- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Nephrocare Health Services IPO

₹14,016/32 shares

Minimum Investment

IPO Details

10 Dec 25

12 Dec 25

₹14,016

32

₹438 to ₹460

NSE, BSE

₹353.41 Cr

17 Dec 25

Nephrocare Health Services IPO Timeline

Bidding Start

10 Dec 25

Bidding Ends

12 Dec 25

Allotment Finalisation

15 Dec 25

Refund Initiation

16 Dec 25

Demat Transfer

16 Dec 25

Listing

17 Dec 25

Nephrocare Health Services Limited

Nephrocare Health Services Ltd. delivers comprehensive dialysis care through a wide network of clinics in India and select international markets. Its offerings include diagnosis, haemodialysis, home and mobile dialysis, wellness programmes, and an in-house pharmacy. As of March 31, 2025, it operated 490 clinics, with 447 in India and 43 overseas, including the world’s largest dialysis clinic in Uzbekistan. Serving 29,281 patients and completing 2.88 million treatments in Fiscal 2025, Nephrocare addressed critical demand, particularly in tier II and III cities.

Nephrocare Health Services Limited IPO Overview

Nephrocare Health IPO is a book-built issue that includes a fresh issue worth ₹353.41 crores along with an offer for sale of 1.13 crore shares. The IPO opens for subscription on December 10, 2025, and closes on December 12, 2025. The allotment is expected to be finalised on December 15, 2025, and the company is scheduled to list on both BSE and NSE on December 17, 2025. The price band for the issue is yet to be announced. ICICI Securities Ltd. is acting as the book-running lead manager, while Kfin Technologies Ltd. is serving as the registrar for the IPO.

Nephrocare Health Services Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹353.41 crore |

| Offer for Sale (OFS) | 1.13 crore equity shares |

| IPO Dates | December 10, 2025 – December 12, 2025 |

| Price Bands | To be announced |

| Lot Size | To be updated |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 9,26,50,799 shares |

| Shareholding Post-Issue | To be updated |

Nephrocare Health Services IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Nephrocare Health Services Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Nephrocare Health Services Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.19% |

| Net Asset Value (NAV) | ₹59.56 |

| Return on Equity (RoE) | 13.45% |

| Return on Capital Employed (RoCE) | 18.67% |

| EBITDA Margin | 22.05% |

| PAT Margin | 8.88% |

| Debt to Equity Ratio | 0.39 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure by the Company for opening new dialysis clinics in India | 1291.1 |

| Pre-payment, or scheduled repayment, in full or part, of certain borrowings availed by the Company | 1360 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

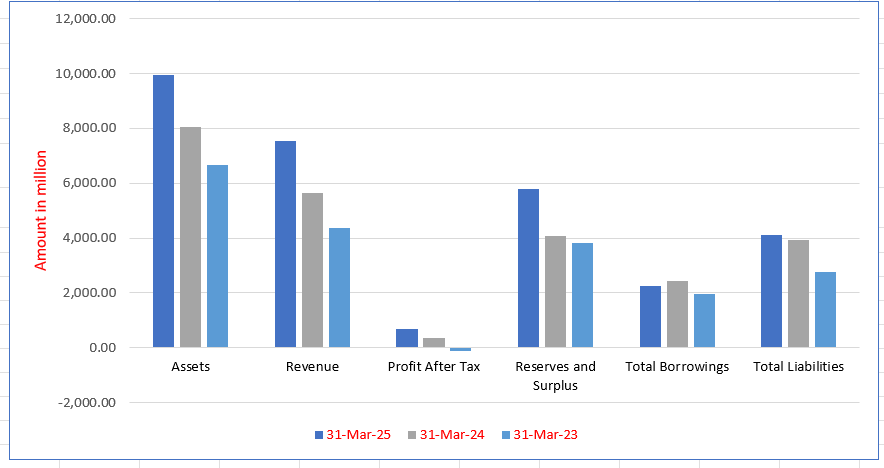

Nephrocare Health Services Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 9,964.60 | 8,060.17 | 6,662.30 |

| Revenue | 7,558.12 | 5,661.55 | 4,372.95 |

| Profit After Tax | 670.96 | 351.33 | (117.89) |

| Reserves and Surplus | 5,786.83 | 4,085.65 | 3,834.96 |

| Total Borrowings | 2,258.02 | 2,433.65 | 1,962.08 |

| Total Liabilities | 4,123.47 | 3,923.08 | 2,775.99 |

Financial Status of Nephrocare Health Services Limited

SWOT Analysis of Nephrocare Health Services IPO

Strength and Opportunities

- Broad network of clinics operating across India and select international markets enhances reach and access.

- Strong presence in tier II and III cities addresses underserved demand and supports expansion.

- Comprehensive service portfolio—including diagnosis, home/mobile dialysis, wellness programs, and in-house pharmacy—promotes continuity of care.

- Robust growth in treatments and patient base demonstrates market capture and operational thrust.

- Strategic partnerships with leading hospital chains enhance credibility, referral pipelines, and service anchoring.

- Increasing dialysis machine capacity reflects infrastructure investment and readiness for rising demand.

- International footprint in multiple countries (e.g., Uzbekistan, Nepal) offers diversification and global growth opportunity.

- Telehealth and mobile dialysis could expand reach and convenience, especially post-pandemic.

- Growing demand for dialysis driven by rising chronic kidney disease prevalence and aging population fuels long-term prospects.

Risks and Threats

- High dependence on physical infrastructure and clinical operations may limit quick scalability.

- Operating costs in remote areas may be higher, affecting profitability and cost control.

- Integrated services require complex coordination, which may strain operational efficiency.

- Dependence on chronic dialysis patients makes revenue vulnerable to healthcare access shifts or innovations.

- Partnerships may dilute branding or create dependency on external entities for referrals.

- Heavy capital expenditure on equipment maintenance and upgrades can pressure margins.

- Cross-border operations expose the company to regulatory, economic, and exchange rate risks.

- Limited digital infrastructure or adoption may hinder rollout of mobile or remote care services.

- Healthcare policy changes, reimbursement cuts, or regulatory shifts may impact affordability and volume.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Nephrocare Health Services Limited

Nephrocare Health Services Limited IPO Strengths

Leading Dialysis Service Provider

Nephrocare Health Services Limited is India’s and Asia’s largest dialysis chain, leading in patient numbers, clinics, cities, and treatments. With over 50% market share in India’s organized dialysis sector and a presence in 21 states and four Union Territories, it is the only Indian provider to have scaled internationally.

Cost-Efficient and Scalable Business Model

The company operates an asset-light model that drives cost efficiencies and operational excellence. By focusing on a cluster-based expansion approach and a centralized procurement process, it has successfully scaled from one clinic to 490 clinics globally, ensuring lower capital expenditure while delivering quality care to diverse patient needs.

Clinical Excellence and Advanced Technology

Nephrocare drives clinical excellence through its proprietary RenAssure protocols and advanced technology. The company utilizes a cloud-enabled dialyzer reprocessing system and mobile applications for patients and nephrologists. With a dedicated ethics committee and the Enpidia training academy, it maintains high-quality standards and a skilled workforce.

Strategic Growth through Acquisitions

The company has a proven track record of strategic growth, combining organic expansion with successful acquisitions in India and internationally. This approach has allowed for rapid scaling and market penetration, as demonstrated by the integration of DaVita India’s operations and a series of key acquisitions in the Philippines, strengthening its global footprint and patient base.

Experienced Leadership and Marquee Investors

Nephrocare is led by an experienced, patient-centric leadership team and a seasoned management team. The company’s expansion has been supported by capital from marquee investors, who have also helped implement strong corporate governance standards. This leadership and financial backing are critical to the company’s growth and strategic initiatives.

More About Nephrocare Health Services Limited

Nephrocare Health Services Limited delivers end-to-end dialysis care through its extensive network of clinics. The Company provides services ranging from diagnosis to treatment and wellness programmes, including haemodialysis, home dialysis, mobile dialysis, and pharmacy support.

Market Leadership

- India’s largest dialysis service provider in Fiscal 2025 by number of patients served, clinics, treatments performed, revenue, and EBITDA (excluding other income).

- 4.4 times the size of the next largest organised provider in India by operating revenue (Fiscal 2024, F&S Report).

- Served 29,281 patients and conducted 2,885,450 treatments in Fiscal 2025, covering around 10% of India’s dialysis patients.

- Ranked largest in Asia and fifth globally in treatments performed during Fiscal 2025.

- Only Indian dialysis provider with an international footprint.

Geographic Presence

- Operates 490 clinics globally, including 43 international centres across the Philippines, Uzbekistan, and Nepal.

- Widely distributed across India with presence in 269 cities, 21 States, and 4 Union Territories.

- Nearly 77% of clinics are located in Tier II and Tier III towns, strengthening accessibility beyond metros.

Ethos: Accessibility, Quality and Value

Nephrocare’s philosophy is built around three guiding principles:

Accessibility

- A diverse presence through standalone clinics, in-hospital units, and public-private partnerships (PPPs).

- Partnerships with leading hospital chains including Max, Fortis, Care Hospitals, Wockhardt, and Ruby Hall.

- Patient-friendly services such as holiday dialysis, dialysis on call, and dialysis on wheels.

Quality

- Protocol-driven care supported by RenAssure, a comprehensive clinical framework.

- Advisory Team of Clinical Experts ensures practices align with global standards.

- Accredited training institute Enpidia, recognised by BONENT (US).

- Technology-driven innovations such as the Renova Dialyzer Reprocessing System.

Value

- Asset-light, scalable model with over 52% of clinics under revenue-sharing format.

- Cost efficiency achieved through centralised procurement, contract manufacturing, and economies of scale.

- Support for underprivileged patients through NephroPlus Foundation.

Patient-Centric Leadership

Founded in 2010, Nephrocare was co-established by Kamal D. Shah, himself a long-term dialysis patient, and Vikram Vuppala. Their mission is to redefine dialysis care in India and beyond. Initiatives such as Aashayein and the Dialysis Olympiad foster engagement, dignity, and hope for patients.

Industry Outlook

Market Size & Growth Prospects

- The overall Indian dialysis market was estimated at USD 5.0 billion in 2024 and is projected to grow to USD 11.3 billion by 2033, at a CAGR of 8.8% for 2025–2033.

- The broader hemodialysis and peritoneal dialysis market is expected to reach USD 4.53 billion by 2030, growing at about 9.9% CAGR (2024–2030).

- Estimates vary: one source projects growth from USD 3.21 billion in 2024 to USD 5.94 billion by 2032, implying a robust 10.5% CAGR.

Segment Outlook: Home Dialysis & Equipment

- Home dialysis systems in India are expanding rapidly—revenue grew from USD 417 million in 2023 to a projected USD 985 million by 2030, at a strong 13.1% CAGR.

- The dialysis equipment market (which includes machines, consumables, accessories) reached USD 826.6 million in 2024, and is expected to grow to USD 1.48 billion by 2033, at a CAGR of 6.2%.

Growth Drivers & Key Trends

- Driving factors include rising diabetes and hypertension prevalence, increasing CKD awareness, public health investments, and expansion of public-private partnerships (PPP) that enhance access to dialysis services.

- Government schemes like PMNDP, state health programmes (e.g., in Delhi and Rajasthan), and proactive infrastructure expansion are increasing dialysis coverage.

- The sector is also witnessing technological advancement: growth in home-based and portable haemodialysis, AI-enabled remote monitoring, and government-supported initiatives aimed at cost reduction and broader accessibility

How Will Nephrocare Health Services Limited Benefit

- With the Indian dialysis market projected to grow at ~9–10% CAGR, Nephrocare’s extensive clinic network and patient base allow it to capture a significant share of rising demand.

- Rapid growth in home dialysis systems (13.1% CAGR) aligns with Nephrocare’s offerings such as home haemodialysis and portable solutions, expanding its service reach into tier-II and tier-III towns.

- Expansion in dialysis equipment and consumables supports Nephrocare’s in-house innovations like the Renova Dialyzer Reprocessing System, enhancing efficiency and cost advantage.

- Public-private partnerships (PPP) and government health schemes are expected to widen patient access, directly benefitingNephrocare’s asset-light model and collaborations with leading hospitals.

- Rising CKD prevalence, driven by diabetes and hypertension, strengthens demand for recurring treatments, ensuring sustainable long-term revenue streams.

- Increasing adoption of AI-enabled monitoring and digital healthcare complements Nephrocare’s tech-driven clinical framework, reinforcing quality leadership.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Nephrocare Health Services Limited

Consolidating Leadership in India

Nephrocare Health Services Limited intends to expand its leadership by establishing new dialysis clinics across India, guided by patient density, CKD incidence, infrastructure, and healthcare schemes. Its asset-light model ensures efficiency, while clinic upgrades and partnerships enhance accessibility, utilization, patient experience, and profitability nationwide.

Scaling International Operations

Nephrocare Health Services Limited seeks to scale operations in existing international markets, including the Philippines and Uzbekistan, through selective acquisitions and partnerships. By leveraging industry expertise, it evaluates high-potential clinics, integrates global practices, and enhances service delivery, thereby expanding patient access and strengthening its international dialysis network.

Expanding into New Global Markets

Nephrocare Health Services Limited aims to expand across Southeast Asia, the CIS, and the Middle East through a phased approach. Guided by healthcare demand, PPP potential, and local partnerships, it leverages India-driven efficiencies and cost advantages to deliver scalable, high-quality, margin-accretive dialysis care internationally.

Enhancing Operating Efficiency

Nephrocare Health Services Limited continues to drive profitability by improving supply chain efficiency and contract manufacturing dialysis consumables. Direct procurement, quality control, and standardized operations reduce third-party dependency and costs. Leveraging its growing scale, the company secures competitive pricing, strengthens product availability, and sustains margin improvements across its network.

Driving Innovation in Digital Healthcare

Nephrocare Health Services Limited prioritizes technology-driven innovation to improve convenience, efficiency, and clinical outcomes. Through home dialysis, remote monitoring, AI-powered predictive care, and patient engagement platforms, it enables timely interventions, reduces errors, and enhances transparency, positioning digital healthcare as a core enabler of scalable, high-quality dialysis services.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Nephrocare Health Services Limited IPO

How can I apply for Nephrocare Health Services Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What does Nephrocare Health Services Ltd. do?

It provides dialysis, home dialysis, and renal care services through clinics in India and international markets.

What is the size of Nephrocare’s IPO?

The IPO includes a ₹353.41 crore fresh issue and 1.28 crore shares offered for sale.

How will the IPO proceeds be utilized?

Funds will support new dialysis clinics, debt repayment, and general corporate requirements for expansion.

On which exchanges will shares be listed?

Nephrocare Health Services Ltd. IPO shares will be listed on both NSE and BSE.

How did the company perform financially in FY 2025?

Revenue grew 34% to ₹769.92 crore, while profit after tax rose 91% to ₹67.10 crore.