- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Long Call Butterfly & Short Call Butterfly: Option Strategies

By HDFC SKY | Updated at: May 18, 2025 11:13 PM IST

In very few cases, option buyers make money, which is a fact established globally. Though option sellers make money, they run a very high risk. That makes traders look for alternatives wherein they can sell options but also limit their losses. Butterfly strategies come into play when the trader does not want to take the risk of shorting a straddle or strangle.

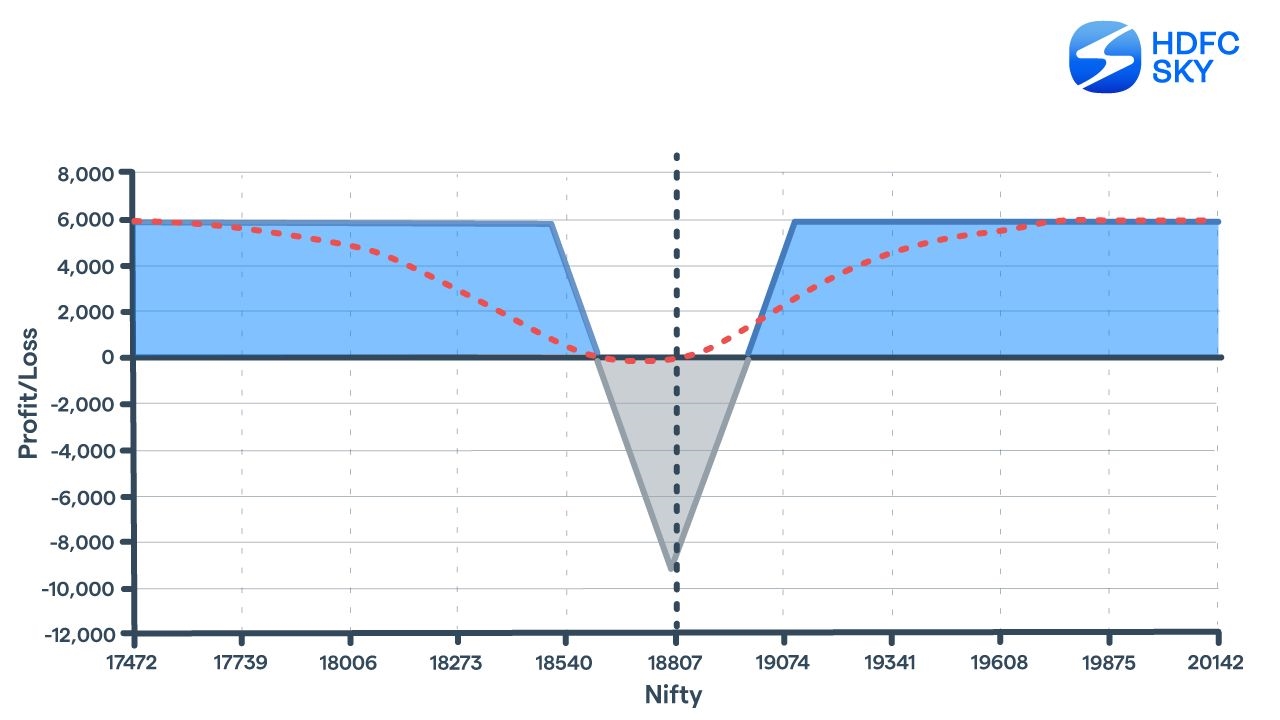

Long Call Butterfly

Long call butterfly is a strategy useful when the trader is of the view that the market is not going to move much. This strategy works when the volatility is low, and the trader is keen to benefit from it with a low-cost strategy.

What are the payoffs?

The trader sells two at the money (ATM) call options. At the same time, he buys an in the money (ITM) call option and buys an out of the money (OTM) call option. All these options must be of the same expiration date and on the same underlying. For the ATM options sold, the trader receives a premium, and for the ITM and OTM options bought, he has to pay the premium. Both these actions – selling two ATM call options and buying an OTM and an ITM call option have to be done simultaneously. Both the options bought should be equidistance to the spot price at the time of entering the trade.

The trader makes maximum profit when the underlying’s price trades near the mid-point (ATM call option’s strike price). The maximum loss takes place when the underlying’s price quotes close to the strike price of any of the options bought.

How does the strategy work?

After initiating a Long Call Butterfly, the trader can square off all these positions- short ATM calls, long ITM call options and long OTM call options. He can book his profits or loss by doing so. To close the strategy, the trader has to square off all three options. Squaring off only one would lead him to a situation where he still has open positions.

The premium oscillates as the underlying stock or index’s price changes. As the call options near the expiry, the theta decay takes over, and the premium on the option starts going down, other things remaining the same. ITM call option premium erode slowly compared to the premium on the OTM call.

If the underlying’s price on the day of expiry closes near the spot price at the time of entry (or the strike price of the ATM calls sold), then the premium received is pocketed on the options sold. The ITM call option premium also paid generally goes down and incurs some loss, and the OTM call option premium paid is completely lost.

The premium paid for the OTM call option and ITM call option reduces the risk if the price of underlying swings too much. For this protection, the trader has to pay a premium. If he buys call options too close to the spot, then the quantum of possible loss stand minimized, but in that case,

the premium is also high. If he buys a far out of the money call option, then the premium he pays is low, but the quantum of possible loss increases.

Though the possibility of maximum loss and maximum profit is well defined, there are traders who keep a stop loss based on the maximum loss they want to take per trade. For example, a trader may want to risk only, say, 5% of his capital on a trade.

Example:

Nifty closes at 18,812

The trader sells two NIFTY 08 DEC 2022 18800 CE at Rs 139

He buys one NIFTY 08 DEC 2022 18500 CE at Rs 368

He buys one NIFTY 08DEC 2022 19100 CE at Rs 27

If the Nifty closes at 18,800, then the trader makes a profit of Rs 13,900 on the two ATM options sold. But he incurs a loss of Rs 3,400 on the ITM option bought and a loss of Rs 1,350 on the OTM option bought. Effectively a profit of Rs 9,175.

If the Nifty closes at 18,500, then the trader makes a profit of Rs 13,900 on the two ATM options sold. But he incurs a loss of Rs 18,400 on the ITM option bought and a loss of Rs 1,350 on the OTM option bought. Effectively a loss of Rs 5,850.

If the Nifty closes at 19,100, then the trader makes a loss of Rs 16,100 on the two ATM options sold. But he makes a profit of Rs 11,600 on the ITM option bought, and a loss of Rs 1,350 on the OTM option bought. Effectively a loss of Rs 5,850.

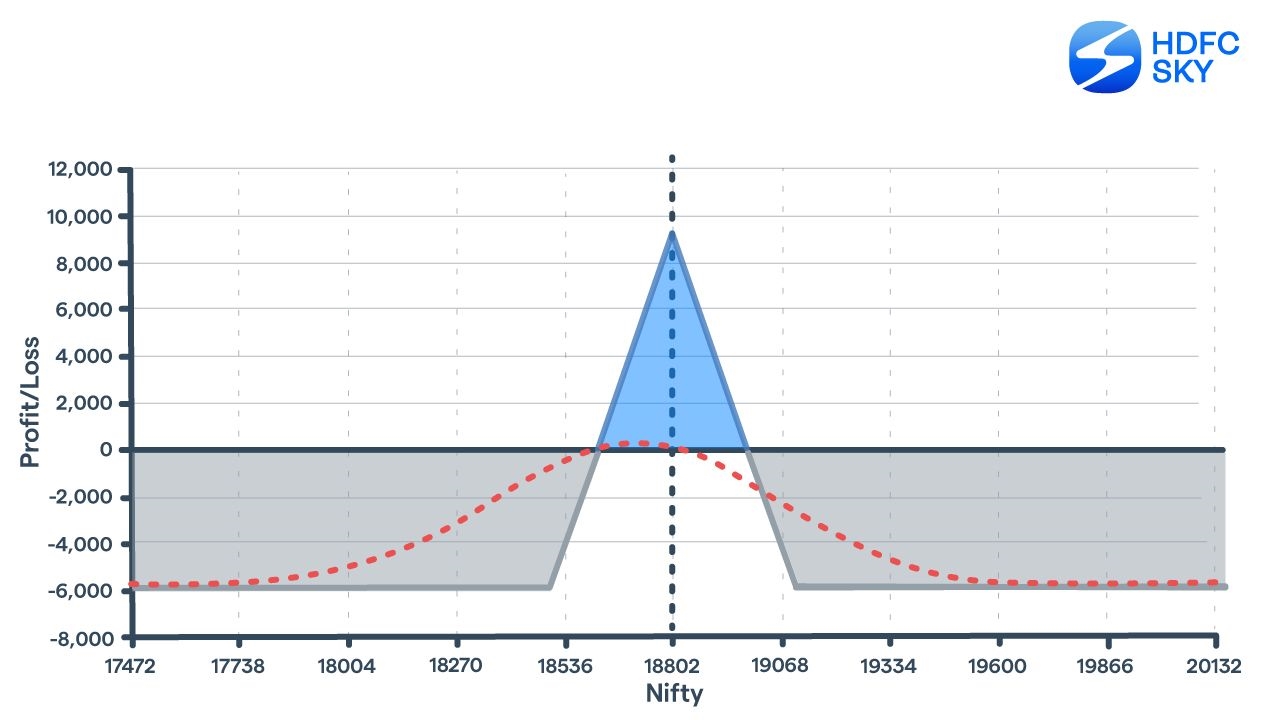

Short Call Butterfly

Short call butterfly is a strategy useful when the trader is of the view that the market is going to make a big move. This strategy is a non-directional strategy. This strategy works when the volatility is going to increase, and the trader is keen to benefit from it.

What are the payoffs?

The trader buys two at the money (ATM) call options. At the same time, he sells an in the money (ITM) call option and sells an out of the money (OTM) call option. All these options must be of the same expiration date and on the same underlying. For the ATM options bought, the trader pays a premium and for the ITM and OTM options sold, he receives the premium. Both these actions – buying two ATM call options and selling an OTM and an ITM call option has to be done simultaneously. Both the options sold should be equidistance to the spot price at the time of entering the trade.

The trader makes a maximum loss when the underlying’s price trades near the mid-point (ATM call option’s strike price). The maximum profit is made when the underlying’s price quotes close to the strike price of any of the options sold.

How does the strategy work?

After initiating a short Call Butterfly, the trader can square off all these positions – long ATM calls, short ITM call options and short OTM call option. He can book his profits or loss by doing so. To close the strategy, the trader has to square off all three options.

The premium oscillates as the underlying stock or index’s price changes. As the call options near the expiry, the theta decay takes over, and the premium on the option starts going down, other things remaining the same. ITM call option premium erode slowly compared to the premium on the OTM call.

If the underlying’s price on the day of expiry closes near the spot price at the time of entry (or the strike price of the ATM calls sold), then the premium paid for the ATM options bought is lost. The premium on the ITM call option generally goes down and makes a profit, and the OTM call option premium also goes down and makes some money.

Though the possibility of maximum loss and maximum profit is well defined, there are traders who keep a stop loss based on the maximum loss they want to take per trade. For example, a trader may want to risk only say 5% of his capital on a trade.

Example:

Nifty closes at 18,812

A trader buys two NIFTY 08 DEC 2022 18800 CE at Rs 139

He sells one NIFTY 08 DEC 20222 18500 CE at Rs 368

He sells one NIFTY 08 DEC 2022 19100 CE at Rs 27

If the Nifty closes at 18,812, then the trader makes a loss of Rs 13,900 on the two ATM options bought. But he makes a profit of Rs 3,400 on the ITM option sold and makes a profit of Rs 1,350 on the OTM option sold. Effectively a loss of Rs 6,600.

If the Nifty closes at 18,500, then the trader makes a loss of Rs 13,900 on the two ATM options bought. But he makes a profit of Rs 18,400 on the ITM option sold and makes a profit of Rs 1,350 on the OTM option sold. Effectively a profit of Rs 5,850.

If the Nifty closes at 19,100, then the trader makes a profit of Rs 16,100 on the two ATM options bought. But he makes a loss of Rs 11,400 on the ITM option sold and a profit of Rs 1,350 on the OTM option sold. Effectively a profit of Rs 5,850.