- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

National Securities Depository Limited IPO (NSDL IPO)

₹13,680/18 shares

Minimum Investment

IPO Details

30 Jul 25

01 Aug 25

₹13,680

18

₹760 to ₹800

NSE, BSE

₹4 Cr

06 Aug 25

National Securities Depository Limited IPO (NSDL IPO) Timeline

Bidding Start

30 Jul 25

Bidding Ends

01 Aug 25

Allotment Finalisation

04 Aug 25

Refund Initiation

05 Aug 25

Demat Transfer

05 Aug 25

Listing

06 Aug 25

NSDL IPO (National Securities Depository Limited IPO)

Established in 2012, National Securities Depository Limited (NSDL) is a SEBI-registered Market Infrastructure Institution (MII) in India. It functions as a securities depository, managing electronic records related to allotment and ownership transfer. NSDL’s key services include dematerialisation, trade settlement, pledging, off-market transfers, and asset servicing for demat securities. It also offers e-voting, CAS, and non-disposal undertakings. Its subsidiaries include NDML, which provides e-governance and regulatory services, and NPBL, a B2B payments bank offering digital banking and financial product distribution.

National Securities Depository Limited IPO (NSDL IPO) Overview

The NSDL IPO is a book-built issue totalling ₹4,011.60 crore, comprising a complete Offer for Sale of 5.01 crore equity shares. The subscription window will remain open from 30 July to 1 August 2025, with allotment expected on 4 August and listing tentatively scheduled for 6 August on the BSE. The price band is fixed at ₹760 to ₹800 per share, and the lot size is 18 shares, requiring a minimum retail investment of ₹13,680. For sNII, the minimum application is 14 lots (252 shares) amounting to ₹2,01,600, while bNII participation begins at 70 lots (1,260 shares) totalling ₹10,08,000.

NSDL IPO Important Dates

Here’s the NSDL IPO schedule.

- IPO Open Date: July 30, 2025 (Wednesday)

- IPO Close Date: August 1, 2025 (Friday)

- UPI Mandate Cut-off Time: 5 PM on August 1, 2025

- Tentative Allotment Date: August 4, 2025 (Monday)

- Refund Initiation: August 5, 2025 (Tuesday)

- Credit of Shares to Demat Account: August 5, 2025 (Tuesday)

- Tentative Listing Date on BSE and NSE: August 6, 2025 (Wednesday)

NSDL IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 4011.60 Cr (aggregating to 5,01,45,001 shares) |

| NSDL IPO Dates | 30 July 2025 to 1 August 2025 |

| Price Bands | ₹760 – ₹780 per share |

| Lot Size | 18 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 20,00,00,000 shares |

| Shareholding post -issue | 20,00,00,000 shares |

NSDL IPO Lots

| Application Type | Lots | Shares | Amount |

| Retail (Min) | 1 | 18 | ₹14,400 |

| Retail (Max) | 13 | 234 | ₹1,87,200 |

| S-HNI (Min) | 14 | 252 | ₹2,01,600 |

| S-HNI (Max) | 69 | 1,242 | ₹9,93,600 |

| B-HNI (Min) | 70 | 1,260 | ₹10,08,000 |

National Securities Depository Limited IPO (NSDL IPO) Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

National Securities Depository Limited IPO: NSDL IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 17.16 |

| Price/Earnings (P/E) Ratio | 46.63 |

| Return on Net Worth (RoNW) | 17.11% |

| Net Asset Value (NAV) | – |

| Return on Equity | 17.11% |

| Return on Capital Employed (ROCE) | 22.7% |

| EBITDA Margin | 23.95% |

| PAT Margin | 22.35% |

| Debt to Equity Ratio | – |

Objectives of the NSDL IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

National Securities Depository Limited (NSDL Financials in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,984.84 | 2,257.74 | 2,093.48 |

| Revenue | 1,535.19 | 1,365.71 | 1,099.81 |

| Profit After Tax | 343.12 | 275.45 | 234.81 |

| Reserves & Surplus | 232.31 | 216.32 | 199.08 |

| Total Borrowings | – | – | – |

Financial Status of National Securities Depository Limited (NSDL)

SWOT Analysis of National Securities Depository Limited IPO (NSDL IPO)

Strength and Opportunities

- First and largest electronic depository in India.

- Huge asset base (~₹398 lakh cr) across >2.8 cr demat accounts.

- T+2 (and moving to T+1) settlements improve efficiency.

- Backed by major banks and NSE participation.

- Expansive digital infrastructure and cybersecurity protocols.

- Diversified services: e-voting, pledging, off-market transfers.

- Subsidiaries (NDML, Payments Bank) open new revenue streams.

- Scope for growth via e-governance, PAN/TIN services.

- Demat migration still underway—room for onboarding new investors.

- Strong trust due to SEBI oversight and robust systems.

Risks and Threats

- Heavily dependent on market activity, cyclicality risk.

- Faces strong competition from CDSL, which has larger retail presence.

- Regulatory scrutiny risk (e.g. past multiple account scam).

- Complex services may deter smaller participants.

- High compliance and audit costs.

- Limited pricing flexibility in regulated environment.

- Payments bank arm faces saturated digital banking sector.

- Cyber threat exposure could impact trust.

- Dependency on broker-distributor network limits direct outreach.

- Regulatory shifts or policy changes could disrupt business.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About National Securities Depository Limited (NSDL)

National Securities Depository Limited IPO (NSDL IPO) Strengths

India’s First and Leading Depository Operating a Wide Range of Technology-Driven Businesses

National Securities Depository Limited (NSDL), India’s first and largest depository, revolutionised securities handling by introducing dematerialisation, streamlining settlement cycles, and enabling rolling and T+0 settlements. With over 38.77 million active demat accounts, ₹500,000 billion in assets under custody, and presence in 218 countries, NSDL leads India’s digital transformation in securities infrastructure.

Strong Focus on Technology-Led Product Innovation

National Securities Depository Limited (NSDL) leverages cutting-edge technology to innovate and enhance user experience. From pioneering SMS alerts in 2007 to launching blockchain-based platforms, digital CP issuance, and smart tax services, NSDL’s tech-driven solutions serve issuers, investors, and intermediaries, ensuring secure, real-time access, data centralisation, and seamless transaction processing across India’s financial ecosystem.

Robust IT Infrastructure and Advanced Cybersecurity Measures

National Securities Depository Limited (NSDL) upholds system integrity through resilient IT infrastructure, real-time cybersecurity operations, and global risk management standards. With SOC, MITRE ATT&CK® framework, EDR, encryption, and SEBI-aligned upgrades, NSDL safeguards investor data, ensures regulatory compliance, and proactively mitigates cyber threats while supporting India’s dynamic financial ecosystem with secure, scalable digital services.

Stable Revenue Base Driven by Recurring Income

National Securities Depository Limited (NSDL) maintains financial stability through a strong recurring revenue stream. Core services like annual custody and participant fees, along with value-added offerings, contribute over 85% of total recurring revenue. Backed by millions of accounts and thousands of issuers, NSDL’s model ensures consistent income, independent of market fluctuations.

Diversified Asset Classes and Well-Integrated Business Verticals

National Securities Depository Limited (NSDL) holds a dominant position with diverse asset classes in demat accounts, including equities, debt, funds, and gold receipts, representing over 85% of total securities. Its subsidiaries, NDML and NPBL, offer technology, regulatory, and financial services, broadening revenue streams and strengthening its comprehensive market presence.

Experienced Senior Management Team

National Securities Depository Limited (NSDL) is led by a highly experienced senior management team averaging over 20 years in the industry. Key leaders include Vijay Chandok (MD & CEO) with 31 years’ experience, Gopalan Srinivasa Raghavan (Executive Director), Prashant Pramod Vagal (COO), and other seasoned experts driving strategic growth and strong governance.

More About National Securities Depository Limited (NSDL)

National Securities Depository Limited (NSDL) is a SEBI-registered Market Infrastructure Institution (MII) that offers a broad spectrum of services to India’s financial and securities markets. Since the enactment of the Depositories Act in 1996, NSDL has been a pioneer, initiating the dematerialisation of securities in India.

As of December 31, 2024, NSDL is the largest depository in India in terms of:

- Number of issuers and active instruments

- Market share in demat value

- Settlement volume

- Value of assets held under custody

It operates through a widespread network of 63,542 depository participant service centres, significantly ahead of CDSL.

Core Depository Services

NSDL enables investors to hold securities in digital format via Demat Accounts through its registered depository participants. These accounts cover a wide range of asset classes:

- Equities (listed and unlisted), preference shares, and warrants

- Debt instruments: corporate bonds, CPs, CDs, PTCs, G-Secs, SGBs, etc.

- Funds: mutual funds, REITs, InvITs, AIFs

- Other instruments: municipal debt, T-bills, e-gold receipts

Its centralized digital book-keeping ensures secure, efficient, and cost-effective holding and transfer of securities.

Service Ecosystem & Revenue Model of NSDL

NSDL’s clientele includes issuers, investors, custodians, brokers, and financial institutions. It generates recurring revenue through:

- Custody fees from issuers

- Annual maintenance and transaction fees from depository participants

Technological Leadership and Subsidiaries

Through subsidiaries NSDL Database Management Limited (NDML) and NSDL Payments Bank Limited (NPBL), NSDL offers:

- E-governance, KYC, and insurance repository services

- Blockchain-based platforms and e-voting solutions

- B2B digital banking focused on financial inclusion

Market Reach and Growth

By December 31, 2024:

- Over 38.77 million active demat accounts

- Present in 99.32% of Indian pin codes and 218 countries

- 64,535 issuers registered, with 6,158 listed

Assets under custody stood at ₹77,814.10 billion for individuals and HUFs, commanding a market share of:

- 85.57% for NRIs

- 96.93% for debt securities

Financial Performance

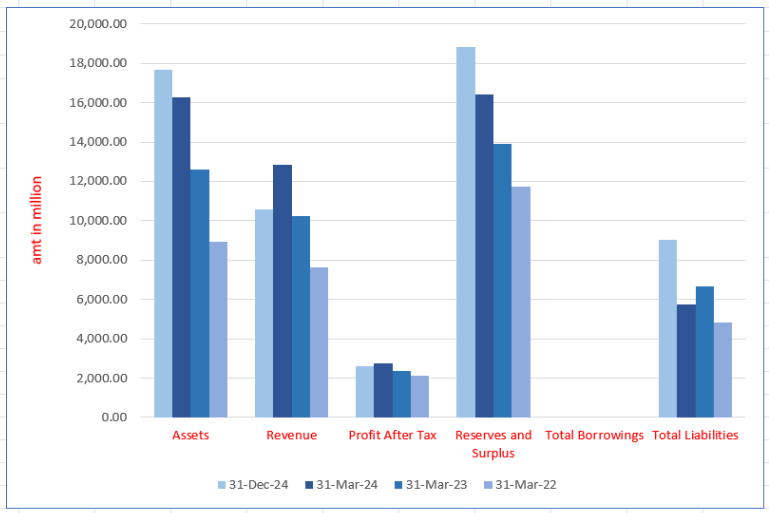

Between FY 2022 and FY 2024:

- Revenue from operations rose from ₹7,611.09 million to ₹12,682.44 million

- Profit after tax increased to ₹2,754.45 million

- EBITDA grew at a CAGR of 12.80%, reaching ₹3,811.33 million

NSDL is led by Mr Vijay Chandok (MD & CEO), supported by a team of seasoned professionals whose leadership ensures continued growth and innovation.

Industry Outlook

India’s depository landscape, consisting primarily of NSDL and CDSL, has witnessed robust growth driven by rising investor participation and digital adoption:

- Demat account surge: As of September 2024, India had 175 million demat accounts, with around 4.4 million added in a single month. By FY25, the number climbed to 192.4 million, with a record 41.1 million new accounts opened.

- Market share trends: CDSL currently leads with approximately 76% in active accounts, while NSDL holds around 3.91 crore active accounts as of early 2025.

- Future expansion: The Indian demat market is projected to grow at a CAGR of approximately 17.4% through 2030, targeting a value of USD 95.7 million.

Growth Drivers

- Digital onboarding: Faster and simpler account opening processes

- Retail equity momentum: More Indians investing in IPOs, mutual funds, and secondary markets

- Regulatory reforms: T+1 settlements, e-governance initiatives, and corporate action automation

- Technological upgrades: Adoption of e-voting, blockchain tools, and digital KYC

Demand for NSDL’s Core Services

NSDL’s product portfolio including dematerialisation, settlement, pledging, e-voting, consolidated account statements, and covenant monitoring via blockchain is poised to benefit from:

- Rising asset under custody: Custody values exceed ₹77,814 billion with strong market share across segments.

- Debt and NRI activity: NSDL holds around 85.6% of NRI assets and 96.9% of demat debt.

- Technology-driven expansions: Offerings via NDML and NPBL align with increasing demand for fintech, digital banking, and e-governance services.

Growth Outlook & Forecast

- Revenue momentum: Peer CDSL recorded a 5-year revenue CAGR of around 30%, with a projected 10-year CAGR of about 10.9%.

- Industry trajectory: The depository services segment is expected to grow at 15–20% annually, supported by increasing retail participation and digital infrastructure adoption.

- Next-gen disruption: Continued modernization—such as cloud computing, blockchain, and real-time settlements—will create incremental monetisation opportunities for digital depositories.

How Will National Securities Depository Limited Benefit

- Strong growth in demat accounts boosts NSDL’s core revenue streams from account maintenance and transactions.

- Increasing market participation supports greater demand for digital custody and settlement services.

- High-value assets under custody ensure consistent earnings through issuer custody fees.

- NSDL’s technological edge, including blockchain and e-voting solutions, strengthens its service offerings.

- Expansion in retail and NRI segments enhances its market share in demat debt and global asset custody.

- Rising IPO activity and regulatory reforms increase volumes in primary and secondary markets.

- Subsidiaries like NDML and NPBL open new monetisation avenues in e-governance and digital banking.

- Broad service centre presence improves accessibility and user acquisition across India.

- NSDL’s leadership in innovation positions it to benefit from next-gen financial infrastructure demands.

- Sustained revenue growth and profitability reinforce its position as a leading depository institution.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for National Securities Depository Limited (NSDL)

Focus on Growth and Market Penetration

National Securities Depository Limited (NSDL) aims to expand market penetration by leveraging its robust technology and diverse financial services. With rapid Demat account growth and regulatory support, NSDL targets urban and underserved regions, fintech partnerships, mutual fund dematerialization, innovative products, investor education, and enhanced collaborations to drive sustainable growth in India’s capital markets.

Ongoing IT Infrastructure Investment for Operational Excellence

National Securities Depository Limited (NSDL) continually invests in upgrading its IT infrastructure to enhance operational efficiency, service quality, and resilience. Emphasizing security and business continuity, NSDL adopts advanced technology, digitizes processes, and improves system scalability to support growth and ensure uninterrupted, reliable securities market operations.

Diversifying Offerings and Expanding Database Management

National Securities Depository Limited (NSDL) aims to diversify NDML’s services by introducing new products across KYC registration, insurance repository, payment aggregation, registrar and transfer agency, and the National Skills Registry. These initiatives target enhanced efficiency, market share growth, and innovative, integrated customer solutions.

Expanding Market Share of Payments Bank Business

National Securities Depository Limited (NSDL) is scaling its payments bank business by expanding financial inclusion, enhancing digital banking via the NSDL Jiffy app, growing merchant payment solutions, launching cash management services, and broadening third-party product distribution like insurance and mutual funds.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On National Securities Depository Limited IPO (NSDL IPO)

How can I apply for National Securities Depository Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the NSDL IPO open and close?

The NSDL IPO open and close dates are 30 July 2025 and 1 Aug 2025, respectively

What is the total issue size of the NSDL IPO?

The IPO comprises 5.01 crore equity shares offered entirely through an Offer for Sale (OFS).

On which stock exchanges will NSDL be listed?

NSDL will be listed on both BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Who are the lead managers for the NSDL IPO?

ICICI Securities, Axis Capital, HSBC Securities, IDBI Capital, Motilal Oswal, and SBI Capital Markets are lead managers.

What is the face value per share in the NSDL IPO?

The face value of each equity share in the NSDL IPO is ₹10 per share.