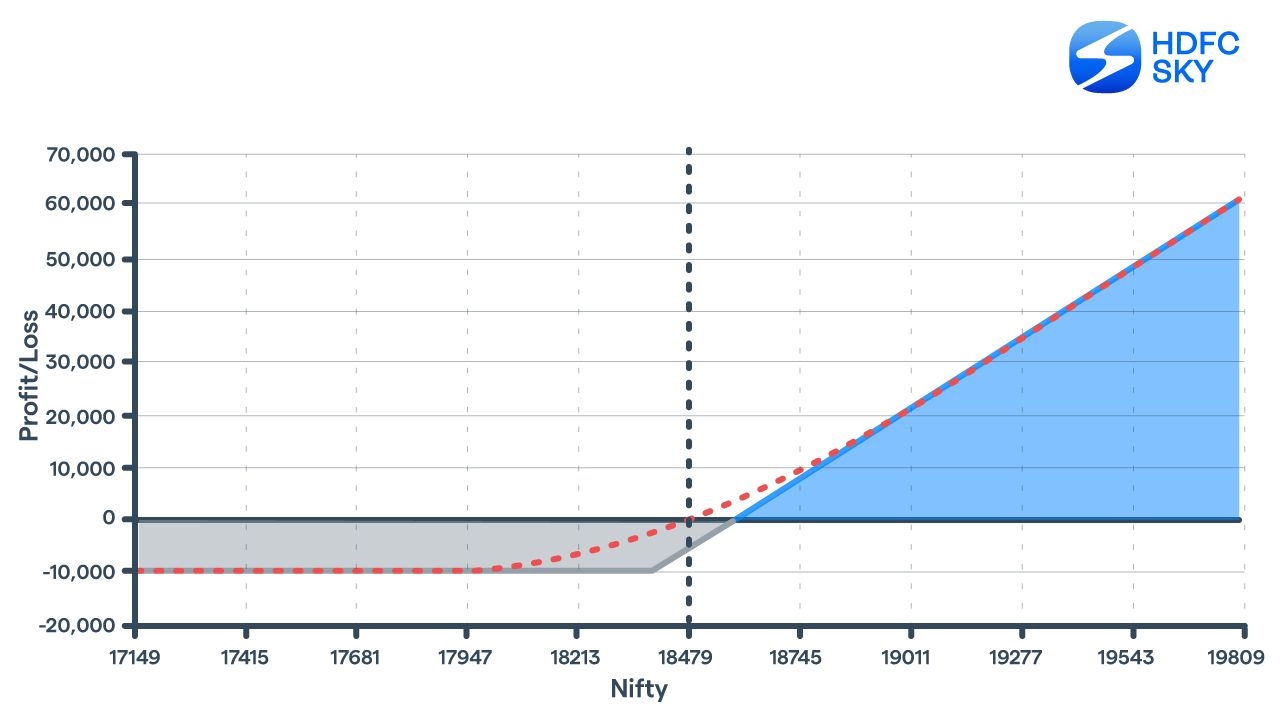

What are the payoffs?

The long call strategy has a predefined limited amount of loss – the amount of premium paid if the price of the underlying stock or index does not go above the strike price. The buyer of the call option has the scope to make unlimited profits. If the stock or index goes above the strike price, then the amount of profit for the call option buyer is the market price minus the strike price minus the premium paid.

How does the strategy work?

After buying a call option the buyer has the right to sell it any time in the market and square off the trade if he wants to book his profit or loss. The premium oscillates as the underlying stock or index’s price changes. If the price keeps trending in the upward direction and the volatility increases then the premium also goes up, other things remaining the same. If the price of the underlying tanks, then the premium also falls. As the call option nears the expiry, the premium goes down, other things remain the same. This time decay eats into the premium. Put simply, the trader is better off if the stock price moves up quickly.

Traders generally buy an at-the-money option if they expect the price to inch up. However, if the trader expects a big move in the price of the underlying, then he may buy an out of the money call option. The premium payable is less in the case of the latter, compared to the former. For far-out-the-money call options, the premium charged is even smaller. Traders must keep in mind that the option seller for the far out of the money option charges a small premium because of the relatively less probability of materializing the expected large price move compared to an at the money or an option where the strike price is a tad above the current market price.

Here, volatility plays an important role. If the price of the underlying stock goes up, but volatility does not rise, then the premium does not increase. This can generally happen during results season because volatility contracts once the results are out.

Example:

Nifty Closes at 18,484.10 on November 24, 2022.

Nifty 01DEC2022 CE 18,400 quotes at Rs 192.05

The call option buyer will make money if the Nifty closes on the day of expiry (01DEC2022) above 18,400 + 192.05 = 18,592.05, assuming zero* brokerage and transaction cost.

If the Nifty closes at 18,700, then the profit for the option buyer is 18,700 – 18,400 – 192.05 = Rs 107.95 multiplied by the contract size, i.e., 50 (for Nifty option) = Rs 5,397.5.

Long Put

At times the markets turn volatile, and there is a fair chance that the price of securities may go down. In such circumstances, a trader may have a bearish view of the price of a stock or an index. Hence, he may want to buy a put option of a security on which he has a negative view.

When to initiate:

When the price of a stock is expected to go down, then a put option is bought. The trader expects the stock or the index to trade below the strike price of the put option before the expiry of the option.

Why initiate?

A trader keen on benefitting from the downward movement in the stock price without committing a large pool of capital may look at this strategy. This strategy allows the trader to take exposure to stocks by paying a small premium. It also brings in leverage. Otherwise, the trader would have been asked to pay in full for all the shares he wants to short sell. The premium so paid gives the put option buyer a right but not the obligation to sell the underlying security at the strike price of the option.

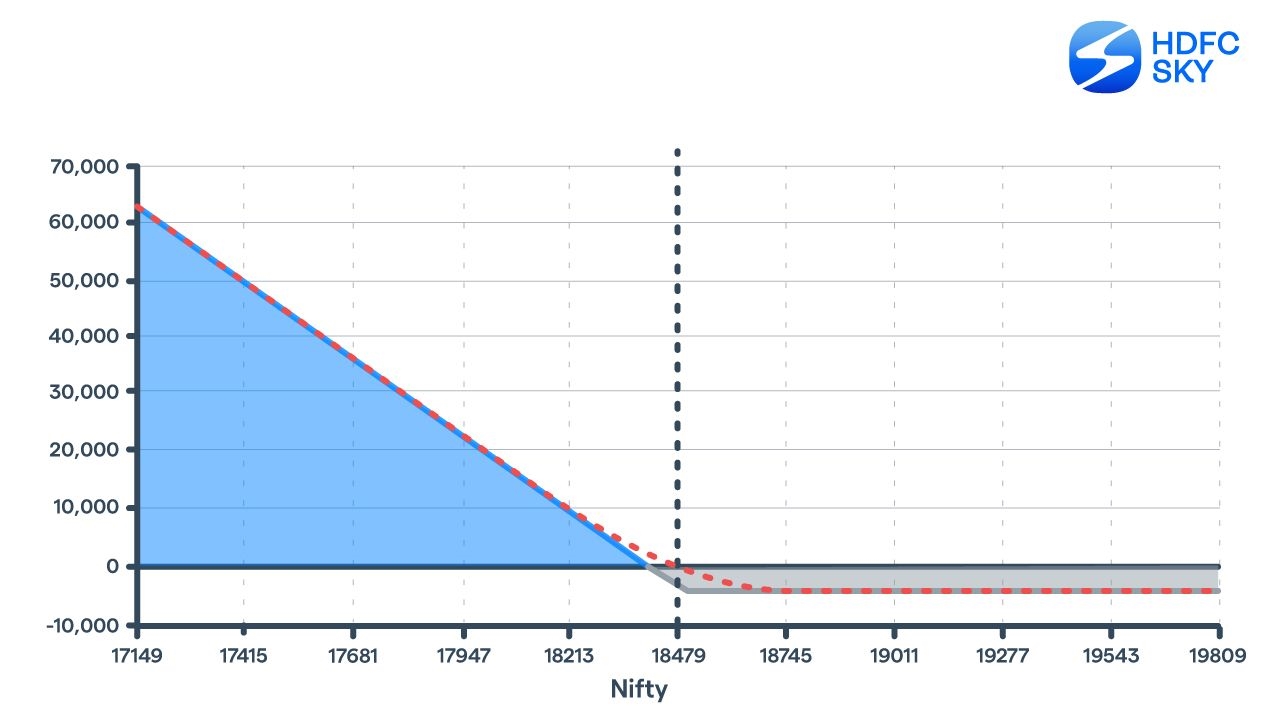

What are payoffs?

The long put strategy has a predefined limited amount of loss – the amount of premium paid if the stock or index does not go below the strike price. The buyer of the put option has the scope to make profits till the price tends to zero. If the stock or index goes below the strike price, then the amount of profit the put option buyer makes is the strike price minus the market price minus the premium paid.

How does the strategy work?

After buying a put option, the buyer has the right to sell it at any time in the market and square off the trade if he wants to book his profit or loss. The premium oscillates as the underlying stock or index’s price changes. If the price keeps trending down and the volatility increases, then the premium also goes up, other things remaining the same. If the price of the underlying rises, then the premium falls. As the put option nears the expiry, the premium goes down, other things remaining the same. This time decay eats into the premium. Put simply, the trader is better off if the stock price moves down quickly.

Traders generally buy an at the money option if they expect the price to go down. However, if the trader expects a big move in the price of the underlying, then he may buy an out of the money put option. The premium payable is less in the case of the latter compared to the former. For far out the money put options, the premium charged is even smaller. Traders must keep in mind that the option seller for the far out of the money option charges a small premium because of relatively less probability of materializing the expected price move compared to an at the money or an option where the strike price is a tad below the current market price.

Example:

Nifty Closes at 18,484.10 on November 24, 2022.

Nifty 01DEC2022 PE 18500 quotes at Rs 87.55

The put option buyer will make money if the Nifty closes on the day of expiry (01DEC2022) below 18,500-87.55 = 18,412.45, assuming zero* brokerage and transaction cost.

If the Nifty closes at 18,300, then the profit for the option buyer is 18,500 – 18,300 – 87.55 = 112.45 rupees multiplied by the contract size, i.e. 50 (for Nifty option) = Rs 5,622.5.

Conclusion:

Buying a call option or put option is the simplest thing a trader can do. It requires less capital compared to a position in the cash market. However, a prudent approach involves the right selection of the security and the right strike price in the right direction.