- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Modern Portfolio Theory (MPT): Balancing Risk and Return

By HDFC SKY | Published at: May 28, 2025 04:20 PM IST

Modern Portfolio Theory (MPT), introduced by Harry Markowitz in the 1950s, is an investment strategy that focuses on creating an optimal portfolio by balancing risk and return. The theory posits that investors can achieve the best possible returns for a specific level of risk by diversifying their investments across different assets.

MPT highlights that various assets react differently to market changes, so combining them in a portfolio can help lower overall risk. Investing involves finding the right balance between risk and return. Every investor aims to maximise profits while keeping risks as low as possible.

If you’ve ever wondered how to invest smartly while keeping risks in check, this blog will explain it in straightforward terms. Let’s explore the basics of MPT, including its uses, benefits, and criticisms.

What is the Modern Portfolio Theory (MPT)?

Modern Portfolio Theory (MPT) is a strategy for investors aimed at building an optimal portfolio through asset diversification. It proposes that by selecting a combination of assets with low or negative correlations, investors can achieve the highest expected returns for a specific level of risk.

The theory assumes that:

- Investors tend to be cautious, favouring lower risk while seeking similar returns.

- Asset prices typically exhibit a normal distribution.

- Investors strive to achieve the highest returns possible for a specific level of risk.

- Having a diversified portfolio can help minimise overall investment risk.

MPT assists investors in grasping the connection between risk and return and how various assets work together within a portfolio.

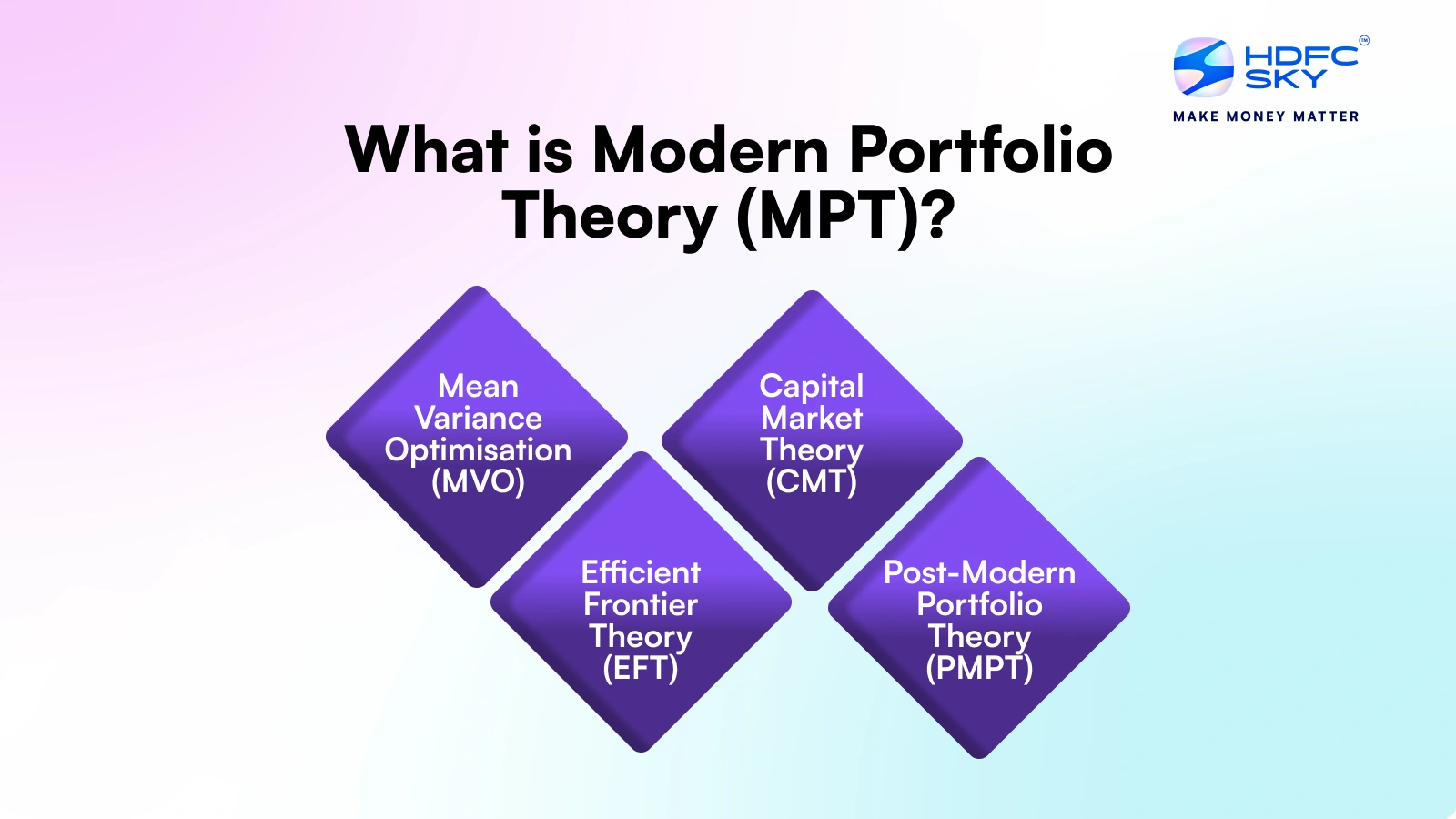

Types of Modern Portfolio Theory

MPT can be classified into various types depending on its application in finance:

1. Mean-Variance Optimisation (MVO)

This is the foundation of MPT. It assists investors in identifying the best portfolio by examining expected returns, variances, and the relationships between various assets.

2. Efficient Frontier Theory

The efficient frontier is a curve that illustrates the highest possible return for a specific level of risk. Portfolios that fall on this frontier are deemed optimal.

3. Capital Market Theory (CMT)

CMT builds on MPT by adding the Capital Market Line (CML), which incorporates a risk-free asset. This addition aids investors in making choices between risky and risk-free investments.

4. Post-Modern Portfolio Theory (PMPT)

PMPT is an improved version of MPT that emphasises downside risk rather than variance. It acknowledges that investors are generally more afraid of losses than they are motivated by potential gains.

How to Use Modern Portfolio Theory in Finance?

Using Modern Portfolio Theory (MPT) in finance involves utilising its principles to create a diversified portfolio that balances risk and return according to an investor’s preferences. Here’s how to implement MPT:

- Identify Investment Objectives and Risk Tolerance: Begin by outlining your financial goals (such as retirement or wealth growth) and assessing your risk tolerance (the level of risk you’re comfortable taking for potential returns). MPT aids in aligning your portfolio with these objectives.

- Select Asset Classes: Choose a variety of asset classes (like equities, bonds, real estate, and commodities) that are expected to perform differently under various market conditions. The goal is to select assets not closely correlated to one another to minimise risk.

- Estimate Expected Returns and Risks: For each asset, determine expected returns, risk (standard deviation), and correlations with other assets. These metrics are essential for evaluating its potential risk-return profile.

- Construct the Efficient Frontier: Using the expected returns, risks, and correlations, develop various combinations of assets to create the efficient frontier. This represents portfolios that provide the highest return for a specific level of risk.

- Choose the Optimal Portfolio: Based on your risk tolerance, select a portfolio from the efficient frontier that aligns best with your risk-return preferences.

- Monitor and Rebalance: As market conditions evolve, consistently review and adjust your portfolio to maintain the desired risk-return balance.

By applying MPT, investors can build a diversified portfolio that maximises returns for a given level of risk or minimises risk for a target return, ensuring their investments align with long-term financial goals.

Advantages and Limitations of Modern Portfolio Theory

Advantages of Modern Portfolio Theory

Here are the benefits of modern portfolio theory:

- Diversification: MPT helps investors reduce risk by diversifying their investments across different assets that are not perfectly correlated, leading to more stable returns.

- Optimised Risk-Return Trade-off: It enables investors to select portfolios that offer the highest return for a given level of risk or the lowest risk for a desired level of return.

- Efficient Frontier: MPT provides a clear framework through the efficient frontier, guiding investors in choosing the best portfolio based on their risk tolerance.

- Scientific Approach: MPT uses statistical methods to bring a structured, data-driven approach to portfolio management, making it easier for investors to make informed decisions.

- Long-term Focus: It encourages long-term investment strategies, focusing on steady, risk-adjusted returns rather than short-term gains.

- Widely Used: Financial institutions, fund managers, and individual investors around the globe utilise MPT.

Overall, MPT helps investors build portfolios that maximise returns while managing risk effectively.

Limitations of Modern Portfolio Theory

Here are the criticisms and challenges of Modern Portfolio Theory:

- Historical Data Reliance: MPT heavily uses past data (returns, correlations). This may not predict future performance, especially in India’s dynamic market.

- Normal Distribution Assumption: Assumes investment returns follow a bell curve, underestimating the probability of extreme market events (“fat tails”) which occur.

- Correlation Instability: Assumes correlations between assets are stable. In reality, especially during crises, correlations can increase, reducing diversification benefits when needed most.

- Estimation Challenges: Accurately forecasting expected returns, variances, and correlations needed for MPT is extremely difficult.

- Risk Definition Narrow: Defines risk solely as volatility (variance), ignoring other crucial risks like liquidity risk, credit risk, or severe downside potential (tail risk).

- Ignores Investor Behaviour: Assumes all investors are rational, overlooking behavioural biases (like panic selling or herd mentality) prevalent in markets.

- Doesn’t Account for Costs: Standard MPT models often overlook real-world transaction costs and taxes.

Despite these limitations, MPT remains a fundamental investment management principle.

Understanding MPT With an Example

Imagine an investor named Jay who wants to build a diverse portfolio that includes stocks and bonds.

- Step 1: Asset Selection

- Stocks come with a higher risk but also the potential for higher returns, offering around a 12% return with a risk level of 15%.

- On the other hand, bonds present a lower risk and consequently lower returns, typically yielding about a 6% return with an 8% risk.

- Step 2: Correlation Analysis

Stocks and bonds correlate at -0.3, indicating that they tend to move in opposite directions. - Step 3: Portfolio Optimisation

Using the principles of MPT, Jay analyses different combinations of these stocks and bonds to find the best possible expected return for a given level of risk (or the lowest risk for a given expected return).

Based on the inputs (returns, risks, correlation), MPT might recommend an allocation like 60% in stocks and 40% in bonds as an optimal strategy for Jay’s desired risk-return balance. - Step 4: Result

Following this allocation, Jay’s portfolio is expected to yield a combined return of 9.6% with a significantly reduced risk (standard deviation) of approximately 8.6%, demonstrating how diversification lowered the overall portfolio volatility compared to holding only stocks.

Conclusion

Modern Portfolio Theory (MPT) is one of the key investment strategies in finance. It emphasises the importance of diversifying investments, balancing risk with potential returns, and employing quantitative analysis to help investors build efficient portfolios.

However, investors must recognise its limitations and adjust their strategies according to actual market conditions. If you’re just starting to invest, applying the principles of MPT can assist you in creating a robust portfolio while effectively managing risk. Whether you’re looking at stocks, mutual funds, or bonds, grasping MPT concepts will provide you with a competitive advantage in the financial landscape!

Related Articles

FAQs on Modern Portfolio Theory (MPT)

How to Use Modern Portfolio Theory in Finance?

MPT is utilised for diversifying portfolios, allocating assets, managing risk, and planning for retirement. It assists investors in creating optimal investment portfolios.

Does Diversification in MPT Eliminate Risk?

Diversification helps to lower specific risks associated with individual investments, but it cannot completely remove systematic risks that affect the entire market.

What are the Criticisms of Modern Portfolio Theory?

MPT faces criticism for its assumption of rational investors, its dependence on historical data, and its failure to consider market anomalies such as crashes.

How does Modern Portfolio Theory help in understanding investment returns and risk?

MPT assists investors in optimising their returns while managing risk by pinpointing the perfect combination of assets.

What role does Modern Portfolio Theory play?

MPT is essential in portfolio management as it provides a quantitative method for making investment decisions and assessing risk.