- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Om Power Transmission IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Om Power Transmission IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Om Power Transmission Limited

Established in 2011, Om Power Transmission Limited is a leading power transmission infrastructure EPC company with over 14 years of expertise. The company specialises in executing high-voltage (HV) and extra-high-voltage (EHV) transmission lines, substations, and underground cabling projects on a turnkey basis, covering design, engineering, installation, testing, commissioning, and operation and maintenance services. As of August 31, 2025, its unexecuted order book included 56 projects worth ₹77,619.35 lakhs, comprising 50 EPC projects and 6 O&M contracts across key business verticals.

Om Power Transmission Limited IPO Overview

Om Power Transmission Limited submitted its Draft Red Herring Prospectus (DRHP) to SEBI on September 30, 2025, seeking approval to raise capital through an Initial Public Offering (IPO). The proposed IPO is a Book-Built Issue of 1.00 crore equity shares, comprising a fresh issue of up to 0.90 crore shares and an offer for sale (OFS) of up to 0.10 crore shares. The equity shares are planned to be listed on both NSE and BSE. Beeline Capital Advisors Pvt. Ltd. will act as the book-running lead manager, while MUFG Intime India Pvt. Ltd. has been appointed as the registrar to the issue.

As per the DRHP, the face value of each share is ₹10, with the issue price band, lot size, and IPO dates yet to be announced. The total issue size aggregates up to ₹[.] crore, and the sale type is Fresh Capital-cum-Offer for Sale.The company’s pre-issue shareholding stands at 2,66,70,000 shares, with promoters—Kalpesh Dhanjibhai Patel, Kanubhai Patel, and Vasantkumar Narayanbhai Patel—holding 92.26% before the issue. The post-issue holding will be adjusted based on equity dilution.

Om Power Transmission Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.0 crore equity shares |

| Fresh Issue | 0.90 crore equity shares |

| Offer for Sale (OFS) | 0.10 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,66,70,00,000 shares |

| Shareholding post-issue | TBA |

Om Power Transmission IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Om Power Transmission Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Om Power Transmission Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.98 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 30.40% |

| Net Asset Value (NAV) | ₹29.53 |

| Return on Equity (RoE) | 35.83% |

| Return on Capital Employed (RoCE) | 41.76% |

| EBITDA Margin | 12.66% |

| PAT Margin | 7.84% |

| Debt to Equity Ratio | 0.26 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements of the Company towards purchase of machinery and equipment | 108.69 |

| Pre-payment/ re-payment, in part or full, of certain outstanding borrowings availed by the Company | 256.18 |

| Funding long-term working capital requirement of the Company | 550 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

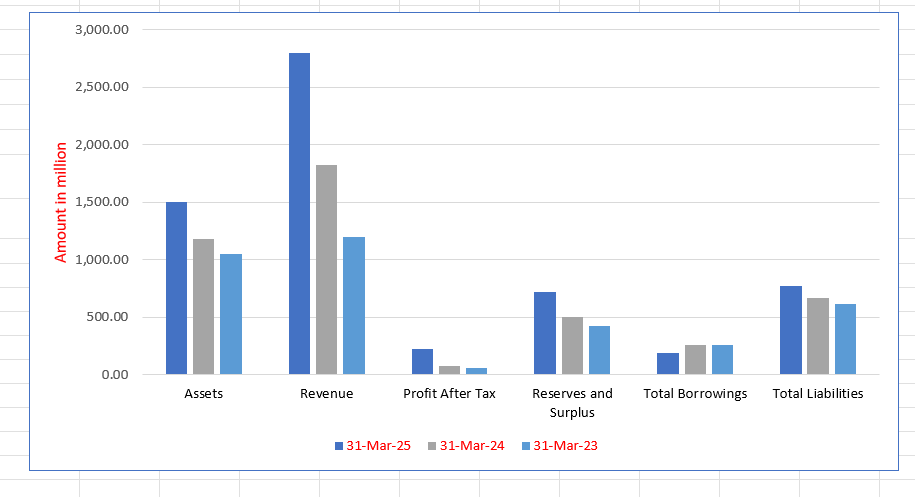

Om Power Transmission Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,501.71 | 1,178.50 | 1,051.42 |

| Revenue | 2,794.35 | 1,827.62 | 1,202.36 |

| Profit After Tax | 220.85 | 74.12 | 62.29 |

| Reserves and Surplus | 720.54 | 500.37 | 427.61 |

| Total Borrowings | 189.05 | 262.28 | 255.69 |

| Total Liabilities | 775.17 | 672.13 | 617.81 |

Financial Status of Om Power Transmission Limited

SWOT Analysis of Om Power Transmission IPO

Strength and Opportunities

- Strong promoter experience and deep industry knowledge in EPC contracting.

- Robust order-book visibility providing revenue stability and near-term growth.

- Proven capability in executing transmission lines and substations up to 400 kV.

- Expanding demand for power transmission infrastructure in India drives growth.

- Opportunity to diversify into maintenance and renewable grid integration services.

- Potential to leverage technology and digital systems for better project monitoring.

- Healthy financial ratios and improving debt-to-equity position in recent years.

- Growing government investment in electrification supports long-term opportunities.

- Scope for strategic partnerships and expansion into new domestic and overseas markets.

Risks and Threats

- Heavy dependence on tender-driven projects, which can reduce profit margins.

- High working capital needs due to long receivable cycles and retention money.

- Geographic concentration of projects increases exposure to regional risks.

- Competitive bidding environment exerts pricing pressure and lowers profitability.

- Exposure to project delays, land clearance issues, and supply-chain disruptions.

- Any large-scale capital expenditure or debt increase could strain finances.

- Rising raw material costs and interest rate fluctuations can impact margins.

- Payment delays from public sector clients may affect liquidity.

- Cyclicality in infrastructure spending could influence order inflows and utilisation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Om Power Transmission Limited

Om Power Transmission Limited IPO Strengths

Execution Excellence and Project Completion

Om Power Transmission Limited (OPTL) has a 14-year track record as a Gujarat-based EPC company, specializing in delivering high-voltage (HV) and extra-high voltage (EHV) transmission line and substation projects. The company’s expertise covers the complete EPC value chain, enabling it to consistently complete projects on time, with numerous instances of ahead-of-schedule delivery for clients like GETCO and those in the automobile industry.

Robust and Growing Order Book

The company’s order book is a strong indicator of future revenue visibility and operational scale-up. As of August 31, 2025, the order book aggregated to ₹77,619.35 lakhs across 56 projects, with a healthy Book-to-Bill Ratio. The Order Book is diversified across business verticals, and OPTL is now strategically expanding its geographical reach beyond Gujarat into states like Punjab and Rajasthan.

Consistent and Strong Financial Performance

Om Power Transmission Limited has demonstrated significant financial strength and consistent growth over the last three Fiscals. Its revenue from operations grew at a CAGR of 52.45% from Fiscal 2023 to Fiscal 2025, with profit for the year increasing at an 88.17% CAGR. The company has also maintained efficient resource utilization, generating a Return on Capital Employed (RoCE) of 41.76% for Fiscal 2025, which supports its ability to bid for larger projects.

Experienced Leadership and Domain Knowledge

The company benefits from seasoned Promoters and a strong Senior Management team with deep domain knowledge in the power transmission sector. Promoters like Kalpesh Dhanjibhai Patel and Kanubhai Patel bring over 30 years of industry experience each. Their technical expertise, active involvement, and industry relationships enable effective problem-solving, strategic growth, and successful execution of complex infrastructure projects.

More About Om Power Transmission Limited

Om Power Transmission Limited (OPTL) is a power transmission infrastructure engineering, procurement, and construction (EPC) company with over 14 years of experience. Established in 2011 in Gujarat, the company specialises in high-voltage (HV) and extra-high-voltage (EHV) transmission lines, substations, and underground cabling projects. Its turnkey services include design, engineering, supply, erection, installation, testing, commissioning, and operation and maintenance (O&M).

Over the years, OPTL has successfully commissioned more than 1,000 circuit kilometres (CKM) of transmission lines and 11 substations. The company’s EPC capabilities cover transmission lines up to 400 kV and substations up to 220 kV.

Operational Strength and Growth

As of August 2025, OPTL’s unexecuted order book stood at ₹77,619.35 lakhs, comprising 56 projects, including 50 EPC and six O&M contracts. The company also operates and maintains 134 substations across Gujarat, Rajasthan, and Punjab.

Key milestones include:

- Recognition as Best EPC Company for two consecutive years (2015–17) by GETCO.

- ISO certifications in quality, safety, and environmental management.

- “AA Class” certification from GETCO, authorising work up to 400 kV transmission lines and 220 kV substations.

Financially, OPTL recorded strong growth with revenue increasing from ₹12,023.63 lakhs in FY 2023 to ₹27,943.51 lakhs in FY 2025, a CAGR of 52.45%. Profit for the year rose from ₹622.87 lakhs to ₹2,208.48 lakhs, achieving a CAGR of 88.17%.

Business Verticals

- Transmission Line EPC Projects – Involves turnkey execution of 11 kV to 400 kV transmission lines, including route survey, tower erection, and commissioning.

- Substation EPC Projects – Provides end-to-end services for both Air-Insulated (AIS) and Gas-Insulated (GIS) substations up to 220 kV.

- Underground Cabling Projects – Executes HV and EHV underground cabling solutions in space-constrained urban and industrial zones.

- Operation and Maintenance Services – Offers long-term O&M contracts ensuring continuous and safe functioning of transmission assets.

Client Base

OPTL’s clientele includes public sector undertakings such as state transmission utilities, as well as private entities, renewable developers, and industrial clients. Its proven track record and repeat business reflect strong credibility and operational excellence in India’s power transmission sector.

Industry Outlook

India’s power transmission and distribution (T&D) sector is poised for sustained growth, driven by rising electricity demand, expanding renewable energy capacity, and large-scale grid modernisation. The T&D equipment market, valued at around USD 11.58 billion in 2024, is projected to reach approximately USD 21.83 billion by 2033, reflecting a CAGR of about 6.8% during 2025–2033. Similarly, the broader power grids market, estimated at USD 10.72 billion in 2024, is expected to grow to USD 18.52 billion by 2033, with a CAGR of 5.8%.

Key growth drivers include:

- Increasing electricity consumption, growing at 5–6.5% annually.

- Integration of renewable energy sources into the national grid.

- Significant government investments in transmission infrastructure.

- Expansion of high-voltage and extra-high-voltage (EHV) networks.

Products and Verticals Related to the Company

For segments relevant to companies such as Om Power Transmission Limited — including transmission lines, substations, and underground cabling — the industry shows strong potential:

- Transmission Lines: Valued at around USD 9.6 billion in 2024, the Indian transmission line market is forecasted to reach USD 12.7 billion by 2033, at a CAGR of roughly 3.1%.

- HVDC and EHV Systems: Expected to grow from USD 15.07 billion in 2025 to USD 31.06 billion by 2035, at a CAGR of about 7.5%.

- Underground Cabling and Grid Modernisation: The grid modernisation market, valued at USD 1.25 billion in 2024, is projected to grow rapidly to USD 5.42 billion by 2032, at a CAGR of around 20.1%.

Key Industry Figures and Future Growth

- India’s electricity consumption touched nearly 1,694 billion units in FY25, with a five-year CAGR of about 7.4%.

- The total transmission line network is expected to reach around 648,000 circuit km by FY32, supported by a transformation capacity exceeding 2,300,000 MVA.

- Strong policy focus on renewable integration and green energy corridors will continue driving EPC demand.

Implications for Om Power Transmission Limited

With expertise in 11 kV–400 kV transmission lines, 220 kV substations, and underground cabling, Om Power Transmission Limited is strategically positioned to leverage the sector’s growth. The surge in HVDC, grid expansion, and technology-driven transmission solutions presents significant opportunities for EPC players with technical and operational capabilities.

How Will Om Power Transmission Limited Benefit

- The company is well-positioned to capitalise on India’s expanding power transmission network, with its proven expertise in executing 11 kV–400 kV projects.

- Rising investments in renewable energy integration will create consistent demand for new substations and grid connectivity projects.

- The rapid growth in HVDC and EHV systems will offer opportunities for higher-value, technology-driven EPC contracts.

- Government initiatives promoting grid modernisation and underground cabling will expand the company’s project pipeline across urban and industrial zones.

- Increasing public and private sector participation in infrastructure projects will enhance tender opportunities.

- Its track record with state utilities like GETCO and PGCIL provides a competitive edge in upcoming national grid expansion projects.

- The ongoing push for green energy corridors aligns with the company’s capabilities in high-capacity power evacuation systems.

- Continued focus on O&M services ensures recurring revenue and long-term client partnerships.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Om Power Transmission Limited

Geographic Footprint Expansion

Om Power Transmission Limited (OPTL) is actively expanding its operations beyond Gujarat to capitalize on India’s growing power sector, projected to reach USD 280 billion by FY30. The company recently secured first EPC contracts in Rajasthan and Punjab, significantly reducing geographical concentration risk. OPTL plans to continue diversifying its portfolio across multiple states to broaden its revenue base.

Improving Operational Efficiency and Cost Management

OPTL is committed to strengthening its competitive position by continually focusing on operational efficiency and cost management in its turn-key EPC services. The company aims to optimize project execution through enhanced planning, monitoring, and quick mobilization of equipment. This strategic approach ensures projects are delivered within stipulated timelines and budgets, reinforcing a strong track record of contract fulfillment.

Targeting High-Value, Large-Scale Projects

Leveraging its technical competence in executing complex EHV projects (up to 400 kV), OPTL intends to aggressively bid for large-scale, high-value projects across India. The company is capitalizing on the massive demand in power transmission and distribution by focusing on opportunities where its execution experience, financial strength, and accreditations act as key entry barriers

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Om Power Transmission Limited IPO

How can I apply for Om Power Transmission Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Om Power Transmission Limited IPO?

It is a book-built issue of 1 crore equity shares, comprising a fresh issue and an offer for sale.

When was the DRHP for the IPO filed?

The company filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025.

How many shares are offered in the IPO?

The IPO comprises 90 lakh fresh equity shares and 10 lakh shares under the offer for sale.

Where will the shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE stock exchanges.

How will the IPO proceeds be utilised?

Proceeds will fund equipment purchases, repay borrowings, meet working capital needs, and cover general corporate purposes.