- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Om Freight Forwarders IPO

₹14,208/111 shares

Minimum Investment

IPO Details

29 Sep 25

03 Oct 25

₹14,208

111

₹128 to ₹135

NSE, BSE

₹122.31 Cr

08 Oct 25

Om Freight Forwarders IPO Timeline

Bidding Start

29 Sep 25

Bidding Ends

03 Oct 25

Allotment Finalisation

06 Oct 25

Refund Initiation

07 Oct 25

Demat Transfer

07 Oct 25

Listing

08 Oct 25

Om Freight Forwarders Limited

Om Freight Forwarders Limited is a third-generation international logistics company with over 40 years of experience. Headquartered in Mumbai, it serves 700+ locations worldwide with offices across five continents, including China, Hong Kong, the UK, and Singapore. With branches at major Indian cities, airports, and seaports, it offers versatile freight solutions. Accredited by MTO, IATA, and FIATA, Om Freight partners with global freight forwarders and customs brokers to provide tailored, cost-effective logistics services, including end-to-end legal, warehousing, and distribution support.

Om Freight Forwarders Limited IPO Overview

Om Freight Forwarders IPO is a book-built issue worth ₹122.31 crores, comprising a fresh issue of 0.18 crore shares aggregating ₹24.44 crores and an offer for sale of 0.73 crore shares aggregating ₹97.88 crores. The subscription opens on September 29, 2025, and closes on October 3, 2025, with allotment expected on October 6 and listing on BSE and NSE scheduled for October 8, 2025. The price band is ₹128 to ₹135 per share, with a lot size of 111 shares. Retail investors can apply with a minimum investment of ₹14,985, while sNII and bNII categories require ₹2,09,790 and ₹10,03,995 respectively. Smart Horizon Capital Advisors Pvt. Ltd. is the book-running lead manager, and Bigshare Services Pvt. Ltd. acts as the registrar.

Om Freight Forwarders Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 90,60,074 shares (aggregating up to ₹122.31 Cr) |

| Fresh Issue: 18,10,074 shares (aggregating up to ₹24.44 Cr)

Offer for Sale (OFS): 72,50,000 shares of ₹10 (aggregating up to ₹97.88 Cr) |

|

| IPO Dates | 29 September 2025 to 3 October 2025 |

| Price Bands | ₹128 to ₹135 per share |

| Lot Size | 111 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,18,65,400 shares |

| Shareholding post -issue | 3,36,75,474 shares |

Om Freight Forwarders IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 111 | ₹14,985 |

| Retail (Max) | 13 | 1,443 | ₹1,94,805 |

| S-HNI (Min) | 14 | 1,554 | ₹2,09,790 |

| S-HNI (Max) | 66 | 7,326 | ₹9,89,010 |

| B-HNI (Min) | 67 | 7,437 | ₹10,03,995 |

Om Freight Forwarders Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Om Freight Forwarders Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) (Pre/Post) | 6.90/6.53 |

| Price/Earnings (P/E) Ratio (Pre/Post) | 19.56/20.67 |

| Return on Net Worth (RoNW) | 6.82% |

| Net Asset Value (NAV) | 47.57 |

| Return on Equity | 13.53% |

| Return on Capital Employed (ROCE) | 15.80 |

| EBITDA Margin | 7.69% |

| PAT Margin | 4.49% |

| Debt to Equity Ratio | 0.17 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of the capital expenditure requirements of the company related to the acquisition of commercial vehicle and heavy equipment | 171.5 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

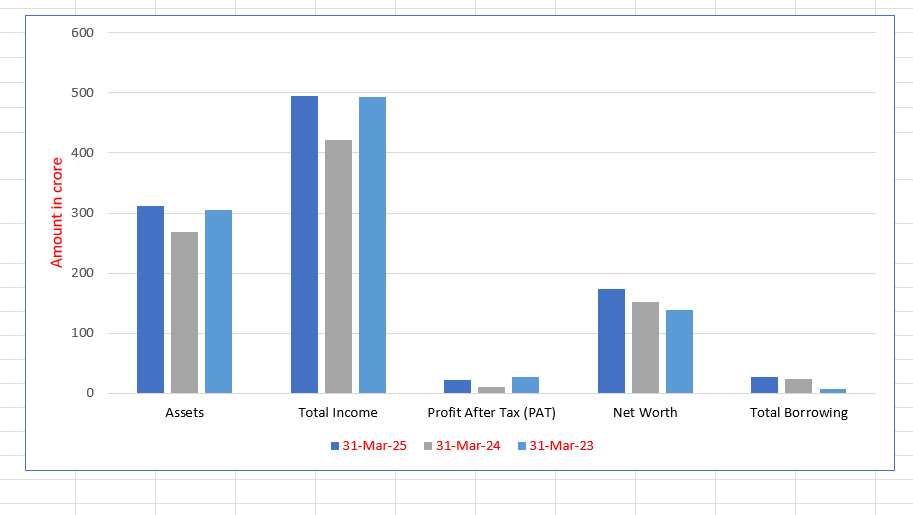

Om Freight Forwarders Limited (in crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 312.02 | 268.84 | 305.18 |

| Total Income | 494.05 | 421.32 | 493.35 |

| Profit After Tax (PAT) | 21.99 | 10.35 | 27.16 |

| Net Worth | 173.47 | 151.58 | 139.24 |

| Total Borrowing | 26.95 | 24.47 | 7.53 |

Financial Status of Om Freight Forwarders Limited

SWOT Analysis of Om Freight Forwarders IPO

Strength and Opportunities

- Over four decades of domain expertise in international logistics.

- Established presence across 700+ locations worldwide.

- Accredited by industry bodies like MTO, IATA, and FIATA.

- Strong relationships with international freight forwarders and customs brokerages.

- Diverse service offerings including air, sea, and road freight, charter services, and warehousing.

- Expansion into emerging markets like China, Hong Kong, UK, and Singapore.

- Strong infrastructure with branches at major cities, commercial hubs, airports, and seaports across India.

- Ability to offer end-to-end logistics solutions, including legal, warehousing, and distribution services.

- Commitment to quality and customer-centric policies.

Risks and Threats

- Limited global brand recognition compared to larger competitors.

- Dependence on a few key markets for revenue generation.

- Potential vulnerability to geopolitical tensions affecting international trade routes.

- Exposure to fluctuations in fuel prices impacting operational costs.

- Challenges in maintaining consistent service quality across all regions.

- Regulatory hurdles in different countries affecting operational flexibility.

- Potential risks associated with cybersecurity threats to digital platforms.

- Competition from both large multinational logistics companies and local low-cost providers.

- Challenges in adapting to rapidly changing technological advancements in logistics.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Om Freight Forwarders Limited IPO

End-to-End Logistics Services and Solutions

Om Freight Forwarders Limited offers comprehensive end-to-end logistics services tailored to meet diverse client needs. Their solutions include domestic and international transportation, multi-user warehousing, in-factory logistics, and value-added services like packaging and post-shipment support. With a pan-India network and customised supply chain solutions, the company ensures efficiency, scalability, and long-term partnerships across varied industries, including a decade-long collaboration with a leading steel producer.

Track record of high-quality and efficient service delivery

Since its establishment in 1995, Om Freight Forwarders Limited has built a strong reputation for delivering reliable and high-quality logistics solutions. The company adheres to certified standards—ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018—ensuring process-driven service excellence across freight forwarding, bulk handling, ODC transport, and safety-critical logistics operations.

Operational capabilities of own fleet

Om Freight Forwarders Limited operates a versatile in-house fleet comprising cranes, forklifts, trailers, payloaders, tippers, and marine vessels. With 99 skilled equipment operators as of September 30, 2024, the company ensures efficient operations, reduced downtime, and smooth cargo movement across ports, warehouses, and client destinations, reinforcing its self-reliant logistics infrastructure.

Building long-term client relationships

Om Freight Forwarders Limited has cultivated enduring client relationships, with high contract renewal rates reflecting service satisfaction. The company consistently delivers tailored solutions and maintains strong engagement with clients, including five of its top ten customers for over five years, helping secure a recurring revenue base and sustained business growth.

Presence across diverse industry verticals

Om Freight Forwarders Limited caters to over 1,500 clients across industries like steel, mining, EPC, FMCG, power, and tyres. Its comprehensive door-to-door B2B logistics services and sector-specific expertise enable it to transfer best practices across verticals, resulting in customised solutions and broader industry reach across each fiscal year.

Skilled and experienced management team with relevant industry experience

Om Freight Forwarders Limited is steered by an experienced leadership team led by its promoters and directors with decades of expertise in logistics. With operational heads in place for each business vertical, the company fosters growth through sound governance, long-term employee retention, and a performance-driven workforce culture.

Technological Integration

Om Freight Forwarders Limited leverages advanced technologies to provide real-time tracking, route optimisation, and inventory control. Its tech-driven approach ensures operational transparency, seamless client system integration, and customised solutions—optimising costs, improving service efficiency, and upholding committed delivery timelines across supply chain operations.

More About Om Freight Forwarders Limited

Om Freight Forwarders Limited is a distinguished third-party logistics (3PL) provider headquartered in Mumbai, offering integrated logistics services to clients worldwide. Established formally in 1995 under the leadership of the Late Jagannath Vishanji Joshi, the company has grown into a full-scale logistics solutions provider with a global presence. Currently, Rahul Jagannath Joshi serves as the Managing Director, supported by a team with extensive logisticsexpertise.

Comprehensive Service Portfolio

The company delivers end-to-end logistics solutions, ensuring cost-effective, seamless, and timely delivery for businesses regardless of location. Its key services include:

- International freight forwarding

- Customs clearance (CHA) across all major Indian air and seaports

- Vessel agency services

- Transportation via sea, air, road, and rail

- Warehousing and distribution

- Specialised project cargo handling requiring technical expertise and detailed planning

Om Freight specializes in the transportation of complex cargo such as over-dimensional cargo (ODC), heavy lifts, breakbulk, sensitive, and dry bulk cargo, with turnkey solutions tailored to customer needs.

Operational Excellence and Network

With over four decades of experience, the company blends deep customs knowledge with advanced IT systems, ensuring compliance and minimal delays. It operates pan-India through 28 branches and maintains an extensive global network covering 800+ destinations through partnerships. A hybrid asset strategy combining owned and rental equipment optimizes efficiency and flexibility, with a fleet of 152 commercial vehicles and equipment supported by 15 logistics partners.

Client Base and Industry Reach

Om Freight serves diverse industries such as Minerals & Mining, Oil & Gas, FMCG, Energy, and Infrastructure. The company consistently manages high cargo volumes, reflecting strong market demand.

Recognition and Awards

The company has been recognised for excellence and innovation, including record-breaking customs clearance times at JNPT and commendations from Mumbai Port Authority and Adani Ports & SEZ.

Industry Outlook

The Indian logistics industry is a pivotal component of the nation’s economy, facilitating the movement of goods across various sectors. In 2024, the market was valued at USD 228.4 billion and is projected to reach USD 428.7 billion by 2033, growing at a CAGR of 6.50% .

Growth Drivers

- E-commerce Expansion: The rapid growth of e-commerce is driving demand for efficient logistics services, with the sector expected to grow at 18% annually through 2025 .

- Infrastructure Development: Initiatives like Bharatmala and Sagarmala are enhancing road and port connectivity, reducing logistics costs and improving efficiency

- Government Policies: Programs such as the National Logistics Policy aim to reduce logistics costs from 14% to 10% of GDP by 2030, promoting technology adoption and skill development .

- Manufacturing Growth: The “Make in India” initiative is boosting domestic manufacturing, increasing the need for robust logistics networks.

- Urbanisation: The development of smart cities and improved infrastructure is generating substantial freight demand for construction materials and consumer goods.

Technological Advancements

- Automation: The logistics automation market is expected to grow from USD 1.88 billion in 2024 to USD 8.07 billion by 2033, driven by the need for faster supply chain operations .

- Digitalisation: The integration of AI, IoT, and blockchain is enhancing supply chain visibility and operational efficiency .

Environmental Initiatives

- Sustainable Practices: The industry is adopting renewable energy solutions, electric vehicle fleets, and circular economy initiatives to reduce carbon footprints .

- Decarbonization Efforts: The government has identified key highway segments for zero-emission truck movement to help achieve climate goals .

How Will Om Freight Forwarders Limited Benefit

- Increased demand for integrated logistics due to rapid e-commerce growth will expand their client base.

- Infrastructure projects like Bharatmala and Sagarmala will enhance multi-modal transport efficiency.

- The National Logistics Policy will reduce operational costs and improve turnaround times.

- “Make in India” and urbanisation will generate higher cargo volumes in manufacturing and infrastructure sectors.

- Rise in logistics automation will support faster cargo handling through Om Freight’s advanced IT systems.

- Digitalisation through AI, IoT, and blockchain aligns with their tech-enabled service model.

- Green initiatives and EV adoption will support Om’s shift towards sustainable logistics practices.

- Government support for decarbonisation and zero-emission corridors strengthens Om Freight’s eco-compliance positioning.

- Growing warehousing demand complements their pan-India network and global reach.

- Recognition and efficiency at ports position them as a preferred partner amid increasing competition.

Peer Group Comparison

| Name of Company | Revenue

(₹ million) |

Face Value (₹) | P/E (Times) | EPS (₹) | RoNW (%) | NAV (₹) |

| OM Freight Forwarders Limited | 4,105.01 | 10 | [●] | 3.25 | 6.82 | 47.57 |

| Peer Groups | ||||||

| Tiger Logistics (India) Limited | 4,193.26 | 10 | 3.87 | 2206.83 | 23.85 | 2269.63 |

| Accuracy Shipping Limited | 2,402.59 | 1 | 248.67 | 12.27 | 11.70 | 10.48 |

| Total Transport Systems Limited | 7,083.27 | 1 | 88.10 | 0.03 | 0.43 | 7.71 |

| AVG Logistics Limited | 4,881.02 | 10 | 9.38 | 0.78 | 1.65 | 47.17 |

| Patel Integrated Logistics Limited | 4,798.89 | 10 | 15.53 | 26.66 | 15.97 | 146.37 |

Key Strategies for Om Freight Forwarders Limited

Strategic Investment in Fleet and Equipment

Om Freight Forwarders Limited continues to invest significantly in commercial vehicles and earthmoving equipment to enhance service capacity and internal fleet strength. This ongoing investment aligns with their asset-based model, enabling greater operational control, improved customer integration, and reduced reliance on third-party providers.

Capitalising on Logistics Industry Transformation

Recognising the impact of GST and market evolution, Om Freight Forwarders Limited is expanding its advanced, large-format warehousing solutions. By embracing automation and scalable technology, they aim to consolidate operations and support rising demand from FMCG, e-commerce, and third-party logistics providers.

Establishing New Warehousing for Operational Scale

Om Freight Forwarders Limited is developing a large, multi-user warehouse in Bhiwandi, strategically located near major highways. This facility, equipped with automation and real-time tracking, aims to streamline inventory management, reduce operational costs, and provide scalable warehousing solutions tailored to growing client demands.

Customer Acquisition and Sector Diversification

Om Freight Forwarders Limited targets new customer acquisition by leveraging its core logistics expertise. With a track record of onboarding hundreds of new clients annually, the company is also expanding into sectors like FMCG, automotive, and energy, ensuring broader market reach and future-ready growth.

Technology-Led Operational Excellence

Om Freight Forwarders Limited is committed to enhancing technology across operations. By integrating advanced transport and warehouse management systems, IoT projects, and real-time analytics, the company aims to increase asset efficiency, automate core processes, and deliver superior service through cloud-based digital logistics platforms.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Om Freight Forwarders Limited IPO

How can I apply for Om Freight Forwarders Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of Om Freight Forwarders Limited IPO?

The IPO includes a ₹24.44 crore fresh issue and ₹97.88 crore through offer for sale.

On which exchanges will Om Freight Forwarders Limited be listed?

The company plans to list its equity shares on both BSE and NSE exchanges.

Who are the promoters of Om Freight Forwarders Limited?

Promoters include Rahul Joshi, Jitendra Joshi, Harmesh Joshi, and Kamesh Joshi holding 99.04% pre-issue stake.

What services does Om Freight Forwarders Limited provide?

The company offers global logistics, freight forwarding, warehousing, and end-to-end legal and distribution solutions.

What is the face value of Om Freight Forwarders Limited shares?

Each equity share of Om Freight Forwarders Limited has a face value of ₹10.