- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Lumino industries IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Lumino industries IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

About Lumino industries Limited

Lumino Industries Limited, headquartered in Kolkata with a manufacturing facility in Howrah, India, brings over three decades of expertise in the power and energy sector. The company is committed to powering lives, connecting people, and enabling growth. As a leading manufacturer, it offers a wide range of products, including cables, conductors, and wires. Additionally, as a major player in Engineering, Procurement, and Construction (EPC), Lumino Industries delivers projects in key infrastructure sectors such as distribution and transmission, railway electrification, reconductoring with HTLS conductors, solar power projects, and EHV substations.

Lumino industries Limited IPO Overview

Lumino Industries IPO is a book-building issue of ₹1,000.00 crores, consisting of a fresh issue of ₹600.00 crores and an offer for sale of ₹400.00 crores. The IPO dates and price band are yet to be announced, and the allotment is expected to be finalised soon. Motilal Oswal Investment Advisors Limited, JM Financial Limited, and Monarch Networth Capital Ltd are the book running lead managers, while Bigshare Services Pvt Ltd is the registrar. For detailed information, investors can refer to the Lumino Industries IPO Draft Red Herring Prospectus (DRHP). The pre-issue shareholding stands at 24,35,78,096 shares. The DRHP was filed with SEBI on January 23, 2025. The company’s promoters are Purushottam Dass Goel, Devendra Goel, and Jay Goel, with a 100% shareholding before the issue. Post-issue shareholding details will be updated after finalisation.

Lumino industries Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹600 crore

Offer for Sale (OFS): ₹400 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 24,35,78,096 shares |

| Shareholding post -issue | TBA |

Lumino industries Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Lumino industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Lumino industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.56 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 21.52% |

| Net Asset Value (NAV) | 18.30 |

| Return on Equity | 21.52% |

| Return on Capital Employed (ROCE) | 19.60% |

| EBITDA Margin | 10.14% |

| PAT Margin | 6.07% |

| Debt to Equity Ratio | 0.69 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding prepayment, repayment and/ or payment obligations to lenders towards borrowings and Acceptances, in part or full | 4200 |

| Capital expenditure for purchase of equipment and machinery, civil works and interior development of an existing

manufacturing facility |

150.83 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

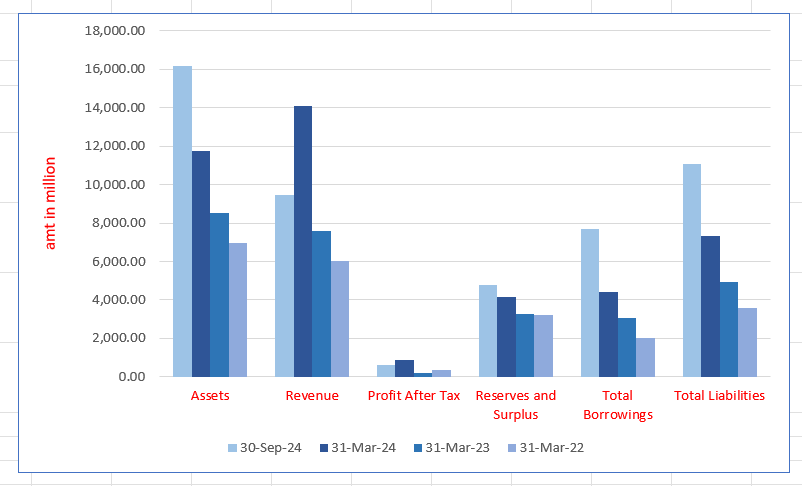

Lumino industries Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 16,180.57 | 11,767.41 | 8511.38 | 6973.44 |

| Revenue | 9476.21 | 14,073.15 | 7602.12 | 6040.11 |

| Profit After Tax | 636.96 | 866.07 | 193.98 | 337.37 |

| Reserves and Surplus | 4790.66 | 4155.21 | 3289.55 | 3202.12 |

| Total Borrowings | 7699.74 | 4422.69 | 3054.27 | 1999.51 |

| Total Liabilities | 11,085.44 | 7307.73 | 4917.36 | 3588.22 |

Financial Status of Lumino industries Limited

SWOT Analysis of Lumino industries IPO

Strength and Opportunities

- Diversified product portfolio reduces market risks.

- State-of-the-art manufacturing facilities in Howrah.

- Strong project management with expertise in turnkey projects.

- Preferred contractor for fast-track infrastructure projects.

- Integrated global supply chain ensuring efficient delivery.

- Unparalleled manufacturing, engineering, and design capabilities.

- Experienced professionals maintaining quality standards.

- Reputed clientele including Power Grid Corporation & L&T.

- Robust financial growth with an 85.12% revenue increase.

- Strong order book of Rs 1,803.53 crore.

- Growing demand for renewable energy projects.

- Government initiatives boosting infrastructure development.

- Expansion into emerging markets in Africa & Asia.

- Diversification into non-power infrastructure sectors.

- Adoption of advanced technologies in manufacturing.

- Strategic partnerships with international firms.

- Increasing urbanization driving higher energy needs.

- Potential for backward integration to control raw material costs.

- Rising demand for smart grid solutions.

- Opportunities in electric vehicle infrastructure development.

Risks and Threats

- Working capital-intensive operations due to high receivables.

- Dependence on government projects may lead to payment delays.

- Exposure to raw material price fluctuations affecting margins.

- Limited presence in non-power sectors.

- Employee concerns about management and work environment.

- Challenges in scaling operations internationally.

- High competition from established EPC players.

- Reliance on a few key clients for significant revenue.

- Continuous investment needed in technology to stay competitive.

- Potential overextension due to rapid expansion plans.

- Economic downturns affecting infrastructure spending.

- Stringent environmental regulations increasing compliance costs.

- Volatility in raw material prices impacting profitability.

- Intense competition leading to price wars.

- Delays in government project approvals.

- Currency fluctuations affecting export margins.

- Political instability in key markets.

- Technological advancements rendering existing products obsolete.

- Supply chain disruptions due to global events.

- Changes in trade policies impacting international operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Lumino industries Limited IPO

More About Lumino industries Limited

Lumino Industries Limited is an integrated engineering, procurement, and construction (EPC) company in India, specializing in the manufacturing and supply of conductors, power cables, electrical wires, and specialized components. The company caters to India’s growing power distribution and transmission industry, including high-temperature low-sag (HTLS) conductors.

Market Position and Performance

- Recognized as the fastest-growing player in the conductors, power cables, and power EPC sector based on revenue from operations CAGR (FY 2022-2024).

- Achieved an Operating EBITDA Margin of 10.14% in FY 2024, the second highest among industry peers in India.

- Recorded 10.65% EBITDA Margin for six months ending September 30, 2024, the highest among peers.

Business Model

Lumino Industries operates a product-driven business model focusing on:

- Designing, engineering, and manufacturing specialized products.

- Supplying conductors, power cables, and electrical components for various applications, including industrial, renewable energy, communication systems, and railway networks.

- Integrated operations that ensure captive consumption, enhancing revenue stability and reducing dependence on external suppliers.

Key Business Segments

- Manufacturing

- Fastest-growing manufacturer in the conductors and power cables industry.

- Product Categories:

- Aluminium Conductors – Used in overhead distribution and transmission lines.

- Power Cables – Essential for electric power distribution, substations, and industrial applications.

- Electrical Wires – Includes thermoset insulated wire, earth wires, and house wires under the brand ‘Lumicon’.

- Manufacturing Facilities:

- Two plants in Howrah, West Bengal, with a combined 40,000 MT aluminium consumption capacity.

- Warehousing space of 110,000 sq. ft.

- ISO and NABL-certified facilities ensuring quality control.

- Expansion plan with a 250,000 sq. ft. manufacturing facility in Ranihati, West Bengal, increasing production capacity.

- International Certifications:

- UL Certification for compliance with U.S. and European regulatory standards, expanding global market opportunities.

- EPC (Engineering, Procurement, and Construction)

- Comprises five business lines:

- Power distribution and transmission.

- EHV substations.

- Re-conductoring with HTLS conductors.

- Railway electrification.

- Solar power projects.

- Clientele:

- Central and state power utilities in India such as Kashmir Power Distribution Corporation Limited, Assam Power Distribution Company Limited, and West Bengal State Electricity Distribution Company Limited.

- International projects, including an ongoing EPC power distribution project in Rwanda.

- Awards & Recognitions:

- Skoch-NSE Award (2019) for MSME excellence.

- Runner-up award in the MSME vendor category by Power Grid.

Industry Outlook

India’s power generation and transmission sectors are poised for significant growth

Market Growth and Projections

- Power Generation and Transmission Expansion: Projected to reach USD 280 billion by FY2030, a 2.2x increase from FY2024 levels.

- Annual Power Consumption: Expected to grow over 7% annually, necessitating an increase in total power generation capacity from 442 GW in FY2024 to 673 GW by FY2030.

Cables and Conductors Market

- Domestic Growth: The cables industry experienced a 23.6% growth in 2023-24, while the conductor segment saw a 2.1% increase.

- International Demand: In 2023-24, conductor exports reached Rs 58.81 billion, and HV and LV cable exports soared to Rs 80.05 billion, indicating robust global demand for Indian products.

Future Outlook

- Transmission Infrastructure Investment: Over Rs 9.15 trillion is expected to be invested in transmission infrastructure by 2032, aiming to add more than 191,000 ckt km of transmission lines and 1,270 GVA of transformation capacity.

- Renewable Energy Integration: Plans to evacuate over 600 GW of renewable energy by 2032 will drive demand for advanced cables and conductors, aligning with Lumino’s product offerings.

How Will Lumino industries Limited Benefit

- Rising Demand for Conductors and Cables: India’s expanding power sector will drive higher demand for conductors and cables. Lumino, with a 23.6% growth in cables and 2.1% in conductors, is well-positioned for market expansion.

- Infrastructure Investments: With Rs 9.15 trillion investment in transmission infrastructure by 2032, Lumino’s EPC segment will benefit from increased demand for power distribution, transmission, and EHV substations projects.

- Renewable Energy Expansion: The government’s plan to evacuate 600 GW of renewable energy by 2032 will boost Lumino’s HTLS conductors, power cables, and solar project EPC solutions, enhancing its revenue streams.

- Export Opportunities: Growing conductor exports (Rs 58.81 billion) and HV/LV cable exports (Rs 80.05 billion) open global market avenues for Lumino’s UL-certified products, strengthening international expansion.

- Market Leadership and Growth: As the fastest-growing player in conductors and cables, Lumino’s expanding manufacturing facilities, strong EPC presence, and stable EBITDA margins (10.14% FY24) will reinforce its competitive advantage.

Peer Group Comparison

| Name of Company | Total Income (₹ in million) | Face Value (₹ per share) | EPS (₹) | NAV (₹ per share) | P/E | RoNW (%) |

| Lumino Industries Limited | 14,270.25 | 5.00 | 3.56* | 18.30* | NA | 21.52 |

| Peer Group | ||||||

| Apar Industries Limited | 1,62,394.10 | 10.00 | 212.10 | 964.35 | 47.35 | 27.01 |

| Bajel Projects Limited | 11,945.11 | 2.00 | 0.37 | 49.11 | 683.78 | 0.76 |

| Kalpataru Projects International Limited | 1,96,904.20 | 2.00 | 31.37 | 254.79 | 38.36 | 13.24 |

| KEC International Limited | 1,99,665.81 | 2.00 | 13.49 | 147.96 | 73.38 | 9.53 |

| KEI Industries Limited | 81,530.96 | 2.00 | 64.25 | 348.70 | 63.96 | 20.26 |

| Universal Cables Limited | 20,442.70 | 10.00p | 31.19 | 511.54 | 24.56 | 6.62 |

Key Insights

- Total Income: Lumino Industries Limited has the lowest total income among its peers at ₹14,270.25 million. In contrast, KEC International and Kalpataru Projects lead with over ₹196,000 million, indicating a significantly larger market presence and revenue generation capability.

- Face Value: Lumino’s face value of ₹5.00 per share is different from most peers, who have either ₹2.00 or ₹10.00. This suggests a unique share structuring approach, potentially affecting investor perception and dividend allocation.

- Earnings Per Share (EPS): With an EPS of ₹3.56, Lumino falls far behind industry leaders like Apar Industries (₹212.10) and KEI Industries (₹64.25). This lower EPS suggests lower profitability per share, impacting investor returns and valuation.

- Net Asset Value (NAV): Lumino’s NAV of ₹18.30 is considerably lower than peers, such as Apar (₹964.35) and Universal Cables (₹511.54). This indicates a smaller asset base, which may affect financial stability and market valuation.

- Price-to-Earnings (P/E): The P/E ratio for Lumino is not available, but industry peers show wide variations. Bajel Projects has the highest at 683.78, while Universal Cables has the lowest at 24.56. A high P/E suggests strong future earnings expectations.

- Return on Net Worth (RoNW): Lumino has an RoNW of 21.52%, higher than Universal Cables (6.62%) but lower than Apar (27.01%). This indicates effective capital utilization but suggests room for improvement compared to industry leaders.

Lumino industries Limited IPO Strengths

- Leading Growth in the Power EPC Industry

Lumino Industries Limited is the fastest-growing player in the conductors, power cables, and power EPC industry, leveraging integrated manufacturing and supply of high-quality products to support India’s expanding power distribution and transmission sector

- Cost-Efficient and Integrated Business Model

Lumino Industries Limited leverages a synergistic integration of Manufacturing and EPC segments, ensuring cost efficiency, optimized resource utilization, and revenue stability. This product-driven approach enhances bidding capabilities, strengthens supply chain resilience, and maximizes profitability through economies of scale.

- Integrated Manufacturing Excellence

The company operates advanced manufacturing facilities, ensuring high-quality production for diverse industrial applications. With global certifications, strategic supply chain management, and adaptable machinery, it efficiently serves domestic and international clients while maintaining stringent quality standards and regulatory compliance.

- Top of Form

- Bottom of Form

- Strong and Diversified Order Book

The company’s order book signifies future growth, with ₹14,585.37 million in EPC projects and ₹3,449.89 million in manufacturing. A pan-India presence ensures regional diversification, enabling efficient execution, maximizing opportunities, and fostering strong client relationships through quality-driven project delivery.

- Top of Form

- Bottom of Form

- Strategic Alliances and Experienced Leadership

The company forms global partnerships, including Tokyo Rope, to enhance technical expertise. Strong leadership, with decades of industry experience, drives innovation. A skilled workforce and training initiatives ensure excellence, fostering growth in power infrastructure and engineering solutions.

Key Strategies for Lumino industries Limited

- Leveraging Market Opportunities and Core Competencies

By capitalizing on execution capabilities, industry expertise, and strong client relationships, the focus remains on expanding the order book in the EPC power transmission and distribution sector. Targeting high-growth segments ensures a competitive edge, driving both domestic and international project acquisitions.

- Capitalizing on Growth in Power Sector Investments

With substantial investments projected in the global and Indian power sectors, rising demand for transmission infrastructure presents opportunities for expansion. The emphasis remains on high-voltage conductors, system strengthening, and renewable energy-driven demand, ensuring continued participation in industry growth.

- Strengthening Market Presence Through Innovation

A strategic shift towards high-performance conductors and advanced power transmission solutions enhances market position. By focusing on HV conductors, reconductoring projects, and efficiency-driven innovations, the approach ensures higher profitability, sustained demand, and broader engagement in infrastructure and energy expansion.

- Expanding Manufacturing Capabilities and Product Development

Increasing manufacturing capacity with new facilities, advanced technology integration, and product diversification strengthens operational efficiency. Planned investments in high-performance cables, e-beam curing, and aluminium-based conductors enhance production capabilities, ensuring a competitive advantage in both domestic and global markets.

- Diversification into Allied EPC Sectors

Expanding into railway electrification and infrastructure EPC sectors by leveraging existing project execution expertise broadens revenue streams. The approach ensures participation in high-margin business opportunities, strengthening market position and supporting long-term growth across transmission, distribution, and electrification initiatives.

Chart

Revenue

0Total Assets

0Profit

0How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the size of Lumino Industries' IPO?

The IPO comprises a fresh issue of ₹600 crore and an offer-for-sale of ₹400 crore, totaling ₹1,000 crore.

When is the Lumino Industries IPO expected to open?

The IPO is anticipated to open in the second week of May 2025; exact dates are yet to be finalized.

What is the price band for the Lumino Industries IPO?

The price band for the IPO has not been announced yet.

How can investors apply for the Lumino Industries IPO?

Investors can apply online using UPI or ASBA payment methods through their bank’s net banking services or brokers offering UPI applications.

Who are the lead managers and registrar for the Lumino Industries IPO?

The lead managers are Motilal Oswal Investment Advisors, JM Financial, and Monarch Networth Capital; the registrar is Bigshare Services.