- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Long Straddle and Short Straddle

By HDFC SKY | Updated at: Apr 24, 2025 03:08 PM IST

Summary

In our series of derivatives trading with exotic options strategies, the Long Straddle and Short Straddle are the most used event-based strategy by savvy traders in order to pre-empt unforeseen outcomes.

Basically, traders with no view on the underlying security or index may want to trade using a straddle. They anticipate a large move in the prices but do not know in which direction. In such cases, straddle come into the picture. For example, a straddle can be considered ahead of monetary policy announcements or earning announcements of a company. Some traders initiate straddle even for intra-day trades with clearly specified stop losses.

When to initiate?

This strategy is initiated when the trader anticipates a big move in prices in the near term, and the trader does not have a clear idea in which direction (up or down) the price of the underlying will go.

Why initiate?

A direction-neutral trader keen on taking advantage of the price movement can benefit from the straddle.

What are the payoffs?

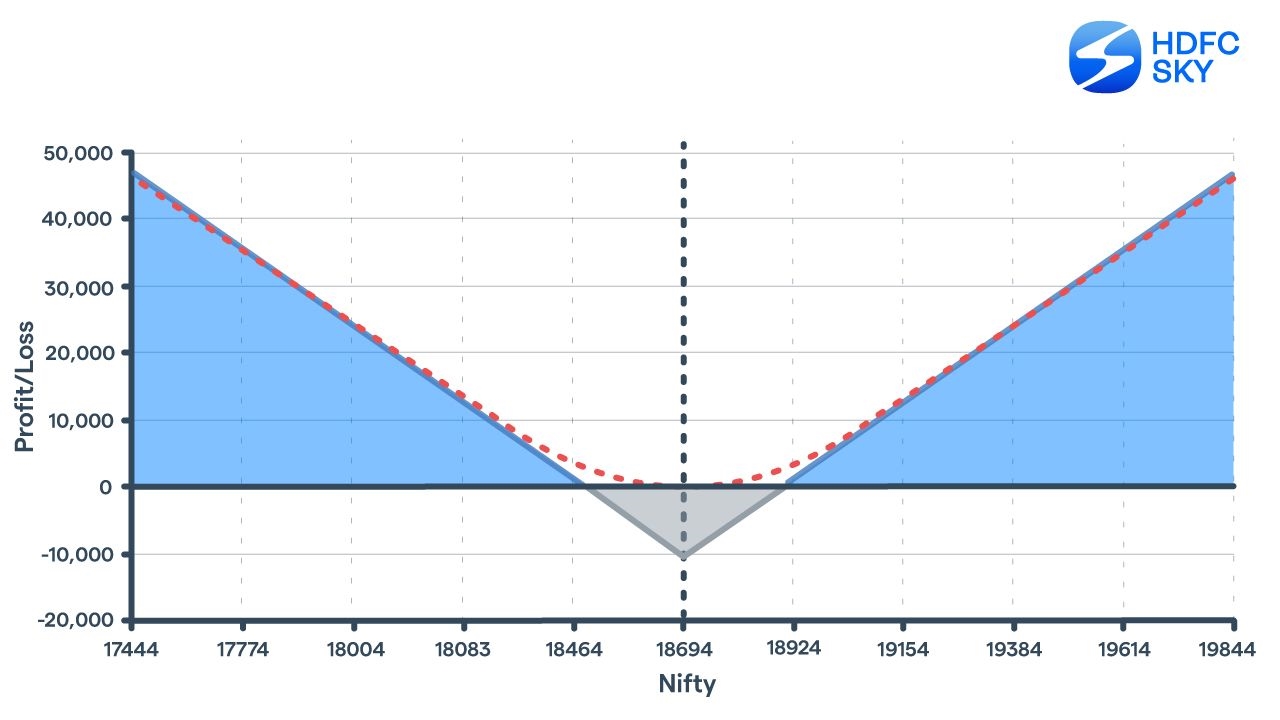

Long Straddle involves buying a call option and a put option of the same strike price. Since the trader is buying a call option and a put option, he pays the premium for acquiring the right but not the obligation to participate in the price moves in both directions. Typically, while executing a long straddle strategy, the traders buy at the money put and call options. Since the strike price is close to the spot price, the premium payable is more than the premium payable on out of the money options.

If the price of the underlying moves fast in either direction, then the price of that option goes up. Larger the move, the larger the uptick in the premium of the option. Of course, the option on the other side loses value quickly.

If contrary to the expectation of a large movement in either direction, the price of the underlying does not move at all or moves a little, then the premium on both call and put options starts falling. In that case, the trader incurs losses on both sides.

How Does the Strategy Work?

Ahead of a big event which is typically known to the market, the expected volatility is also high. That ensures that the premium is also high. The trader buys both call option and put option of the same strike price – typically very close to the spot price of the underlying stock or index.

After the event outcome, the market participants analyse the outcome and the price of the underlying moves. For the purpose of simplicity, let’s assume that the price goes up substantially, in

that case, the premium on the call option goes up and the premium on the put option starts going down.

The trader can, at the time of entry into this strategy can, key in stop loss prices on both the call option and put option. As the prices move immediately after the event, the stop loss gets triggered. In the above case, the put option gets sold. Then the trader holds on to the remaining option – the call option in the above case and exits as his price objective is reached.

If the event proves to be a non-event, the price of the underlying does not move or moves a little. In that case, the premium on both the call option and put option comes down. If the premium reaches the stop loss level, then the options are sold in the market.

This way, the losses are minimized, and the profits are allowed to run.

Example

Nifty closes at 18,696.1 on December 01, 2022

Trader anticipates big volatility amid expiry. On the one hand, the selloff in US equities may run off on Indian stocks, and hence Indian equities are expected to fall big, and on the other hand, the crude oil prices are down, which should ensure lower inflation and better earnings growth ahead, which should take Nifty to a new high. The trader does not know which way the Nifty will move. But is sure that the move is going to be big. So, he decides to go for a long straddle strategy.

He buys NIFTY 08 DEC 18700 PE at Rs 92.3 and NIFTY 08 DEC 18700 CE at Rs 115.8. The total premium payment stands at Rs 208.1 x 50 = Rs 10,405.

The stop loss on both the call option and put option is kept at a stipulated level, say 20% below the cost of acquisition.

If the Nifty spot moves to 19,000, then the call option will make money, whereas the put option will hit the stop loss placed at Rs 73.84. In this move, the payoff for the trader will be the profit on the call option minus the loss on the put option.

Profit on the call option is 19000 – 18700 – 115.8 = 184.2 For a lot size of 50, it is = Rs 9,210.

Loss on the put option is Rs 92.3 – Rs 73.84 = Rs 18.46. For a lot size of 50, it is = Rs 923.

Hence, for the long straddle in the above scenario, the payoff is Rs 9,210 – Rs 923 = Rs 8,287

If the Nifty falls big, the put option makes money, and the stop loss on call option gets triggered.

If the Nifty does not make a big move and remains close to the spot price, then the premium gradually starts coming down. In that case, both stop losses get hit. In that case, the total loss is Rs 2,081. {Rs 18.46 loss on PE and Rs 23.16 loss on CE, at 20% of the cost of acquisition}.

In rare cases, the underlying index moves in one direction quickly, which leads to the stop loss getting triggered on the other side. Then the underlying moves in the opposite direction equally fast and the option in the profit also gives losses. Smart traders hence do not hold the straddle for long. They prefer to book profits quickly.

Since you are buying options in a long straddle strategy, booking profits quickly is far more important, as the time decay eats into the premium. Stop losses keyed in, help you protect your capital.

Now let’s look at short straddle and how it helps.

Why a short straddle?

Smart traders know that most of the time, the best of the expectations are in price, and after the news, the market does not really react in the same direction or reacts far less. For example, ahead of monetary policy, everyone may anticipate a 50 basis points hike in the repo rate. This may have been factored in the Bank Nifty level. If the outcome is on the lines of the expectation, then the index may not move much. In such cases, it makes sense to sell options and pocket the premium, which is typically at an elevated level due to the expectation of a large move.

What are the payoffs?

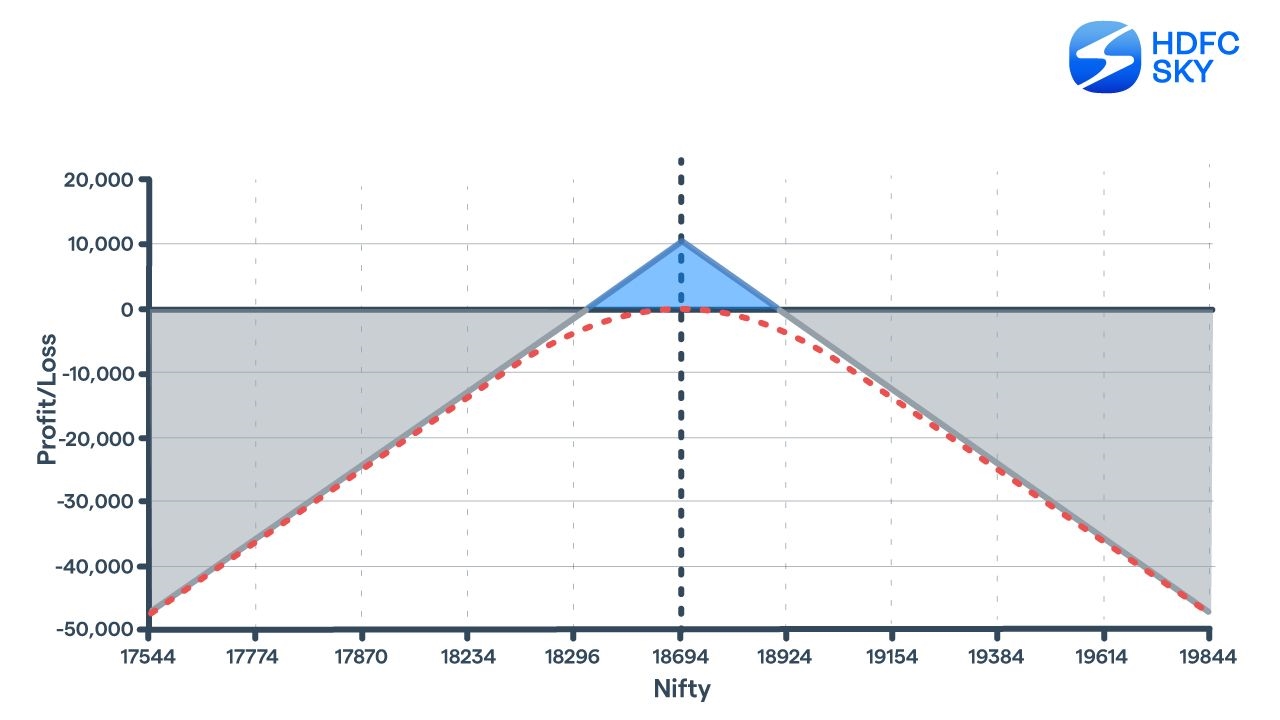

Short Straddle involves selling a call option and a put option of the same strike price. Since the trader is selling a call option and put option, he receives the premium for transferring the right but not the obligation to the option buyer to participate in the price moves in both directions. Typically, while executing a short straddle strategy, the traders sell at the money put and call options. Since the strike price is close to the spot price, the premium receivable is more than the premium receivable on out of the money options.

If the price of the underlying moves fast in either direction, then the price of that option goes up. Larger the move, the larger the uptick in the premium of the option. That is where the stop loss should be introduced, and the losses should be booked out quickly. Of course, the option on the other side loses value quickly. That is where the money is to be made.

If, contrary to the expectation of a large movement in either direction, the price of the underlying does not move at all or moves a little, then the premium on both call and put option start falling. In that case, the trader makes money on both sides.

Since short straddle involves the selling of options, the trader has to keep a large margin in place.

How does the strategy work?

As we know, the expected volatility is high ahead of a big event in the market. This ensures a high premium. The trader sells both call option and put option of the same strike price, which is typically very close to the spot price of the underlying stock or index.

After the event outcome, the market participants analyse the outcome and the price of the underlying moves. Let’s assume that the price goes up substantially. In that case, the premium on the call option goes up and the premium on the put option starts going down.

The trader can, at the time of entry into this strategy, create stop loss prices on both call option and put option – say at a price 20% higher than the cost of selling for each option. As the prices move immediately after the event, the stop loss gets triggered. In the above case, the call option gets bought. Then the trader holds on to the remaining option – the put option in the above case and exits as his price objective is reached or the premium goes near zero.

If it is a non-event, the price of the underlying does not move or moves a little. Here, the premium on both call option and put option falls. That is the best outcome for a short straddle strategy. The trader gets to keep the premium.

As the trader is selling options, the losses can be unlimited, the stop loss needs to be adhered to ensure that the losses are minimized.

Example

Nifty closes at 18,696.1 on December 01, 2022

Trader anticipates big volatility ahead of expiry. On the one hand, the sell-off in US equities may pressure the Indian stocks, and hence the Indian equities are expected to fall big. While on the other hand, crude oil prices have fallen considerably, surfacing hopes of lower inflation and better earnings growth ahead, which should take the Nifty to a new high. The trader, however, does not expect the Nifty to move much. Hence, he decides to go for a short straddle strategy.

He sells Nifty 08 DEC 18700 PE at Rs 92.3 and NIFTY 08 DEC 18700 CE at Rs 115.8. The total premium received stands at Rs 208.1 x 50 = Rs 10,405.

The stop loss on both the call option and put option is kept at a stipulated level, say 20% above the cost of acquisition for each option.

If the Nifty remains close to the spot price and does not move heavily, then the premium gradually starts falling. Here, the trader can book profit. If the Nifty closes at 18700, then he gets to keep the entire premium.

If the Nifty spot moves to 19,000, then the premium on the call option shoots up, and the stop loss gets triggered. Whereas the premium on the put option goes down. In this case, the payoff for the trader will be the profit on the put option minus the loss on the call option.

Profit on the Put option assuming the premium goes to zero: = Rs 92.3 – Rs 0 = Rs 92.3. For the lot size of 50, the profit stands at Rs 4,615.

Loss on the Call option: = Cost of buying it back (Rs 138.96) – premium received at the time of selling (Rs 115.8) = Rs 23.16. For the lot size of 50, the loss stands at Rs 1,158.

Hence the payoff for this strategy is Rs 4,615 – Rs 1,158 = Rs 3,457.

Short straddle can be an effective play for traders who understand money management and can manage their trades effectively by sticking to stop losses.

Since you are selling options in a short straddle strategy, time decay is your friend. It eats the premium. If the price movement is slow or far below the anticipated, then the premium falls, and the trader is more likely to make money.