- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Meesho IPO

IPO Details

03 Dec 25

05 Dec 25

₹14,985

135

₹105 to ₹111

NSE, BSE

₹4,250 Cr

10 Dec 25

Meesho IPO Timeline

Bidding Start

03 Dec 25

Bidding Ends

05 Dec 25

Allotment Finalisation

08 Nov 25

Refund Initiation

09 Nov 25

Demat Transfer

09 Dec 25

Listing

10 Nov 25

About Meesho Limited IPO

Meesho Limited is a pioneering multi-sided technology platform democratizing e-commerce in India. Founded in 2015, it connects consumers, sellers, logistics partners, and content creators on a single marketplace. The company focuses on affordability and accessibility, enabling a vast base of sellers to reach a wide consumer demographic, particularly beyond metro cities. Meesho operates its core marketplace and new initiatives like Valmo, its logistics network, and a digital financial services platform. With millions of transacting users and sellers, Meesho has become a significant force in the Indian e-commerce landscape, driven by a culture of innovation and cost efficiency.

Meesho Limited IPO Overview

The Securities and Exchange Board of India (SEBI) approved the Initial Public Offer (IPO) of Meesho Ltd. on 14 October 2025. Following SEBI approval, valid for 12 months, the company will proceed with the IPO launch subject to market conditions and other regulatory approvals. The Meesho IPO is a book-built issue comprising a fresh issue of ₹4,250 crore and an offer for sale (OFS) of up to 17.57 crore equity shares.

The equity shares are proposed to be listed on both NSE and BSE. Kotak Mahindra Capital Co. Ltd. is appointed as the book running lead manager, while Kfin Technologies Ltd. serves as the registrar. Key details including IPO dates, price band, and lot size are yet to be announced. The face value of each share is ₹1, and the IPO is structured as a fresh issue-cum-OFS under the book-building mechanism. Pre-issue shareholding stands at 1,94,74,98,633 shares. The company filed its draft red herring prospectus (DRHP) with SEBI on 9 April 2025, receiving SEBI approval on 1 August 2025.

Check Meesho IPO UDRHP for detailed information

Meesho IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹5,421.20 Crores (₹4,250 Cr Fresh Issue + ₹1,171.20 Cr OFS) |

| Fresh Issue | ₹4,250 Crores (38.29 crore shares) |

| Offer for Sale (OFS) | ₹1,171.20 Crores (10.55 crore shares) |

| IPO Dates | December 3, 2025 to December 5, 2025 |

| Price Bands | ₹105 – ₹111 per share |

| Lot Size | 135 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | Promoters: 18.51% |

| Shareholding Post-Issue | 4,51,31,31,000 shares (Approx.) |

Meesho IPO Important Dates

| Event | Date |

| IPO Open Date | Wed, Dec 3, 2025 |

| IPO Close Date | Fri, Dec 5, 2025 |

| Tentative Allotment | Mon, Dec 8, 2025 |

| Initiation of Refunds | Tue, Dec 9, 2025 |

| Credit of Shares to Demat | Tue, Dec 9, 2025 |

| Tentative Listing Date | Wed, Dec 10, 2025 |

Meesho IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 135 | 14,985 |

| Retail (Max) | 13 | 1755 | 1,94,805 |

| S-HNI (Min) | 14 | 1890 | 2,09,790 |

| S-HNI (Max) | 66 | 8910 | 9,89,010 |

| B-HNI (Min) | 67 | 9045 | 10,03,995 |

Meesho Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Meesho Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ (9.98) |

| Price/Earnings (P/E) Ratio | TBA |

| Return on Net Worth (RoNW) | (252.37%) |

| Net Asset Value (NAV) | ₹ 3.68 |

| Return on Equity (RoE) | (252.37%) |

| Return on Capital Employed (RoCE) | (11.68%) |

| EBITDA Margin | (5.58%) |

| PAT Margin | (11.56%) |

| Debt to Equity Ratio | 4.03 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment for cloud infrastructure, in Meesho Technologies Private Limited (MTPL), our Subsidiary | 13,900 |

| Payment of salaries for the Machine Learning, AI and technology teams for AI and technology development undertaken by MTPL, our Subsidiary | 4,800 |

| Investment in MTPL, our Subsidiary, for expenditure towards marketing and brand initiatives | 10,200 |

| Funding inorganic growth through acquisitions and other strategic initiatives and general corporate purposes | [●] |

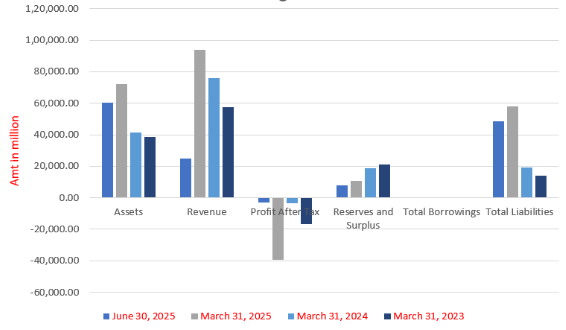

Meesho Limited Financials (in million)

| Particulars | June 30, 2025 | March 31, 2025 | March 31, 2024 | March 31, 2023 |

| Assets | 60,495.97 | 72,260.87 | 41,609.93 | 38,533.49 |

| Revenue | 25,038.66 | 93,899.03 | 76,151.48 | 57,345.19 |

| Profit After Tax | (2,893.58) | (39,417.05) | (3,276.41) | (16,719.02) |

| Reserves and Surplus | 7905.94 | 10,475.08 | 18,755.02 | 21,177.75 |

| Total Borrowings | – | – | – | – |

| Total Liabilities | 48,459.78 | 57,805.69 | 19,313.51 | 13,814.34 |

Financial Status of Meesho Limited

SWOT Analysis of Meesho IPO

Strength and Opportunities

- Large and growing consumer base with high engagement

- Unique multi-sided platform connecting key e-commerce stakeholders

- Value proposition focused on affordability and accessibility

- Strong growth metrics in GMV, orders, and transacting users

- Ability to scale in a capital-efficient manner

- Cost-conscious organization with a culture of financial discipline

- Organisation built on culture of agility and innovation

- Experienced and professional management team

- Significant headroom for growth in the under-penetrated Indian e-commerce market

- Opportunity to expand product assortment and seller base

- Potential to deepen monetization through advertising and new services

Risks and Threats

- History of net losses and negative cash flow

- Accumulated deficits and negative net worth

- Significant dependence on key management personnel

- Intense competition in the Indian e-commerce market

- Inability to achieve or sustain profitability

- Risks associated with managing growth and new initiatives

- Regulatory changes and legal compliance requirements

- Data security and privacy breach risks

- Potential for seller or consumer dissatisfaction

- Economic downturns impacting discretionary spending

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Meesho Limited

Meesho Limited IPO Strengths

Large and Growing Consumer Base with High Engagement

Meesho Limited has cultivated a vast and expanding community of transacting users, which demonstrates strong engagement on its platform. The company’s focus on affordability and a wide product assortment has driven high order frequency and user retention. This large, active user base creates powerful network effects, attracting more sellers and enhancing the platform’s value proposition, forming a sustainable competitive advantage and a solid foundation for future monetization.

Unique Multi-Sided Platform Ecosystem

Meesho operates a distinctive multi-sided technology platform that seamlessly integrates consumers, sellers, logistics partners, and content creators. This interconnected ecosystem creates synergistic value, where each stakeholder group enhances the experience for the others. Sellers gain access to a large market, consumers benefit from variety and low prices, logistics partners ensure efficient delivery, and content creators aid in product discovery, creating a resilient and self-reinforcing business model.

Value Proposition Centered on Affordability and Accessibility

Meesho Limited has established a strong market position by democratizing e-commerce for a broad consumer base across India, including Tier 2+ cities. Its platform is designed to offer affordable products and a low-cost structure for sellers, removing barriers to online commerce. This focus on value and accessibility has been instrumental in tapping into the vast, underserved Indian market, driving its rapid growth and widespread adoption.

Strong Growth Demonstrated by Key Operational Metrics

Meesho Limited exhibits robust operational performance, evidenced by consistent and rapid growth in its Gross Merchandise Value (GMV) and the number of placed orders. The company has successfully expanded its base of annual transacting users and sellers year-on-year. This strong top-line growth underscores the scalability of its platform and its effective execution in capturing market share within the competitive Indian e-commerce landscape.

Ability to Scale in a Capital-Efficient Manner

Meesho Limited has demonstrated a notable ability to launch and grow new services with low incremental investments, as seen with its Valmo logistics network. The company maintains a culture of financial discipline, leveraging technology and automation to optimize expenditures. This capital-efficient approach allows it to pursue growth and innovation while managing cash flows, aiming for long-term value creation without proportionate increases in capital expenditure.

Cost-Conscious Organization with Financial Discipline

Meesho Limited operates with a deeply ingrained culture of cost consciousness and financial discipline across all functions. The company meticulously tracks and optimizes expenditures using technology and process innovation. This disciplined approach to capital allocation ensures that investments are made with a long-term value creation lens, allowing it to extend its runway and improve unit economics as it scales.

Agile and Innovative Organizational Culture

Meesho Limited is built on a foundation of agility and innovation, guided by its core “Meesho Mantras” such as ‘User First’ and ‘Think 10X, Take Risks’. The company employs a pod-based, cross-functional team structure that empowers employees to solve problems end-to-end. This culture has enabled successful pivots and the creation of new business verticals, allowing it to adapt quickly to market changes and stakeholder needs.

Experienced and Visionary Management Team

The company is led by its founders, Vidit Aatrey and Sanjeev Kumar, who have been pivotal in shaping its strategic direction. The management team comprises professionals with diverse backgrounds and extensive experience in technology, finance, retail, and e-commerce. Their combined expertise has been instrumental in navigating the competitive landscape, driving product development, and steering the company through periods of rapid growth and transformation.

More About Meesho Limited

Business Model and Operations

Meesho Limited operates as a multi-sided technology platform that drives e-commerce in India by connecting a diverse network of stakeholders: consumers, sellers, logistics partners, and content creators. Its primary marketplace enables consumers, especially from Tier 2+ cities, to access a wide range of affordable products. For sellers, many of whom are small and medium enterprises or individuals, Meesho provides a low-cost platform to grow their businesses online. The company’s operations are divided into two key segments:

- Marketplace: This is the core revenue-generating segment, facilitating transactions between stakeholders. Revenue streams include fees for services provided to sellers, such as payment processing, advertising, and seller insights.

- New Initiatives: This segment encompasses emerging business verticals, including Valmo (a low-cost local logistics network for daily essentials) and a pilot digital financial services platform offered through regulated partners.

Growth Trajectory and Market Position

Meesho has demonstrated explosive growth, becoming a major player in the Indian e-commerce sector. Key metrics highlight this trajectory:

- The Gross Merchandise Value (GMV) grew to ₹503.61 billion in Fiscal 2025, up from ₹345.04 billion in Fiscal 2023.

- The platform hosted 575,465 annual transacting sellers and 213.17 million annual transacting users as of the twelve months ended June 30, 2025.

- Order frequency has consistently increased, indicating deeper user engagement, reaching 9.23 in Fiscal 2025.

- A key factor in its growth has been the reduction in customer acquisition costs, with Advertising and sales promotion expenses declining as a percentage of both revenue and expenses, showcasing the powerful network effects of its platform.

Technology and Logistics Backbone

Technology is the core of Meesho’s operations. The company leverages a robust cloud infrastructure to handle high transaction volumes and ensure platform scalability and resilience. It is heavily invested in advancing its Artificial Intelligence (AI) and Machine Learning (ML) capabilities through “Meesho AI Labs,” focusing on personalization, risk management, and advertising optimization.

For logistics, Meesho’s Valmo network integrates third-party providers to ensure efficient and low-cost order fulfilment across India. Remarkably, Valmo processed 763.51 million shipped orders in Fiscal 2025 with a lean team of only 173 full-time employees, exemplifying the company’s focus on operational efficiency and capital-light scaling.

Industry Outlook

The Indian e-commerce industry is on a trajectory of robust and sustained growth, driven by a confluence of favorable factors. According to industry reports from sources like Redseer, the market is expected to continue its expansion at a significant Compound Annual Growth Rate (CAGR) in the coming years, potentially reaching a value of hundreds of billions of dollars by the end of the decade.

Key Growth Drivers:

- High Smartphone Penetration: With over 690 million smartphone users as of Fiscal 2025 and growing, the digital addressable market is vast.

- Increasing Internet Adoption: Cheap data plans and improving connectivity are bringing millions of new users online, particularly in Tier 2, Tier 3 cities, and rural India.

- Under-Penetrated Online Shopper Base: Despite the large smartphone user base, online shoppers number only around 250-270 million, indicating immense headroom for growth.

- Digital Payments Infrastructure: The widespread adoption of UPI and other digital payment methods has made online transactions seamless and trustworthy.

- Expansion Beyond Electronics: E-commerce penetration in non-electronics categories like Fashion, Grocery, and Home & Kitchen remains relatively low compared to electronics, representing a substantial growth avenue.

Outlook for Meesho’s Core Segments:

- Mass-Market Commerce: Meesho’s focus on affordability and value positions it perfectly to capture the next wave of users from smaller cities and towns, who are highly price-sensitive.

- Content Commerce: This segment is in its nascent stages in India, accounting for only 1-2% of the e-commerce market, significantly lower than Indonesia (20-30%) and China (40-50%). This highlights a substantial white-space opportunity for growth, which Meesho is already tapping into.

- Digital Advertising: E-commerce platforms are capturing a growing share of digital advertising budgets due to their high-intent user base and measurable ROI for sellers. This trend supports Meesho’s advertising-led monetization strategy.

- Logistics Efficiency: While logistics yields in India have declined, they remain higher than in more mature markets like China, indicating room for further cost optimization, which aligns with Meesho’s efforts through Valmo.

How Will Meesho Limited Benefit

- Benefit from the overall expansion of the Indian e-commerce market, capturing a significant share of the millions of new internet users coming online.

- Leverage its value-focused proposition to effectively target the vast, under-penetrated consumer base in Tier 2+ cities, which is a primary growth engine for the sector.

- Capitalize on the low penetration of non-electronics categories by expanding assortment in fashion, home & kitchen, and daily essentials, driving higher order frequency.

- Tap into the high-growth content commerce segment, where it is an early mover in India, to enhance user engagement and open new monetization channels.

- Grow its advertising revenue as e-commerce platforms increasingly capture a larger portion of digital ad spends from sellers seeking measurable returns.

- Utilize its low-cost operational model and logistics efficiencies to maintain a competitive advantage on price, which is critical for the mass-market segment.

- Exploit the significant headroom for logistics cost optimization in India to further reduce seller costs, enabling more competitive pricing and attracting more sellers.

- Use its large and engaged user base as a platform to launch and scale new initiatives and financial services with minimal incremental marketing costs.

- Strengthen its cash flow generation through operating leverage, increased monetization, and the scaling of high-margin ancillary services.

Peer Group Comparison

| Name of the Company | Face Value (₹) | P/E | Revenue (in ₹ Million) | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV (₹) |

| Meesho | ₹9 | (9.98) | ₹93,899.03 | (9.98) | (9.98) | (252.37%) | ₹3.68 |

| Eternal Limited | ₹15 | 9.57 | ₹202,430.00 | ₹0.60 | ₹0.58 | 2.16% | ₹31.42 |

| Swiggy Limited | ₹1 | N.A. | ₹152,267.55 | (13.72) | (13.72) | (30.50%) | ₹40.98 |

| Brainbees Solutions Limited | ₹2 | N.A. | ₹76,596.14 | (4.11) | (4.11) | (26.63%) | ₹91.00 |

| FSN E-Commerce Ventures Limited | ₹1 | 12.13 | ₹79,498.20 | ₹0.23 | ₹0.23 | 5.21% | ₹4.55 |

| Vishal Mega Mart Limited | ₹10 | 7.14 | ₹107,163.45 | ₹1.40 | ₹1.36 | 9.85% | ₹13.92 |

| Trent Limited | ₹10 | 6.12 | ₹171,346.10 | ₹43.51 | ₹43.51 | 27.93% | ₹153.64 |

| Avenue Supermarts Limited | ₹10 | 101.33 | ₹593,580.50 | ₹41.61 | ₹41.50 | 13.63% | ₹329.29 |

Key Strategies for Meesho Limited

Expanding Consumer and Seller Base

Meesho aims to deepen its market penetration by increasing its consumer base and their transaction frequency. This will be achieved by expanding product assortment, scaling initiatives like Meesho Mall for brands and content commerce, and reducing entry barriers for sellers. The company will leverage performance and brand marketing, alongside AI-driven tools for seller support and product discovery, to attract both new consumers and a broader base of offline sellers to its platform.

Investing in Technology and AI Development

Continuous investment in technology and product development is a core strategy for Meesho. The company will advance its AI capabilities through “Meesho AI Labs,” focusing on personalization, risk management, and assisted shopping. It plans to strengthen its cloud infrastructure for scale and resilience and invest in talent to drive innovation. This focus ensures Meesho remains at the forefront of technological advancements to enhance stakeholder experiences and operational efficiency.

Enhancing Affordability and Accessibility

Meesho is committed to making e-commerce more affordable and accessible across India. The strategy involves further lowering the average cost charged to sellers by driving technology-led efficiencies and optimizing its Valmo logistics network. By reducing fulfilment costs, Meesho can enable more competitive pricing for consumers, particularly in low-ticket, high-frequency categories, thereby deepening its reach and democratizing internet commerce.

Increasing Cash Flow Generation

Meesho plans to enhance its cash flow generation by scaling platform monetization. This includes increasing the adoption of existing services like seller advertisements and launching new high-margin, low-capex offerings. The company benefits from operating leverage; as its scale increases, it can absorb fixed costs more efficiently. The large existing user base allows new services to be launched with limited incremental marketing investment.

Driving Innovation Through Horizon 2 Initiatives

Meesho will continue to drive innovation through its structured “Horizon 2 Initiatives” program. This involves experimenting with new opportunities like Meesho AI Labs, a local logistics network for essentials, and a financial services platform. Each initiative is rigorously tested for product-market fit and unit economics before scaling. This disciplined approach to innovation allows Meesho to unlock future growth streams and strengthen its core business.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Meesho Limited IPO

How can I apply for Meesho Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size for the Meesho IPO?

The lot size for an application is 135. The minimum amount of investment required by an retail is ₹14,985 (135 shares) (based on upper price). The lot size investment for sNII is 14 lots (1,890 shares), amounting to ₹2,09,790, and for bNII, it is 67 lots (9,045 shares), amounting to ₹10,03,995.

What is the price band for the Meesho IPO?

Meesho IPO price band is set at ₹105.00 to ₹111.00 per share.

Will Meesho Limited be profitable after the IPO?

The company has stated a history of net losses and cannot assure that it will achieve or sustain profitability in the future.

What is the core business of Meesho Limited?

Meesho operates a multi-sided e-commerce marketplace connecting consumers, sellers, and other partners, focusing on affordable products.