- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Narrow Range (NR4, NR7)

By HDFC SKY | Updated at: May 16, 2025 03:15 PM IST

A Narrow Range trading strategy is a breakout-based approach that assumes that a stock’s price trends up or down after consolidating in a narrow range. This is popularly known as the NR7 Strategy in trading circles.

The idea of trading on narrow ranges comes from Tony Crabel’s book, Day Trading with Short Term Price Patterns & Opening Range Breakout. Even though the book was published in the 90s, the narrow range trading strategy, especially the NR4 (Narrow Range 4) and NR7 (Narrow Range 7) are still popular today.

Understanding NR7/NR4

What is NR4 and NR7? NR7 is the day when the price range was the narrowest in the last seven days. Similarly, NR4 is the day when the price range was the narrowest in the last four days. The range is the price difference between that day’s High and Low.

A bullish setup occurs when the breakout is from the top of the NR7/NR4 candle. If the breakout happens at the bottom of the NR7/NR4 candle, it is considered bearish, a key part of NR7 breakout concept.

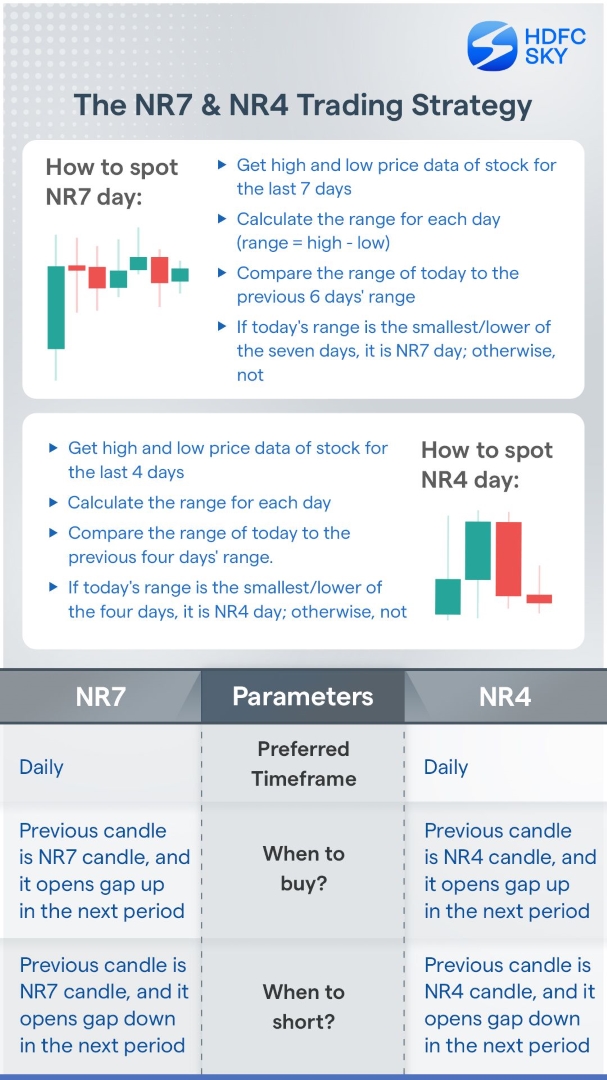

How to spot NR7 day:

- Get high and low-price data of stock for the last seven days.

- Calculate the range for every day (range = high – low).

- Compare the range of today to the previous six days’ range.

- If today’s range is the smallest of the seven days, it is NR7 day; otherwise, not – this is fundamental to what is NR7 Strategy.

How to spot NR4 day:

- Get high and low-price data of stock for the last four days

- Calculate the range for every day (range = high – low)

- Compare the range of today to the previous four days’ range.

- If today’s range is the smallest of the four days, it is NR4 day; otherwise, not.

How to use NR7/NR4 strategy

Bullish setup: The first step in this strategy is to identify the NR7/NR4 day. While the charting tool does the math for you, the calculation for arriving at these days is given above. If the NR7/NR4 day is the current day, traders can look to initiate a buy position on a move above the high of the narrow range day.

Profits can be booked near the next resistance level or a percentage target can be used. Traders can use the Parabolic SAR (10.4) to set up the trailing stop-loss.

Bearish setup: First, you need to identify the NR7/NR4 day. If the NR7/NR4 day is the current day, traders can look to initiate a short position on a move below the low of the narrow range day.

In this case, the next support level is will be the price target. Alternatively, a percentage target can be used. The next step is to set a trailing stop-loss using the Parabolic SAR.