- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Neelkanth Realtors IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Neelkanth Realtors Limited

Founded in 1980, Neelkanth is a highly regarded real estate development company based in Mumbai. Renowned for its portfolio of residential properties, shopping malls, and commercial spaces, the company is committed to design excellence, superior build quality, and timely project delivery. Neelkanth Realtors Limited focuses on crafting distinctive residential and commercial developments in the micro-markets of the Mumbai Metropolitan Region (MMR).

The company’s diversified project suite spans various price points and micro-markets, catering to a wide range of clients. Neelkanth Realtors Limited delivers tailored offerings and amenities based on the specific needs of each location and community, ensuring optimal revenue generation while shaping vibrant spaces that enhance urban living.

Neelkanth Realtors Limited IPO Overview

Neelkanth Realtors IPO is a bookbuilding of 1.35 crore shares, consisting entirely of a fresh issue of 1.35 crore shares. The IPO dates are yet to be announced, and the allotment is expected to be finalized on [.]. The price bands for the IPO are also yet to be announced. Swastika Investmart Ltd is acting as the book-running lead manager for the Neelkanth Realtors IPO, while Link Intime India Private Ltd is the registrar for the issue. Investors can refer to the Neelkanth Realtors IPO DRHP for detailed information. The IPO will be listed at BSE and NSE, with each share having a face value of ₹10.

The total issue size aggregates up to ₹[.] crore, and the shareholding post-issue will stand at 1,35,00,000 shares. The offer document was filed with SEBI/Exchange on January 2, 2025, and was returned on March 28, 2025. The promoters of Neelkanth Realtors include Rashmi C Bhimjyani, Bhavik Rashmi Bhimjyani, Avadh Financial Advisory LLP, Barsana Financial Advisory LLP, Murlidhar Financial Advisory LLP, Rasbihari Advisory Services LLP, Kamashi Advisory Services LLP, Surshyam Trading LLP, and Chitrakoot Advisory Services LLP. The shareholding pre-issue was 100%, and post-issue shareholding will be updated based on equity dilution calculations.

Neelkanth Realtors LimitedUpcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.35 crore equity shares |

| Offer for Sale: NA | |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,35,00,000 shares |

| Shareholding post -issue | TBA |

Neelkanth Realtors IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Neelkanth Realtors Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Neelkanth Realtors Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 6.08 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 33.48% |

| Net Asset Value (NAV) | 21.23 |

| Return on Equity | 33.48% |

| Return on Capital Employed (ROCE) | 16.58% |

| EBITDA Margin | 73.80% |

| PAT Margin | 32.37% |

| Debt to Equity Ratio | 3.03 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding development cost of Neelkanth Plaza Project (Funding Development Expenses) | 6783.38 |

| Repayment/ Pre-payment, in part or full of certain borrowings | [●] |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

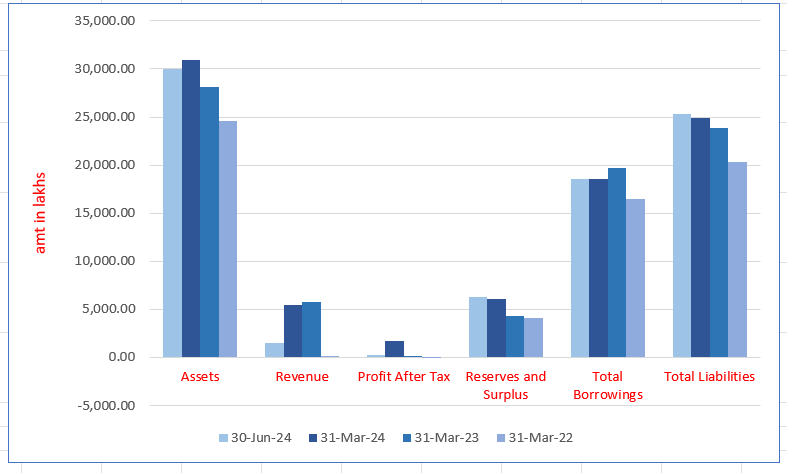

Neelkanth Realtors Limited Financials (in lakhs)

| Particulars | 30 June 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 30,007.57 | 30,951.85 | 28,114.77 | 24,553.09 |

| Revenue | 1507.91 | 5505.73 | 5786.84 | 70.16 |

| Profit After Tax | 237.95 | 1749.73 | 7.86 | (9.98) |

| Reserves and Surplus | 6307.69 | 6067.86 | 4313.52 | 4097.25 |

| Total Borrowings | 18,512.92 | 18,502.82 | 19,706.07 | 16,493.59 |

| Total Liabilities | 25,364.38 | 24,848.38 | 23,815.75 | 20,370.34 |

Financial Status of Neelkanth Realtors Limited

SWOT Analysis of Neelkanth Realtors IPO

Strength and Opportunities

- Established in 1980, Neelkanth has a long-standing presence in Mumbai's real estate market.

- Diverse portfolio includes residential, commercial, and retail projects, catering to various market segments.

- Focus on design excellence and build quality enhances brand reputation.

- Timely project delivery builds customer trust and satisfaction.

- Presence in key micro-markets of the Mumbai Metropolitan Region (MMR) offers strategic advantages.

- Ability to offer projects across a wide range of price points attracts a broad customer base.

- Tailored amenities based on community needs enhance project appeal.

- Strong relationships with contractors and suppliers ensure efficient project execution.

- Experienced management team guides strategic decision-making.

- Opportunities to expand into emerging micro-markets within MMR for growth.

- Potential to leverage digital marketing strategies to reach a wider audience.

Risks and Threats

- Limited online presence may reduce engagement with tech-savvy clients.

- High competition in Mumbai's real estate sector could impact market share.

- Regulatory changes in real estate laws may affect project timelines and costs.

- Economic downturns can lead to reduced demand for real estate investments.

- Fluctuations in construction material costs can impact profitability.

- Delays in infrastructure development in certain areas may affect project desirability.

- Dependence on the Mumbai market makes the company vulnerable to regional economic changes.

- Environmental regulations may increase compliance costs and project delays.

- Rising interest rates can deter potential homebuyers, affecting sales.

- Labor shortages or strikes can disrupt construction schedules.

- Negative market sentiment due to real estate scams can affect buyer confidence.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Neelkanth Realtors Limited IPO

Prominent Real Estate Developer in MMR

- Neelkanth Realtors Limited is a key player in Mumbai’s Eastern Suburbs and Thane City, as per the Anarock Report.

- The company specialises in residential and commercial developments across micro-markets in the Mumbai Metropolitan Region (MMR).

- It offers a diverse portfolio of projects spanning various price points tailored to community needs.

Brand Philosophy

- Focused on customer satisfaction, the company builds nurturing spaces for a superior lifestyle.

- The Neelkanth brand is trusted for quality, reflecting its deep commitment to excellence.

Historical Background

- Originating in the 1980s under the Bhimjyani family, the company began independently in 2009 after a mutual court arrangement.

- Both partner families retained the right to use the Neelkanth brand for real estate development.

Business Model and Approach

Customer-Centric Model

- Prioritises customer needs in various locations, ticket sizes, and configurations.

- Offers differentiated products through market understanding, design capabilities, and effective execution.

In-House Expertise

- Operations encompass land acquisition, project planning, marketing, and construction activities.

- The in-house sales team works with non-exclusive channel partners to support buyers throughout the process.

Collaborations

- Partners with reputed architects like Shashikant Deshmukh & Associates for project conceptualisation.

Leadership and Team

Experienced Leadership

- Promoted by Mr. Rashmi C. Bhimjyani and Mr. Bhavik R. Bhimjyani, with decades of expertise in real estate and trading.

- The leadership team includes professionals like CEO Mr. Anil Dwivedi, with over 25 years of industry experience.

Operational Highlights

Completed Projects

- 39 projects developed, covering an area of 15,68,434.66 square feet.

Ongoing Projects

- Three projects with a RERA carpet area of 1,11,486.95 square feet.

Upcoming Projects

- Four projects with an estimated RERA carpet area of 3,75,078 square feet (subject to approval and changes).

Land Reserves

- Total development potential of 2,30,000 square feet, as per court-approved consent terms.

Vision for Growth

- Neelkanth Realtors Limited aims to expand its presence in MMR with quality offerings and innovative designs.

- Strong brand recall and customer-centric practices continue to drive the company’s success in real estate development.

Industry Outlook

Increasing Penetration of Housing and Home Ownership

Key Highlights:

- Growth in Households:

- Households increased by 28.51% from 191.96 million (2001) to 246.69 million (2011).

- Owned houses rose by 28.36% from 166.35 million to 213.53 million during the same period.

- Urban and Rural Trends:

- Urban household share grew from 28% (2001) to 32% (2011).

- Rural household share dropped from 72% to 68% in the same period.

Insights from Ownership Patterns:

- Urban homeownership increased marginally from 67% (2001) to 69% (2011).

- Rural homeownership rose slightly from 94% to 95%, indicating gradual urban migration.

Urbanization and Urban Housing Shortage

Urban Growth Projections:

- By 2046, 50% of India’s population is projected to live in urban areas (UNDP).

- 8 cities will surpass 10 million population by 2035, driving demand for housing and real estate.

Housing Shortage Estimates:

- 18.78 million houses are needed as per the 12th Five-Year Plan.

- 99% of the shortage is in the EWS and LIG categories.

Government Interventions:

Pradhan Mantri Awas Yojana (PMAY):

- Launched in 2015, extended till December 2024.

- Promotes “Housing for All” through incentives for developers and buyers.

Growing Income Levels and Housing Demand

Rising Middle-Class Influence:

- Over 100 million households will move to Upper Mid, and Higher Income brackets by 2030 (World Economic Forum).

- Anticipated housing demand: 100 million units in the coming decade

Shrinking Household Sizes and Real Estate Policy Reforms in India

- Shrinking Household Size:

- The rise of nuclear families has reduced household sizes, boosting housing demand.

- Cities like NCR, MMR, and Bengaluru show significant declines in household sizes.

- Real Estate Policy Initiatives:

- Mortgage Rates: Despite a 250 bps increase, demand remained robust; rates stabilised at 6.5%.

- Loan Restructuring: RBI allowed one-time restructuring and repayment extensions for developers.

- Housing Finance: INR 10,000 crore allocated to NHB for liquidity support during COVID-19.

- Stamp Duty Cuts: Maharashtra and Karnataka reduced stamp duties, driving property sales.

- PMAY Urban Scheme: Additional INR 18,000 crore to provide housing for 1 crore families.

- SWAMIH Fund: INR 13,200 crore invested in 108 projects, aiding 87,000 homebuyers.

- Builder Premium Discounts: 50% reduction in real estate premiums in Maharashtra until March 2022.

- Property Tax Waivers: Maharashtra waived tax for homes up to 500 sq. ft., benefiting 1.61 million flats.

Consolidation of Maharashtra’s Real Estate Sector

Regulatory reforms like RERA, GST, and the Benami Act enhanced transparency and accountability in Maharashtra’s real estate sector. Demonetisation and restricted NBFC funding pushed smaller developers to exit or collaborate with larger players. Consequently, the sector became more organised, favouring institutional investments and formalising operations, while branded developers gained dominance.

Affordability Trends and Consumer Preferences

Government policies and rising incomes have significantly boosted housing affordability, with the index improving from 22 in 1995 to 3.3 in 2023, as per HDFC’s FY-23 report. Stable home loan rates post-repo rate hikes and growing demand for branded, under-construction homes highlight evolving consumer confidence and market resilience.

Demand Drivers for Real Estate in MMR

- Economic Hub: Mumbai is India’s financial capital, housing key financial institutions.

- Employment Generation: Both organized and unorganized sectors fuel housing demand.

- Social Infrastructure: Top healthcare, education, retail, and recreational facilities drive demand.

- Improved Disposable Income: Increased income among working professionals boosts demand.

- Migration to Suburbs: Movement from Island City to suburbs like Thane due to affordability and infrastructure.

Several ongoing and upcoming infrastructure projects in Mumbai and MMR aim to enhance transportation capacity and sustainability. Key initiatives include Metro expansions, Coastal Road development, Mumbai Trans Harbour Link, Navi Mumbai International Airport, and the ongoing Monorail and Metro projects to improve connectivity and reduce congestion.

Eastern Suburbs

- Established a residential micro-market with walk-to-work opportunities.

Key Demand Drivers

- Access to office locations in Powai, SEEPZ, Andheri, Kurla, Vikhroli, Kanjur Marg, and Ghatkopar.

- Improved social and physical infrastructure.

- Central Railway Line and Jogeshwari-Vikhroli Link Road are key connectors.

- Metro Line 1 (Ghatkopar to Versova) and upcoming Line 4 (Wadala to Thane).

- Large office spaces in Vikhroli and Kanjur Marg boosting demand.

Consolidated Sales for the Period CY 2019 – Q1 2024 in Eastern Suburb

- High demand for 1BHK (35.43%) and 2BHK (48.67%) apartments.

- Together, 1BHK and 2BHK account for 84.10% of total sales.

Supply, Demand, and Price Forecast & Outlook Till 2026

- Supply is expected to reach nearly 20,000 units by 2026.

- Absorption is expected to remain high, increasing by 42% in 2023 from 2022.

- Pricing is forecasted to increase gradually until 2026.

Thane Region Overview

Thane, once a distant suburb of Mumbai, has evolved into a vibrant city with its own identity. It is well-connected to Mumbai and the MMR via the Eastern Express Highway and Central Railway line, offering a range of residential options and strong economic growth.

Key Highlights:

- Real estate: Rapid growth, with a range of residential options.

- Economic drivers: Finance, technology, healthcare, and education.

- Social infrastructure: Excellent hospitals, schools, and shopping malls.

- Transportation: Upcoming metro line 4 to improve connectivity.

Market Outlook (2024-2026):

- Forecasted supply: Expected to increase, reaching 20,000+ units by 2026.

- Demand: Strong demand for 1 BHK and 2 BHK properties, with sales expected to rise by 33% in 2023.

Infrastructure Developments in Thane

- Mahasamruddhi Expressway

- 701 km, 6-lane expressway connecting Mumbai and Nagpur.

- Travel time reduced to 7 hours. Completion by 2024.

- Bullet Train Station

- Mumbai-Ahmedabad High-Speed Rail to cut travel to 2 hours.

- Thane station will be ready by 2027.

- Data Centers

- CtrlS and Sify provide managed services and cloud solutions.

- Maharashtra’s policy encourages data center growth.

- New Development Areas

- Key regions: Ghodbandar, Kolshet, and Extended Thane/Bhiwandi.

- Enhanced connectivity and affordable real estate options.

How Will Neelkanth Realtors Limited Benefit?

- Strategic Location Advantages

With the development of key infrastructure like the Mahasamruddhi Expressway and Bullet Train, Neelkanth Realtors Limited can capitalise on increased connectivity in Thane. This will enhance accessibility to their properties, offering a competitive edge in the growing real estate market.

- Rising Housing Demand

As urbanisation increases and the demand for housing in MMR surges, Neelkanth Realtors Limited is well-positioned to tap into the need for affordable and quality residential developments. This demand will provide them with ample opportunities for sustained growth and project expansion.

- Government Initiatives

With the government’s focus on housing for all, including schemes like PMAY, Neelkanth Realtors Limited can benefit from incentives for developers. This will lower project costs, making it easier for them to deliver quality homes while catering to the growing middle-class population.

- Infrastructure Developments in Thane

The ongoing and upcoming infrastructure projects, including metro expansion and new transport links, will enhance connectivity and improve the quality of life in Thane. Neelkanth Realtors Limited’s properties in this region will become more attractive to homebuyers, driving demand.

- Enhanced Real Estate Market Dynamics

With the consolidation of Maharashtra’s real estate sector and increasing consumer preference for branded, under-construction homes, Neelkanth Realtors Limited’s reputation for quality and reliability will allow it to attract investors and buyers, making its developments more desirable in the competitive market.

Peer Group Comparison

| Name of the Company | Total Income (₹ in lakhs) | Face Value per Equity Share (₹) | P/E Ratio | EPS (Basic) (₹) | RoNW (%) | NAV (₹) |

| Neelkanth Realtors Limited | 5,505.73 | 10 | [●] | 6.08 | 33.48 | 21.23 |

| Suraj Estate Developers Limited | 38,685.10 | 5 | 29.18 | 20.29 | 23.87 | 118.08 |

| Arkade Developers Limited | 63,658.54 | 10 | 21.26 | 8.09 | 46.96 | 21.28 |

| Peninsula Land Limited | 52,787.00 | 2 | 13.87 | 3.13 | 86.20 | 6.66 |

Key Insights

- Total Income: Neelkanth Realtors Limited’s total income of ₹5,505.73 lakhs is considerably lower than its peers, reflecting its smaller scale of operations. In contrast, Arkade Developers Limited leads with ₹63,658.54 lakhs, indicating broader market penetration and a diversified portfolio. Higher income signifies established operations and strong revenue streams.

- Face Value per Equity Share: The ₹10 face value of Neelkanth Realtors Limited matches Arkade Developers Limited, suggesting comparability in share structure. Suraj Estate Developers Limited and Peninsula Land Limited have lower face values at ₹5 and ₹2, respectively, which can make their shares more accessible to retail investors.

- Price-to-Earnings (P/E) Ratio: Neelkanth Realtors Limited’s P/E ratio is undisclosed, making direct valuation comparisons challenging. A higher P/E, like Suraj Estate Developers Limited’s 29.18, often indicates market confidence and growth expectations, while Peninsula Land Limited’s 13.87 suggests lower market optimism or a mature business cycle.

- Earnings Per Share (Basic): With an EPS of ₹6.08, Neelkanth Realtors Limited demonstrates moderate profitability per share. However, Suraj Estate Developers Limited outperforms with ₹20.29, reflecting superior earnings potential. Lower EPS in peers like Peninsula Land Limited at ₹3.13 may indicate lesser profitability or higher expenses.

- Return on Net Worth (RoNW): Neelkanth Realtors Limited’s RoNW of 33.48% reflects the efficient utilization of shareholder equity. Arkade Developers Limited leads with 46.96%, indicating better profitability. Peninsula Land Limited’s exceptional 86.20% may result from one-time gains or aggressive financial strategies. Suraj Estate Developers Limited’s 23.87% shows consistent but comparatively lower returns.

- Net Asset Value (NAV): With a NAV of ₹21.23, Neelkanth Realtors Limited displays a reasonable asset valuation per share. Suraj Estate Developers Limited’s ₹118.08 highlights a robust asset base, making it a stronger contender in the industry. Meanwhile, Peninsula Land Limited’s ₹6.66 may suggest a smaller asset backing relative to its equity.

Neelkanth Realtors Limited IPO Strengths

- Established Brand and Market Expertise

Neelkanth Realtors Limited boasts a distinguished legacy in Mumbai’s residential real estate market, especially in the Eastern Suburbs and Thane City. Their deep understanding of market dynamics and regulatory frameworks has enabled them to identify promising opportunities in mid-end, luxury, and ultra-luxury segments. This expertise stems from their association with the erstwhile Neelkanth Group, a name synonymous with trust and quality.

- Strategically Located Projects

Neelkanth Realtors Limited develops projects in prime locations across Mumbai’s Eastern Suburbs and Thane City. These areas are coveted for high demand, premium positioning, and attractive realisations. Proximity to commercial hubs, transport links, and lifestyle amenities enhances their projects’ desirability. This strategic positioning allows them to cater to diverse customer needs while capitalising on market growth in these sought-after submarkets.

- Diverse Portfolio Across Segments

With a diversified portfolio, Neelkanth Realtors Limited caters to customers across income brackets. Their projects span mid-end to ultra-luxury segments, featuring studio apartments, 2 BHK, 3 BHK, and 4 BHK units. Each project integrates modern amenities and superior design. This breadth of offerings ensures they meet the preferences of varied demographics, strengthening their position in Mumbai’s dynamic real estate market.

- Proven Project Management Excellence

Neelkanth Realtors Limited demonstrates exceptional project management capabilities, honed over decades. Their integrated approach encompasses land acquisition, in-house design, resource optimisation, and adherence to timelines. Collaborations with renowned consultants and focus on quality assurance ensure customer satisfaction. Their track record of delivering over 36 successful projects in the Mumbai Metropolitan Region underscores their expertise in efficient execution.

- Customer-Centric Marketing Strategies

Neelkanth Realtors Limited employs a customer-focused marketing approach. Their experienced sales and CRM teams work to understand market trends, ensuring strategic project positioning. Dedicated efforts from enquiry to possession build strong customer relationships, fostering goodwill and referrals. This approach enhances brand value and drives sales, further solidifying their standing as a trusted developer in Mumbai and Thane’s competitive real estate landscape.

Key Insights from Financial Performance

- Assets: As of June 30, 2024, Neelkanth Realtors Limited reported assets of ₹30,007.57 lakhs, reflecting a marginal decline from ₹30,951.85 lakhs on March 31, 2024. Over two years, assets increased steadily, from ₹24,553.09 lakhs in 2022 to ₹28,114.77 lakhs in 2023.

- Revenue: The company’s revenue for the quarter ending June 30, 2024, stood at ₹1,507.91 lakhs, significantly lower than ₹5,505.73 lakhs in FY 2024 and ₹5,786.84 lakhs in FY 2023. However, it shows remarkable growth compared to ₹70.16 lakhs recorded in FY 2022, indicating business expansion.

- Profit After Tax: Profit after tax for Q1 FY 2025 was ₹237.95 lakhs, down from ₹1,749.73 lakhs in FY 2024. Notably, the company achieved positive results in FY 2023, with ₹7.86 lakhs, rebounding from a loss of ₹9.98 lakhs in FY 2022, reflecting improved profitability.

- Reserves and Surplus: The reserves and surplus grew steadily over the years, standing at ₹6,307.69 lakhs as of June 30, 2024, compared to ₹6,067.86 lakhs in FY 2024 and ₹4,313.52 lakhs in FY 2023. This consistent growth reflects the company’s robust financial health and profit retention.

- Total Borrowings: Neelkanth Realtors Limited recorded borrowings of ₹18,512.92 lakhs in June 2024, slightly increasing from ₹18,502.82 lakhs in FY 2024. While borrowings peaked at ₹19,706.07 lakhs in FY 2023, they decreased from ₹16,493.59 lakhs in FY 2022, indicating prudent financial management.

- Total Liabilities: The company’s total liabilities rose to ₹25,364.38 lakhs in June 2024 from ₹24,848.38 lakhs in FY 2024. Over two years, liabilities increased progressively, from ₹20,370.34 lakhs in FY 2022 to ₹23,815.75 lakhs in FY 2023, aligning with asset and operational growth.

Other Financial Details

- Employee Benefits Expense: This expense was ₹101.78 lakh for Q1 FY2024, a decrease from ₹215.15 lakh in FY2024. This expense indicates the company’s commitment to employee compensation. The reduction suggests cost optimization or variations in workforce size during different periods.

- Finance Costs: Finance costs for Q1 FY2024 were ₹555.05 lakh, significantly lower than ₹1,660.45 lakh in FY2024. Finance costs fluctuate with borrowing levels, suggesting that in FY2024, the company had higher financing requirements or incurred more interest payments compared to FY2023.

- Depreciation and Amortization Expense: These expenses were ₹4.81 lakh in Q1 FY2024, up from ₹9.37 lakh in FY2024. This suggests a relatively consistent asset depreciation rate, though lower in Q1, possibly due to new investments or asset disposals in FY2024.

- Other Expenses: Other expenses were ₹466.15 lakh in Q1 FY2024, showing a reduction compared to ₹2,877.23 lakh in FY2024. The high cost in FY2024 might reflect higher operational, administrative, or project-related expenses, while the Q1 figures show lower operational costs.

Key Strategies for Neelkanth Realtors Limited

- Strengthening Market Position in Thane City

Neelkanth Realtors Limited aims to consolidate its market position in Thane City through upcoming projects with a carpet area of approximately 3,75,078 square feet. Leveraging their brand, deep experience, and successful execution track record, they plan to capitalise on Thane City’s premium positioning, stable demand, and growth in residential demand driven by improved connectivity, affordability, and emerging commercial hubs.

- Development of Land Reserves at Vidyavihar

Neelkanth Realtors Limited intends to develop 2,30,000 square feet of land reserves at Vidyavihar through Gammon Neelkanth Realty Corporation, where they hold a 33% stake. By fully utilising FSI/TDR potential, they aim to unlock value, subject to marketability and regulatory clearances. This initiative aligns with their strategy to maximise existing assets and drive growth in high-potential areas within the MMR region.

- Expanding Differentiated Product Offerings

Neelkanth Realtors Limited continues to offer studio apartments, 2 BHK, 3 BHK, and 4 BHK units across mid-end, luxury, and ultra-luxury segments. Their upcoming projects include modern apartments, commercial shops, and premium amenities like a clubhouse, swimming pool, and gardens, priced between ₹51–420 lakh. This differentiation through quality and competitive pricing strengthens their appeal across various customer segments.

- Exploring New Development Opportunities

Neelkanth Realtors Limited plans to expand its footprint in the MMR and Pune by leveraging regulatory changes like RERA and market consolidation opportunities. By adopting flexible land acquisition models, including joint ventures and development management, they aim to increase market penetration. Their execution expertise and strategic land sourcing enable them to predict high-demand areas and explore growth opportunities outside their core markets.

Competitor Analysis of Neelkanth Realtors Limited

- Suraj Estate Developers Limited

Suraj Estate Developers Limited is a prominent real estate developer in Mumbai, specializing in residential and commercial projects. They have a strong market presence with a diverse portfolio, focusing on quality construction and timely delivery. Neelkanth Realtors Limited competes with Suraj Estate by offering similar residential developments in Mumbai’s Eastern Suburbs and Thane City. While both companies emphasize quality, Neelkanth Realtors differentiates itself through its upcoming projects and strategic focus on select micro-markets.

- Arkade Developers Limited

Arkade Developers Limited is a Mumbai-based real estate company known for its residential projects targeting the mid to premium segments. They have established a reputation for delivering quality homes with modern amenities. Neelkanth Realtors Limited competes with Arkade Developers by focusing on similar market segments in Mumbai’s Eastern Suburbs and Thane City. Both companies aim to enhance their market positions through upcoming projects, but Neelkanth Realtors differentiates itself by leveraging its brand and deep experience in successful execution.

- Peninsula Land Limited

Peninsula Land Limited is a well-established real estate developer in India, known for its large-scale residential and commercial projects. They have a strong presence in major cities, including Mumbai. Neelkanth Realtors Limited competes with Peninsula Land by focusing on the Thane City region, a prime real estate market in the Mumbai Metropolitan Region (MMR). While Peninsula Land has a broader market presence, Neelkanth Realtors aims to consolidate its position in Thane City through upcoming projects and a strategic focus on select micro-markets.

- Godrej Properties

Godrej Properties is a leading real estate developer in India, known for its premium residential and commercial projects across major cities. They have a strong brand presence and a diverse portfolio. Neelkanth Realtors Limited competes with Godrej Properties by focusing on the Thane City region, offering residential projects in the mid to luxury segments. While Godrej Properties has a broader market presence, Neelkanth Realtors differentiates itself by leveraging its deep experience and track record of successful execution in select micro-markets.

- Macrotech Developers (Lodha Group)

Macrotech Developers, formerly known as Lodha Group, is a prominent real estate developer in India, known for its luxury residential and commercial projects. They have a strong presence in Mumbai and other major cities. Neelkanth Realtors Limited competes with Macrotech Developers by focusing on the Thane City region, offering residential projects in the mid to luxury segments. While Macrotech Developers has a broader market presence, Neelkanth Realtors differentiates itself by leveraging its brand and deep experience in successful execution in select micro-markets.

- Oberoi Realty

Oberoi Realty is a leading real estate developer in India, known for its premium residential and commercial projects. They have a strong presence in Mumbai and other major cities. Neelkanth Realtors Limited competes with Oberoi Realty by focusing on the Thane City region, offering residential projects in the mid to luxury segments. While Oberoi Realty has a broader market presence, Neelkanth Realtors differentiates itself by leveraging its deep experience and track record of successful execution in select micro-markets.

- Keystone Realtors

Keystone Realtors is a Mumbai-based real estate developer known for its residential projects targeting the mid to premium segments. They have established a reputation for delivering quality homes with modern amenities. Neelkanth Realtors Limited competes with Keystone Realtors by focusing on similar market segments in Mumbai’s Eastern Suburbs and Thane City. Both companies aim to enhance their market positions through upcoming projects, but Neelkanth Realtors differentiates itself by leveraging its brand and deep experience in successful execution.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the purpose of Neelkanth Realtors Limited's IPO?

Neelkanth Realtors Limited’s IPO aims to raise funds for developing ongoing and upcoming projects, including the Neelkanth Plaza Project in Thane, repaying debt, and general corporate purposes.

When will the Neelkanth Realtors Limited IPO open for bidding?

The opening and closing dates for Neelkanth Realtors Limited’s IPO have yet to be announced. Investors should stay updated on the official timeline.

What is the issue size of the Neelkanth Realtors Limited IPO?

Neelkanth Realtors Limited plans to issue 1.35 crore equity shares, each with a face value of ₹10, as part of its IPO.

How will the funds from the IPO be used?

The funds raised will be utilized for developing ongoing and upcoming projects, including the Neelkanth Plaza Project in Thane, repaying debt, and meeting general corporate needs.

What is the share allocation for Neelkanth Realtors Limited’s IPO?

The IPO will allocate 50% of shares to institutional investors, 15% to non-institutional investors, and 35% to retail investors.

Where will Neelkanth Realtors Limited’s shares be listed?

Neelkanth Realtors Limited’s shares will be listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) after the IPO.

How can I apply for Neelkanth Realtors Limited’s IPO?

Investors can apply for Neelkanth Realtors Limited’s IPO through their Demat account, using online platforms, or through brokers once the IPO opens for bidding.