- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Manika Plastech IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Manika Plastech IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Manika Plastech Limited

Manika Plastech Limited is an Indian manufacturer of specialized polymer-based packaging solutions, including multilayer barrier films and containers for food, pharmaceuticals, personal care, agrochemicals, and lubricants. Using advanced co-extrusion technology, the company produces high-barrier, customized packaging that enhances shelf life and protects products from environmental factors. Serving domestic and international markets, it emphasizes sustainability, efficiency, and global quality standards. Manika Plastech operates seven facilities across Dehradun, Hosur, Panipat, Una, and Dadra, covering 51,000 square meters with 27,600 MTPA capacity, supported by five warehouses.

Manika Plastech Limited IPO Overview

Manika Plastech Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 2, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building issue comprising a fresh issue of ₹115 crore and an Offer for Sale (OFS) of up to 1.5 crore equity shares. The equity shares are proposed to be listed on NSE and BSE. Pantomath Capital Advisors Pvt. Ltd. is the Book Running Lead Manager, and MUFG Intime India Pvt. Ltd. is the registrar of the issue. Key details such as IPO dates, price band, and lot size are yet to be announced.

The IPO will have a face value of ₹2 per share, with the fresh issue aggregating up to ₹115 crore and the OFS consisting of 1,50,00,000 shares. The issue type is Bookbuilding, and the shares will be listed on NSE and BSE. Before the issue, the promoters—Nikunj Mohanlal Kapadia, Munjal Nikunj Kapadia, Mihir Nikunj Kapadia, Pratik Nikunj Kapadia, and Vridaa Holding Trust—hold 100% of the company’s 9,50,00,000 shares. Post-issue shareholding details will be updated after completion of the IPO.

Manika Plastech Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹115 crore |

| Offer for Sale (OFS) | 1.50 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,50,00,000 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Manika Plastech Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Manika Plastech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.22 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 10.70% |

| Net Asset Value (NAV) | ₹11.35 |

| Return on Equity (RoE) | 10.70% |

| Return on Capital Employed (RoCE) | 8.91% |

| EBITDA Margin | 8.59% |

| PAT Margin | 3.13 |

| Debt to Equity Ratio | 0.86 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the capital expenditure towards purchase of plant and machinery | 598.2 |

| Repayment and/or pre-payment, in part or full, of certain borrowings availed by our Company | 250.0 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

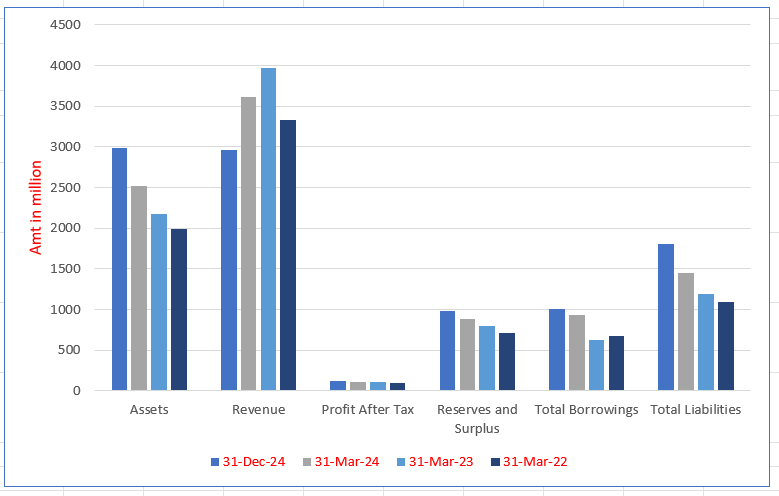

Manika Plastech Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2982.32 | 2522.16 | 2178.61 | 1986.72 |

| Revenue | 2955.81 | 3607.72 | 3965.09 | 3328.22 |

| Profit After Tax | 116.90 | 115.45 | 113.19 | 99.66 |

| Reserves and Surplus | 983.90 | 888.48 | 792.60 | 707.65 |

| Total Borrowings | 1003.68 | 930.57 | 626.28 | 680.76 |

| Total Liabilities | 1808.42 | 1443.68 | 1196.01 | 1089.07 |

Financial Status of Manika Plastech Limited

SWOT Analysis of Manika Plastech IPO

Strength and Opportunities

- Established industry presence with over 25 years in polymer packaging manufacturing.

- Diverse product portfolio including battery casings, pails, and thinwall containers.

- Strong long-term client relationships across multiple Indian states

- Advanced manufacturing facilities with six units and five warehouses

- Proprietary designs enhancing product differentiation

- Sustainability initiatives using recycled polymers and solar energy

- Strategic facility locations ensuring efficient logistics

- Experienced management team with decades of industry knowledge

- Growth potential in energy storage, FMCG, and packaging sectors.

- Opportunities for expansion in international markets and innovative packaging solutions.

Risks and Threats

- High customer concentration with top clients contributing majority of revenue.

- Limited geographic diversification, primarily domestic operations.

- Exposure to raw material price fluctuations impacting costs

- Dependence on consistent energy supply for operations

- Regulatory compliance risks with environmental and safety regulations

- Intense competition from organized and unorganized players

- Economic sensitivity affecting customer budgets

- Limited brand recognition internationally

- Supply chain vulnerabilities due to dependence on specific suppliers

- Market volatility and changing consumer demands.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Manika Plastech Limited

Manika Plastech Limited IPO Strengths

Strategic Proximity and Operational Flexibility

Manika Plastech Limited’s customer-focused manufacturing strategy situates most facilities and warehouses near key clients, enabling efficient sourcing, flexible production, and reduced delivery times. This proximity optimizes logistics, lowers costs, enhances service, supports rapid demand shifts, and strengthens customer retention. Interchangeable machinery across facilities further allows seamless production adjustments, reinforcing client relationships and ensuring consistent quality and supply

Entry Barriers and Customer Retention

Manika Plastech Limited’s extensive manufacturing infrastructure, strategically located near key clients, creates strong entry barriers for competitors. Long-term relationships, stringent approval processes, and critical product applications make switching suppliers costly and complex. Customer reliance on tailored solutions, regulatory compliance, and intellectual property protection further strengthen retention, providing the company a competitive advantage and sustainable market position

Integrated In-House Design, Development, and Labelling

Manika Plastech Limited offers end-to-end RPP solutions, from design and mould development to manufacturing, labelling, and delivery. With 36 registered designs, 800+ moulds, and over 5,650 SKUs across battery casings, pails, and thinwall containers, its 29-member in-house design team collaborates with customers to create customised, compliant, and high-quality products efficiently.

De-Risked Diversified Business Model

Manika Plastech Limited operates a de-risked model with 2,947 products across automotive, energy, paint, FMCG, and agrochemical sectors. Its six strategically located facilities and 805 in-house moulds enable flexible production, multi-product manufacturing, and reliable supply. Diverse customers, suppliers, and labelling capabilities ensure operational resilience, geographic reach across 24 states, and adaptability to demand fluctuations.

Longstanding Customer and Supplier Relationships

Manika Plastech Limited has built enduring relationships with renowned customers and key suppliers over two decades. Repeat customers contribute over 65% of revenue, reflecting loyalty and trust. Strategic proximity to clients, dedicated manufacturing facilities, and consistent procurement from top suppliers ensure reliable supply, high-quality inputs, and strengthened operational and revenue stability

Integrated Quality Assurance Infrastructure

Manika Plastech Limited maintains a robust quality assurance framework across all facilities, supported by 54 dedicated employees. Standardised, semi-automated processes, advanced inspection systems, and compliance with ISO and IATF certifications ensure product reliability. Rigorous audits, traceability, and low defect rates underlie operational excellence, creating barriers to entry and reinforcing customer trust and workplace safety

Commitment to Sustainable Packaging and ESG Standards

Manika Plastech Limited integrates sustainability across its operations, using energy-efficient SERVO motors, solar power, and recycled polymers. Lightweight thinwall designs and reprocessing of discarded materials reduce waste. The company has increased recycled content to over 15%, planted 635 trees, and adheres to ESG principles, promoting eco-friendly, circular economy packaging solutions.

Experienced Promoters and Management Team

Manika Plastech Limited is led by promoters Nikunj Mohanlal Kapadia, Munjal Nikunj Kapadia, Mihir Nikunj Kapadia, and Pratik Nikunj Kapadia, each with over two decades in the RPP industry. Supported by seasoned managerial and functional teams, they oversee business development, manufacturing, and product divisions, driving operational expansion and leveraging deep domain expertise across all company functions.

More About Manika Plastech Limited

Manika Plastech Limited is a design-led, precision-engineered manufacturer of rigid polymer packaging, serving critical industries such as energy storage, dairy, paints, chemicals, and consumer goods. The company develops its products in-house, holding 36 registered designs, including two under renewal, under the Designs Act, 2000.

Its product portfolio includes high-performance battery casings, pails, and thinwall containers tailored for industrial and consumer applications. These solutions emphasize durability, product safety, efficiency, and shelf-life preservation while protecting contents across diverse environments.

Product and Service Offerings

The company provides end-to-end solutions covering design, development, raw material sourcing, manufacturing, heat sealing, labelling, quality assurance, and delivery. Key offerings include:

- Battery Casings: Precision injection-moulded components for energy storage systems, compliant with Japanese Industrial Standards (JIS) and Deutsches Institut Für Normung (DIN).

- Pails and Thinwall Containers: Packaging for paints, lubricants, chemicals, and food products ensuring structural integrity and secure distribution.

- Painting Facility: Automotive component painting for EV and conventional vehicle manufacturers.

Common rigid polymer products, manufactured using injection and blow moulding techniques, serve industries including automotive, energy, pharmaceuticals, personal care, agrochemicals, and e-commerce.

Manufacturing and Operational Capabilities

Manika Plastech operates seven manufacturing facilities across Dehradun, Hosur, Panipat, Una, and Dadra, along with five strategically located warehouses. Facilities leverage semi-automated production, high-voltage leak testing, and in-mould labelling technologies to maintain precision and quality.

The company plans to expand capacity from 27,600 MTPA to 36,800 MTPA by adding plant and machinery, with potential new facilities in eastern and southern India. Production volumes have grown steadily, supported by energy-efficient SERVO motors and solar power installations.

Quality and Sustainability

Manika Plastech emphasizes quality, safety, and sustainability:

- ISO 9001:2015, ISO 14001:2015, ISO 45001:2018 certifications across multiple facilities

- IATF 16949 accreditation for automotive components

- Recycled polymers constitute 10–16% of polymer consumption

- Solar energy provides 12% of overall power requirements

Customer Base and Market Presence

The company serves a diversified customer base of over 178 clients across 24 states in India. Its top 20 clients have an average nine-year relationship, reflecting deep trust and reliability. Key customers include Livguard Energy Technologies, Luminous Power Technologies, Kansai Nerolac Paints, and Grasim Industries.

Manika Plastech is positioned to capitalize on India’s rapidly growing RPP market, projected to reach INR 1,385 billion by FY 2029, driven by industrial and consumer demand.

Industry Outlook

The Indian rigid plastic packaging industry is experiencing robust growth, driven by increasing demand across various sectors. The market is projected to reach USD 19.40 billion by 2030, growing at a CAGR of 6.32% from 2025 to 2030.

Key statistics include:

- 2024 Market Size: USD 14.28 billion

- 2030 Market Size: USD 19.40 billion

- CAGR (2025–2030): 6.32%

Growth Drivers

Several factors contribute to the expansion of the rigid plastic packaging market:

- Dairy sector expansion, with fluid milk consumption projected to rise consistently, driving bottle and jar demand.

- Rapid roll-out of cold-chain facilities increases the need for durable packaging solutions.

- Government initiatives, including infrastructure funds for processing units, are boosting demand for multilayer HDPE bottles.

- Growing consumer preference for eco-friendly packaging is pushing manufacturers toward recyclable materials.

Product Segmentation & Industry Fit

Manika Plastech Limited operates within the rigid plastic packaging sector, focusing on precision-engineered products. Its offerings align with the industry’s growth trajectory:

- Battery Casings: Serving the energy storage sector, meeting rising demand for reliable energy solutions.

- Pails and Thinwall Containers: Catering to paints, chemicals, and food industries, ensuring safe and efficient distribution.

- Automotive Component Painting: Supporting the growing electric vehicle market with specialized automotive components.

Market Trends & Innovations

- Polypropylene is projected to post the fastest CAGR through 2030, reflecting a shift toward cost-effective materials.

- Manufacturers are increasingly adopting sustainable materials such as recyclable PET, HDPE, and bio-based plastics.

- Investment in advanced extrusion and injection lines enables production efficiency and high-quality packaging.

The Indian rigid plastic packaging industry presents significant growth opportunities, driven by sector-specific demand and sustainability trends. Manika Plastech Limited is well-positioned to capitalize on these developments with its diverse product portfolio and focus on innovation and quality.

How Will Manika Plastech Limited Benefit

- Expansion in the dairy sector increases demand for Manika Plastech’s thinwall containers and pails.

- Growing energy storage market boosts sales of precision-engineered battery casings.

- Adoption of eco-friendly packaging aligns with the company’s use of recycled polymers and sustainable materials.

- Rising electric vehicle production enhances demand for automotive component painting services.

- Government support for processing units and infrastructure development creates new business opportunities.

- Investments in advanced extrusion and injection technologies improve production efficiency and product quality.

- Increasing cold-chain facilities drive need for durable packaging, supporting the company’s high-performance solutions.

- Growing consumer base for food, chemicals, and paints ensures steady demand for rigid polymer containers.

- Expansion of Manika Plastech’s capacity allows it to serve new geographies and larger clients efficiently.

- Strong reputation and diversified product portfolio position the company to capture long-term industry growth

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Manika Plastech Limited

Scaling Production Capabilities and Diversifying Product Offerings

Manika Plastech Limited expands production and diversifies products using injection moulding and ISBM technology. It plans new machinery, additional moulds, and facility expansions to enhance capacity, operational flexibility, and serve emerging industries including FMCG, personal care, beverages, and pharmaceuticals while ensuring quality and cost efficiency.

Expanding Geographical Footprint

Manika Plastech Limited strengthens pan-India presence by setting up facilities in eastern and southern regions. Expansion enhances access to raw materials, new suppliers, and customers, reduces regional risks, supports capacity growth, and enables the company to better serve existing clients while onboarding new business opportunities.

Focus on Deleveraging and Financial Flexibility

Manika Plastech Limited aims to reduce debt and improve its debt-to-equity ratio by repaying existing borrowings. This strategy enhances financial flexibility, lowers debt servicing costs, and enables utilization of internal accruals for growth, facilitating future business expansion and funding potential opportunities efficiently.

Strengthening Growth through Customer Expansion and ESG Practices

Manika Plastech Limited grows by increasing business with existing clients and acquiring new customers. It invests in infrastructure, product innovation, and in-house services, while enhancing sustainability through renewable energy, recycled polymers, and water conservation, aligning with ESG standards and promoting circular economy practices.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Manika Plastech IPO

How can I apply for Manika Plastech Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of the Manika Plastech Limited IPO?

The IPO comprises a fresh issue of ₹115 crore and an offer-for-sale of 1.5 crore equity shares by VRIDAA Holding Trust.

How will Manika Plastech utilize the IPO proceeds?

Approximately ₹59.8 crore will fund capital expenditure for plant and machinery, and ₹25 crore will be used for debt repayment.

Who are the lead managers for the IPO?

Pantomath Capital Advisors Private Limited is the appointed book running lead manager for the Manika Plastech IPO.

Where can I check my IPO allotment status?

Allotment status can be checked on the registrar’s website, MUFG Intime India Pvt Ltd, or on stock exchange platforms.

When is the Manika Plastech IPO expected to open?

The IPO opening and closing dates have not been announced yet; updates will be provided in the Red Herring Prospectus.