- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Milky Mist IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Milky Mist IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Milky Mist Limited

Milky Mist Dairy Food Limited is an Indian dairy company producing and distributing a diverse range of dairy and frozen food products. It pioneered branded packaged paneer in India and later expanded to curd, ghee, butter, cheese, yogurt, ice cream, UHT products, chocolates, and sweetened condensed milk. Operating a farm-to-retail model, the company sources raw milk from over 67,000 farmers across Tamil Nadu, Andhra Pradesh, and Karnataka. Its Perundurai facility focuses on value-added dairy, while Bengaluru produces frozen foods. With a strong logistics and distribution network across India and exports to 15+ countries, Milky Mist holds significant market share in paneer and cheese.

Milky Mist Limited IPO Overview

Milky Mist Dairy Food Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 21, 2025, aiming to raise ₹2,035.00 crores through an Initial Public Offer (IPO). The issue comprises a fresh share issuance of ₹1,785.00 crores and an Offer for Sale (OFS) of ₹250.00 crores. The equity shares are proposed to be listed on both NSE and BSE. While the book running lead manager has not yet been appointed, Kfin Technologies Ltd. will act as the registrar. Key details including IPO dates, price band, and lot size are yet to be announced. The IPO follows a book-building process, with a face value of ₹2 per share.

Milky Mist Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹2035 crore |

| Fresh Issue | ₹1785 crore |

| Offer for Sale (OFS) | ₹ |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 64,22,85,000 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Milky Mist Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Milky Mist Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹0.73 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 18.98% |

| Net Asset Value (NAV) | ₹3.78 |

| Return on Equity (RoE) | 15.11% |

| Return on Capital Employed (RoCE) | 9.54% |

| EBITDA Margin | 13.21% |

| PAT Margin | 1.96% |

| Debt to Equity Ratio | 4.20 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or in part, of certain outstanding borrowings availed by the Company | 7500 |

| Financing the capital expenditure requirements in relation to the expansion and modernisation of the Perundurai Manufacturing Facility | 4147.15 |

| Deployment of visi coolers, ice cream freezers and chocolate coolers | 1,294.28 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

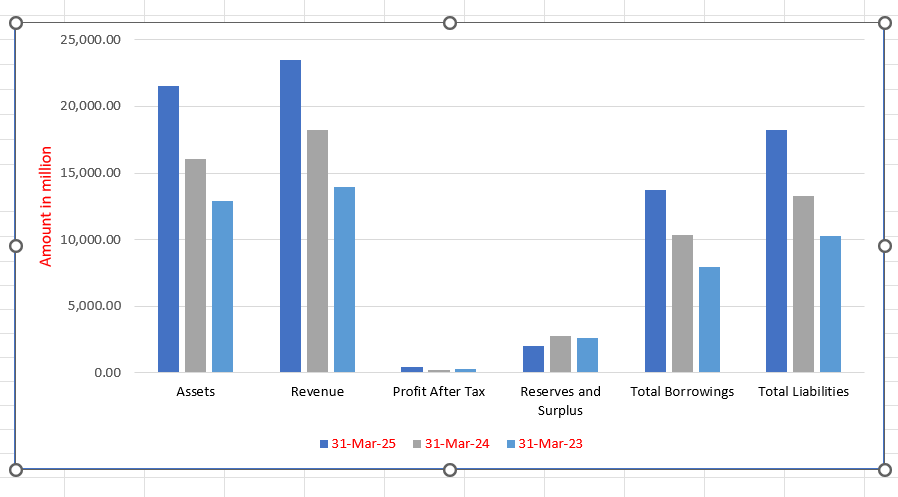

Milky Mist Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 21,505.90 | 16,062.56 | 12,894.20 |

| Revenue | 23,495.03 | 18,216.09 | 13,941.75 |

| Profit After Tax | 460.74 | 194.44 | 272.30 |

| Reserves and Surplus | 1,993.36 | 2,784.97 | 2,588.23 |

| Total Borrowings | 13,763.77 | 10,367.24 | 7,980.64 |

| Total Liabilities | 18,227.97 | 13,241.91 | 10,270.29 |

Financial Status of Milky Mist Limited

SWOT Analysis of Milky Mist IPO

Strength and Opportunities

- Strong brand recognition in Southern India.

- Diverse product portfolio with over 110 SKUs, including paneer, ghee, and ice cream.

- Robust supply chain with direct sourcing from over 30 crore liters of milk annually.

- Strategic digital marketing initiatives, enhancing online presence and customer engagement.

- Plans for IPO to raise ₹2,035 crore, aiming for expansion and debt reduction.

- Focus on value-added products, yielding higher profit margins compared to plain milk.

- Strong relationships with local dairy farmers, ensuring quality raw materials.

- Commitment to sustainability and ethical sourcing practices.

- Continuous innovation in product offerings to meet changing consumer preferences.

Risks and Threats

- Limited presence in Northern and Western India.

- Dependency on a single manufacturing facility in Perundurai.

- High operational costs due to cold chain logistics.

- Vulnerability to fluctuations in raw milk prices.

- Intense competition from established dairy brands like Amul and Hatsun.

- Challenges in maintaining consistent product quality across all batches.

- Limited international market penetration.

- Potential regulatory challenges in different markets.

- Risks associated with scaling operations rapidly post-IPO.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Milky Mist Limited

Milky Mist Limited IPO Strengths

Technological Innovation and Automation

Milky Mist Limited leverages advanced technology to enhance its manufacturing processes. The company has implemented automated systems for tasks like paneer production, from continuous, large-scale manufacturing to robotic packaging. This approach, alongside technologies like aseptic packing for long-shelf-life products, ensures superior product quality, hygiene, and operational efficiency while minimizing human intervention and waste.

Quality Control and Certifications

Milky Mist Limited places a high emphasis on stringent quality control across all operations. The company’s Perundurai Manufacturing Facility holds U.S. FDA, ISO 22000:2018, and FSSC 22000 certifications, ensuring adherence to global food safety and quality standards. Its in-house laboratory and multi-stage testing process, from raw milk procurement to final product analysis, guarantees consistent, high-quality products for both domestic and export markets.

Project Execution and Capacity Expansion

Milky Mist Limited has demonstrated strong project execution capabilities by consistently expanding and upgrading its manufacturing facilities. The company’s substantial investments in property, plant, and equipment have enabled it to modernize its infrastructure, diversify its product range, and increase its installed capacities for various dairy products. This has resulted in a broader product portfolio and improved operational productivity and cost-efficiency.

Strategic Management of Seasonal Milk Fluctuations

Milky Mist Limited effectively manages seasonal fluctuations in milk supply by converting excess milk from the winter flush season into long-shelf-life products like cheddar cheese and UHT powder. In contrast, during the summer, the company focuses on high-demand items such as ice cream and buttermilk. This strategic approach ensures optimal milk utilization, minimizes wastage, and maintains a stable supply chain year-round.

Direct Milk Sourcing and Farmer Engagement

Milky Mist Limited directly procures raw milk from a large network of farmers, fostering transparency and trust without intermediaries. The company supports farmers through various initiatives, including providing cattle feed, veterinary services, and training. Its three-tier quality control process, featuring automated data capture and direct bank payments, ensures the high quality of raw milk while strengthening long-term, mutually beneficial relationships with farmers.

Multi-Channel Sales and Integrated Logistics

Milky Mist Limited utilizes a diverse multi-channel sales strategy, including general trade, modern trade, and e-commerce platforms, supported by an in-house logistics fleet. The company’s owned refrigerated trucks and tankers ensure product quality from farm to shelf, allowing it to expand its market presence beyond South India. This integrated approach, along with strategic investments in visi coolers and its own parlours, enhances delivery efficiency and brand visibility.

Commitment to Sustainability

Milky Mist Limited is dedicated to environmental, social, and governance (ESG) practices. The company generates a significant portion of its energy from renewable sources, including solar and wind power, and has implemented technology to convert wastewater into reusable processed water. By using electric vehicles for a portion of its fleet and engaging in community initiatives like tree planting, the company actively works to reduce its carbon footprint and support sustainable operations.

Experienced Management and Financial Growth

Milky Mist Limited benefits from an experienced management team with deep knowledge of the dairy and food industry, led by its founders with over two decades of experience. The strategic direction provided by the management team, along with the company’s diversified product categories and expanding geographical presence, has consistently fueled strong financial growth. Their expertise allows the company to capitalize on market opportunities and drive business development.

More About Milky Mist Limited

Milky Mist Dairy Food Ltd. is one of India’s fastest-growing packaged food companies with revenues exceeding ₹15,000 million, registering a CAGR of 29.82% from Fiscal 2023 to Fiscal 2025 (Source: 1Lattice Report). Focused exclusively on premium, value-added dairy products, the company is dedicated to meeting diverse consumer needs throughout the day, from breakfast to dinner. Milky Mist offers a wide range of products, including cheese, paneer, butter, curd, ghee, yogurt, ice cream, UHT long-shelf-life products, chocolates, frozen foods, ready-to-eat (RTE), and ready-to-cook (RTC) items under its flagship brand ‘Milky Mist’ and sub-brands such as ‘SmartChef’, ‘Capella’, ‘Misty Lite’, along with recently acquired brands ‘Briyas’ and ‘Asal’.

Market Leadership

- First private company in India to launch branded packaged paneer and expand into curd, ghee, butter, cheese, yogurt, ice cream, UHT products, chocolates, and sweetened condensed milk.

- Largest private packaged paneer brand with ~17% market share (Fiscal 2025) in the organized segment.

- Largest private packaged cheese brand in South India (~12% market share) and third nationally (~5%).

- Among the top three private packaged yogurt brands (~7% market share nationally).

- Prices for paneer and curd are 10–25% above average Indian brands, enabling premium realizations of ~₹74 per litre of milk procured.

Integrated Farm-to-Retail Operations

Milky Mist sources raw milk directly from 67,615 farmers across 22 districts in Tamil Nadu, Andhra Pradesh, and Karnataka, within a 400 km radius of its Perundurai facility. The company maintains a three-tier milk quality system, including automated milk collection units (3,460 AMCUs), chilling centers (21), and rigorous testing at manufacturing facilities.

Manufacturing and Technology

- Two facilities: Perundurai, Tamil Nadu (value-added dairy) and Bengaluru, Karnataka (frozen foods, RTE/RTC).

- Advanced machinery ensures quality, efficiency, and hygiene; Perundurai facility is U.S. FDA approved.

- Seasonal milk-balancing strategy optimizes production of high-demand and long-shelf-life products.

Logistics and Distribution

- Fleet: 44 milk vans, 252 reefer trucks, 34 ambient trucks; IoT-enabled for real-time tracking.

- Distribution across 22 states and 5 union territories, with 3,062 distributors, 44 C&F depots, and over 350,000 retail touchpoints.

- Export presence in 15+ countries, including the U.S., Singapore, Australia, and Middle Eastern markets.

Retail and Consumer Engagement

- 108 Milky Mist exclusive parlours across eight states, including company-operated and franchise models.

- Deployment of 13,885 visi coolers, 13,804 ice cream freezers, and 559 chocolate coolers across thousands of retail outlets.

- Dedicated 549-member sales, distribution, and marketing team ensuring brand visibility and operational efficiency.

Industry Outlook

India’s dairy industry is experiencing robust growth, driven by increasing domestic demand and a growing consumer preference for value-added products. Key statistics include:

- Market Size: Valued at approximately ₹18,975 billion in 2024.

- Projected Growth: Expected to reach ₹57,001.81 billion by 2033, reflecting a CAGR of 12.35% from 2025 to 2033.

- Milk Production: Forecasted to rise to 216.5 million metric tons in 2025.

Value-Added Dairy Products: A Growing Segment

The demand for value-added dairy products is surging, fueled by consumer preferences for convenience, health, and premium offerings. These products include cheese, paneer, butter, curd, ghee, yogurt, ice cream, UHT long-shelf-life products, chocolates, frozen foods, and ready-to-eat (RTE) and ready-to-cook (RTC) items. The market for dairy products is projected to grow at a CAGR of 6.76% from 2024 to 2030.

Growth Drivers

- Urbanization: Increasing urban populations are driving demand for packaged and ready-to-eat dairy products.

- Health Consciousness: Rising awareness about health and wellness is boosting the consumption of probiotic and low-fat dairy options.https://www.sphericalinsights.com/reports/india-dairy-market?utm_source=chatgpt.com

- Premiumization: Consumers are willing to pay a premium for high-quality, branded dairy products.

- Technological Advancements: Innovations in dairy processing and packaging are enhancing product shelf life and convenience.

How Will Milky Mist Limited Benefit

- Milky Mist Limited is well-positioned to capitalize on the growing demand for value-added dairy products such as cheese, paneer, yogurt, and butter, which are experiencing rising consumer preference.

- The company can leverage urbanization trends and increased consumption of packaged, ready-to-eat, and convenient dairy offerings to expand its market reach.

- Premiumization in the Indian dairy sector allows Milky Mist to maintain and potentially increase its pricing power, reinforcing its high-margin product strategy.

- Technological advancements in processing, packaging, and logistics can enhance Milky Mist’s operational efficiency, product shelf life, and distribution capabilities.

- Expanding health-conscious consumer preferences for probiotic and low-fat options provide opportunities for Milky Mist to innovate and diversify its product portfolio.

- Growing milk production and supply across India ensures consistent raw material availability, supporting the company’s farm-to-retail integration and enabling scaling of operations.

- Export opportunities and increasing international demand for Indian dairy products can help Milky Mist expand its global footprint.

Peer Group Comparison

| Name of the company | Revenue (in ₹ million) | Face value (₹) | P/E ratio | EPS

(₹) |

RoNW (%) | NAV

(₹) |

| Milky Mist | 23,495.03 | 2 | TBD | 0.73 | 18.98% | 3.78 |

| Peer Groups | ||||||

| Bikaji Foods International Limited | 26,218.54 | 1.00 | 91.56 | 8.02 | 14.52% | 55.22 |

| Britannia Industries Limited | 179,426.70 | 1.00 | 65.05 | 90.45 | 50.02% | 180.83 |

| Dodla Dairy Limited | 37,200.65 | 10.00 | 32.94 | 43.27 | 18.49% | 234.68 |

| Hatsun Agro Product Limited | 86,997.60 | 1.00 | 78.48 | 12.51 | 16.23% | 77.11 |

| Nestle India Limited | 202,015.60 | 1.00 | 72.95 | 33.27 | 79.99% | 41.59 |

| Parag Milk Foods Limited | 34,322.10 | 10.00 | 24.91 | 9.97 | 11.61% | 85.73 |

| Tata Consumer Products Limited | 176,183.00 | 1.00 | 84.03 | 13.06 | 6.39% | 205.95 |

Key Strategies for Milky Mist Limited

Geographical Expansion and Market Penetration

Milky Mist Limited is dedicated to strengthening its market position in Southern India while establishing a stronger presence in other regions. The company intends to increase sales volumes and revenue by expanding through e-commerce, modern trade channels, and investing in logistics infrastructure and retail coolers.

Enhancing Production and Procurement

Milky Mist Limited aims to expand its manufacturing capabilities by adding new plants for products like whey protein and yogurt. The company also plans to augment its procurement network by strengthening existing relationships and building new ones with milk farmers through various support initiatives.

Strengthening Brand Visibility and Equity

Milky Mist Limited seeks to reinforce its brand through increased advertising and strategic marketing campaigns. The company intends to leverage digital platforms, brand ambassadors, and influencer partnerships to enhance its brand presence, boost consumer awareness, and improve overall brand equity.

Pursuing Inorganic Growth

Milky Mist Limited plans to grow through strategic acquisitions that create synergies and align with its business goals. The company will actively seek opportunities to acquire entities that expand its product portfolio, customer base, and market exposure in new end-markets and geographic regions.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Milky Mist Limited IPO

How can I apply for Milky Mist Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of Milky Mist IPO?

The total issue size is ₹2,035 crore, comprising a fresh issue and an offer-for-sale.

What is the purpose of this IPO?

Proceeds will be used for debt repayment, Perundurai facility expansion, and purchasing visicoolers/freezers.

On which exchanges will the shares be listed?

Milky Mist equity shares are proposed to list on the NSE and BSE mainboards.

What is the face value of the IPO shares?

The face value of each equity share is ₹2, with the issue price band yet to be announced.

Who can invest in this IPO?

Retail, non-institutional, qualified institutional investors, and eligible employees can apply as per category limits