- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Mangal Electrical IPO

₹13,858/26 shares

Minimum Investment

IPO Details

20 Aug 25

22 Aug 25

₹13,858

26

₹533 to ₹561

NSE, BSE

₹400 Cr

28 Aug 25

Mangal Electrical IPO Timeline

Bidding Start

20 Aug 25

Bidding Ends

22 Aug 25

Allotment Finalisation

25 Aug 25

Refund Initiation

26 Aug 25

Demat Transfer

26 Aug 25

Listing

28 Aug 25

Mangal Electrical Industries Limited

Incorporated in 2008, Mangal Electrical Industries Limited manufactures transformers used in electricity distribution and transmission. The company also processes components such as lamination, CRGO slit coils, amorphous cores, coil and core assemblies, wound cores, toroidal cores, and oil-immersed circuit breakers. Operating under the brand name “Mangal Electrical,” it enjoys strong recognition and brand recall. The company trades CRGO and CRNO coils, produces transformers ranging from 5 KVA to 10 MVA, and provides EPC services for substations, supported by five production facilities in Rajasthan.

Mangal Electrical Industries Limited IPO Overview

Mangal Electrical IPO is a book-built issue with a total size of ₹400.00 crore, comprising a fresh issue of 0.71 crore shares. The subscription window will open on August 20, 2025, and close on August 22, 2025, with allotment expected to be finalised on August 25, 2025. The company’s shares are proposed to be listed on both BSE and NSE, with a tentative listing date set for August 28, 2025.

The IPO price band has been fixed between ₹533.00 and ₹561.00 per share, and the minimum lot size for retail investors is 26 shares, requiring an investment of ₹13,858. For small non-institutional investors (sNII), the minimum application size is 14 lots, equivalent to 364 shares worth ₹2,04,204, while for big non-institutional investors (bNII), the minimum stands at 69 lots or 1,794 shares, amounting to ₹10,06,434. Systematix Corporate Services Ltd. is acting as the book-running lead manager, and Bigshare Services Pvt. Ltd. has been appointed as the registrar for the issue.

Mangal Electrical Industries Limited IPO Details

| Particulars | Details |

| IPO Date | 20 August 2025 to 22 August 2025 |

| Listing Date | 28 August 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹533 to ₹561 per share |

| Lot Size | 26 Shares |

| Total Issue Size | 71,30,124 shares (aggregating up to ₹400.00 Cr) |

| Fresh Issue | 71,30,124 shares (aggregating up to ₹400.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 2,05,00,000 shares |

| Share Holding Post Issue | 2,76,30,124 shares |

| Market Maker Portion | NA |

Mangal Electrical Industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Mangal Electrical Industries Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 26 | ₹14,586 |

| Retail (Max) | 13 | 338 | ₹1,89,618 |

| S-HNI (Min) | 14 | 364 | ₹2,04,204 |

| S-HNI (Max) | 68 | 1,768 | ₹9,91,848 |

| B-HNI (Min) | 69 | 1,794 | ₹10,06,434 |

Mangal Electrical Industries Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue | 74.19% |

Mangal Electrical Industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | Pre-issue: ₹23.08 ; Post-issue: ₹17.12 |

| Price/Earnings (P/E) Ratio | Pre-issue: 24.31x ; Post-issue: 32.77x |

| Return on Net Worth (RoNW) | 34.14% |

| Net Asset Value (NAV) | ₹79.10 |

| Return on Equity | 29% |

| Return on Capital Employed (ROCE) | 25.38% |

| EBITDA Margin | 14.90% |

| PAT Margin | 8.61% |

| Debt to Equity Ratio | 0.92 |

Objectives of the Proceeds

- Repayment/ prepayment of certain outstanding borrowings – ₹101.27 crore

- Capital expenditure for expanding Unit IV facility in Rajasthan – ₹87.86 crore

- Funding working capital requirements – ₹122.00 crore

- General corporate purposes – Balance proceeds

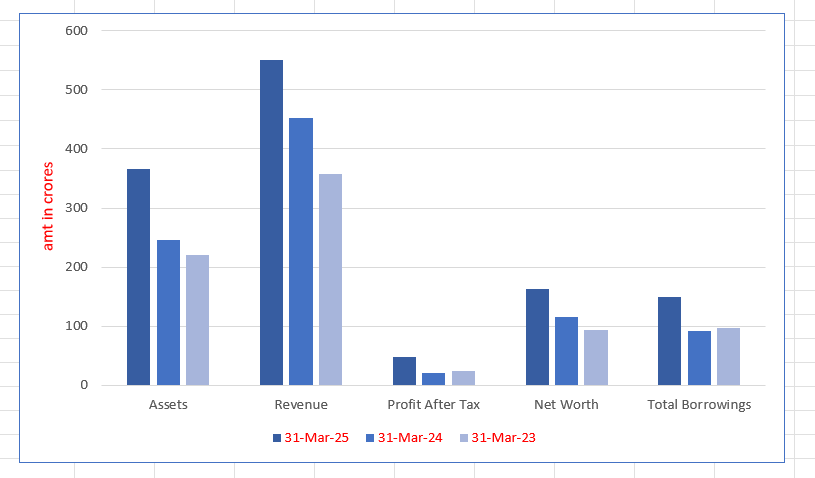

Key Financials (in ₹ Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 366.46 | 246.54 | 221.26 |

| Revenue | 551.39 | 452.13 | 357.81 |

| Profit After Tax | 47.31 | 20.95 | 24.74 |

| Net Worth | 162.16 | 114.99 | 93.97 |

| Total Borrowings | 149.12 | 92.12 | 96.64 |

SWOT Analysis of Mangal Electrical IPO

Strength and Opportunities

- Experienced promoters and management team with proven industry expertise.

- Strong backward and forward integration ensuring operational efficiency

- Diversified customer base across utilities and industrial segments

- Expanding capacity with five production facilities in Rajasthan.

Risks and Threats

- High dependence on power sector regulatory environment.

- Intense competition from established domestic and global players

- Rising raw material prices may impact profitability

- High working capital requirements affect liquidity position.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Mangal Electrical Industries Limited

Mangal Electrical Industries IPO Strengths

- Promoters demonstrate strong leadership with extensive domain knowledge and strategic vision.

- The company possesses approvals granted to only a few select industry players.

- Broad and diversified customer base across multiple industries ensures business stability.

- Backward and forward integration enhances operational control and improves cost efficiency.

- Established track record of delivering consistent business growth year-on-year.

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Mangal Electrical Industries Ltd. | 23.08 | 23.08 | 79.10 | – | 34.14 | – |

| Peer Group | ||||||

| Vilash Transcore Limited | 14.58 | 14.58 | 117.68 | 36.48 | 15.27 | 4.54 |

| Jay Bee Laminations Limited | 12.31 | 12.31 | 65.42 | 18.28 | 24.11 | 3.46 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Mangal Electrical Industries Limited IPO

How can I apply for Mangal Electrical Industries Limited IPO?

You can apply via HDFC Sky using UPI-based ASBA for secure transactions.

What is the minimum investment required in Mangal Electrical Industries Limited IPO?

The minimum investment is ₹14,586 for one lot consisting of 26 shares.

When will shares of Mangal Electrical Industries Limited IPO be listed?

The tentative listing date is 28 August 2025 on both NSE and BSE.

What is the objective of raising funds through this IPO?

Funds will be used for debt repayment, expansion, working capital, and corporate purposes.