- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What is Mutual Fund Overlap?

- Why Mutual Fund Overlap Occurs

- Risks of Mutual Fund Overlap

- Types of Portfolio Overlap

- Advantages of Avoiding Mutual Fund Portfolio Overlap

- How to Detect Mutual Fund Overlap?

- How to Reduce Mutual Fund Portfolio Overlap?

- Importance of Diversification in Avoiding Mutual Fund Overlap

- Conclusion

- FAQs on What is Mutual Fund Overlap?

- What is Mutual Fund Overlap?

- Why Mutual Fund Overlap Occurs

- Risks of Mutual Fund Overlap

- Types of Portfolio Overlap

- Advantages of Avoiding Mutual Fund Portfolio Overlap

- How to Detect Mutual Fund Overlap?

- How to Reduce Mutual Fund Portfolio Overlap?

- Importance of Diversification in Avoiding Mutual Fund Overlap

- Conclusion

- FAQs on What is Mutual Fund Overlap?

What is Mutual Fund Overlap & How to Detect Mutual Fund Overlap?

By HDFC SKY | Updated at: Nov 19, 2025 11:27 AM IST

When two or more mutual funds in your portfolio own the same equities or securities, this is referred to as mutual fund overlap. This duplication may occur between funds in the same category (for example, two large-cap funds) or even between categories if the fund managers make investments in comparable businesses.

If you are a mutual fund investor, it is important to understand MF overlap. This blog will help you learn everything about mutual fund portfolio overlap and how you can check mutual fund portfolio overlap.

What is Mutual Fund Overlap?

Mutual fund overlap, also known as MF portfolio overlap, is a situation that occurs in a mutual fund investor’s portfolio when two or more mutual fund schemes hold the same securities or assets. This situation leads to false diversification,’ where investors think they are investing in different funds but actually invest in the same underlying assets (such as shares of the same companies or the same bonds) multiple times.

For example: If you hold two different large-cap equity funds, and both funds have Reliance Industries, Infosys and HDFC Bank among their top holdings, you have an overlap.

Mutual fund overlap usually occurs when fund managers invest in popular companies that appear across multiple schemes-especially in the same category. If you don’t use a mutual fund overlap tool or manually check mutual fund overlap, you might unknowingly double down on the same stocks. While each fund might have different objectives, strategies, or other holdings, the common positions in the top stocks lead to this concentration, reducing the unique diversification benefit you might expect from holding separate funds.

MF overlap generally occurs due to the following reasons:

- Holding multiple mutual funds in the same category, such as multiple large-cap funds.

- Investing in sectoral or thematic mutual fund schemes that have common holdings.

- Mixing index mutual funds and actively managed mutual funds that track the same benchmarks, such as the Nifty or Sensex.

- Not checking the holdings of the new funds against the holdings of the previously invested mutual funds.

Why Mutual Fund Overlap Occurs

Mutual fund overlap happens when two or more of your mutual fund investments hold the same stocks or securities. This is common and can happen due to several reasons:

- Investing in Similar Fund Categories: If you invest in multiple large-cap or multi-cap funds, they often hold similar stocks

- Popular Stocks Across Funds: Some high-performing companies are favoured by many fund managers, so they appear repeatedly across different schemes.

- Lack of Diversification Planning: Choosing mutual funds without checking their portfolios can result in buying funds that hold the same assets.

- Fund Manager Preferences: A fund manager handling multiple schemes may stick to the same set of stocks, causing overlap.

- Tracking the Same Index: Funds following the same benchmark index (like Nifty 50) naturally invest in the same companies.

- Fund Mergers or Changes in Strategy: When mutual funds merge or change investment styles, overlap may occur with your existing portfolio.

Understanding overlap is important because too much of it can reduce the benefit of diversification and increase risk concentration.

Risks of Mutual Fund Overlap

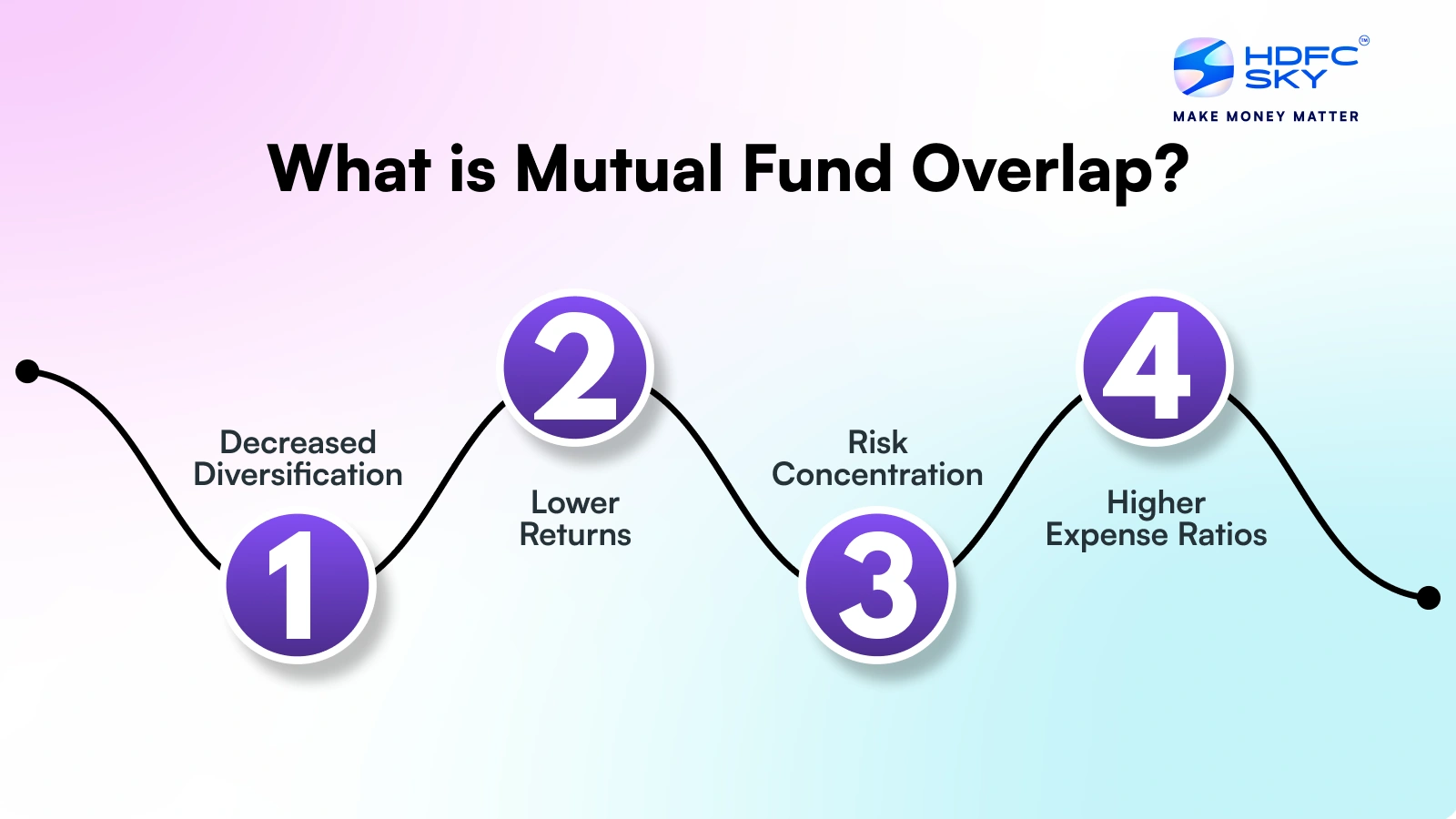

Initially, you may think that investing in several mutual fund schemes can be good for diversification and profit potential. However, if you don’t conduct a mutual fund overlap comparison, your portfolio can become riskier. Here are the risks involved with the overlap between mutual funds:

- Decreased Diversification: Overlapping holdings in several mutual funds decreases the overall diversification. Since investments in many holdings are repeated, it decreases the spread of risk and can lead to losses.

- Risk Concentration: Portfolio overlap in mutual funds leads to investments in the same securities. If one security becomes bearish and falls in its price, repeated investments in your portfolio can lead to higher losses. For example, if a stock which is in 4 of your mutual fund schemes falls in price, it will negatively impact the return in 4 of your schemes.

- Lower Returns: If you fail to check mutual fund overlap, it can lead to lower returns due to false diversification. Since you have not invested in other securities but have repeated the investments, any downfall in the price can lead to heavy losses. Furthermore, it also lowers the return potential as you may have invested in other high-performing securities.

- Higher Expense Ratios: Every mutual fund charges its own expense ratios, such as the management fee. When you fail to compare mutual fund overlap and invest in the same securities, you pay more to own the same securities. This can lower the overall returns.

Managing mutual fund portfolio overlap is thus essential to ensure your portfolio’s risk is appropriately managed and aligned with your investment goals.

Types of Portfolio Overlap

Portfolio overlap occurs when multiple investment schemes hold the same or similar securities. Here are the common types:

- Stock Overlap: Multiple mutual funds holding the same stocks.

- Sector Overlap: Funds heavily invested in the same sectors (e.g., IT, banking).

- Market Cap Overlap: Holding funds focused on similar market capitalisations (large-cap, mid-cap).

- Geographic Overlap: Exposure to the same international markets across different funds.

- Asset Class Overlap: Investing in multiple funds that include similar asset classes like equities, bonds, or gold.

Advantages of Avoiding Mutual Fund Portfolio Overlap

Avoiding portfolio overlap ensures better diversification and reduces the risk of concentrated exposure. It helps in optimising returns with balanced risk.

- Enhanced Diversification: Reduces exposure to the same stocks across multiple funds.

- Risk Management: Limits losses from underperforming sectors or companies.

- Improved Returns: Broader exposure to different assets can improve overall portfolio performance.

- Cost Efficiency: Prevents duplication of holdings, avoiding unnecessary expense ratios.

- Balanced Asset Allocation: Ensures alignment with financial goals and investment strategy.

- Easier Performance Evaluation: Makes it simpler to track and measure fund performance.

How to Detect Mutual Fund Overlap?

To reduce risk and improve returns, it’s important to regularly check mutual fund overlap. You can do this by reviewing fund holdings manually or using a mutual fund overlap tool that provides overlap percentages for better clarity. Here is how to do a mutual fund overlap check to detect mutual fund overlap:

- Compare Top Holdings: Every mutual fund publishes its top holdings regularly. To compare MF overlap, check the top 10 holdings of all the mutual fund schemes you have invested in. If you find the same securities across funds, it means that you have an MF overlap.

- Online Tools: There are numerous online tools available that can help you check mutual fund overlap. You can use these analysis tools by entering the names of the mutual fund schemes. The tool will showcase the overlapping percentage.

- Category Check: You can avoid mutual fund overlap by doing a category check for all the mutual fund schemes. For example, you can check if the funds belong to the same category, such as large-cap, mid-cap, etc. Funds in the same category often invest in similar securities.

- Portfolio Analysis: One of the best ways of doing an MF overlap check is by analysing the entire portfolio. Take every mutual fund scheme you have invested in or are looking to invest in and compare their holdings. If you find similar securities in a majority of the schemes, it means that your mutual funds are overlapping.

When using tools to check overlapping of mutual funds, look for a percentage figure representing the degree of overlap. A higher percentage indicates greater overlap.

How to Reduce Mutual Fund Portfolio Overlap?

Reducing portfolio overlap helps in diversifying investments and managing risk effectively. Here are key ways to minimise overlap:

- Diversify by Fund Category: Choose funds from different categories like large-cap, mid-cap, debt, and international.

- Review Fund Holdings: Regularly check top holdings of your funds to avoid duplication.

- Use Overlap Tools: Utilise online portfolio overlap checkers to compare mutual fund holdings.- Select Different Fund Managers: Different AMCs often follow varied strategies, reducing overlap.

- Avoid Multiple Similar Index Funds: Don’t invest in multiple funds tracking the same benchmark.

- Consolidate Funds: If overlap is high, consider switching to distinct funds that fill different roles in your portfolio.

Importance of Diversification in Avoiding Mutual Fund Overlap

Diversification is crucial in building a balanced and risk-managed investment portfolio. It ensures you don’t concentrate your capital in similar assets, reducing overall portfolio risk.

- Minimises Risk: Investing across different sectors or asset classes limits exposure to any single underperforming area.

- Enhances Returns Stability: Diversified portfolios tend to perform more consistently across market cycles.

- Reduces Redundancy: Helps avoid owning multiple funds with the same top holdings.

- Improves Asset Allocation: Encourages strategic investment across equity, debt and hybrid funds.

- Supports Long-Term Goals: Balanced diversification aligns better with long-term financial planning and goals.

Conclusion

Mutual fund overlap is a situation that can increase the risk in your portfolio. Even when you think you are investing in multiple securities and diversifying your investments, you may be investing in the same securities. An overlap between mutual funds can lower the effects of diversification and hurt your portfolio’s return potential.

To protect your returns and minimise risks, regularly perform a mutual fund overlap comparison. Using an online mutual fund overlap calculator helps you make informed decisions and avoid unnecessary duplication in your portfolio and ensure that you can achieve your financial goals through your mutual fund investments.

Related Articles

FAQs on What is Mutual Fund Overlap?

How often should I check my mutual fund portfolio for overlap?

You should check your portfolio once every 6 months or when you are investing in a new mutual fund scheme.

Are index funds more prone to overlap?

Yes, index funds that track the same benchmark, such as Nifty 50 or Sensex, are more prone to overlap.

How do you calculate the overlap between two portfolios?

You can do a mutual fund overlap comparison by analysing the weightage of each holding in two or more mutual fund schemes.

How much mutual fund overlap is acceptable?

A mutual fund overlap of 10-15% is generally acceptable. If it is above 20-25%, it means that the overlap is high.

Is there a mutual fund overlap tool?

Yes, there are numerous tools available online which can help you compare mutual fund overlaps.