- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Mutual Funds Journey In SKY

By HDFC SKY | Updated at: Nov 13, 2025 06:45 PM IST

Mutual funds offer a number of benefits to investors, including:

– Diversification:

Mutual funds allow investors to diversify their portfolios across a variety of asset classes and sectors. This helps to reduce risk, as your investment is not tied to the performance of any one individual stock or bond.

– Professional management:

Mutual funds are managed by professional fund managers who have the expertise and experience to make investment decisions that are in the best interests of the fund’s shareholders.

– Affordability:

Mutual funds are relatively affordable to invest in, with many funds offering low minimum investment amounts.

– Liquidity:

Mutual funds are generally very liquid investments, meaning that you can easily sell your shares and redeem your investment proceeds.

Other benefits of investing in mutual funds include:

– Flexibility:

Mutual funds offer a variety of investment options to choose from, so you can find a fund that matches your investment goals and risk tolerance.

– Convenience:

Mutual funds are easy to buy and sell, and you can manage your investment portfolio online or through a financial advisor.

– Transparency:

Mutual funds are subject to strict regulations, which means that investors have access to detailed information about the fund’s holdings and performance.

Types of Mutual Funds

There are many different types of mutual funds available, each with its own investment objective and risk profile. Some of the most common types of mutual funds include:

– Equity funds:

Equity funds invest in stocks. Equity funds can be further categorized by market capitalization (e.g., large-cap, mid-cap, small-cap) and investment style (e.g., growth, value).

– Debt funds:

Debt funds invest in bonds. Debt funds can be further categorized by credit quality (e.g., government bonds, corporate bonds) and maturity (e.g., short-term bonds, long-term bonds).

– Hybrid funds:

Hybrid funds invest in both stocks and bonds. Hybrid funds offer investors a more balanced investment approach than equity funds or debt funds.

– Money market funds:

Money market funds invest in short-term debt instruments, such as Treasury bills and commercial paper. Money market funds are the most conservative type of mutual fund, with very low risk and low returns.

How to Invest in Mutual Funds

To invest in mutual funds, you can open an account with HDFC SKY. Once you have opened an account, you can choose the mutual funds that you want to invest in and purchase shares.

You can invest in mutual funds on a lumpsum basis or through a systematic investment plan (SIP). An SIP is a way to invest in mutual funds on a regular basis, such as monthly or quarterly. SIPs are a good way to start investing with a small amount of money and to build your investment portfolio over time.

Discover the Mutual Funds in SKY!!

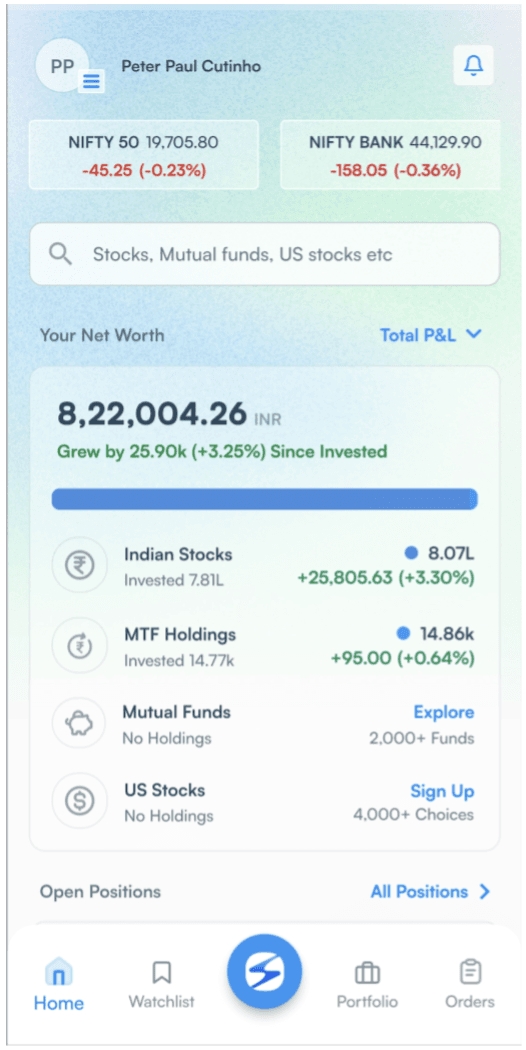

1.) Go to HDFC SKY dashboard and click on Mutual Funds

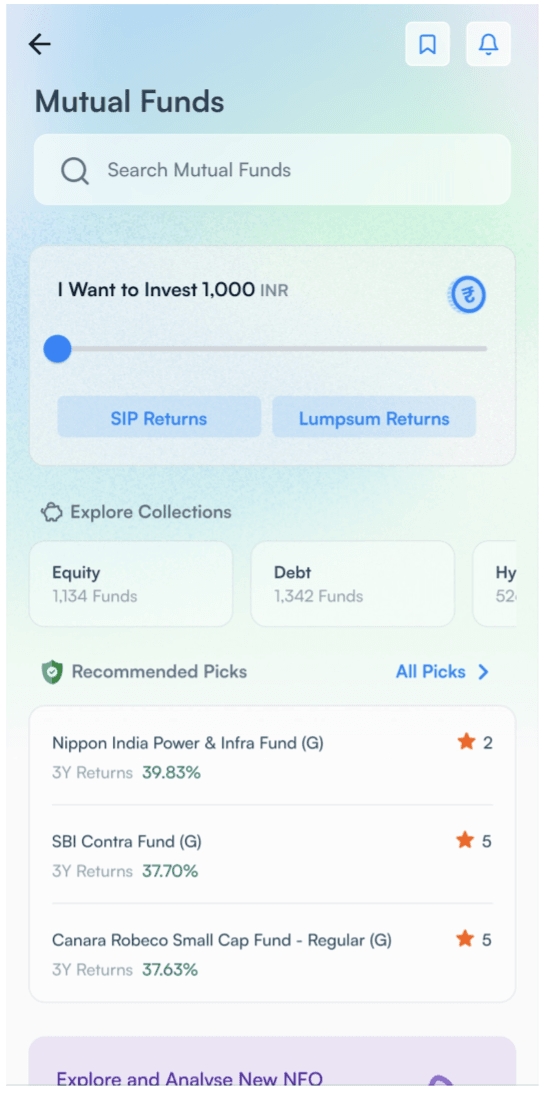

2.) Mutual Funds dashboard

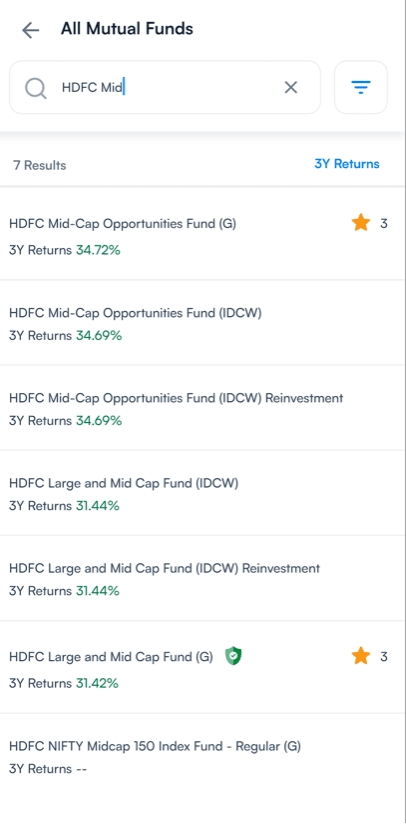

3.) Search for Mutual Funds

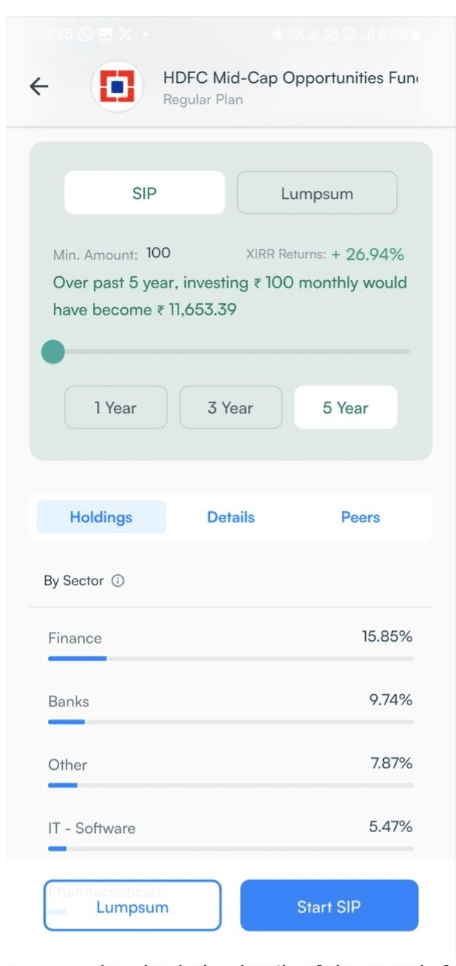

4.) Select Your desired Mutual Fund

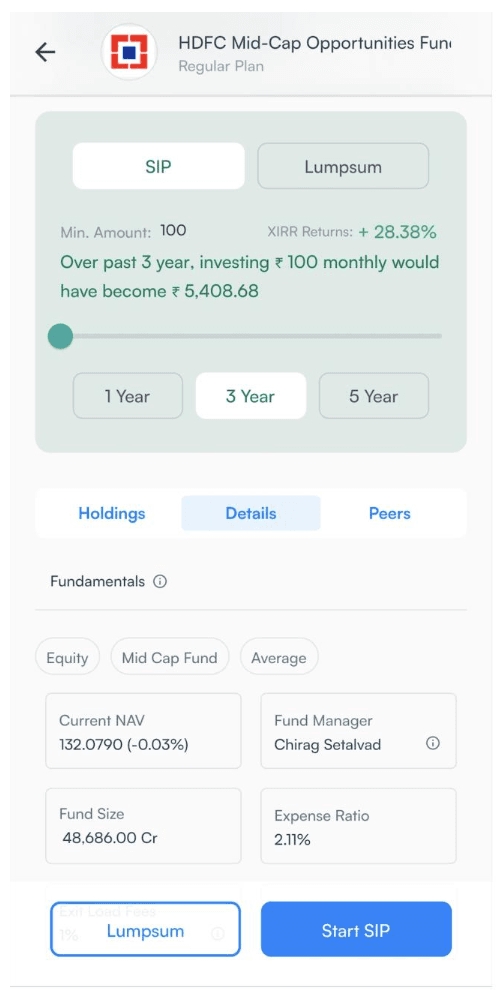

5.) You can see the details of past returns and Funds holdings details which shows top stocks where this MF scheme has invested.

6.) You can also check the details of the Mutual funds scheme like Fund Size, NAV, Category, Fund Manager and Peers

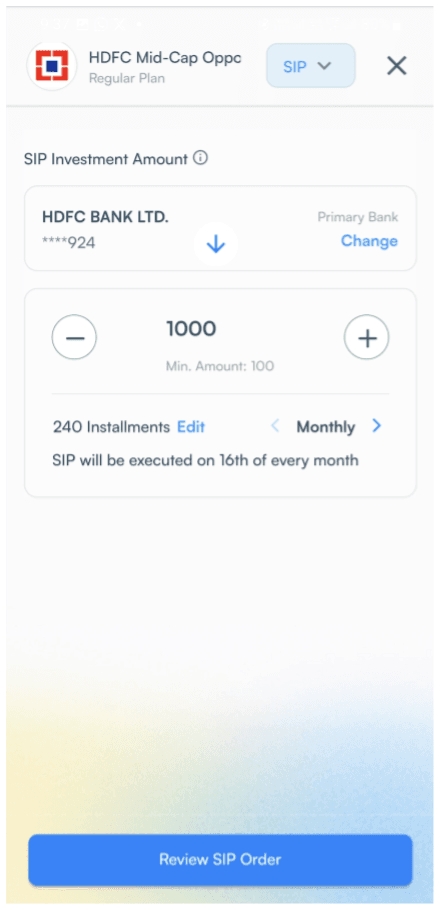

7.) Investing as a SIP

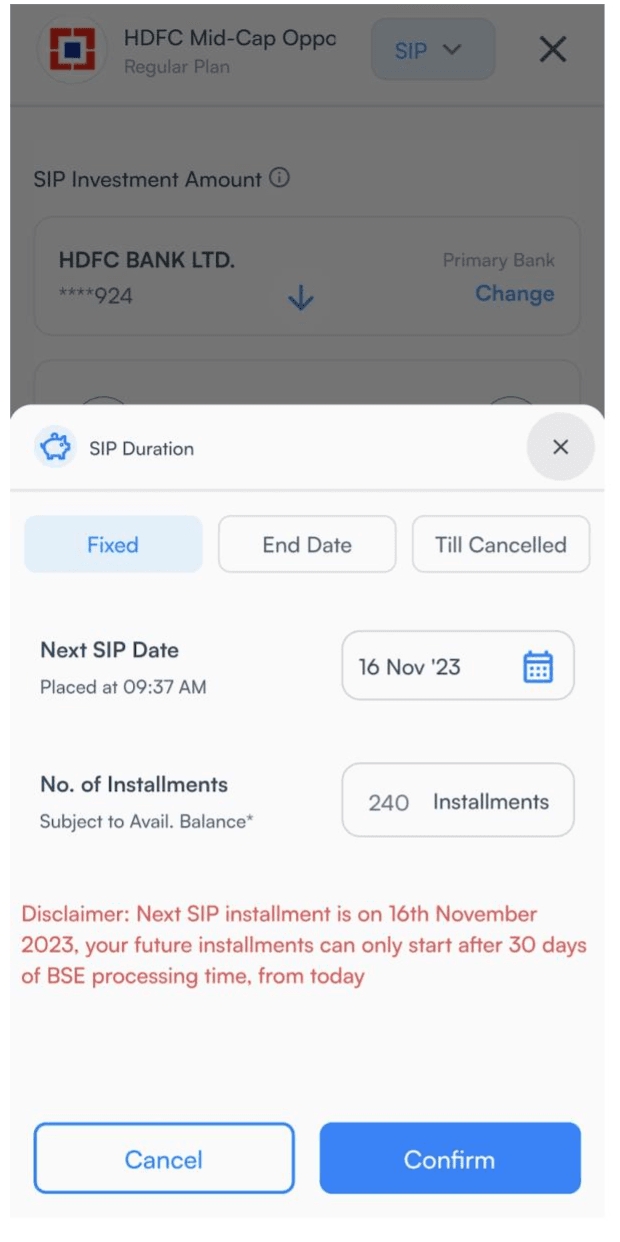

8.) Edit the SIP Date and frequency

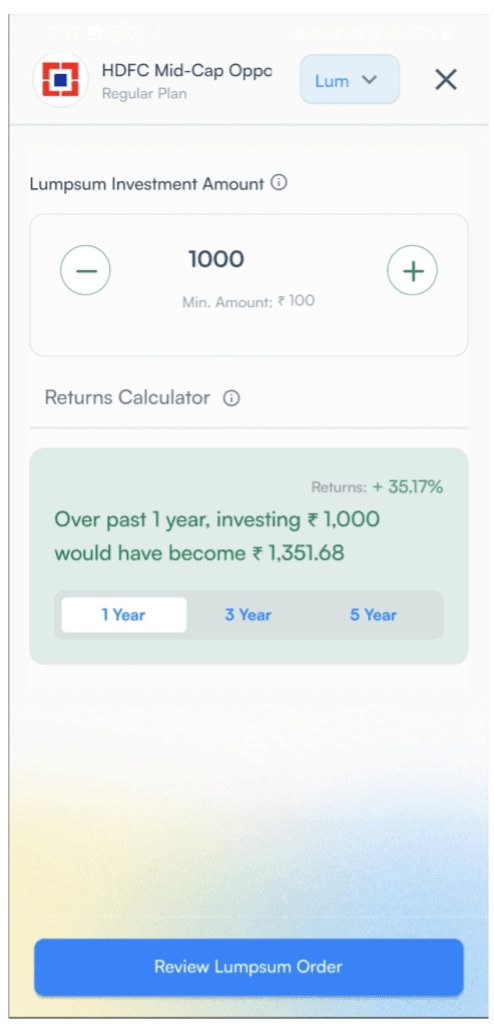

9.) Investing as a Lumpsum

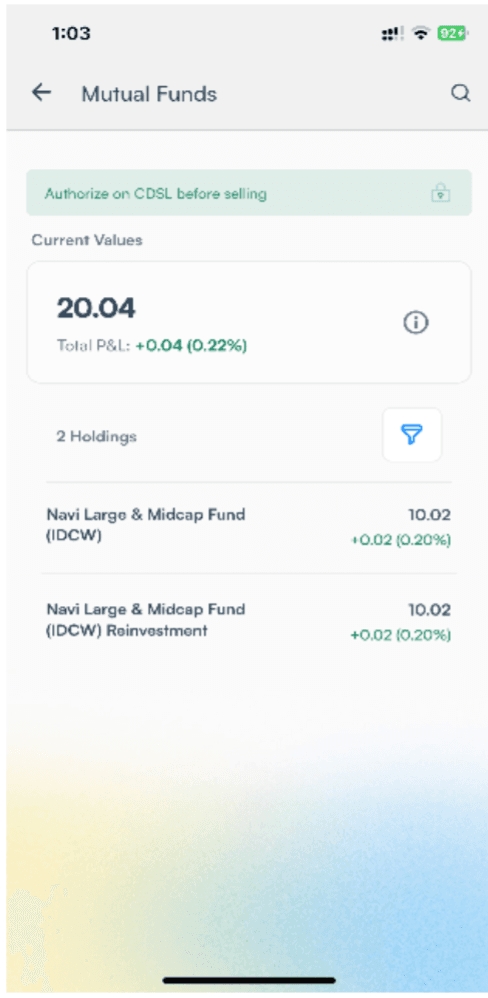

10.) You can see the all your Mutual Funds in the holding section

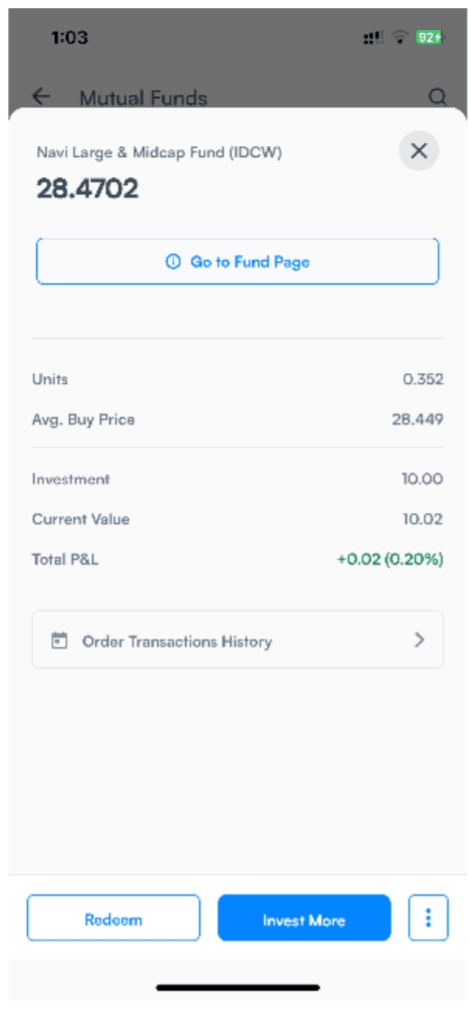

11.) You can check the number of available units, Average buy price by clicking on your invested Mutual Fund. You also has the option to Redeem or Invest more in the same Mutual Fund.

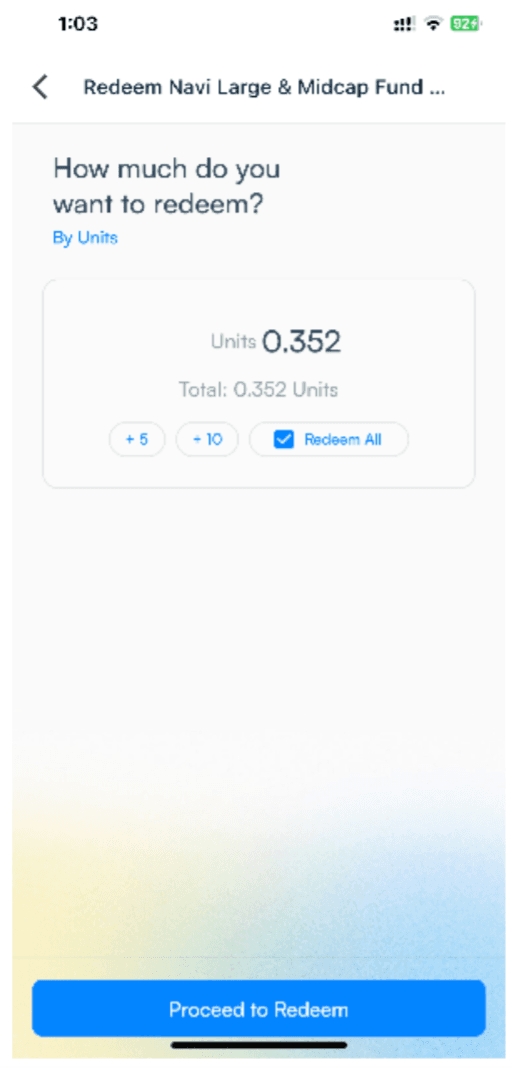

12.) By taping on Redeem below screen appear. You can mention the desired units for redeem and click on Proceed to redeem.

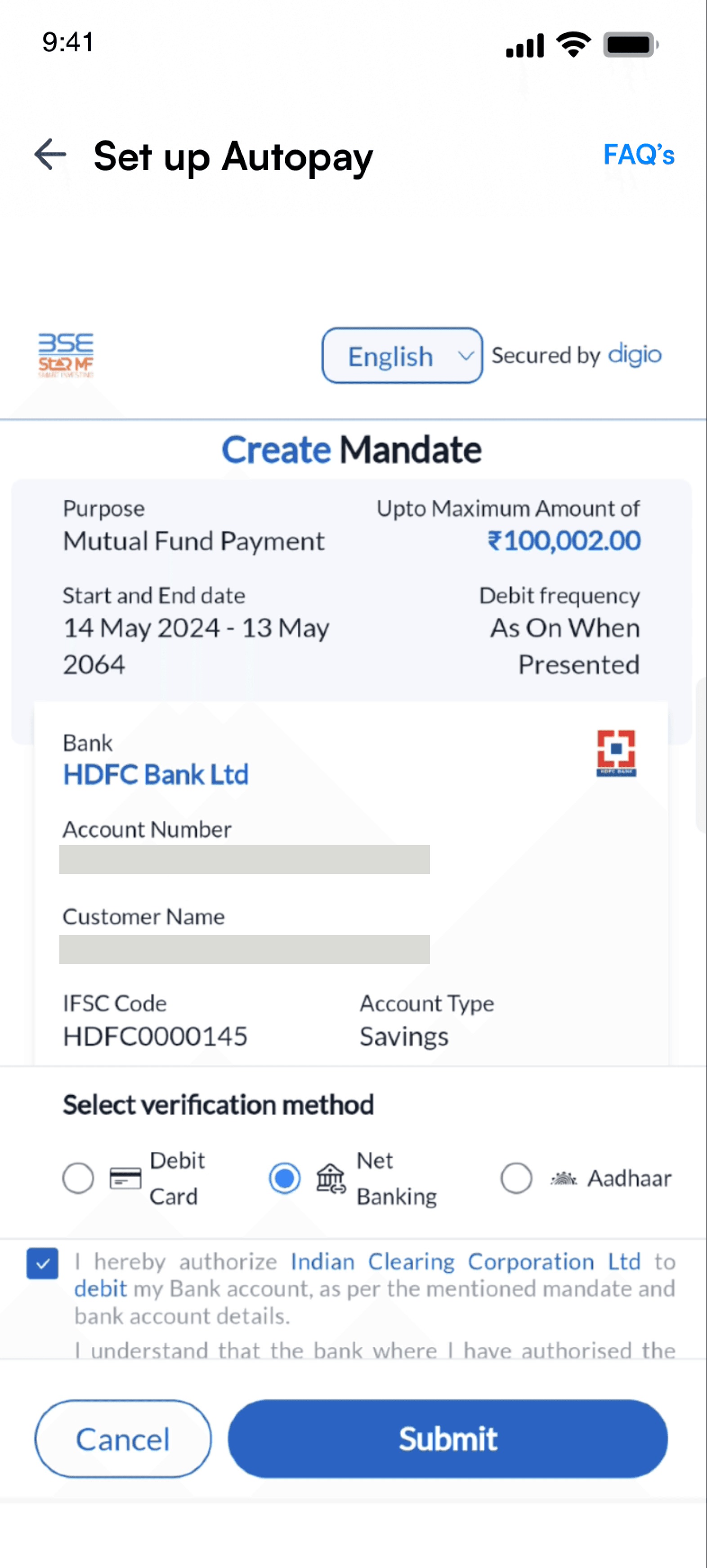

AutoPay Mandate:

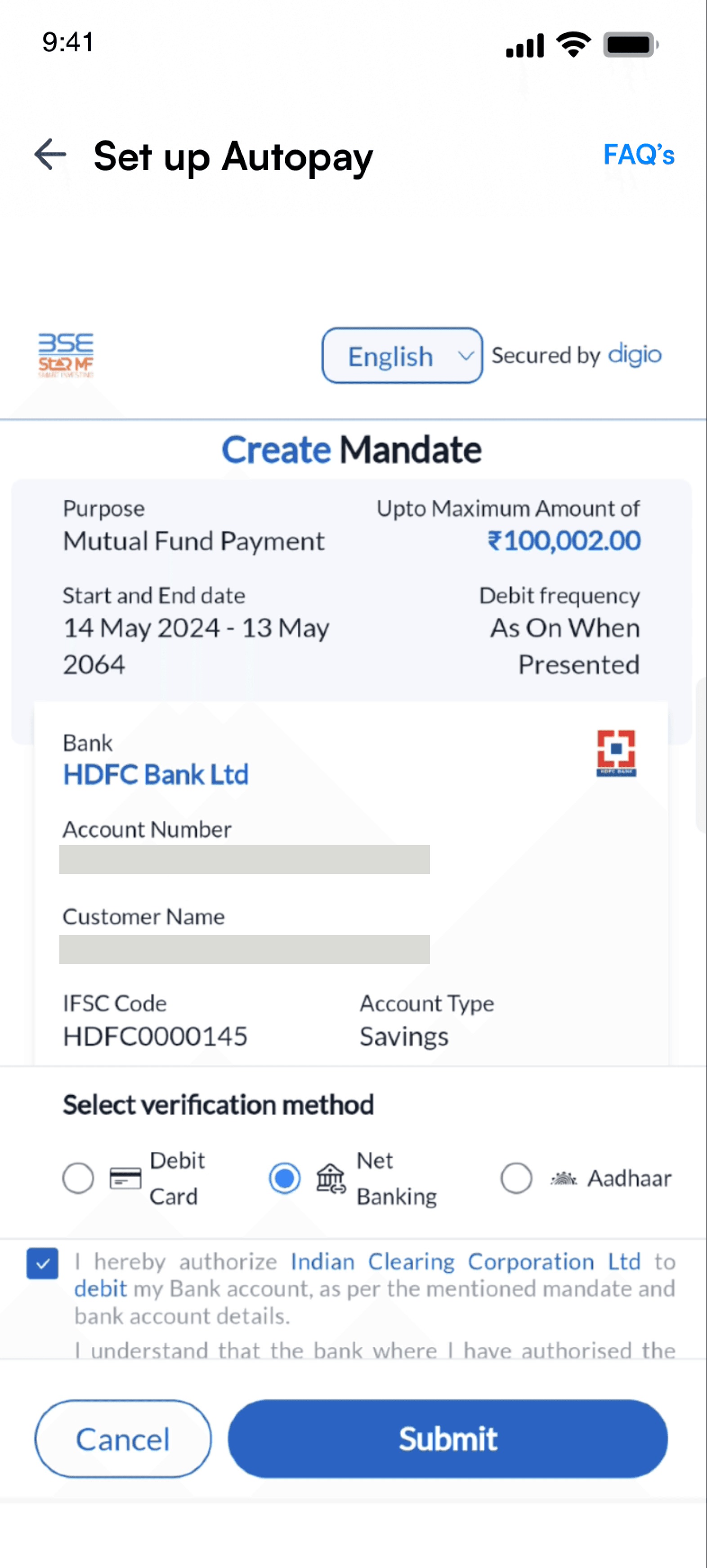

- For placing SIP orders, it is compulsory to create mandate via Netbanking.

- Once you have placed first SIP order, you will be asked to set up autopay, follow the below steps to create mandate:

- Once you see the below screen (take this as example), review the information and click on Submit.

- You will be asked to login through Netbanking.

- Once you have entered the login credentials, add OTP which you have received on your mobile number and click on Submit.

This will complete your Autopay Setup!

Note:

HDFC SKY will allow you to setup AutoPay mandate within 6 working days from your first SIP order placed.

If you failed to setup AutoPay in T+6 days, your first SIP will get cancelled.

Happy Investing!

FAQs

How to setup MF Auto pay mandate on HDFC SKY?

https://youtube.com/shorts/RTvbM1Kf8jQ?feature=share

AutoPay Mandate:

- For placing SIP orders, it is compulsory to create mandate via Netbanking.

- Once you have placed first SIP order, you will be asked to set up autopay, follow the below steps to create mandate:

- Once you see the below screen (take this as example), review the information and click on Submit.

2. You will be asked to login through Netbanking.

3. Once you have entered the login credentials, add OTP which you have received on your mobile number and click on Submit.

This will complete your Autopay Setup!

Note: HDFC SKY will allow you to setup AutoPay mandate within 6 working days from your first SIP order placed. If you failed to setup AutoPay in T+6 days, your first SIP will get cancelled.