- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Manipal Payment & Identity Solutions IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Manipal Payment & Identity Solutions IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Manipal Payment & Identity Solutions Limited

Manipal Payment & Identity Solutions Ltd (MPISL) is India’s largest banking and smart card manufacturer, offering end-to-end card services from creation and design to manufacturing and delivery. It serves a prestigious clientele including public and private sector banks, fintech companies, and various government departments. The company has a significant global footprint with operations across the United Kingdom, Europe, Asia-Pacific, and MEA regions. Supported by 10 state-of-the-art factory setups and 19 production units across 11 cities, MPISL leverages its advanced technological infrastructure and strong security compliance to maintain its leadership position in the payment and identity solutions market. (85 words)

Manipal Payment & Identity Solutions Limited IPO Overview

SEBI approved the Initial Public Offer (IPO) of Manipal Payment & Identity Solutions Ltd. on 2 September 2025, allowing the company to move forward with the next steps toward launching the issue, subject to market conditions and additional regulatory clearances. This approval will remain valid for 12 months. The IPO will be a Book Build Issue and will include a fresh issue of ₹400 crore along with an offer for sale (OFS) of up to 1.75 crore equity shares. The company intends to list its equity shares on both the NSE and BSE. Motilal Oswal Investment Advisors Ltd. has been appointed as the book-running lead manager, while MUFG Intime India Pvt. Ltd. will act as the registrar. Details such as the IPO dates, price band and lot size will be announced in due course. Investors can refer to the Manipal Payment and Identity Solutions IPO DRHP for further information.

The IPO will have a face value of ₹2 per share and will follow the bookbuilding route. The sale type is categorised as Fresh Capital-cum-Offer for Sale. The fresh issue will aggregate up to ₹400 crore, while the offer for sale will include 1.75 crore equity shares of ₹2 each, with the total value to be updated once the price band is finalised. The shares will be listed on both the BSE and NSE after completion of the process. Before the IPO, the company’s total shareholding stands at 22,23,65,000 shares.

According to the DRHP status, the company filed the draft with SEBI on 28 June 2025 under the confidential route and received approval on 2 September 2025. The promoters of Manipal Payment & Identity Solutions Ltd. include Tonse Gautham Pai, T. Satish U. Pai, Sandhya S. Pai, Manipal Technologies Limited, Manipal Media Network Limited, Tridevitha Consultancy Services Private Limited and Tridevita Family Trust 2017. The promoter holding prior to the issue is 62.10%, while post-issue holding will be determined after final details are announced.

Manipal Payment & Identity Solutions Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue of ₹400.00 Crores + OFS of up to 1.75 Crore shares |

| Fresh Issue | ₹400.00 Crores |

| Offer for Sale (OFS) | Up to 1,75,00,000 shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 22,23,65,000 shares |

| Shareholding post-issue | TBA |

Manipal Payment & Identity Solutions IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Manipal Payment & Identity Solutions Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Manipal Payment & Identity Solutions Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) – FY25 | ₹13.65 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) – FY25 | 45.54% |

| Net Asset Value (NAV) – as of 31 Mar 2025 | ₹29.68 |

| Return on Equity (RoE) – FY25 | 55.08% |

| Return on Capital Employed (RoCE) – FY25 | 33.97% |

| EBITDA Margin – FY25 | 32.01% |

| PAT Margin – FY25 | 22.10% |

| Debt to Equity Ratio – as of 31 Mar 2025 | 0.76 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are proposed to be utilised by the Company in the following manner:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure for new equipment at various facilities | 2,871.43 |

| General corporate purposes* | [●] |

Note: The amount utilised for general corporate purposes shall not exceed 25% of the Gross Proceeds. The final amounts will be determined upon finalisation of the Offer Price.

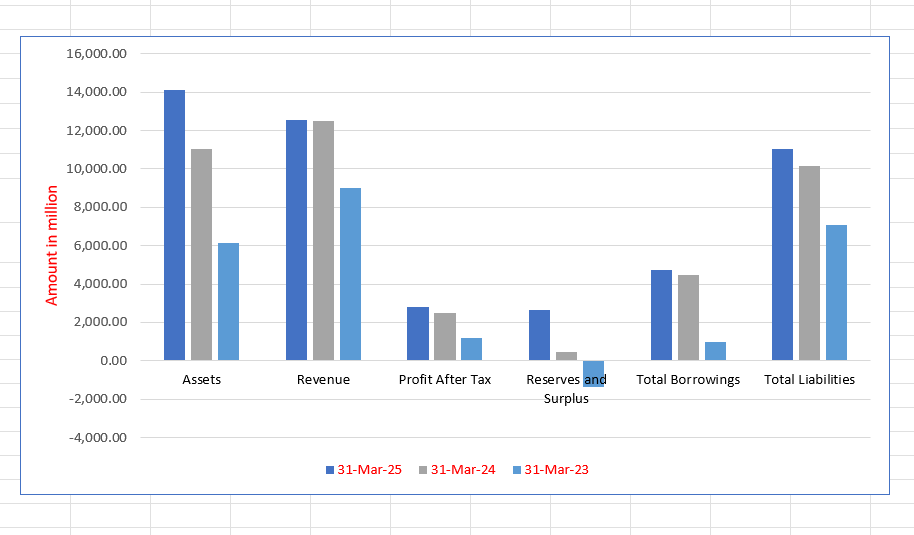

Manipal Payment & Identity Solutions Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 14,096.69 | 11,027.09 | 6,134.53 |

| Revenue | 12,560.71 | 12,475.22 | 9,021.74 |

| Profit After Tax | 2,822.14 | 2,491.65 | 1,176.72 |

| Reserves and Surplus | 2,628.86 | 482.51 | (1,344.27) |

| Total Borrowings | 4,728.66 | 4,494.74 | 966.21 |

| Total Liabilities | 11,054.22 | 10,130.97 | 7,065.19 |

Financial Status of Manipal Payment & Identity Solutions Limited

SWOT Analysis of Manipal Payment & Identity Solutions IPO

Strength and Opportunities

- Dominant market share in Indian card issuance

- Long-standing relationships with marquee banks and government

- Expansive and innovative product portfolio

- Comprehensive, integrated one-stop solutions

- Globally certified, technology-driven secure operations

- Strong financial performance with consistent growth

- Backing of the reputable Manipal Group

- Significant domestic manufacturing capacity

- Growing global footprint and export potential

- Leadership in emerging segments like metal cards

Risks and Threats

- High customer concentration risk with top clients

- Dependence on the growth of physical card issuance

- Vulnerability to global chip shortages and supply chain disruptions

- Intense competition in the payment solutions space

- Rapid technological changes requiring constant investment

- Cybersecurity threats and data privacy risks

- Regulatory changes in banking and payment networks

- Economic downturns impacting consumer spending

- Fluctuations in raw material prices

- Execution risks associated with international expansion

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Manipal Payment & Identity Solutions Limited

Manipal Payment & Identity Solutions Limited IPO Strengths

Market Leadership and Scale

Manipal Payment & Identity Solutions Limited is among the largest manufacturers of payment cards both globally and in India. For Fiscal 2025, the company held an estimated market share of approximately 36.2% in the credit card issuance market and 31.2% in the debit card issuance market in India. This significant scale of operations positions it as a prominent player and provides a competitive advantage in terms of vendor negotiations, production efficiency, and the ability to cater to large-volume orders from major banks and government projects.

Long-Standing Marquee Customer Relationships

The company caters to a diverse set of over 220 customers, including prominent private banks, public sector banks (PSBs), and fintechs. Its business is built on long-standing relationships, with a significant portion of its revenue coming from customers served for over five years. The high-security nature of its services creates high entry barriers and fosters strong client loyalty, providing visibility into future revenues and enabling strategic capex planning based on predictable demand from its established, marquee clientele.

Expansive and Innovative Product Portfolio

Manipal Payment & Identity Solutions Limited offers a wide suite of products, including various payment cards (colour core, metal, rPVC, LED), cheque solutions, smart wearables, and identity solutions for governments. Its ability to provide comprehensive, integrated offerings like bundled cards, cheques, and logistics acts as a one-stop solution for banks. Continuous innovation, such as launching India’s first rPVC Rupay card and developing instant card issuance kiosks, allows the company to meet evolving customer needs and differentiate itself in the market.

Technology-Driven and Secure Operations

The company’s facilities are certified by major payment networks like Mastercard and RuPay, reflecting its adherence to stringent security and quality standards. It employs advanced technology for manufacturing and personalization, with robust IT and cybersecurity measures, including Hardware Security Modules (HSMs) and regular VAPT audits. This technology-driven and secure infrastructure is a critical requirement for its customers and serves as a significant barrier to entry for potential competitors.

Backing of the Manipal Group and Experienced Management

As part of the reputable Manipal Group, the company benefits from its legacy, brand value, and shared resources. It is led by an experienced management team with considerable industry expertise and long associations with the group. This strong foundation provides strategic guidance, stability, and access to a skilled employee base, positioning the company well to capitalize on future growth opportunities and navigate industry challenges effectively.

More About Manipal Payment & Identity Solutions Limited

Manipal Payment & Identity Solutions Ltd (MPISL) has established itself as a cornerstone of India’s financial and identity infrastructure. Its journey from a card manufacturer to a comprehensive solutions provider underscores its strategic vision and execution capabilities.

Core Business Verticals

- Payment Solutions: This is the company’s flagship business, encompassing the manufacturing and personalization of debit, credit, prepaid, and metal cards. It also includes innovative offerings like NFC/QR code solutions, payment-enabled smart wearables (watches, keyrings), and digital automation solutions.

- Identification Solutions: MPISL is a key partner for central and state governments, providing secure documents such as driving licenses, vehicle registration certificates, and national identity cards. It also offers transit management solutions, including NCMC-compliant dual-interface (DI) cards.

- Secure Solutions: This vertical includes secure logistics, personalization of insurance policies, and security-enhanced packaging like tamper-evident envelopes and holograms.

- Smart Tagging and IoT Solutions: The company produces excise labels with holograms and encrypted QR codes for state excise departments and offers end-to-end track-and-trace solutions using RFID technology.

Manufacturing and Operational Prowess

MPISL operates a robust network of 10 state-of-the-art factories with 19 production units spread across 11 cities in India. This includes:

- Two base card manufacturing facilities located in Manipal, Karnataka.

- Multiple personalization bureaus in Noida, Navi Mumbai, Manipal, and Chennai, enabling localized personalization that reduces turnaround time and logistics costs.

The company’s commitment to security is evident in its numerous certifications from payment networks and adherence to international standards like ISO 27001:2022 for information security.

Financial Trajectory

MPISL has demonstrated a strong and consistent financial performance, marked by robust revenue growth and expanding profitability. Its revenue from operations increased from ₹9,021.74 million in Fiscal 2023 to ₹12,560.71 million in Fiscal 2025. More impressively, its Profit After Tax (PAT) more than doubled during the same period, from ₹1,176.72 million to ₹2,822.14 million, reflecting improved operational efficiency and scaling of operations.

Strategic Acquisitions

The company has grown both organically and inorganically. It acquired the Value Document Processing (VDP) business of Manipal Technologies Limited, which included printing of cheques and secure logistics. It also acquired the smart tagging and IoT solutions business. These acquisitions have enabled MPISL to offer bundled services, creating a sticky customer relationship and opening up new revenue streams.

Industry Outlook

The payment card and secure identification industry in India is poised for significant growth, driven by financial inclusion, digitalization, and government initiatives.

Payment Cards Market Growth

The Indian payment cards market, inclusive of credit, debit, and prepaid payment instruments, is experiencing a robust expansion. The total number of payment cards issued is projected to grow from 302 million units in 2025 to 519 million units by 2030, at a compelling CAGR of 11.4%. In value terms, the market size for card manufacturing and disbursal services is expected to surge from ₹26,096 million in 2025 to ₹61,684 million by 2030, representing a CAGR of 18.8%.

Key Growth Drivers:

- Financial Deepening: Increased penetration of banking services and formal credit.

- Rising Affluence: Growth in the middle class and disposable income, boosting credit card adoption.

- Digital Payments Push: Government and regulatory policies promoting digital transactions.

- Premiumization: Growing demand for premium products like metal cards, which are expected to see a CAGR of 51.8% in unit distribution from 2025 to 2030 in India.

- Transit Solutions: The rollout of the National Common Mobility Card (NCMC) across public transport systems.

Secure Identity Solutions Market

The market for government ID smart cards (Aadhaar, driving licenses, e-passports) is also on a high-growth trajectory. The volume of smart cards issued is expected to increase from 26.7 million units in 2025 to 45.7 million units by 2030. The shift towards more durable polycarbonate-based identity cards, as mandated by the Ministry of Road Transport and Highways (MORTH), presents a fresh opportunity for technologically adept manufacturers.

Global Metal Cards Trend

Globally, the metal cards market is expected to grow from 49 million units in 2024 to 113 million units in 2030, at a CAGR of 15%. This trend is mirrored in India, offering high-margin opportunities for manufacturers like MPISL who have the necessary patents and certifications.

How Will Manipal Payment & Identity Solutions Limited Benefit

- Benefit from the projected 11.4% CAGR in payment card issuance in India, directly translating to higher volumes for its core manufacturing business.

- Capitalize on the premiumization trend in the cards market, leveraging its patented metal card manufacturing capability and first-mover advantage to capture a significant share of this high-margin segment.

- Leverage its dominant domestic market share (over 36% in credit cards) to consolidate its position and cross-sell new bundled offerings (cards, cheques, logistics) to its extensive existing client base.

- Tap into the growing global metal cards market, estimated to reach 113 million units by 2030, by expanding its exports and international presence.

- Execute on the significant opportunity in government identity projects, driven by the need for polycarbonate-based driving licenses and the expected growth in e-passports and national ID programs.

- Utilize its integrated one-stop-shop model to secure larger contracts from banks that prefer to engage with fewer vendors for efficiency, thereby creating a sustainable competitive moat.

- Expand its tax stamps and security solutions business across more Indian states and international jurisdictions, diversifying its revenue streams beyond the banking sector.

Peer Group Comparison

| Name of Company | Revenue (in ₹ million) | Face value (₹) | Basic EPS for Fiscal 2025 (₹) | P/E Ratio | RoNW (%) |

| Manipal Payment and Identity Solutions Limited | 12,560.71 | 2 | 13.65 | TBD | 45.54 |

| Peer Group | |||||

| Seshaasai Technologies Limited | 14,631.51 | 1 | 15.06 | 24.82 | 33.20 |

Key Strategies for Manipal Payment & Identity Solutions Limited

Increase Global Payment Cards Market Share

Manipal Payment & Identity Solutions Limited intends to aggressively expand its international footprint by capitalizing on the global growth in the credit card market. The strategy involves leveraging existing relationships with global fintechs like Revolut, utilizing its on-ground sales consultants in key regions, and exploring setting up or acquiring personalization bureaus abroad. The company will also employ a hub-and-spoke model or partner with local entities in countries like Nepal and Sri Lanka to promote, market, and personalize its base cards, thereby increasing its global market share without significant capital outlay.

Focus on Growing Metal Cards Portfolio

The company plans to intensely focus on its high-margin metal cards business, capitalizing on the projected 51.8% CAGR in the Indian market. As a leading domestic manufacturer with a patent, it aims to increase its production capacity and introduce more variants. By reducing import dependence and leveraging its cost and logistics advantages, MPISL is well-positioned to cater to the rising demand from banks and fintechs seeking to offer premium products to affluent customers, both in India and internationally.

Consolidate Market Leadership in India

Manipal Payment & Identity Solutions Limited aims to fortify its dominant position in the Indian card issuance market by pushing its bundled offerings of cards, cheques, and logistics. This one-stop solution is increasingly preferred by banks for its efficiency. The strategy also includes expanding its network of personalization bureaus to improve turnaround times and diversifying its product portfolio with innovative offerings like biometric and wood cards to stay ahead of market trends and customer preferences.

Diversify through Identity Solutions Projects

The company will strategically pursue large-scale government identity projects in India and globally, building on its successful track record. This includes focusing on polycarbonate-based driving licenses and registration certificates, as well as upcoming opportunities in e-passports. Its proven capability to handle sensitive, high-volume projects and meet strict eligibility criteria provides a competitive edge in bidding for domestic and international government contracts, opening up a significant new growth vector.

Expand Tax Stamps Solutions

Manipal Payment & Identity Solutions Limited plans to expand its tax stamps solutions beyond its current engagements. It aims to cater to more state excise departments in India and target international jurisdictions. As India’s tax stamp framework evolves to include more products like tobacco, the company’s capabilities in printing secure excise labels with holograms and encrypted QR codes position it to capture a larger share of this growing and sticky market.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Manipal Payment & Identity Solutions Limited IPO

How can I apply for Manipal Payment & Identity Solutions Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size and price band for the IPO?

The lot size and price band for the Manipal Payment & Identity Solutions Limited IPO are yet to be announced and will be updated by the company.

What is the core business of Manipal Payment & Identity Solutions Ltd?

The company is India’s largest manufacturer of banking and smart cards, providing end-to-end payment and identity solutions.

Where will the company use the money raised from the fresh issue?

The net proceeds will fund capital expenditure for new equipment and be used for general corporate purposes.

Is the IPO an offer for sale (OFS) or a fresh issue?

The IPO is a combination of both a fresh issue of ₹400 crores and an Offer for Sale (OFS) of up to 1.75 crore shares.