- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Midwest IPO

₹14,196/14 shares

Minimum Investment

IPO Details

15 Oct 25

17 Oct 25

₹14,196

14

₹1,014 to ₹1,065

NSE, BSE

₹451 Cr

24 Oct 25

Midwest IPO Timeline

Bidding Start

15 Oct 25

Bidding Ends

17 Oct 25

Allotment Finalisation

20 Oct 25

Refund Initiation

23 Oct 25

Demat Transfer

23 Oct 25

Listing

24 Oct 25

Midwest Limited IPO

Incorporated in 1981, Midwest Limited engages in the exploration, mining, processing, marketing, and export of natural stones. The company is a leading producer of Black Galaxy Granite, renowned for its golden specks. Operating 16 mines across Telangana and Andhra Pradesh, it manages two granite processing facilities in these states. Midwest exports to 17 countries, including China, Italy, and Thailand, serving reputed global clients. With 1,326 personnel and resources in 25 locations, the company ensures sustained expansion and long-term growth.

Midwest Limited IPO Overview

Midwest Ltd. IPO is a book-built issue aggregating ₹451.00 crores, comprising a fresh issue of 0.23 crore shares worth ₹250.00 crores and an offer for sale of 0.19 crore shares worth ₹201.00 crores. The IPO opened for subscription on 15 October 2025 and will close on 17 October 2025, with allotment expected to be finalised on 20 October 2025. The shares are proposed to be listed on BSE and NSE on 24 October 2025. The price band is set at ₹1,014 to ₹1,065 per share, with a lot size of 14 shares. For retail investors, the minimum investment is ₹14,910 based on the upper price. The lot size for sNII investors is 14 lots (196 shares) amounting to ₹2,08,740, while for bNII investors, it is 68 lots (952 shares) amounting to ₹10,13,880. Additionally, up to 10,373 shares are reserved for employees at a discount of ₹101 per share. Dam Capital Advisors Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar of the issue.

Midwest Limited IPO Details

| Particulars | Details |

| IPO Date | 15 October 2025 to 17 October 2025 |

| Listing Date | 24 October 2025 |

| Face Value | ₹5 per share |

| Issue Price Band | ₹1,014 to ₹1,065 per share |

| Lot Size | 14 shares |

| Total Issue Size | 42,34,740 shares (aggregating up to ₹451.00 Cr) |

| Fresh Issue | 23,47,417 shares (aggregating up to ₹250.00 Cr) |

| Offer for Sale | 18,87,323 shares (aggregating up to ₹201.00 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 3,38,12,415 shares |

| Share Holding Post Issue | 3,61,59,832 shares |

Midwest Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Midwest Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 14 | ₹14,910 |

| Retail (Max) | 13 | 182 | ₹1,93,830 |

| HNI (Min) | 14 | 196 | ₹2,08,740 |

Midwest Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 95.83% |

| Post-Issue | 84.39% |

Midwest Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹39.42 (Pre-Issue), ₹26.97 (Post-Issue) |

| Price/Earnings (P/E) Ratio | 27.01x (Pre), 39.49x (Post) |

| Return on Net Worth (RoNW) | 22.11% |

| Net Asset Value (NAV) | ₹163.75 per share |

| Return on Equity | 19.42% |

| Return on Capital Employed (ROCE) | 18.84% |

| EBITDA Margin | 27.43% |

| PAT Margin | 17.17% |

| Debt to Equity Ratio | 0.43 |

Objectives of the Proceeds

- Fund capital expenditure at Midwest Neostone for Phase II Quartz Plant – ₹1,270.49 million

- Purchase electric dump trucks for operations – ₹257.55 million

- Integrate solar energy at select mining sites – ₹32.56 million

- Repay or prepay certain borrowings of company and subsidiary – ₹538.00 million

- General corporate purposes – balance amount

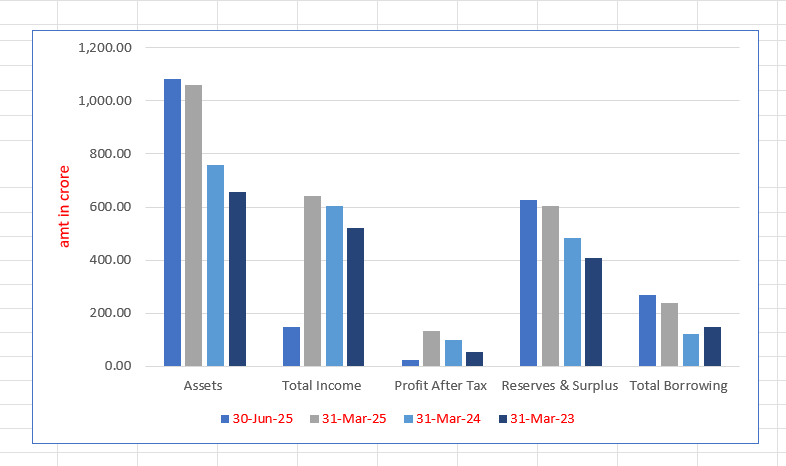

Key Financials (in ₹ lakhs)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,082.81 | 1,058.70 | 757.12 | 656.00 |

| Total Income | 146.47 | 643.14 | 603.33 | 522.23 |

| Profit After Tax | 24.38 | 133.30 | 100.32 | 54.44 |

| Reserves & Surplus | 625.60 | 602.26 | 484.86 | 408.88 |

| Total Borrowing | 270.11 | 236.61 | 120.48 | 149.08 |

SWOT Analysis of Midwest IPO

Strength and Opportunities

- Experienced promoters with deep industry expertise

- Strong domestic and international client base

- Integrated mining and processing operations

- Proven export presence across 17 countries

Risks and Threats

- Heavy dependence on granite and quartz export demand

- Fluctuations in commodity and currency prices

- High capital expenditure and debt obligations

- Regulatory and environmental compliance challenges

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Midwest Limited

Midwest IPO Strengths

- Midwest controls around 64% of India’s Black Galaxy Granite export market, ensuring stable demand and pricing power.

- Revenue grew from ₹502 crore in FY23 to ₹626 crore in FY25, with profit after tax nearly doubling to ₹107 crore.

- EBITDA margin improved from 17.8% to 27.4%, earning ₹27 operating profit for every ₹100 in sales.

- Interest Coverage Ratio of 13.37 indicates strong ability to service interest costs.

- Debt-to-equity ratio of 0.43× shows low dependence on borrowings.

Peer Group Comparison

Midwest Ltd. peer comparison with similar listed entities (As on March 31, 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹ per share) | P/E (x) | RoNW (%) | P/BV Ratio |

| Midwest Limited | 39.42 | 39.42 | 163.75 | — | 22.11 | — |

| Peer Group | ||||||

| Pokarna Ltd. | 60.49 | 60.49 | 250.93 | 12.73 | 24.11 | 3.08 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Midwest Limited IPO

How can I apply for Midwest Limited IPO?

You can apply via HDFCSky using UPI-based ASBA for a safe and paperless process.

What is the minimum investment for Midwest Limited IPO?

The minimum retail investment is ₹14,910 for one lot comprising 14 shares.

When will the Midwest Limited IPO allotment be finalised?

The allotment will be finalised on 20 October 2025, as per the IPO schedule.

On which exchanges will Midwest Limited list?

Midwest Limited IPO will list on both BSE and NSE on 24 October 2025.