- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Milestone Gears IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Milestone Gears IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Milestone Gears Limited IPO

Milestone Gears Limited, incorporated in 1984, is a leading manufacturer of high-precision, complex engineered transmission components. Its diverse product portfolio includes bull gears, rear axles, spindles, internal ring gears, and bevel gears, which are critical for tractors, construction equipment, electric vehicles (EVs), locomotives, and windmills. The company boasts long-standing relationships with major Indian and global OEMs, with an average association of over 18 years with its top 10 customers. With nine strategically located manufacturing facilities and a strong focus on quality and engineering, Milestone Gears has established itself as a trusted supplier in the heavy engineering sector.

Milestone Gears Limited IPO Overview

The Milestone Gears Limited IPO is a book-built issue aiming to raise ₹1,100.00 crores. This comprises a fresh issue of ₹800.00 crores and an Offer for Sale (OFS) of ₹300.00 crores by the promoters. While key details like IPO dates, price bands, and lot size are yet to be announced, the company has filed its Draft Red Herring Prospectus (DRHP) with SEBI on November 18, 2025. The equity shares are proposed to be listed on both the BSE and NSE. Kfin Technologies Ltd. has been appointed as the registrar for this public offer, which will facilitate the allotment and refund processes for investors.

Milestone Gears Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | [.] shares (aggregating up to ₹1,100.00 Cr) |

| Fresh Issue | [.] shares (aggregating up to ₹800.00 Cr) |

| Offer for Sale (OFS) | [.] shares (aggregating up to ₹300.00 Cr) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 9,00,00,000 shares |

| Shareholding post-issue | TBA |

About Milestone Gears IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Milestone Gears Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

Milestone Gears Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 2.45 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 17.47% |

| Net Asset Value (NAV) | ₹ 14.03 |

| Return on Equity (RoE) | 17.47% |

| Return on Capital Employed (RoCE) | 12.23% |

| EBITDA Margin | 18.16% |

| PAT Margin | 4.16% |

| Debt to Equity Ratio | 3.23 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ crores) |

| Repayment/ prepayment of certain outstanding borrowings and accrued interest | 356.86 |

| Financing capital expenditure for a new manufacturing facility in Himachal Pradesh | 296.42 |

| General corporate purposes | [●] |

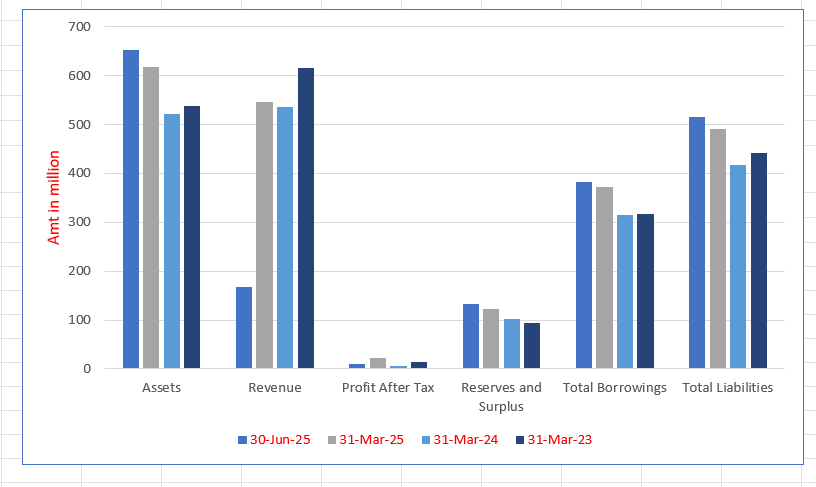

Milestone Gears Limited Financials (in ₹ Crores)

| Particulars | 30June 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 651.84 | 617.67 | 521.61 | 537.81 |

| Revenue | 168.52 | 546.89 | 535.99 | 615.64 |

| Profit After Tax | 9.36 | 22.06 | 6.72 | 14.07 |

| Reserves and Surplus | 132.57 | 123.26 | 101.10 | 93.74 |

| Total Borrowings | 382.58 | 372.76 | 315.25 | 316.84 |

| Total Liabilities | 516.27 | 491.41 | 417.51 | 441.06 |

SWOT Analysis of Milestone Gears IPO

Strength and Opportunities

- Diverse and complex product portfolio serving multiple large sectors.

- Long-standing, entrenched relationships with leading global OEMs.

- Strategically located manufacturing facilities with end-to-end in-house capabilities.

- Strong in-house forging, machining, and heat treatment expertise.

- Proven ability to develop new products and enter high-growth sectors like EVs.

- Experienced technocrat promoters and a skilled senior management team.

- Favorable location in Himachal Pradesh providing access to stable hydel power.

- Significant opportunity to grow in the high-margin EV, locomotive, and windmill sectors.

- Potential to increase exports leveraging the "China-plus-one" strategy.

- Government support through 'Make in India' and PLI schemes for manufacturing.

Risks and Threats

- High debt levels reflected in a Debt/Equity ratio of 3.23.

- Vulnerability to economic cycles affecting the agricultural and construction sectors.

- Intense competition from established domestic and global forging and gear manufacturers.

- Dependence on a limited number of large customers for a significant portion of revenue.

- Fluctuations in the prices of key raw materials like steel.

- Risks associated with executing the planned capacity expansion and new facility setup.

- Global supply chain disruptions and geopolitical tensions impacting exports.

- Stringent and evolving environmental and emission regulations.

- Dependence on a skilled workforce and potential challenges in talent retention.

- Currency exchange rate volatility impacting export competitiveness and profitability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Milestone Gears Limited IPO

Milestone Gears Limited IPO Strengths

Diverse and Complex Product Portfolio with Applications Across Multiple Sectors

Milestone Gears Limited manufactures a wide array of high-precision transmission components, including bull gears, rear axles, and internal ring gears. This diverse portfolio caters to large and stable sectors like agriculture and construction, while also positioning the company to capitalize on high-growth areas such as electric vehicles, locomotives, and wind energy. This multi-sector presence diversifies its revenue streams and reduces dependence on any single industry, providing a robust foundation for sustained growth and resilience against sector-specific downturns.

Long-Standing and Entrenched Customer Relationships with Leading OEMs

Milestone Gears Limited has cultivated deep, trust-based relationships with a strong base of domestic and global original equipment manufacturers. The company’s average association with its top 10 customers exceeds 18 years, demonstrating its reliability as a supplier. These long-term partnerships are built on a foundation of consistent quality, timely delivery, and a collaborative approach to product development, creating significant entry barriers for competitors and ensuring a stable and predictable revenue base.

Strategically Located Manufacturing Facilities with End-to-End In-House Operations

Milestone Gears Limited operates nine manufacturing facilities across Punjab, Haryana, and Himachal Pradesh, providing proximity to key customers and reducing logistics costs. Its integrated operations encompass in-house forging, machining, and heat treatment, allowing for complete quality control over the entire production process. This end-to-end capability, combined with access to stable hydel power in Himachal Pradesh, enhances operational efficiency, ensures supply chain resilience, and enables the company to respond agilely to dynamic customer requirements.

Experienced Technocrat Promoters and a Senior Management Team

Milestone Gears Limited is guided by its promoters, Ashok Kumar Tandon and Aman Tandon, who bring extensive industry experience and technical expertise. This leadership is supported by a seasoned senior management team with deep knowledge in operations, business development, and customer relationships. The promoters’ strategic vision, coupled with the management’s strong execution skills and a large, skilled workforce, has been instrumental in steering the company’s growth and navigating the complexities of the precision engineering industry.

More About Milestone Gears Limited

Milestone Gears Limited is a prominent player in the Indian precision engineering landscape, specializing in the design and manufacturing of mission-critical transmission components. Established in 1984, the company has evolved from a domestic supplier to a globally recognized partner for original equipment manufacturers (OEMs).

Core Business and Product Portfolio

The company’s expertise lies in producing high-tolerance, complex components that are essential for power transmission in heavy machinery. Its key products include:

- Bull Gears and Rear Axles: Critical for the drivetrains of tractors and construction equipment.

- Internal Ring Gears and Bevel Gears: Used in various gearbox applications across sectors.

- Spindles, Rock Shafts, and Transmission Gears: Precision components for transmitting torque and motion.

Manufacturing Prowess and Quality Assurance

Milestone Gears operates nine manufacturing facilities with a combined built-up area of over 398,000 square feet. Its integrated manufacturing model includes:

- In-house Forging: Powered by hammers and upsetters, allowing for precision forging of components.

- Advanced Machining: Over 375 CNC machines ensure high accuracy in gear hobbing, shaping, and grinding.

- Specialized Heat Treatment: SCADA-controlled and CQI-9 compliant processes ensure components meet stringent metallurgical standards.

The company’s facilities are certified under IATF 16949, ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018, reflecting its commitment to quality, environmental management, and occupational health and safety.

Global Customer Base and Export Footprint

Milestone Gears supplies its products to a prestigious clientele, including Mahindra & Mahindra, TAFE, Escorts Kubota, JCB, and CNH Industrial. It has also successfully expanded its global reach, exporting to ten countries including the USA, UK, Germany, and Brazil. The company’s strategy involves deepening relationships with existing customers by increasing its “share of wallet” and onboarding new global OEMs, particularly in the EV and locomotive sectors.

Industry Outlook

The Indian precision components and forging industry is poised for significant growth, driven by strong tailwinds from both domestic and international markets.

Overall Industry Growth

The Indian auto component industry is a key economic driver, with the forging sector being a critical subset. The industry is benefiting from the government’s ‘Make in India’ initiative, Production Linked Incentive (PLI) schemes, and the global ‘China-plus-one’ sourcing strategy. This is positioning India as a preferred global manufacturing hub for precision engineering components.

Growth Drivers

- Agricultural Equipment: India is the world’s largest tractor market by volume. The market is projected to reach approximately 1.5 million units by Fiscal 2030, growing at a CAGR of 8.2% from FY2025.

- Construction Equipment: Driven by massive government infrastructure spending and a real estate boom, this market is projected to expand to approximately ₹1,732.5 billion by Fiscal 2030, at a CAGR of 14.0%.

- Electric Vehicles (EVs): The Indian EV passenger vehicle component market is a high-growth segment. It is projected to reach approximately ₹122.6 billion by Fiscal 2030, growing at a CAGR of 15.5%, with transmission components being the largest sub-segment.

- Locomotives and Windmills: Government investments in railway infrastructure and renewable energy are fueling demand. The Indian railway market is projected to reach ₹3,646.8 billion by FY2030 (CAGR: 5.7%), and the windmill component market is expected to hit ₹512.1 billion (CAGR: 5.2%).

Favourable Market Dynamics

The transition to stricter emission norms is driving the need for more advanced and precise components. Furthermore, European and American OEMs are increasingly shifting their procurement to India to leverage cost competitiveness and a robust manufacturing ecosystem, creating substantial export opportunities for established players like Milestone Gears.

How Will Milestone Gears Limited Benefit

- Capitalize on the exponential growth of the Indian EV market by supplying high-speed precision gears and drivetrain components, leveraging its dedicated EV facility and existing customer relationships.

- Increase its export revenue by leveraging the global ‘China-plus-one’ strategy and its established relationships with international OEMs like John Deere and CNH Industrial.

- Deepen its market share in the stable and growing agricultural sector by offering assembled 4-wheel-drive transmission units, moving up the value chain.

- Tap into the high-value locomotive and windmill sectors by utilizing its precision engineering capabilities to supply heavy components, diversifying its revenue base.

- Benefit from government incentives under the ‘Make in India’ and PLI schemes, which support domestic manufacturing and enhance cost competitiveness for capital expenditure and exports.

- Improve operational efficiency and profitability through debt reduction from IPO proceeds, leading to lower finance costs and an improved debt-to-equity ratio.

- Enhance its manufacturing capacity and capabilities with the new greenfield project, enabling it to meet the growing and complex demands of existing and new customers across all its target sectors.

Peer Group Comparison

| Name of the company | Face value per equity share (₹) | P/E Ratio | EPS (Diluted) (₹ per share) | RoNW (%) | NAV (₹ per share) |

| Milestone Gears Limited | 2.00 | [●] | 2.45 | 17.47% | 14.03 |

| Bharat Forge Ltd | 2.00 | 69.93 | 20.05 | 12.10% | 192.86 |

| Peer Group | |||||

| Sona BLW Precision Forgings Ltd | 10.00 | 49.38 | 9.92 | 17.70% | 90.79 |

| Happy Forgings Ltd | 2.00 | 35.38 | 28.37 | 15.40% | 196.25 |

| Ramkrishna Forgings Ltd | 2.00 | 23.67 | 22.95 | 11.70% | 167.78 |

| Shanthi Gears Ltd | 1.00 | 38.49 | 12.52 | 23.83% | 52.53 |

Key Strategies for Milestone Gears Limited

Leveraging Technology to Grow in High-Growth Sectors

Milestone Gears Limited will leverage its precision engineering capabilities to expand its product portfolio in high-margin sectors like electric vehicles (EVs), locomotives, and windmills. The company intends to utilize IPO proceeds to set up a new facility for manufacturing high-speed EV gears and heavy components for other sectors. By focusing on these high-growth areas, Milestone Gears aims to diversify its revenue streams, capture new market opportunities, and reduce cyclical dependence on its traditional sectors.

Increasing Exports and International Market Presence

Milestone Gears Limited plans to significantly increase its exports, capitalizing on the ‘China-plus-one’ strategy and growing global demand. The company will focus on markets in the United States, Europe, and Japan, leveraging its existing relationships with global OEMs. This strategy aims to diversify its revenue base, mitigate regional economic risks, and position the company as a global supplier of critical precision components, thereby enhancing its long-term growth prospects and market reach.

Sustaining and Strengthening Market Share in Core Sectors

Milestone Gears Limited intends to sustain and strengthen its market leadership in the agricultural and construction equipment sectors. The strategy involves adding new products to existing lines, increasing wallet share with current customers, and onboarding new clients. A key initiative is moving up the value chain by offering fully assembled 4-wheel-drive transmission units to OEMs. This approach will deepen customer relationships and solidify its position as a trusted, value-added supplier in these core markets.

Expanding Capacity and Setting Up a New Manufacturing Facility

Milestone Gears Limited is focused on expanding its manufacturing capabilities to meet rising demand. A portion of the IPO proceeds is earmarked for a new greenfield manufacturing facility in Himachal Pradesh. This facility will be dedicated to producing EV components requiring high-speed precision gears and heavy components for locomotives and windmills. This expansion is crucial for increasing production capacity, entering new product categories, and supporting the company’s long-term growth objectives.

Reducing Operational Costs and Improving Efficiencies

Milestone Gears Limited is committed to continuous improvement in operational efficiency and cost reduction. The company plans to introduce new technologies, expand automation, and explore the installation of rooftop solar power across its facilities. Initiatives also include reducing tool consumption and shifting to sustainable packaging. These efforts are aimed at optimizing manufacturing processes, lowering power and labour costs, and enhancing overall productivity and profitability.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Milestone Gears Limited IPO

How can I apply for Milestone Gears Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Milestone Gears IPO?

The IPO aims to raise ₹1,100 crores, with a fresh issue of ₹800 crores and an OFS of ₹300 crores.

What is the face value of Milestone Gears' equity shares?

The face value of Milestone Gears Limited’s equity shares is ₹2 per share.

How will the company use the money from the fresh issue?

Proceeds will be used for debt repayment and funding a new manufacturing facility in Himachal Pradesh.

Who are the promoters of Milestone Gears Limited?

The promoters are Ashok Kumar Tandon and Aman Tandon.