- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

MEIR Commodities India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

MEIR Commodities India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

MEIR Commodities India Limited

MEIR Commodities, founded in 2018 in India, is a global leader in agricultural commodity trading, specialising in sugar, molasses, and organic products. With a focus on strategic sourcing and strong supplier relationships, MEIR has rapidly expanded its global presence in markets like Europe, West Africa, the Middle East, India, and Bangladesh. The company is committed to fostering sustainable growth, delivering high-quality products, and creating value for its stakeholders. MEIR continues to innovate and drive success through its expertise, market intelligence, and customer-centric approach.

MEIR Commodities India Limited IPO Overview

MEIR Commodities India is set to launch its IPO via book building, comprising 88.23 lakh shares—52.94 lakh fresh and 35.29 lakh under offer-for-sale by promoter Rahil Irfan Iqbal Shaikh. The fresh issue, estimated at ₹48.75 crore, will fund working capital and corporate needs. As per the DRHP filed with SEBI on March 3, 2025, pre-issue shareholding stands at 99.60%. Post-issue, total shares will be 3,52,94,121. IPO dates and price bands are awaited. Smart Horizon Capital is the lead manager; Kfin Technologies is the registrar. As per the DRHP, the promoters held a pre-issue shareholding of 99.60%. The post-issue shareholding will be determined based on equity dilution, calculated by subtracting the post-issue shareholding from the pre-issue holding following the IPO.

MEIR Commodities India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 0.53 crore shares

Offer for Sale (OFS): 0.35 crore shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,00,00,003 shares |

| Shareholding post -issue | 3,52,94,121 shares |

MEIR Commodities India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

MEIR Commodities India IPO Reservation:

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

MEIR Commodities India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.44 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 12.44% |

| Net Asset Value (NAV) | 27.66% |

| Return on Equity | 11.95% |

| Return on Capital Employed (ROCE) | 8.18% |

| EBITDA Margin | 2.60% |

| PAT Margin | 0.86% |

| Debt to Equity Ratio | 1.60 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of the company | 487.5 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

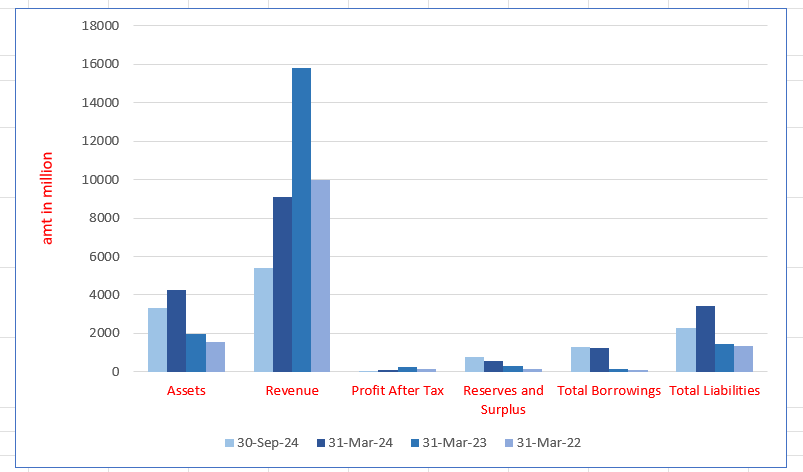

MEIR Commodities India Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 3338.79 | 4275.79 | 1960.13 | 1576.46 |

| Revenue | 5416.36 | 9106.54 | 15,789.76 | 9982.01 |

| Profit After Tax | 22.69 | 78.69 | 247.60 | 155.15 |

| Reserves and Surplus | 755.83 | 566.54 | 287.65 | 160.17 |

| Total Borrowings | 1290.75 | 1232.91 | 140.06 | 91.65 |

| Total Liabilities | 2294.62 | 3445.94 | 1472.84 | 1336.28 |

Financial Status of MEIR Commodities India Limited

SWOT Analysis of MEIR Commodities India IPO

Strength and Opportunities

- Strong presence in over 15 countries.

- Diversified product portfolio, including sugar, pulses, and spices.

- Strategic acquisitions to strengthen supply chain.

- Established reputation in global markets.

- Expertise in agricultural commodity trading.

- Robust export growth, particularly in khandsari.

- Growing demand for khandsari and allied products.

- Expansion of operations into emerging markets.

- Focus on product traceability and quality assurance.

- Leadership with over 18 years of industry experience.

Risks and Threats

- Dependence on global sugar market fluctuations.

- Vulnerability to changes in agricultural policies.

- Limited control over raw material supply chains.

- Risk from volatile international market prices.

- Competition from local and international traders.

- Supply chain disruptions due to geopolitical issues.

- Fluctuations in agricultural production volumes.

- Potential risk from climate change affecting crop yields.

- Regulatory challenges in international markets.

- Risk from global economic slowdowns impacting demand.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About MEIR Commodities India Limited IPO

MEIR Commodities India Limited IPO Strengths

- Global Presence and Strategic Operations

MEIR Commodities India Limited is an established player in agricultural commodity trading, with a presence in India and UAE through its wholly owned subsidiary SATCL and Sri Lanka via associate company SALPL. In fiscal 2024, the company ranked as the fourth largest exporter of Khandsari, accounting for 4.2% by value and 11.7% by volume. With strategic operations, SATCL benefits from UAE’s favourable trade policies, ensuring uninterrupted global sugar trade and supply chain continuity. The company imports commodities from multiple countries to maintain product variety and quality.

- Diverse Product Portfolio

MEIR Commodities India Limited offers a wide range of agricultural products, including sugar, khandsari, rice, pulses, and spices, catering to both domestic and international markets. The diversified product portfolio ensures business resilience, mitigates market risks, and positions the company as a reliable partner, enabling future product expansion.

- Supply Chain Efficiency of MEIR Commodities India Limited

MEIR Commodities India Limited has developed an efficient supply chain infrastructure, forming a foundation for its business operations. Through strong relationships with sugar mills, agricultural producers, and logistics partners, we ensure seamless sourcing, storage, and distribution of commodities, both domestically and internationally. Our direct engagement with producers enhances operational control, minimises supply disruptions, and ensures high-quality products, fostering timely deliveries. With over 63 suppliers in 2024 and strategic acquisitions like SSAIL and SCPL, we aim to optimise production capacity and integrate operations, ensuring cost-effectiveness, timely supplies, and market adaptability.

- Quality Service Commitment

The company takes pride in its unwavering commitment to providing quality services in the agricultural commodities sector. By fostering strong relationships with sugar mills and agricultural producers, it ensures a consistent supply of high-quality products, including sugar, rice, pulses, and spices. Its rigorous quality control measures and transparent processes guarantee product excellence and customer satisfaction.

- Customer-Centric Approach

The company focuses on understanding its client’s requirements and delivering tailored solutions that meet their needs. Serving distributors and clients globally, it ensures efficient procurement and timely delivery of commodities. This systematic approach fosters repeat business, strengthening its position in both domestic and international markets.

More About MEIR Commodities India Limited

Incorporated on May 11, 2018, MEIR Commodities India Limited has established itself as a key player in the trading of agricultural commodities, with a particular focus on sugar, khandsari, and allied sugar products. As a B2B intermediary, the company bridges the gap between producers, such as sugar mills and distributors, facilitating efficient supply chain management.

Diverse Product Portfolio

MEIR Commodities deals with a wide range of agricultural products, including:

- Sugar and allied products

- Khandsari

- Rice

- Pulses

- Spices

- Other agricultural commodities

While most of its products are sold domestically through third-party distributors, MEIR also exports its products to several international markets. The company currently exports to over 15 countries, including the UAE, Turkey, Singapore, and the United Kingdom, and is also actively involved in importing pulses and spices from nations such as Tanzania, Russia, South Africa, and Canada.

Global Reach and Recognition

MEIR Commodities has significantly expanded its presence in global markets, particularly in the export of khandsari. In Fiscal 2024, it emerged as the fourth-largest exporter of khandsari, accounting for a 4.20% share by value and 11.70% by volume in India (Source: D&B Report). The company has received numerous accolades, including:

- Tefla’s Globoil Asia Super Star of the Year 2020

- Outstanding Supplier 2020 by Elite Green

- Agri Start-up of the Year at the SEIA 2024

- Unique Indian MNC at SEIA 2025

Financial Performance

For the six-month period ending September 30, 2024, MEIR Commodities reported revenue from India of ₹37,360.83 lakhs (68.98% of total revenue) and revenue from operations outside India of ₹16,802.82 lakhs (31.02% of total revenue).

Expansion and Strategic Acquisitions

To further strengthen its supply chain and global presence, MEIR has made several strategic acquisitions:

- SIR Agro Trading Co. L.L.C. (UAE-based): Acquired to enhance the company’s ability to source sugar globally and mitigate export restrictions.

- SIR Agro Lanka (Pvt.) Ltd. (Sri Lanka): Established to expand operations in Sri Lanka and gain better insights into the local agricultural market.

- Shivaji Cane Processors Limited (India): Acquired to gain control over the production of khandsari and jaggery powder.

- Shakumbari Sugar and Allied Industries Limited (India): Acquired for better control over sugar production and to participate in India’s Ethanol Blending Policy.

Commitment to Quality and Customer Satisfaction

MEIR is dedicated to ensuring high standards of quality and compliance with global norms. By focusing on traceability in the supply chain, the company ensures that its products meet safety and quality requirements, catering to both domestic and international markets.

Leadership and Vision

Led by Rahil Irfan Iqbal Shaikh, an industry veteran with over 18 years of experience in the sugar sector, MEIR Commodities has thrived under his leadership. His insights and expertise have been instrumental in navigating market dynamics and driving the company’s growth. With a strong focus on customer satisfaction, MEIR is poised to further expand its operations and product offerings in the agricultural commodities market.

Industry Outlook

The agricultural commodities sector in India plays a pivotal role in the nation’s economy, offering significant growth prospects driven by favourable demographic trends, technological advancements, and strategic policy initiatives.

Market Growth and Projections

- Overall Market Expansion: The Indian agricultural commodities market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.15% from 2024 to 2030, with market size expected to reach USD 12.23 billion by 2030.

- Agriculture Sector Growth: The agriculture industry in India was valued at approximately INR 99,689 billion in 2024 and is anticipated to expand at a CAGR of 10.08% between 2025 and 2033, potentially reaching INR 236,603.2 billion by 2033.

- Sugar Industry Dynamics: India, being the world’s largest producer of centrifugal sugar, produced about 34 million metric tons in the 2023/2024 season. However, the 2024/2025 marketing year forecasts a production of 25.8 million metric tons, marking a 19.1% decline from the previous year, primarily due to reduced sugarcane supplies in key producing states.

Growth Drivers

- Population Growth and Urbanisation: India’s burgeoning population and rapid urbanisation are increasing the demand for food and related commodities, thereby expanding the market for agricultural products.

- Technological Advancements: The adoption of modern farming techniques, precision agriculture, and digital tools is enhancing productivity and efficiency in the agricultural sector.

- Government Initiatives: Policies aimed at supporting farmers, improving supply chain infrastructure, and promoting exports are bolstering the agricultural commodities market.

- Export Opportunities: Recent policy shifts, such as lifting export restrictions on rice, are opening new markets and increasing revenue from agricultural exports.

Key Figures and Values

- Sugar Production: Despite the projected decline in the 2024/2025 season, India’s sugar production remains substantial, contributing significantly to both domestic consumption and export.

- Market Size: The agricultural commodities market’s projected growth to USD 12.23 billion by 2030 reflects the sector’s robust expansion and investment potential.

How Will MEIR Commodities India Limited Benefit

- Market Expansion: MEIR’s diverse product portfolio, including sugar, khandsari, rice, pulses, and spices, aligns with the growing demand in domestic and international markets, enhancing revenue potential.

- Export Growth: MEIR’s established presence in over 15 countries positions it to capitalise on India’s export-friendly policies and growing global demand for agricultural commodities.

- Strategic Acquisitions: Acquiring companies like Shivaji Cane Processors Limited and Shakumbari Sugar and Allied Industries Limited provides better control over production, ensuring high-quality products and supply chain efficiency.

- Global Recognition: With accolades such as Tefla’s Globoil Asia Super Star of the Year 2020, MEIR’s global reputation enhances its competitive edge in the agricultural commodities sector.

- Leadership: Under the experienced leadership of Rahil Irfan Iqbal Shaikh, MEIR is poised to navigate market challenges and drive sustainable growth in the agricultural commodities sector.

Peer Group Comparison

| Name of Company | Face Value (₹) | EPS (₹) | PE Ratio (times) | RoNW (%) | NAV (₹) |

| MEIR Commodities India Limited | 10 | 3.44 | [●] | 12.44 | 27.66 |

| Peer Group | |||||

| Sakuma Exports Limited | 1 | 0.27 | 10.37 | 8.28 | 20.58 |

| Uma Exports Limited | 10 | 3.01 | 27.42 | 5.36 | 56.17 |

Key insights

- Face Value: The face value represents the nominal value of a company’s share. MEIR Commodities India Limited has a face value of ₹10, similar to Uma Exports Limited. However, Sakuma Exports has a lower face value of ₹1, indicating a potential difference in the stock’s issuance value.

- EPS: MEIR Commodities India Limited has an EPS of ₹3.44, which reflects the company’s ability to generate profits for shareholders. While higher than Sakuma Exports’ EPS of ₹0.27, it is slightly lower than Uma Exports’ EPS of ₹3.01, showing moderate profitability.

- PE Ratio: The PE ratio indicates the stock’s price relative to its earnings. MEIR Commodities India Limited lacks a PE ratio figure, but Sakuma Exports trades at a PE of 10.37, reflecting lower market expectations, while Uma Exports has a much higher PE of 27.42, suggesting strong investor confidence.

- RoNW: Return on Net Worth (RoNW) measures how effectively a company uses equity capital. MEIR Commodities India Limited has a RoNW of 12.44%, outperforming Sakuma Exports’ 8.28% but lagging behind Uma Exports’ higher RoNW of 56.17%, suggesting stronger capital utilisation by Uma.

- NAV: Net Asset Value (NAV) reflects the company’s total assets minus liabilities per share. MEIR Commodities India Limited shows a NAV of ₹27.66, with Uma Exports having a significantly higher NAV of ₹56.17, indicating better asset management, while Sakuma Exports’ NAV is not provided.

Key Strategies for MEIR Commodities India Limited

- Vertical Integration and Diversification

MEIR Commodities India Limited is evolving from a trading firm into a manufacturing and trading entity. By acquiring stakes in SSAIL and SCPL, the company enhances supply reliability, cost efficiency, and quality control. This move strengthens its market presence while enabling participation in India’s Ethanol Blended Petrol Program.

- Expansion of Product Portfolio

MEIR Commodities India Limited aims to strengthen its product range by leveraging market insights and expanding operations. The company focuses on supply chain optimisation, stakeholder partnerships, and enhancing domestic and international market share. Innovation and quality control drive its strategy, ensuring growth in the competitive agricultural commodities sector.

- Strengthening Global Reach

MEIR Commodities India Limited is actively expanding its international footprint by identifying emerging markets and strengthening distribution networks. The company fosters strategic alliances, joint ventures, and supply chain partnerships to enhance its global presence. By ensuring quality consistency, it positions itself as a trusted partner in the global agricultural industry.

- Enhancing Operational Efficiency

MEIR Commodities India Limited prioritises cost efficiency and operational excellence through economies of scale, better pricing control, and branding initiatives. By optimising production capacity and investing in research and development, the company ensures profitability, sustainability, and adaptability to evolving market demands, reinforcing its position as an industry leader.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for MEIR Commodities India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Meir Commodities India's IPO?

The IPO comprises 52.94 lakh fresh shares and 35.29 lakh shares in an offer-for-sale.

How will the IPO proceeds be utilized?

Approximately ₹48.75 crore will fund working capital and general corporate purposes.

What is Meir Commodities India's primary business?

The company trades B2B agricultural commodities, mainly sugar and related products.

Who is the lead manager for the IPO?

Smart Horizon Capital Advisors Pvt Ltd is the sole book-running lead manager.

On which exchanges will the shares be listed?

The shares are proposed to be listed on NSE and BSE.