- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- What are Non-Current Liabilities?

- Types of Non-Current Liabilities

- Importance of Non-Current Liabilities

- How Do Investors Use Non-Current Liabilities?

- Different Financial Ratios Involving Non-Current Liabilities

- Difference Between Current and Non-Current Liabilities

- Impact of High Non-Current Liabilities on Business

- Conclusion

- FAQs on Non-current Liabilities

- What are Non-Current Liabilities?

- Types of Non-Current Liabilities

- Importance of Non-Current Liabilities

- How Do Investors Use Non-Current Liabilities?

- Different Financial Ratios Involving Non-Current Liabilities

- Difference Between Current and Non-Current Liabilities

- Impact of High Non-Current Liabilities on Business

- Conclusion

- FAQs on Non-current Liabilities

What are Non-current Liabilities & How Do Investors Use Non-Current Liabilities?

By Ankur Chandra | Updated at: Oct 1, 2025 07:44 PM IST

Non-current liabilities are long-term financial obligations a company is required to pay after 12 months or more. These include loans, bonds payable, deferred tax liabilities, and lease obligations. They reflect a company’s long-term financing strategy and play a crucial role in assessing financial stability and leverage.

What are Non-Current Liabilities?

Non-current liabilities meaning refers to the long-term financial obligations of a company that are not due within one year. These liabilities include loans, bonds, and other debts payable over an extended period, helping businesses finance long-term projects and growth.

Non Current Liabilities Examples: Common examples of non-current liabilities include long-term loans, bonds payable, mortgage debts, lease obligations, and deferred tax liabilities. These are financial commitments a company must settle over a period longer than one year.

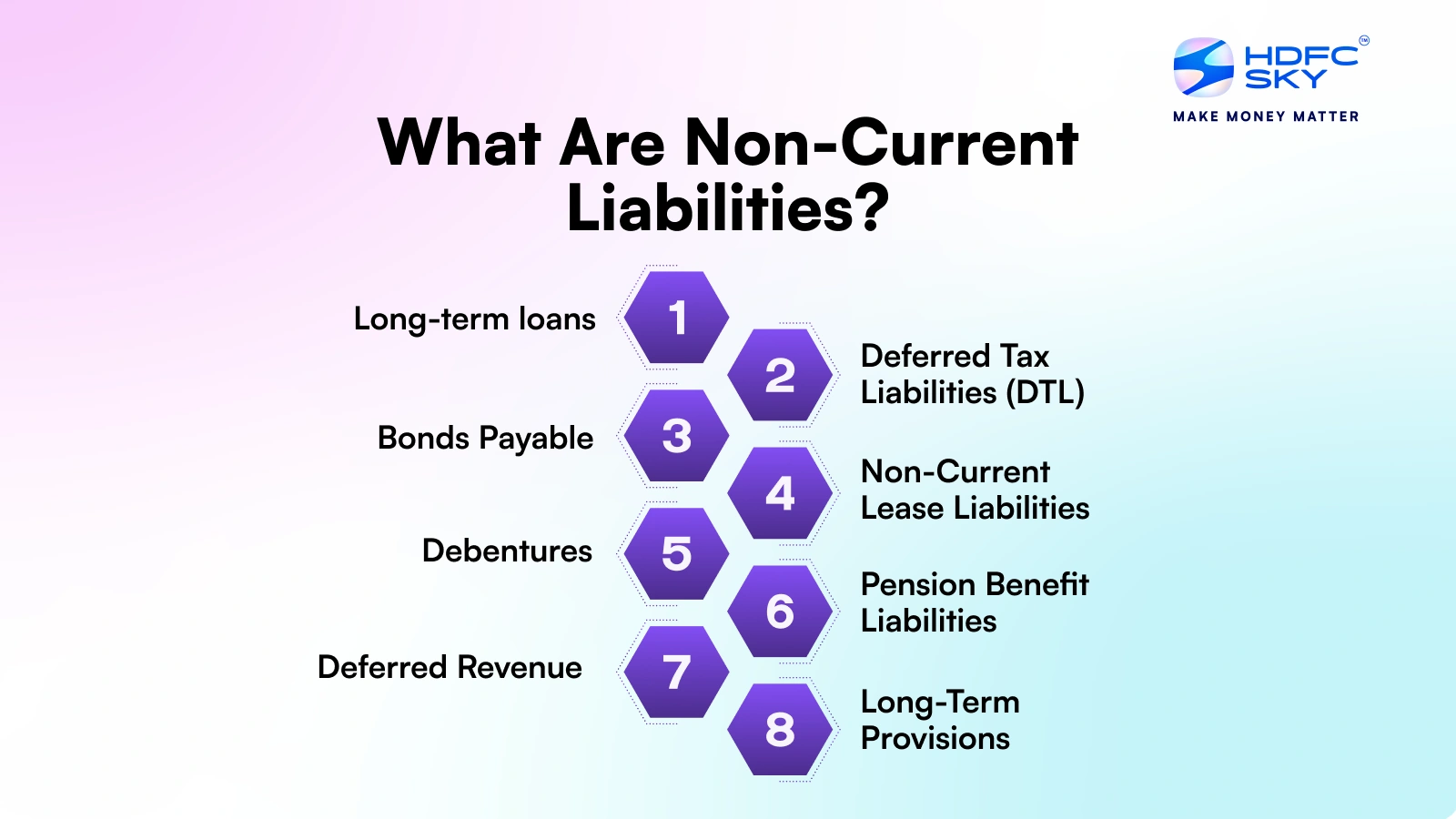

Types of Non-Current Liabilities

Non-current liabilities are long-term financial obligations not due within a year. They support business expansion and capital-intensive operations.

- Long-term loans are borrowings from banks or other financial institutions with repayment schedules that extend beyond one year. They are perhaps the most common form used to finance major capital expenditures or expansion projects.

- Debentures: These are long-term debt instruments issued by companies to raise funds from investors. Debentures may be secured against specific assets or unsecured (relying on the company’s general creditworthiness and goodwill). Interest is typically paid periodically, and the principal is repaid at the maturity date.

- Bonds Payable: Similar to debentures, bonds are long-term debt securities issued to raise capital. They can be secured or unsecured and carry a fixed or variable interest rate (coupon), payable to bondholders over the life of the bond, with principal repayment at maturity.

- Non-Current Lease Liabilities: Under accounting standards like Ind AS 116, companies that lease assets (such as property or equipment) for more than 12 months generally recognise a lease liability on their balance sheet, representing the obligation to make future lease payments. The portion due beyond the next year is classified as a non-current lease liabilities.

- Deferred Tax Liabilities (DTL): These arise due to temporary differences between how certain items (like depreciation) are treated for accounting purposes versus tax purposes. If accounting profit is higher than taxable profit currently, it may result in a DTL, representing taxes expected to be paid in future periods when the temporary differences reverse.

- Pension Benefit Liabilities / Other Post-Employment Benefit Obligations: These represent a company’s long-term obligation to pay retirement benefits, such as pensions or gratuities, to its employees in the future. Companies estimate and provide for these future payouts.

- Long-Term Provisions: Amounts set aside for probable future obligations where the timing or amount is uncertain but expected to be settled beyond one year (e.g., provision for long-term warranties, site restoration costs).

- Deferred Revenue (Long-Term Portion): Cash received from customers for goods or services yet to be delivered or rendered beyond the next operating cycle or year. This represents an obligation to provide those goods/services in the future.

These are key examples of non-current liabilities that reflect a company’s long-term financial commitments.

Importance of Non-Current Liabilities

Non-current liabilities play a key role in supporting a company’s long-term financial planning and capital structure. They help assess financial health and leverage.

- Long-Term Financing: Help fund major investments, expansion, and capital projects.

- Cash Flow Management: Allow companies to spread repayments over time, easing short-term pressure.

- Capital Structure Insight: Reveal the company’s debt-to-equity balance and financial leverage.

- Creditworthiness Indicator: Used by lenders and investors to assess long-term financial stability.

- Planning & Budgeting: Support strategic planning with predictable future obligations.

How Do Investors Use Non-Current Liabilities?

Investors meticulously analyse a company’s non-current liabilities as part of their investment decision-making process:

- Assessing Repayment Ability: They examine the total amount of long-term debt relative to the company’s earnings (EBITDA), cash flows, and equity base to gauge its ability to service (pay interest) and eventually repay these obligations. High leverage with weak cash flow is a major red flag.

- Leverage Ratios: Key ratios like Debt-to-Equity are calculated using non-current liabilities (along with short-term debt). These ratios help investors understand how much financial risk the company is taking on.

- Peer Comparison: Investors compare the leverage ratios and debt structures of companies within the same industry. This helps identify firms that might be overly indebted or potentially underleveraged compared to peers.

- Evaluating Use of Funds: They assess whether the long-term debt taken on has been used productively, financing projects or assets that are expected to generate returns higher than the cost of the debt. Debt used wisely fuels growth; excessive or unproductive debt destroys value.

- Long-Term Viability: Analysing the maturity profile and nature of non-current liabilities helps investors understand the company’s long-term financial commitments and resilience. Companies heavily reliant on long-term borrowing require consistent profitability to manage their obligations.

In essence, non-current liabilities provide critical insights into a company’s financial strategy, risk profile, and long-term sustainability for potential investors in India. Monitoring these figures, often available via financial statements on broker platforms like HDFC Sky, is key.

Different Financial Ratios Involving Non-Current Liabilities

Non-current liabilities are key components in evaluating a company’s long-term financial health. Here are some important financial ratios:

- Debt to Equity Ratio:

- Formula: Total Debt / Shareholders’ Equity

- Measures a company’s financial leverage and reliance on debt over equity.

- Long-Term Debt to Capitalisation Ratio:

- Formula: Long-Term Debt / (Long-Term Debt + Equity)

- Indicates the proportion of long-term debt in the total capital structure.

- Interest Coverage Ratio:

- Formula: EBIT / Interest Expense

- Assesses how easily a company can pay interest on outstanding long-term debt.

- Debt Service Coverage Ratio (DSCR):

- Formula: Net Operating Income / Total Debt Service

- Shows the company’s ability to service its long-term debt (interest + principal).

- Fixed Asset to Long-Term Debt Ratio:

- Formula: Net Fixed Assets / Long-Term Debt

- Evaluates how well long-term assets cover long-term liabilities.

Difference Between Current and Non-Current Liabilities

Current and non-current liabilities are both obligations but differ in their repayment timelines. Here’s how they compare:

| Basis | Current Liabilities | Non-Current Liabilities |

| Meaning | Obligations due within 12 months | Obligations due after 12 months |

| Examples | Trade payables, short-term loans, taxes | Long-term loans, bonds payable, lease liabilities |

| Purpose | To manage day-to-day operations | To fund long-term projects or expansion |

| Repayment | Settled within the operating cycle | Repaid over several years |

| Impact on Liquidity | Directly affects short-term liquidity | Impacts long-term financial planning |

| Shown Under | Current liabilities on balance sheet | Non-current liabilities on balance sheet |

Impact of High Non-Current Liabilities on Business

High non-current liabilities can influence a company’s financial health in several ways. While they help fund long-term growth, excessive debt can pose risks.

- Increased Financial Risk: High long-term debt increases interest obligations, affecting profitability.

- Lower Credit Rating: Lenders may view the business as risky, leading to higher borrowing costs.

- Reduced Investor Confidence: Investors may see high leverage as a sign of financial instability.

- Pressure on Cash Flows: Long-term repayments can tighten cash flow and impact day-to-day operations.

- Potential for Growth: If managed well, borrowed capital can fund expansion and boost future earnings.

Conclusion

Non-current liabilities represent a company’s financial obligations that are due for settlement more than one year or beyond its normal operating cycle. Composing instruments like long-term loans, bonds, debentures, lease liabilities, and deferred taxes, they are a vital source of funding for growth and long-term projects for Indian companies. However, they also represent significant financial commitments and risks.

Understanding the meaning of non-current liabilities, the different types of non-current liabilities, and their implications is essential for investors seeking to analyse a company’s financial health, solvency, and risk profile. While crucial for expansion, effective management and prudent levels of these long-term obligations are key to sustainable corporate success. Knowing what is non-current liability is fundamental for interpreting a company’s balance sheet accurately.

Related Articles

FAQs on Non-current Liabilities

What are short-term liabilities?

Short-term liabilities are obligations that a firm will pay within a year. Examples of short-term liabilities are accounts payable, short-term borrowings, taxes payable, accrued expenses, and the current portion of long-term debt. They are reported in the current liabilities portion of the balance sheet and are a firm’s near-term obligation to pay.

What are the items under non-current liabilities?

These include debentures, long-term loans, bonds payable, deferred tax liabilities, pension benefit obligations, long-term lease obligations, and deferred revenue. These are not short-term obligations or debts falling due within twelve months. All these accounts are reported separately under the non-current liabilities heading in the company’s balance sheet.

How to account for non-current liabilities?

Non-current liabilities are recorded on the company’s balance sheet under a distinct section separate from current liabilities. Each type (e.g., long-term loans, bonds payable) is listed with its corresponding value. The total of these long-term obligations is presented, adhering to Indian Accounting Standards (Ind AS) for proper classification, measurement, and disclosure.

Where are the non-current liabilities?

You will find non-current liabilities listed independently of current liabilities on the balance sheet of a firm. They usually fall within a distinct “Non-Current Liabilities” heading. This category separates each long-term commitment, making it easier for users to understand the firm’s financial commitments beyond the next twelve months.