- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Medicap Healthcare IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Medicap Healthcare IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Medicap Healthcare Limited IPO

Incorporated on 2 June 2017, Medicap Healthcare Limited operates in the pharmaceutical packaging sector, specialising in the manufacture of closures such as Euro Head caps, bottle preforms, Blood Collection Tubes (BCT), and components for Water for Injection (WFI) systems. The company provides advanced packaging solutions to the pharmaceutical and healthcare industries. Operating from a 6,732 sq. ft. state-of-the-art facility equipped with modern technology, Medicap’s product range includes Euro Head caps, bottle preforms, and miscellaneous items like plastic and protector caps. As of 31 August 2025, it employed 66 permanent staff.

Medicap Healthcare Limited IPO Overview

Medicap Healthcare Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 22, 2025, to raise ₹240 crore through an Initial Public Offer (IPO). The IPO will be a Book-Built Issue consisting entirely of a fresh issue of shares, with no offer-for-sale component. The company’s equity shares are proposed to be listed on both NSE and BSE. Aryaman Financial Services Limited has been appointed as the book-running lead manager, while Kfin Technologies Limited will act as the registrar of the issue. Key details such as IPO opening and closing dates, price band, and lot size are yet to be announced. According to the DRHP, the issue will have a face value of ₹10 per share and will aggregate up to ₹240 crore through the issuance of new equity shares. Before the issue, the company had 2,45,00,000 equity shares. Medicap Healthcare’s promoters include Kamalkumar Aggarwal, Rajveer Kamal Aggarwal, and Minal Aggarwal, who collectively hold 98% of the company’s shares prior to the IPO.

Medicap Healthcare Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹240 crore |

| Fresh Issue | ₹240 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,45,00,000 shares |

| Shareholding post-issue | TBA |

Medicap Healthcare IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Medicap Healthcare Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Medicap Healthcare Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.04 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 24.52% |

| Net Asset Value (NAV) | ₹45.24 |

| Return on Equity (RoE) | 27.30% |

| Return on Capital Employed (RoCE) | 17.67% |

| EBITDA Margin | 34.31% |

| PAT Margin | 24.58% |

| Debt to Equity Ratio | 0.67 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Purchase of plant and machinery for the existing Manufacturing Unit | 743.70 |

| Repayment or pre-payment, in full or part, of certain borrowings availed by the Company | 329 |

| Further Investment in the Subsidiary KASR Healthcare Private Limited for Repayment or pre-payment, in full or part, of certain borrowings availed by the Subsidiary Company | 528 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

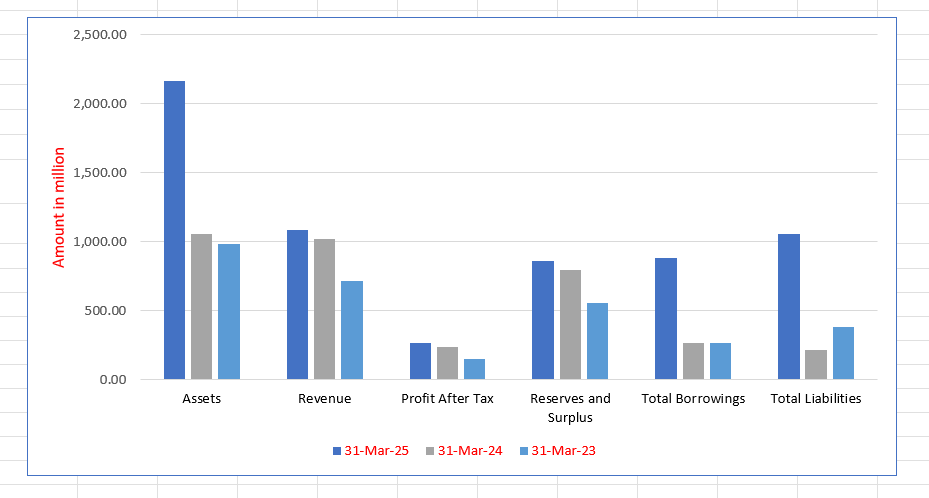

Medicap Healthcare Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,162.87 | 1,058.93 | 983.48 |

| Revenue | 1,083.03 | 1,021.11 | 715.97 |

| Profit After Tax | 266.18 | 238.95 | 147.88 |

| Reserves and Surplus | 863.42 | 793.07 | 554.16 |

| Total Borrowings | 880.90 | 269.78 | 267.72 |

| Total Liabilities | 1,054.37 | 216.86 | 380.32 |

Financial Status of Medicap Healthcare Limited

SWOT Analysis of Medicap Healthcare IPO

Strength and Opportunities

- Strong infrastructure – ultra-modern Class 7 automated manufacturing facility gives a quality edge.

- Specialized niche product focus (Euro Head caps, blood-collection tubes, WFI components) supports differentiation.

- Emphasis on world-class technology, hygiene and GMP standards supports premium positioning.

- Proven industry experience (27+ years of insight cited) provides credibility in packaging.

- Large and growing pharmaceutical packaging market offers significant opportunity for growth.

- Ability to serve both domestic and export markets broadens revenue potential.

- Certified quality focus, technical support and prompt timelines help build strong client relationships.

- Potential to expand product portfolio into adjacent packaging segments and grow via innovation.

- Listing (planned IPO) could provide capital for expansion and enhance brand visibility in the investor market.

Risks and Threats

- Relatively young company in the pharmaceutical packaging space could face maturity-curve limitations.

- Heavy reliance on a limited product range may expose it to single-product risk.

- High capital investment and fixed-asset intensity could pressure margins if utilisation dips.

- Competing with large international packaging players may challenge market share growth.

- Regulatory changes in pharmaceutical-packaging norms could impose compliance costs.

- Supply-chain disruption (raw materials, logistics) could affect manufacturing continuity.

- Pricing pressure from large pharma customers may affect margins.

- Macroeconomic risks (inflation, foreign‐exchange) could impact cost base and profitability.

- Fluctuations in demand from end-pharma industry (like IV fluids) may translate into cyclical performance.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Medicap Healthcare Limited

Medicap Healthcare Limited IPO Strengths

Dominant Position in Growing Pharma Packaging Market

Medicap Healthcare Limited is a dominant player in the Euro Head caps and bottle preforms market, capitalizing on favorable industry tailwinds. As an early entrant in India, it maintains over 40% domestic market share in Euro Head caps. The company is strategically positioned to leverage high-growth segments like Euro Head caps, which command superior margins for IV infusion pack manufacturers.

Strategic Manufacturing and Operational Efficiency

The company’s manufacturing unit is strategically located in Vadodara, Gujarat, providing access to a robust industrial ecosystem and competitive production costs. The facility utilizes a highly automated, quality-centric infrastructure, including Class 10,000 cleanrooms and advanced moulding technologies. This precision-driven approach ensures high product quality and efficiency for meeting global and domestic demands.

Robust Domestic and Expanding Global Presence

Medicap Healthcare has a strong market presence domestically and globally, driving sustainable growth. Its dual-market strategy includes a reliable daily dispatch system for domestic customers and long-term relationships with global clients across 14 countries as of FY 2025. This allows the company to respond swiftly to varied market demands and mitigate volatility.

Strong Customer and Supplier Relationships

The company benefits from long-standing relationships with customers and suppliers, leading to a high rate of repeat orders. Revenue from repeat customers consistently exceeds 90% of total revenue from operations (FY2025: 90.52%), significantly de-risking the business. Limiting suppliers also ensures stable quality and better pricing due to higher purchase volumes.

Demonstrable Financial Performance with High Margins

Medicap Healthcare has a strong financial track record, funding its growth through internal accruals. The company focuses on niche, essential infusion packaging components that command premium pricing and higher margins. It achieved a significant growth trajectory from FY 2023 to FY 2025, with Revenue from Operations growing at a CAGR of $22.99\%$ and Profit After Tax at a CAGR of $34.16\%$.

More About Medicap Healthcare Limited

Medicap Healthcare Limited is a leading name in India’s pharmaceutical packaging sector, specialising in the manufacture of Euro Head caps and bottle preforms. With around 1.4% of the global market share and over 40% of the domestic share in Euro Head caps (F&S Report), the company has established itself as a key industry player. Initially founded as a partnership firm in 2014, it became a public limited company in 2017.

Operations and Manufacturing Excellence

The company operates a 6,732 sq. mt. facility in Manjusar, Vadodara, Gujarat—an industrial hub known for IV fluid manufacturing. This state-of-the-art plant houses 23 injection moulding machines, producing up to 751 million units annually, with a 60% utilisation rate in FY2025. Medicap adheres to strict ISO 9001:2015, ISO 14001:2015, GMP, and DMF standards, ensuring quality and safety. It also promotes sustainability with a 1,530 KW solar power plant, cutting energy dependence by nearly 34%.

Market Landscape

According to the F&S Report, the global pharmaceutical packaging market is valued at USD 37.5 billion (2024) and projected to reach USD 51.4 billion by 2029, growing at a 6.5% CAGR. In India, the sector is expanding at 7.9%, driven by a robust pharma base and health awareness. The Euro Head caps market in India is valued at USD 26.7 million in 2024, expected to reach USD 34.4 million by 2029.

Strategic Growth and Expansion

- Medicap plans to increase capacity by 966 million units per annum, enhancing Euro Head cap and preform production.

- In December 2024, it acquired a 51% stake in KASR Healthcare Pvt. Ltd., marking its entry into IV fluids manufacturing.

- The company is guided by promoters Kamalkumar Aggarwal, Rajveer Kamal Aggarwal, and a skilled leadership team with decades of industry expertise.

Financial Performance

Revenue rose from ₹715.97 million in FY2023 to ₹1,083.03 million in FY2025, a 22.99% CAGR, with EBITDA growing from ₹226.72 million to ₹371.56 million. Approximately 91% of FY2025 revenue came from repeat customers, demonstrating Medicap Healthcare Limited’s consistent quality and long-term client relationships.

Industry Outlook

The pharmaceutical packaging industry in India is witnessing rapid expansion, supported by increasing pharmaceutical production and export demand. The sector was valued at approximately USD 1.8 billion in 2023 and is projected to reach around USD 4.2 billion by 2033, growing at a CAGR of 8.7% between 2024 and 2033. Certain high-value segments, such as primary packaging, are expected to expand at an even higher CAGR of 13.7% from 2024 to 2030, reflecting the growing preference for advanced, high-performance packaging materials.

Key Growth Drivers

- Expanding domestic pharmaceutical manufacturing and exports, reinforcing India’s position as a global generics and vaccine supplier.

- Rising regulatory emphasis on safety, tamper-evidence, and product traceability, leading to higher demand for precision packaging components.

- Growing market for injectables, biologics, and sterile formulations, increasing the requirement for high-quality closures and preforms.

- Enhanced awareness regarding patient safety, dosage accuracy, and contamination prevention.

- Strong investment in automation, R&D, and sustainable materials by Indian packaging firms to meet global quality benchmarks.

Product-Specific Outlook (Closures, Preforms, Euro Head Caps)

Within the broader packaging domain, sub-segments such as pharmaceutical closures, bottle preforms, and Euro Head caps are witnessing consistent growth. The primary pharmaceutical packaging segment in India, which includes bottles and related components, was valued at USD 13.7 billion in 2023 and is expected to rise to USD 33.7 billion by 2030, recording a robust CAGR of about 13.7%.

Globally, the pharmaceutical packaging market was valued at USD 139.4 billion in 2023 and is projected to reach USD 387.5 billion by 2034, reflecting a CAGR of nearly 9.7%.

Future Outlook

The Indian pharmaceutical packaging industry is poised for sustained growth, driven by strong healthcare infrastructure, increasing medicine consumption, export opportunities, and advancements in packaging technologies. Companies such as Medicap Healthcare Limited, specialising in Euro Head caps and bottle preforms, are strategically positioned to capitalise on these expanding market opportunities.

How Will Medicap Healthcare Limited Benefit

- Medicap Healthcare Limited is well-positioned to capitalise on the rising demand for pharmaceutical packaging driven by the expanding domestic and global pharma markets.

- The company’s expertise in manufacturing Euro Head caps and bottle preforms aligns with high-growth segments in the pharmaceutical primary packaging industry.

- Increasing adoption of injectable drugs and sterile formulations will boost demand for its precision-engineered closures and preforms.

- Medicap’s ISO and GMP-certified facility enables it to meet stringent global quality standards, supporting export potential.

- Growing regulatory emphasis on safety and traceability favours manufacturers with technologically advanced, compliant packaging solutions.

- Investments in automation and sustainability, such as its solar-powered operations, enhance cost efficiency and market appeal.

- The company’s planned capacity expansion and acquisition of KASR Healthcare strengthen its integrated presence in the pharmaceutical value chain.

- Overall, Medicap stands to gain from industry-wide growth, innovation, and rising global healthcare needs.

Peer Group Comparison

| Name of Company | Face Value (₹ Per Share) | Revenue for Fiscal 2025 (₹ million) | EPS (₹) | NAV (₹ per share) | P/E | RONW (%) |

| Medicap Healthcare Limited | 10.00 | 1,083.03 | 10.87 | 45.24 | [●] | 24.02% |

| Peer Group | ||||||

| Huhtamaki India Ltd | 2.00 | 25,211.80 | 11.65 | 158.04 | 20.60 | 7.37% |

| EPL Ltd | 2.00 | 2,133.00 | 11.27 | 73.69 | 19.46 | 15.45% |

Key Strategies for Medicap Healthcare Limited

Expansion of Manufacturing Capacity and Technology Deployment

Medicap Healthcare plans to expand its Unit I facility, increasing installed capacity to 1,717 million units annually. By leveraging automation, optimising operations, and enhancing supplier partnerships, the company aims to improve efficiency, reduce costs, strengthen quality assurance, and ensure accurate supply chain and inventory management.

Forward Integration into IV Fluid Bottle Manufacturing

Through a 51% acquisition of KASR Healthcare Private Limited, Medicap Healthcare is establishing a manufacturing facility for IV fluids and packaging bottles. This forward integration strengthens control over the value chain, enhances product compatibility, ensures quality, and positions the company as a comprehensive IV fluid solutions provider.

Continuous Product Upgradation and Sustainable Development

Medicap Healthcare prioritises ongoing R&D to enhance caps, closures, and preforms, delivering premium quality at competitive pricing. The company integrates sustainable processes, including solar-powered operations and resource optimisation, ensuring high product standards, energy efficiency, and minimal environmental impact while maintaining long-term customer value.

Domestic Market Optimisation and Export Expansion

The company focuses on strengthening its presence across India and in international markets, particularly Europe, South America, and the Middle East. By leveraging scale, supply chain efficiency, and industry expertise, Medicap Healthcare aims to capture growing demand for Euro Head caps and bottle preforms while enhancing profitability.

Efficient Client-Centric Distribution and Supply Chain

Medicap Healthcare employs a proactive, daily dispatch model to ensure timely product delivery. By maintaining close client communication, anticipating requirements, and aligning supply with demand, the company reduces client inventory costs, ensures operational efficiency, and fosters long-term, mutually beneficial business relationships.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Medicap Healthcare Limited IPO

How can I apply for Medicap Healthcare Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Medicap Healthcare IPO?

The IPO is a fresh issue of ₹240.00 crore, with no offer for sale component.

On which stock exchanges will the IPO be listed?

Medicap Healthcare IPO is proposed to be listed on NSE and BSE.

Who is managing the Medicap Healthcare IPO?

Aryaman Financial Services Ltd. is the book running lead manager; Kfin Technologies Ltd. is the registrar.

What is the face value of Medicap Healthcare shares?

The face value of each equity share is ₹10 per share.