- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

M&B Engineering IPO

₹13,908/38 shares

Minimum Investment

IPO Details

30 Jul 25

01 Aug 25

₹13,908

38

₹366 to ₹385

NSE, BSE

₹650 Cr

06 Aug 25

M&B Engineering IPO Timeline

Bidding Start

30 Jul 25

Bidding Ends

01 Aug 25

Allotment Finalisation

04 Aug 25

Refund Initiation

05 Aug 25

Demat Transfer

05 Aug 25

Listing

07 Aug 25

M&B Engineering Limited

Established in 1981, M&B Engineering Limited specialises in Pre-Engineered Buildings (PEBs) and Self-Supported Roofing solutions, offering design, engineering, manufacturing, and installation services across India. Catering to sectors like manufacturing, food and beverages, warehousing, logistics, power, textiles, and railways, the company operates two manufacturing facilities in Gujarat and Tamil Nadu with a PEB capacity of 103,800 MTPA. Its Phenix Division delivers integrated PEB solutions, while the Proflex Division manufactures and installs self-supported steel roofing. Exporting to 22 countries, the company has completed over 9,400 projects globally.

M&B Engineering Limited IPO Overview

M&B Engineering IPO is a book-built issue of ₹650 crore, comprising a fresh issue of 0.71 crore equity shares aggregating to ₹275 crore and an offer for sale of 0.97 crore equity shares worth ₹375 crore. The IPO opens for subscription on July 30, 2025, and closes on August 1, 2025. The basis of allotment is expected to be finalised on August 4, 2025, and the shares are likely to be listed on the BSE and NSE on August 6, 2025.

The price band for the IPO is fixed between ₹366 to ₹385 per share, and the lot size is 38 shares. For retail investors, the minimum investment required is ₹13,908. For small non-institutional investors (sNII), the lot size is 14 lots, i.e., 532 shares, amounting to ₹2,04,820, while for big non-institutional investors (bNII), it is 69 lots or 2,622 shares, totalling ₹10,09,470.

Equirus Capital Private Limited is the book-running lead manager to the issue, and MUFG Intime India Private Limited (Link Intime) is acting as the registrar.

. The DRHP was filed with SEBI on February 21, 2025, and February 24, 2025. The pre-issue shareholding is 5,00,00,000 shares with 100% held by promoters. Promoters include GirishbhaiManibhai Patel, Chirag Hasmukhbhai Patel, Malav Girishbhai Patel, Birva Chirag Patel, Vipinbhai Kantilal Patel, Aditya Vipinbhai Patel, LeenabenVipinbhai Patel, Chirag H Patel Family Trust, Vipin K Patel Family Trust, MGM5 Family Trust, MGM11 Family Trust, and Aditya V Patel Family Trust. Post-issue shareholding and allotment dates are yet to be disclosed.

M&B Engineering Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹275 crore Offer for Sale: ₹375 crore |

| IPO Dates | July 30, 2025 to August 1, 2025 |

| Price Bands | ₹366 to ₹385 per share |

| Lot Size | 38 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 5,00,00,000 shares |

| Shareholding Post-Issue | 5,71,42,857 shares |

Important Dates

| IPO Activity | Date |

| IPO Open Date | July 30, 2025 |

| IPO Close Date | August 1, 2025 |

| Basis of Allotment Date | August 4, 2025 |

| Refunds Initiation | August 5, 2025 |

| Credit of Shares to Demat | August 5, 2025 |

| IPO Listing Date | August 6, 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 38 | ₹13,908 |

| Retail (Max) | 13 | 494 | ₹1,90,190 |

| S-HNI (Min) | 14 | 532 | ₹2,04,820 |

| S-HNI (Max) | 68 | 2,584 | ₹9,94,840 |

| B-HNI (Min) | 69 | 2,622 | ₹10,09,470 |

M&B Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Net Offer |

| Retail | Not more than 10% of the Net Offer |

| NII (HNI) | Not more than 15% of the Net Offer |

M&B Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹13.48 (Post IPO) |

| Price/Earnings (P/E) Ratio | 28.55 (Post IPO) |

| Return on Net Worth (RoNW) | 25.14% |

| Net Asset Value (NAV) | ₹61.27 |

| Return on Equity (ROE) | 25.13% |

| Return on Capital Employed | 24.80% |

| EBITDA Margin | 12.78% |

| PAT Margin | 7.73% |

| Debt to Equity Ratio | 0.33 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Re-payment/ pre-payment, in full or in part, of certain outstanding borrowings availed by our Company | 600.00 |

| Funding the capital expenditure requirements for the purchase of equipment and machinery, building works, solar rooftop grid and transport vehicles at the manufacturing facilities | 1298.48 |

| Investment in IT software upgradation | 52.00 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

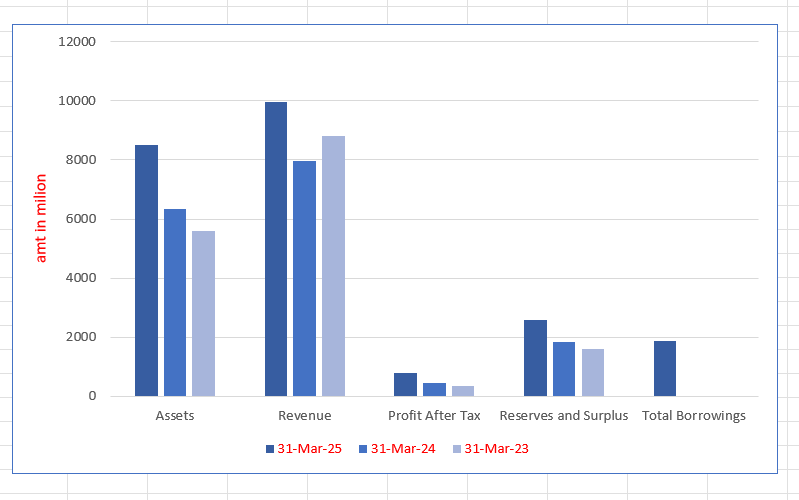

M&B Engineering Limited Financials (in million)

| Particulars | 31 March 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 8492.1 | 6331.11 | 5587.87 |

| Revenue | 9968.9 | 7950.60 | 8804.70 |

| Profit After Tax | 770.5 | 456.34 | 328.92 |

| Reserves and Surplus | 2565.3 | 1830.32 | 1605.12 |

| Total Borrowings | 1864.3 | – | – |

Financial Status of M&B Engineering Limited

SWOT Analysis of M&B Engineering IPO

Strength and Opportunities

- Established in 1981 with extensive industry experience.

- Diversified product portfolio including PEBs and self-supported roofing.

- Strong presence in multiple sectors: manufacturing, warehousing, logistics, and more.

- Two manufacturing facilities in Gujarat and Tamil Nadu with a combined capacity of 103,800 MTPA.

- Exporting to 22 countries, enhancing global footprint.

- Phenix Division offers integrated PEB solutions, leveraging advanced technology.

- Proflex Division specializes in on-site self-supported steel roofing installations.

- Healthy financial risk profile with improved operating margins and strong capital structure.

- Upcoming IPO to fund expansion, indicating growth potential.

Risks and Threats

- Large working capital requirements impacting liquidity.

- Exposure to intense competition in the engineering and construction industry.

- Dependence on economic cycles affecting client investment decisions.

- Fluctuations in raw material prices affecting profit margins.

- Potential delays in project execution due to external factors.

- Risks associated with international operations, including compliance and currency fluctuations.

- Challenges in maintaining consistent quality across diverse projects.

- Recruitment and retention of skilled workforce in a competitive market.

- Regulatory changes and environmental concerns impacting operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

M&B Engineering Limited IPO

M&B Engineering Limited IPO Strengths

- A Market Leader in PEB and Roofing Solutions

M&B Engineering Limited is a key player in India’s PEB and self-supported roofing industry, holding a 75% market share. With operations in 22 countries, it leverages integrated manufacturing, customer-centric solutions, and economies of scale to maintain leadership and expand its presence in global markets, including the US.

- Comprehensive Solutions in PEB and Roofing

M&B Engineering Limited offers specialised products and services, integrating design, engineering, manufacturing, and testing to ensure high safety and performance standards. With expertise in PEBs, structural steel components, and self-supported roofing, the company caters to diverse customer needs through its Phenix and Proflex divisions.

- Strong Customer Relationships and Diverse Industry Presence

M&B Engineering Limited holds an order book of ₹7,666.78 million, serving industries through its Phenix and Proflex divisions. With 9,400+ executed projects, it maintains long-term relationships with key clients like Adani Green Energy and Tata Advanced Systems, ensuring revenue stability, market goodwill, and sustained growth.

- Strategically Located Manufacturing Facilities and Market Leadership

M&B Engineering Limited operates two PEB manufacturing units in Gujarat and Tamil Nadu, serving diverse regions efficiently. With an installed capacity exceeding 100,000 MTPA for PEBs and 1.8 million square metres for self-supported roofing, it holds a 75% market share in India’s self-supported steel roofing sector.

- Experienced Leadership and Professional Management

M&B Engineering Limited is led by experienced promoters and a professional management team with deep industry expertise. Their hands-on approach ensures efficient business operations, strategic growth, and market leadership in self-supported steel roofing. Specialised teams across divisions enable adaptability, quality assurance, and effective response to evolving industry trends.

- Strong Financial Performance and Growth

M&B Engineering Limited has demonstrated a sustained track record of financial excellence. According to the CRISIL Report, the company achieved one of the highest OPBDIT and PAT CAGRs among peers between FY 2022 and FY 2024, with 38.0% and 67.3%, respectively. In FY 2024, it recorded a return on equity of 19.7%, making it the best performer among listed players. The company’s strong financial position, profitability, and access to financing provide a competitive edge, ensuring sustainable growth and market leadership.

More About M&B Engineering Limited

Industry Leadership and Installed Capacity

M&B Engineering Limited is one of India’s leading providers of Pre-Engineered Buildings (PEBs) and Self-Supported Roofing solutions. As of December 31, 2024, the company has:

- An installed PEB capacity of 103,800 MTPA

- A self-supported roofing capacity of 1,800,000 square metres per annum

According to the CRISIL Report, M&B Engineering holds a 75% market share in India’s self-supported roofing segment. The company also recorded one of the highest OPBDIT and PAT CAGRs between Fiscals 2022 and 2024 at 38.0% and 67.3%, respectively.

Business Divisions and Services

M&B Engineering operates through two primary divisions:

Phenix Division

- Specialises in PEBs and complex structural steel components

- Provides turnkey solutions covering design, engineering, manufacturing, and erection

- Serves industries such as warehousing, logistics, textiles, power, and railways

Proflex Division

- Focuses on self-supported steel roofing solutions

- Offers mobile manufacturing units for on-site production

- Installed over 18 million square metres of roofing across 7,825 projects

Market Growth and Competitive Edge

The Indian PEB industry grew at a CAGR of 8.0% from INR 130 billion (Fiscal 2019) to INR 195 billion (Fiscal 2024). Meanwhile, the self-supported roofing market expanded at a 6% CAGR over the same period.

M&B Engineering’s competitive advantage lies in:

- Established brand presence and extensive track record

- In-house design and engineering using software like STAAD PRO, TEKLA, and BricsCAD

- SAP-H4 Hana-driven business operations

- ISO-certified manufacturing facilities

Manufacturing Capabilities

M&B Engineering operates two PEB manufacturing facilities at:

- Sanand, Gujarat (Operational since 2008)

- Cheyyar, Tamil Nadu (Operational since 2024)

The Proflex Division operates a fleet of 14 mobile manufacturing units to deliver roofing solutions across India.

Project Execution and Clientele

With over 9,400 projects executed, M&B Engineering has served 2,000+ customer groups across multiple sectors. Key clients include:

- Adani Green Energy, Tata Advanced Systems, Elecon Engineering

- Balaji Wafers, Intas Pharmaceuticals, Everest Food Products

- Haldiram Foods, Gujarat Tea Processors, Inductotherm (India)

Revenue Breakdown (Fiscal 2024)

- Phenix Division: ₹5,802.28 million (72.98%)

- Proflex Division: ₹2,145.00 million (26.98%)

- Others: ₹3.32 million (0.04%)

Certifications and Recognition

- Sanand Facility: Certified by AISC, RDSO, FM Global, and NABL

- Recognised by the Chief Engineer (Navy) for PEB structures

M&B Engineering Limited continues to drive innovation and excellence, positioning itself as a market leader in India’s PEB and self-supported roofing industry.

Industry Outlook

Market Growth & Demand Drivers

The Indian construction sector is experiencing robust growth, driven by:

- Infrastructure development – Expansion of highways, airports, and industrial zones

- Urbanisation & industrial expansion – Increasing demand for modern, sustainable structures

- Government policies – Initiatives like Make in India, Smart Cities Mission, and PM Gati Shakti are boosting the demand for Pre-Engineered Buildings (PEBs) and self-supported roofing solutions

PEB Industry Trends & Future Growth

- The Indian PEB market has grown at a CAGR of 8%, reaching INR 195 billion in Fiscal 2024

- Rising adoption in warehousing, logistics, railways, and power sectors is fueling expansion

- Automation & advanced design software are improving manufacturing efficiency and project execution

Projected Market Growth (2025-2030)

- PEB market CAGR (2025-2030): Estimated at 9-11% due to increasing infrastructure spending

- Future market size: Expected to surpass INR 350-400 billion by 2030

Key growth drivers:

- Demand from logistics, e-commerce, and industrial manufacturing

- Growing use of sustainable and energy-efficient buildings

- Increasing FDI in warehousing and real estate

Self-Supported Roofing Market: Future Insights

- The self-supported roofing segment grew at a CAGR of 6%, reflecting strong demand from FMCG, pharmaceuticals, and food processing industries

- Mobile manufacturing units are increasingly using on-site roofing solutions, reducing logistics and installation costs

Market CAGR (2025-2030): Expected at 7-9%, driven by:

- Cost-effective & durable construction techniques

- Rising industrial investments in flexible and modular roofing solutions

- Government incentives for green & sustainable construction

How Will M&B Engineering Limited Benefit

- Market Leadership: Holding 75% market share in self-supported roofing, M&B Engineering is positioned for strong growth as demand rises.

- Growth in the PEB Industry: With the PEB market projected to grow at a 9-11% CAGR, M&B Engineering will gain from increasing infrastructure investments.

- Expansion in Self-Supported Roofing: The 7-9% CAGR in this segment will boost Proflex Division’s revenue, expanding its on-site roofing solutions business.

- Support from Government Initiatives: Policies like Make in India and Smart Cities Mission will fuel demand for PEBs and roofing solutions.

- Manufacturing Capacity Advantage: With 103,800 MTPA PEB capacity and 1,800,000 sq. m roofing capacity, M&B Engineering can efficiently meet rising industry needs.

- Technology-Driven Operations: Advanced software like STAAD PRO, TEKLA, and SAP-H4 Hana enhances design, execution, and project efficiency.

- Strong Clientele & Reputation: Serving Adani, Tata, and Balaji Wafers, M&B Engineering benefits from repeat business and industry credibility.

- Mobile Manufacturing Expansion: The 14 mobile units enhance flexibility, reducing logistics costs and improving project execution across India.

- Increase in FDI and Industrial Growth: Increased foreign direct investment (FDI) in warehousing and real estate will boost demand for PEBs and roofing solutions.

- Financial Growth and Profitability: M&B Engineering’s 38% OPBDIT CAGR and 67.3% PAT CAGR from Fiscal 2022-2024 indicate strong profitability and expansion potential.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue from Operations (₹ Million) | Basic EPS 2024 (₹) | P/E | RONW (%) | NAV (₹) |

| M & B Engineering Limited | 10.00 | 7,950.60 | 9.17 | – | 19.68% | 46.61 |

| Peer Groups | ||||||

| Pennar Industries Limited | 5.00 | 31,305.70 | 7.29 | 23.27 | 11.22% | 64.95 |

| Bansal Roofing Products Limited | 10.00 | 1,055.84 | 2.69 | 34.73 | 12.84% | 20.94 |

| HIL Limited | 10.00 | 33,749.66 | 46.15 | 63.12 | 2.78% | 1,661.39 |

| Everest Industries Limited | 10.00 | 15,754.52 | 11.42 | 101.11 | 3.01% | 378.37 |

| Interarch Building Products Limited | 10.00 | 12,933.02 | 58.68 | 21.04 | 19.40% | 308.43 |

Key Strategies for M&B Engineering Limited

- Leveraging Market Leadership in the Domestic PEB Industry

M&B Engineering Limited aims to capitalise on its strong position in India’s Pre-Engineered Buildings (PEB) market. With the industry projected to grow at a robust 10-11% CAGR until 2029, the company intends to strengthen its leadership in the self-supported steel roofing market, supported by increasing investments in infrastructure.

- Expanding Manufacturing Facilities for Enhanced Serviceability

To improve operational efficiency and reduce logistical expenses, M&B Engineering Limited is expanding its manufacturing facilities. The strategic commissioning of the Cheyyar facility enhances its serviceability in southern India, ensuring optimised project execution and strengthening its market presence in new geographical regions.

- Boosting Export Revenue with a Focus on Global Markets

M&B Engineering Limited aims to increase export revenue by targeting key international markets, including the USA, UK, and Saudi Arabia. With India’s PEB exports rising at a CAGR of 19.1%, the company plans to leverage its competitive pricing, quality adherence, and manufacturing capabilities to strengthen its global footprint.

- Geographical Diversification to Reduce Market Dependency

Recognising the need for geographical diversification, M&B Engineering Limited plans to expand into regions where it currently has limited presence. This strategy minimises dependence on specific markets, allowing the company to capitalise on opportunities across India while catering to the expanding reach of its existing clientele.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On M&B Engineering Limited's proposed IPO

What is the size and structure of M&B Engineering Limited's proposed IPO?

M&B Engineering Limited plans to raise ₹650 crore through its IPO, comprising a fresh issue of ₹275 crore and an offer for sale of ₹375 crore by promoters.

What are the objectives of the fresh issue component in the IPO?

The fresh issue aims to fund capital expenditures for equipment, machinery, building works, solar rooftop grids, transport vehicles, IT software upgrades, and to repay or prepay certain borrowings.

What does the Offer for Sale entail in this IPO?

The offer for sale involves promoters selling shares worth ₹375 crore, including contributions from Girishbhai Manibhai Patel, Chirag Hasmukhbhai Patel, and other family members.

What are M&B Engineering Limited's primary business operations?

M&B Engineering specializes in pre-engineered buildings and self-supported roofing solutions, serving sectors like general engineering, manufacturing, food and beverages, warehousing, logistics, power, textiles, and railways.

When is the IPO expected to open for subscription?

As of now, M&B Engineering Limited has refiled its draft red herring prospectus with SEBI, and the IPO’s opening date has not been announced.