- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Methodhub Software IPO

₹1,14,000/600 shares

Minimum Investment

IPO Details

05 Dec 25

09 Dec 25

₹1,14,000

600

₹190 to ₹194

BSE

₹103.02 Cr

12 Dec 25

Methodhub Software IPO Timeline

Bidding Start

05 Dec 25

Bidding Ends

09 Dec 25

Allotment Finalisation

10 Dec 25

Refund Initiation

11 Dec 25

Demat Transfer

11 Dec 25

Listing

12 Dec 25

Methodhub Software Limited

Methodhub Software Limited, incorporated in 2016, is an IT services and consulting provider supporting global digital transformation initiatives. The company offers specialised technology solutions across industries such as BFSI, Oil & Gas, Healthcare, Telecom, Automotive, and IT Consulting. Its service portfolio includes Cloud Services, Data & AI, Cybersecurity, ERP/CRM integration, and recruitment delivery solutions. With 29 clients and 294 professionals as of October 31, 2025, Methodhub delivers scalable, domain-focused solutions that address evolving technology needs of enterprises worldwide.

Methodhub Software Limited IPO Overview

Methodhub Software Limited IPO is a book-built issue comprising a fresh issue of ₹87.50 crore and an offer for sale of 8,00,000 shares. The IPO opens on December 5, 2025, and closes on December 9, 2025, with allotment expected on December 10, 2025. Shares are proposed to be listed on BSE SME on December 12, 2025. The price band remains undisclosed and is marked as ₹[.] to ₹[.] per share. Horizon Management Pvt. Limited acts as the book-running lead manager, while Maashitla Securities Pvt. Limited is the registrar. The IPO includes market making by Giriraj Stock Broking Pvt. Limited and Rikhav Securities Limited, with reservations distributed as per SME regulations.

Methodhub Software Limited IPO Details

| Particulars | Details |

| IPO Date | December 5, 2025 to December 9, 2025 |

| Listing Date | December 12, 2025 (Tentative) |

| Face Value | ₹10 per share |

| Issue Price Band | ₹[.] to ₹[.] per share |

| Lot Size | Not disclosed |

| Total Issue Size | Fresh issue + OFS |

| Fresh Issue | [.] shares (aggregating up to ₹87.50 Cr) |

| Offer for Sale | 8,00,000 shares (aggregating up to ₹[.] Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 1,43,43,201 shares |

| Share Holding Post Issue | Not disclosed |

| Market Maker | Giriraj Stock Broking Pvt. Limited, Rikhav Securities Limited |

Methodhub Software Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Offer |

| Retail | Not less than 35% of the Net Offer |

| NII (HNI) | Not less than 15% of the Net Offer |

Methodhub Software Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 35.29% |

| Post-Issue | Not disclosed |

Objectives of the Issue

- Repayment or prepayment of outstanding loans of the company – ₹13.60 crore

- Strengthening long-term working capital requirements – ₹25 crore

- Investment in MethodHub Consulting Inc. (USA) for working capital – ₹4 crore

- Funding for inorganic acquisitions and general corporate needs – amount not specified

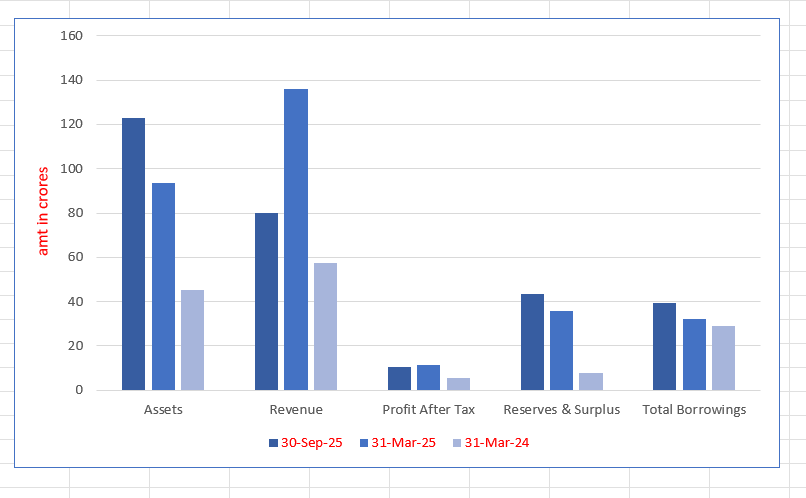

Key Financials (₹ crore)

| Particulars | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 |

| Assets | 122.81 | 93.55 | 45.15 |

| Revenue | 80.22 | 136.01 | 57.59 |

| Profit After Tax | 10.35 | 11.50 | 5.41 |

| Reserves & Surplus | 43.40 | 35.76 | 7.98 |

| Total Borrowings | 39.17 | 32.16 | 28.83 |

SWOT Analysis of Methodhub Software IPO

Strength and Opportunities

- Strong client relationships with global enterprises

- Experienced management and skilled workforce

- Diversified industry presence and scalable operations

- Rapid revenue growth with rising digital demand

Risks and Threats

- Dependence on technology spending cycles

- Intense competition in IT services sector

- Margin pressure due to project-based pricing

- Exposure to overseas economic fluctuations

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Methodhub Software Limited

Methodhub Software IPO Strengths

- Experienced leadership team with deep domain and technology expertise.

- Long-term relationships with global clients across diversified industries.

- Strong presence in digital solutions including Cloud, Data & AI, and Cybersecurity.

- Scalable business model supported by 294 skilled employees and consultants.

- Rapid financial growth with significant increase in revenue and profitability.

- Broad service portfolio enabling cross-industry demand and repeat business.

Methodhub Software Limited Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV |

| Methodhub Software | 17.67 | 17.67 | 36.10 | — | 26.92 | — |

| Peer Group | ||||||

| Esconet Technologies | 6.11 | 6.11 | 53.50 | 35.00 | 15.00 | 3.40 |

| Infobeans Technologies | 15.58 | 15.58 | 136.00 | 28.00 | 12.40 | 4.51 |

| Silver Touch Technologies | 22.00 | 22.00 | 105.00 | 39.00 | 17.60 | 6.63 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Methodhub Software IPO

How can I apply for the Methodhub Software IPO?

You can apply using UPI-based ASBA through HDFC Sky by selecting the IPO and completing the mandate.

What are the dates for subscribing to the Methodhub Software IPO?

The IPO opens on December 5, 2025 and closes on December 9, 2025 for all investors.

When will the allotment for the Methodhub Software IPO be announced?

The allotment is expected to be finalised on December 10, 2025, followed by refunds and demat credit.

Where will Methodhub Software shares be listed after the IPO?

The equity shares of Methodhub Software Limited are proposed to be listed on the BSE SME platform.