- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Mann Fleet Partners IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Mann Fleet Partners IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Mann Fleet Partners Limited

Incorporated in 1992, Mann Fleet Partners Ltd. provides comprehensive car rental services across ultra-luxury, luxury, premium, and economy segments, catering to corporates, governments, embassies, travel agencies, retail clients, and high-net-worth individuals. The company offers a range of mobility solutions, including event-based transportation, spot rentals, long-term rentals, package-based services, and self-drive car leasing. With a professionally managed fleet, Mann Fleet Partners delivers chauffeured car rentals across India, balancing economy, premium, and luxury vehicles to meet diverse transportation needs through its Corporate Car Rentals (CCR) and Retail Car Rental (RCR) services.

Mann Fleet Partners Limited IPO Overview

Mann Fleet Partners Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is structured as a book-built issue of 0.80 crore equity shares, comprising a fresh issue of up to 0.64 crore shares and an offer for sale (OFS) of up to 0.16 crore shares. The equity shares are proposed to be listed on both the NSE and BSE. Khambatta Securities Ltd. is appointed as the book running lead manager, while Bigshare Services Pvt. Ltd. will act as the registrar for the issue. Key details such as the IPO dates, price band, and lot size are yet to be announced.

The IPO will have a face value of ₹10 per share, with a total issue size of 80,10,000 shares, aggregating up to ₹[.] crore. The fresh issue will include 64,10,000 shares (aggregating up to ₹[.] crore), and the OFS will consist of 16,00,000 shares (aggregating up to ₹[.] crore). The shares will be listed on both BSE and NSE, and the pre-issue shareholding of the company stands at 2,56,29,143 shares. The promoters of Mann Fleet Partners Ltd.—Amrit Pal Singh Mann, Parmjeet Mann, and Robin Singh Mann—hold a pre-issue stake of 96.61%, with the post-issue promoter holding yet to be disclosed

Mann Fleet Partners Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 0.80 crore equity shares |

| Fresh Issue | 0.64 crore equity shares |

| Offer for Sale (OFS) | 0.16 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,56,29,143 shares |

| Shareholding post-issue | TBA |

Mann Fleet Partners IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Mann Fleet Partners Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Mann Fleet Partners Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.52 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 21.93% |

| Net Asset Value (NAV) | ₹34.27 |

| Return on Equity (RoE) | 21.93% |

| Return on Capital Employed (RoCE) | 19.88% |

| EBITDA Margin | 50.04% |

| PAT Margin | 19.57% |

| Debt to Equity Ratio | 0.75 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the capital expenditure requirements of the Company towards purchase of fleets. | 637.9 |

| Pre-payment and/or re-payment, full or in part, of certain outstanding borrowings availed by the Company | 187.6 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

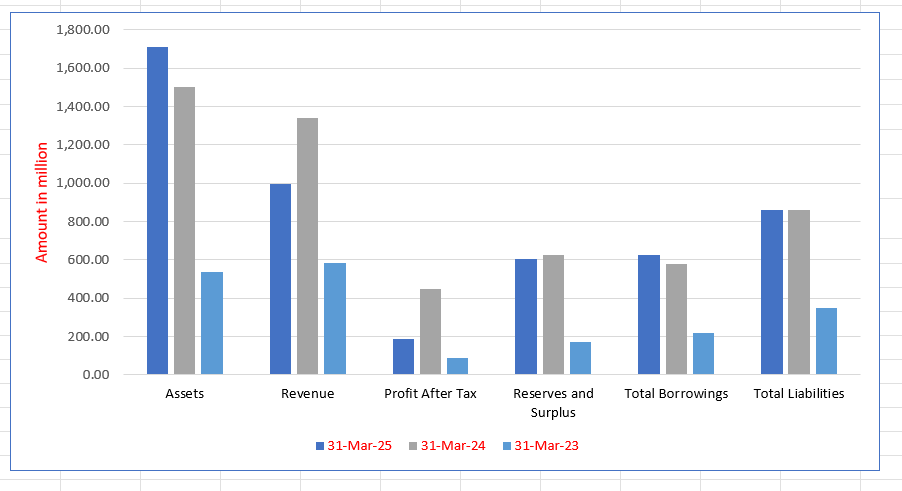

Mann Fleet Partners Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,710.78 | 1,502.37 | 536.66 |

| Revenue | 997.57 | 1,341.81 | 583.14 |

| Profit After Tax | 186.40 | 446.47 | 87.57 |

| Reserves and Surplus | 602.02 | 624.27 | 173.86 |

| Total Borrowings | 627.00 | 577.41 | 216.11 |

| Total Liabilities | 860.74 | 860.39 | 350.14 |

Financial Status of Mann Fleet Partners Limited

SWOT Analysis of Mann Fleet Partners IPO

Strength and Opportunities

- Strong heritage since 1992 and recognised brand in chauffeur driven mobility services.

- Diverse fleet across luxury, premium, and economy segments enabling broad market reach.

- Established relationships with corporates, governments, embassies, and HNI clients.

- Increasing demand for premium mobility and event transport services in India.

- Opportunity to expand into selfdrive leasing, spot rentals, and new cities.

- Potential listing (IPO) provides access to capital and enhances visibility.

- Scope for digital/tech adoption (app based booking, fleet tracking) to improve operations.

- Ability to introduce long term rental contracts and bundled packages to increase recurring revenue.

- Expansion beyond Tier 1 cities to tap underpenetrated markets presents growth potential.

Risks and Threats

- Asset heavy fleet ownership model demands large capital expenditure and increases risk.

- Revenue concentrated in a few states increasing geographic risk.

- Intense competition in chauffeur driven mobility may pressure pricing and margins.

- Dependence on key customers and long term contracts could pose business risk if clients exit.

- Chauffeur shortage or rising compensation could erode profitability and service quality.

- Macroeconomic slowdown or inflation may reduce corporate travel and rental demand.

- Lack of customer facing mobile application and lag in advanced technology may hamper competitiveness.

- Regulatory changes, vehicle acquisition cost rises, or financing constraints can affect business.

- Asset concentration in key Tier 1 cities means disruption in those markets may materially impact operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Mann Fleet Partners Limited

Mann Fleet Partners Limited IPO Strengths

Strong Profitability and Scale

Mann Fleet Partners Limited operates as a large-scale, consistently profitable ground passenger transportation provider with a resilient revenue base, having maintained profitability through major economic downturns. The Company owns 269 vehicles and serves 80 Indian cities with over 350 employees across six strategic offices. Its revenue from operations grew at a CAGR of $10.93\%$ from FY2023 to FY2025.

Decades of Experience and Customer Focus

The Company has over 30 years of experience in organized ground transportation, allowing it to build deep industry expertise and a strong brand image. Its unwavering focus on customer service and relationship management has resulted in a significant base of long-standing clientele, with some relationships lasting over a decade. This ensures revenue stability and operational excellence.

Extensive Pan-India Geographical Reach

Mann Fleet Partners Limited provides CCR and RCR services across 80 cities in India, utilizing a mix of its proprietary and aggregated vendor fleets. With six strategically located offices (Delhi, Mumbai, Chennai, etc.), the Company possesses a wide network. It seeks to expand regional offices to increase proprietary fleet use and enhance profit margins.

Commitment to Service Excellence

The Company maintains a credible brand in the chauffeur-driven mobility space through meticulous application of best practices and a dedicated team. Service delivery is anchored in quality, consistency, and reliability, supported by a trained workforce, well-maintained vehicles, 24/7 customer service, and real-time monitoring technology, ensuring a safe and dependable experience.

Prudent Marketing and Brand Visibility

Mann Fleet Partners Limited has historically focused on organic growth, utilizing a prudent marketing budget centered on word-of-mouth referrals, vehicle branding, and targeted digital outreach. This cost-effective strategy has created a resilient consumer base with a high repeat rate. The Company is now incorporating formal social-media marketing for expansion.

Operational Excellence and Seamless Service

The Company delivers stress-free, end-to-end transportation solutions by meticulously managing deployment, maintenance, and logistics. Its emphasis on fleet management and integration of on-ground and operations teams ensures accuracy, reliability, and swift execution. Technology, including GPS tracking and internal management software, is continuously optimized for a seamless customer experience.

Delivering Strong Financials

The Company has a proven track record of healthy financial performance, demonstrating a steady, organic increase in revenue and profitability. This growth is driven by the gradual expansion of its operations and clientele, supported by a combination of operational and functional excellence, prudent budgeting, and opportunistic investment decisions.

More About Mann Fleet Partners Limited

Mann Fleet Partners Limited is a leading provider of ultra-luxury, luxury, premium, and economy car rental services, catering to corporates (“Corporate Car Rental” or “CCR”), governments, embassies, travel agencies, retail clients (“Retail Car Rental” or “RCR”), and high-net-worth individuals (“HNIs”). The company offers comprehensive mobility solutions, including event-based transportation, spot rentals, long-term rentals, package-based services, and self-drive car leasing.

As of the Draft Red Herring Prospectus, Mann Fleet Partners operates in 83 cities across India, the United Arab Emirates, Saudi Arabia, and England, with 80 cities located in India, using a combination of owned fleets and vendor-operated vehicles.

Service Offerings

The company provides professionally managed chauffeur services across various segments by balancing an efficient mix of economy, premium, and luxury vehicles. Key offerings include:

- Airport transfers, corporate events, conferences, and exhibitions

- Outstation trips and hourly rentals

- Long-term rentals and self-drive car leasing

- Full-stack solutions for both corporate and retail clients

Mann Fleet Partners differentiates itself through a strong focus on safety, punctuality, and customer satisfaction, curating services to match diverse client preferences and budgets.

Technology & Fleet Management

The company leverages technology-enabled fleet management systems such as TAS and G Track to enhance operational efficiency and provide a seamless customer experience. A proprietary Driver App and central transport management system support reservations, vehicle tracking, incident management, billing, vendor payments, and fleet maintenance.

Market Presence & Growth Strategy

Mann Fleet Partners has a strong presence in 27 states and 4 union territories in India, including tier-1 and tier-2 cities, with scope for geographic expansion and fleet growth. The CCR segment caters to corporate clients, including over 17 Fortune 500 companies in FY25, while RCR addresses individual and family transportation needs. International services are provided through a global vendor network, covering locations such as London and Gulf countries.

The company operates a proprietary fleet of over 269 vehicles spanning economy, premium, luxury, minivans, and coaches, while retaining a significant portion of recurring customers.

Leadership & Recognition

Led by Promoter Amrit Pal Singh Mann with over 33 years of industry experience, the management team combines expertise in chauffeur-driven mobility with strategic vision. The company has received multiple awards, including National Tourism Awards, recognition from the U.S. Embassy, and the Leaders of Road Transport Awards.

With a robust management team, technologically advanced operations, and a broad service portfolio, Mann Fleet Partners is well-positioned to capture growth opportunities in the organized chauffeur-driven mobility sector.

Industry Outlook

Market Size & Growth Prospects

- The Indian car rental market was valued at around USD 2.74 billion in 2024, and is expected to reach approximately USD 9.29 billion by 2033, implying a CAGR of about 14.5% between 20252033.

- Other estimates show the market will grow at a CAGR of ~13.9% from 20252030, expanding from USD 5,845.7 million in 2024 to USD 13,023.6 million by 2030.

- The AsiaPacific car rental market is projected to grow at a CAGR of ~12.7% from 20252030, with India among the highest growth countries in the region.

Key Growth Drivers

- Rising disposable incomes and shifting consumer preference for mobilitysolutions rather than vehicle ownership.

- Growth in tourism and domestic travel, plus corporate travel demand, increasing the need for flexible rental and chauffeurdriven services.

- Increased digitalisation: Online booking platforms, mobile apps, fleet-tracking, and telematics are facilitating rental service growth and operational efficiencies.

- Growing acceptance of selfdrive and chauffeurdriven leases, especially in metro and tier2 cities, and expansion of short-term rental models and long-term contract models.

- Infrastructure improvements (highways, airports, regional connectivity) supporting inter-city rentals and event/corporate mobility solutions.

Segment & Vehicle Type Insights

- In 2024, the economy car segment generated the largest revenue in India’s rental market, while luxury/premium cars are expected to show the fastest growth during the 20252030 period.

- The selfdrive car rental segment is gaining traction, though still smaller versus chauffeurdriven. The global self-drive market is also expected to grow steadily over the next five years.

- Short-term rentals dominate currently, but long-term rental/subscription models are forecast to grow at higher rates over the next several years as corporates seek predictable mobility solutions.

Relevance for Mann Fleet Partners Limited

- The growing demand for premium mobility and corporate chauffeured services aligns with the company’s luxury/premium vehicle offerings.

- Expansion into long-term contracts and package-based mobility aligns with the projected growth of subscription and rental duration models.

- Technology-enabled fleet management and digital platforms are increasingly becoming differentiators, complementing the company’s focus on operational efficiency and customer experience.

How Will Mann Fleet Partners Limited Benefit

- The growing Indian car rental market, with a CAGR of 1314%, provides strong revenue growth potential for premium and economy services.

- Rising corporate travel and tourism demand supports expansion of the CCR segment across tier1 and tier2 cities.

- Increasing acceptance of selfdrive and chauffeur-driven leases aligns with the company’s current service offerings and expansion plans.

- Technology adoption and digital fleet management trends enhance operational efficiency and customer satisfaction, complementing existing TAS and G Track systems.

- Infrastructure improvements across highways, airports, and regional connectivity expand the company’s geographic reach and inter-city service capabilities.

- Growth in long-term rental and subscription models provides opportunities for predictable revenue and stronger client retention.

- Premium and luxury vehicle segments’ faster growth supports higher-margin services and differentiated offerings.

- Full-stack mobility solutions enable cross-selling between CCR and RCR, maximizing revenue per customer.

Peer Group Comparison

| Name of the Company | Face Value (₹ per share) | Revenue (₹ in milion) | EPS FY2025 (₹ per share) | NAV (₹ per share) | P/E Ratio | RoNW (%) |

| Mann Fleet Partners Limited | 10 | 952.71 | 7.52 | 34.27 | [●] | 21.93 |

| Peer Group | ||||||

| Ecos (India) Mobility & Hospitality Limited | 225 | 6539.64 | 10.02 | 36.96 | 25.71 | 27.10 |

| International Travel House Limited | 104 | 2356.27 | 33.96 | 206.85 | 14.24 | 16.42 |

Key Strategies for Mann Fleet Partners Limited

Certainly. Here is the rephrased content for each of the strategies of Mann Fleet Partners Limited, presented in the third person with a heading for each, and within the approximate 45-word limit per point.

Strategic Geographical Expansion

Mann Fleet Partners Limited seeks to expand its physical presence in new Indian cities by establishing branch offices and acquiring proprietary fleets. This strategy is designed to reduce reliance on costly vendor fleets, improve access to inaccessible clients, and enhance both the customer base and overall company profitability.

Focusing on Technological Advancements

The Company will leverage technology to improve operational efficiency and scale. This includes expanding internal software to automate workflows, shifting codebase, and developing external portals for clients and vendors. The goal is to facilitate booking, management, and real-time trip tracking for enhanced service.

Enhancing GPS Vehicle Tracking

To bolster client safety and operational transparency, Mann Fleet Partners Limited has partnered with a third-party provider to integrate Global Positioning System (GPS) devices across its fleet. This technology enables continuous, real-time vehicle location monitoring, supporting efficient fleet management and upholding high standards of security.

Maintaining a Robust Operational Framework

The Company employs a strong operational framework to ensure consistent service quality and vehicle availability. This involves efficient scheduling, proactive route management, and equipped dispatch locations. Strict processes govern everything from reservations to pre-dispatch checks, driven by a focus on customer feedback and continual improvement.

Capitalizing on Established Brand and Scale

Mann Fleet Partners Limited leverages its 30-year-old brand and large, diverse fleet to handle complex, large-scale logistics for events, corporates, and high-net-worth clients. This operational capacity, coupled with visual branding and strategic marketing, enables the Company to function as a single integrated service provider.

Operational Excellence through Quality Execution

The Company’s operations prioritize reliability, safety, and customer experience through a disciplined maintenance protocol via authorized dealerships. Its integrated system of best practices, fleet management tools, and a trained chauffeur workforce ensures high-quality, consistent service, reinforcing its position in the premium segment.

Promoter-Led Business with Strong Execution

The Company’s growth is largely attributed to its experienced Promoters, particularly the Managing Director, who has over 33 years in the luxury fleet segment. Their expertise, industry relationships, and strong execution capabilities are instrumental in implementing growth strategies, ensuring a foundation for both organic and strategic acquisition-led expansion.

Leveraging Market Position for Growth

Mann Fleet Partners Limited will leverage its strong market position and deep, 30-year industry expertise to capitalize on market growth. By expanding its network of proprietary operations, the Company aims to increase its fleet size, attract new clients, and upscale services while maintaining its benchmark quality standards.

Commitment to Environmental Sustainability

The Company is committed to sustainability by transitioning its fleet to be fully Euro VI-compliant by the end of Fiscal 2025. This strategy involves phased replacement of older vehicles. Furthermore, the Company plans to deploy a dedicated management team and advanced telematics to support future EV integration.

Investing in Human Capital and Service Quality

To ensure dependable service, the Company is focusing on developing a professional chauffeur workforce. This includes establishing a dedicated Chauffeurs Training Centre to provide structured, standardized training on safe driving, customer service, and protocols for sensitive, high-profile assignments, thereby strengthening operational reliability.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Mann Fleet Partners Limited IPO

How can I apply for Mann Fleet Partners Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When was the Mann Fleet Partners IPO filed with SEBI?

The company filed its Draft Red Herring Prospectus with SEBI on September 29, 2025.

What is the total issue size of the IPO?

The IPO comprises 0.80 crore equity shares, including a fresh issue of 0.64 crore and an OFS of 0.16 crore.

On which stock exchanges will the IPO be listed?

Mann Fleet Partners IPO is proposed to be listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

How is the IPO reserved among investor categories?

Not more than 50% of shares are for QIBs, at least 35% for retail, and at least 15% for NIIs.

What are the main objectives of the IPO?

Proceeds will fund fleet expansion, prepayment of borrowings, and general corporate purposes to strengthen business operations.