- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Omnitech Engineering IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Omnitech Engineering IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Omnitech Engineering Limited

Omnitech Engineering provides precision-engineered components, turnkey industrial automation, and customised mechanical systems for industries like automotive, aerospace, pharmaceuticals, food processing, and general manufacturing. Specialising in design, fabrication, assembly, and integration, it offers CNC machining, custom tooling, special purpose machines, material handling systems, and robotics integration. Committed to quality and innovation, Omnitech works closely with clients on bespoke projects that enhance productivity and efficiency. Over the last three fiscal years, it has supplied 220 customers in 22 countries from its two advanced facilities in Metoda and Chhapara, Rajkot, Gujarat.

Omnitech Engineering Limited IPO Overview

Omnitech Engineering Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on June 30, 2025, to raise ₹850 crore through an Initial Public Offer (IPO). The IPO is structured as a book-built issue, comprising a fresh share issue of ₹520 crore and an offer for sale (OFS) of ₹330 crore. The company’s equity shares are proposed to be listed on NSE and BSE. Equirus Capital Pvt. Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar. Key details such as IPO dates, price band, and lot size are yet to be announced, with promoters Udaykumar Arunkumar Parekh and Dharmi A Parekh currently holding 94.08% of shares pre-issue.

Omnitech Engineering Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹850 crore |

| Fresh Issue | ₹520 crore |

| Offer for Sale (OFS) | ₹330 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,52,49,680 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Omnitech Engineering Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Omnitech Engineering Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.26 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 21.46% |

| Net Asset Value (NAV) | ₹19.82 |

| Return on Equity (RoE) | 21.55% |

| Return on Capital Employed (RoCE) | 16.08% |

| EBITDA Margin | 34.31% |

| PAT Margin | 12.54% |

| Debt to Equity Ratio | 1.60 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment and/ or pre-payment, in full or in part, of our certain outstanding borrowings availed by the Company | 1400 |

| Setting up New Projects | 2136.83 |

| Funding towards Capital Expenditure at Existing Facility | 157.03 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

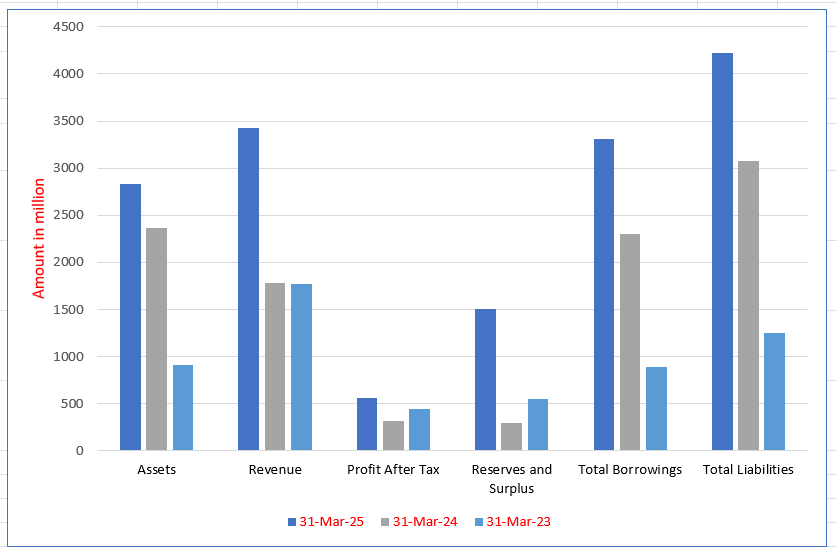

Omnitech Engineering Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2837.04 | 2363.92 | 913.51 |

| Revenue | 3429.13 | 1781.80 | 1773.31 |

| Profit After Tax | 561.87 | 314.86 | 439.66 |

| Reserves and Surplus | 1510.16 | 294.75 | 549.38 |

| Total Borrowings | 3306.27 | 2304.87 | 888.11 |

| Total Liabilities | 4226.89 | 3075.10 | 1252.37 |

Financial Status of Omnitech Engineering Limited

SWOT Analysis of Omnitech Engineering IPO

Strength and Opportunities

- Established track record of over 15 years in precision component manufacturing.

- Strong export orientation, with approximately 74% of revenue from international markets.

- Diverse customer base across critical sectors like oil & gas, aerospace, and agriculture.

- Robust profitability with a healthy EBITDA margin of around 36% in FY24.

- ISO-certified facilities ensuring adherence to international quality standards.

- Significant order book indicating sustained demand.

- Strategic investments in technology and infrastructure to enhance manufacturing capabilities.

- Plans for IPO to raise funds for debt reduction and capacity expansion.

- Geographic diversification with exports to over 22 countries.

Risks and Threats

- High working capital intensity due to elongated operating cycle.

- Limited bargaining power against large OEMs.

- Profit margins susceptible to fluctuations in raw material prices and foreign exchange rates.

- Ongoing capital expansion leading to increased debt levels.

- Potential risks associated with the commercialisation of new facilities.

- Vulnerability to geopolitical and economic uncertainties affecting global supply chains.

- Dependence on a few key customers for a substantial portion of revenue.

- Challenges in maintaining consistent product quality across diverse customer requirements.

- Exposure to regulatory changes in international markets.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Omnitech Engineering Limited

Omnitech Engineering Limited IPO Strengths

Strong Industry Presence and Enduring Customer Relationships

Omnitech Engineering Limited maintains strong ties with marquee clients across diverse industries, including energy, motion control, automation, industrial equipment, and specialised applications. With consistent quality, engineering expertise, and customised solutions, the company enjoys high repeat business, reflecting enduring partnerships and a proven ability to meet stringent client standards globally.

Global Reach and Supply Chain Excellence

Omnitech Engineering Limited operates an export-driven business, serving customers in 22 countries with most revenue generated outside India. Backed by supply chain expertise, advanced IoT-enabled operations, and strategic warehousing in the USA, the company ensures timely delivery, operational resilience, and responsive service across diverse global markets.

Operations Backed by Advanced Manufacturing Infrastructure

Omnitech Engineering Limited operates two ISO- and API-certified manufacturing facilities in Rajkot, spanning 59,603 sq. m with a combined capacity of 1.73 million machining hours. A new Padavala unit will add machining and fabrication capacity. Strategically located near Mundra Port, these facilities integrate advanced automation, testing, and IoT 4.0 for operational excellence.

Experienced Leadership with Strong Industry Expertise

Omnitech Engineering Limited is led by founder Udaykumar Arunkumar Parekh, with over 19 years in machining, supported by an accomplished Board and skilled senior management. Backed by 1,527 employees, including 586 machine specialists, their combined expertise drives growth, operational excellence, and strategic vision across evolving industry demands.

Proven Financial Growth and Operational Expansion

Omnitech Engineering Limited achieved 39.06% revenue CAGR from Fiscal 2023–2025 while maintaining EBITDA margins above 34%. Strategic investments of ₹2,641.69 million expanded machining capacity to 1.73 million hours, with further additions underway. Strong returns on equity and consistent performance reflect the company’s ability to grow sustainably while enhancing operational capabilities.

More About OMNITECH ENGINEERING Limited

Omnitech Engineering Limited is a leading manufacturer of high-precision engineered components and assemblies, serving global customers across industries such as energy, motion control and automation, industrial equipment systems, metal forming, and other diversified applications. With 18 years of expertise, the company specializes in precision-machined components for safety-critical applications.

The company manufactures components ranging from 0.003 kg to 503.33 kg in weight, 1.27 cm to 1 m in diameter, and 0.2 cm to 10 m in length, catering to diverse customer requirements worldwide. According to the ICRA report, OMNITECH is among India’s fastest-growing manufacturers of high-precision components, with a revenue increase of 92.45% between Fiscal 2024 and Fiscal 2025 and a CAGR of 39.06% from Fiscal 2023 to Fiscal 2025.

Global Presence

During Fiscals 2023–2025, OMNITECH supplied components to over 220 customers across 22 countries, including the United States, India, UAE, Germany, Bulgaria, Sweden, and Canada. Revenue from operations is largely international, with 74.95% derived from outside India in Fiscal 2025.

Industry Applications

- Energy: Components for oil & gas, wind energy, and power sectors.

- Motion Control & Automation: Electro-mechanical systems for drives, motors, sensors, automation, and hydraulics.

- Industrial Equipment Systems: Aerospace ground support, construction equipment, and winches/hoists.

- Others: Metal forming and diversified industrial applications.

Revenue contribution from Fiscal 2025:

- Energy: ₹1,356.29 million (42.35%)

- Motion Control & Automation: ₹1,143.75 million (35.71%)

- Industrial Equipment Systems: ₹644.30 million (20.12%)

- Others: ₹58.52 million (1.82%)

Manufacturing and Quality

OMNITECH operates two facilities in Rajkot, Gujarat, equipped for design, prototyping, manufacturing, assembly, and testing. Facilities hold ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, AS9100:2016, IATF16949:2016, and API certifications. Over 309 CNC machines, grinding, gear, and laser cutting equipment support precision manufacturing, with IoT 4.0 solutions enabling real-time operational monitoring.

Customer Relationships

The company maintains strong customer retention, with repeat customers contributing 79.78% of revenue in Fiscal 2025. Awards for supplier excellence include recognition from Dover, John Bean Technologies, and Power Building Private Limited.

Leadership

Omnitech is guided by founder Udaykumar Arunkumar Parekh, supported by an experienced board and senior management team, comprising professionals in operations, finance, marketing, and compliance.

Industry Outlook

The Indian manufacturing sector, encompassing precision engineering and industrial components, is poised for substantial growth. The overall Indian manufacturing market is projected to reach USD 711.35 billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.20% from 2025 to 2034. Within this sector, the precision engineering components market is expected to grow from USD 19.3 billion in 2024 to USD 20.11 billion in 2025, maintaining a strong growth trajectory to reach USD 28 billion by 2033, with a CAGR of 4.2% from 2025 to 2033.

Key Growth Drivers

- Infrastructure Development: Government initiatives such as the National Infrastructure Pipeline, a USD 1.4 trillion program, are accelerating demand for construction and industrial equipment, thereby driving the need for precision components.

- Technological Advancements: The adoption of Industry 4.0 technologies, including automation and IoT, is enhancing manufacturing capabilities and precision in component production.

- Export Opportunities: India’s growing export activities, particularly in engineering goods, are expanding market reach for precision components.

Industry Segmentation

- Energy Sector: Components for oil & gas, wind energy, and power sectors.

- Motion Control & Automation: Electro-mechanical systems for drives, motors, sensors, automation, and hydraulics.

- Industrial Equipment Systems: Aerospace ground support, construction equipment, and winches/hoists.

- Others: Metal forming and diversified industrial applications.

The precision engineering and industrial components industry in India is on an upward trajectory, driven by infrastructure development, technological advancements, and expanding export opportunities. Companies operating in this sector are well-positioned to capitalize on these growth prospects

How Will Omnitech Engineering Limited Benefit

- Anticipated growth of the Indian precision engineering components market from USD 19.3 billion in 2024 to USD 28 billion by 2033 offers significant expansion opportunities.

- Strong export potential due to operations in over 22 countries allows tapping into rising global demand for engineering goods.

- Alignment with Industry 4.0 through IoT-enabled and precision manufacturing enhances efficiency and competitiveness.

- Infrastructure expansion under initiatives like the National Infrastructure Pipeline drives higher demand for engineered components.

- A robust base of repeat customers, contributing 79.78% of Fiscal 2025 revenue, ensures steady cash flows.

- Ability to cater to varied industries such as automotive, industrial, and construction reduces dependency on a single sector.

- Ongoing innovation in product design and manufacturing capabilities strengthens market positioning.

- Opportunities in renewable energy and other emerging sectors expand long-term revenue streams.

Peer Group Comparison

| Name of Company | Face Value (₹ per share) | Total Income (in ₹ million) | EPS | NAV (₹) | P/E | RONW (%) |

| Omnitech Engineering Limited | 5 | 3497.06 | 4.26 | 19.82 | – | 21.46 |

| Peer Groups | ||||||

| Azad Engineering Limited | 2 | 4679.45 | 14.66 | 215.7 | 113.5 | 6.21 |

| Unimech Aerospace and Manufacturing Limited | 5 | 2676.93 | 17.59 | 131.53 | 76.16 | 12.48 |

| PTC Industries Limited | 10 | 3422.27 | 41.37 | 925.42 | 368.72 | 4.4 |

| MTAR Technologies Limited | 10 | 6811.45 | 17.19 | 236.97 | 98.34 | 7.26 |

| Dynamatic Technologies Limited | 10 | 14266.0 | 63.39 | 1056.48 | 114.73 | 6.0 |

Key Strategies for Omnitech Engineering Limited

Expanding Presence in Precision Engineering Markets

Omnitech Engineering Limited leverages precision engineering sector growth by serving diverse industries, including energy, automation, and industrial equipment. With certifications like AS9100:2016 and new fabrication capabilities, it aims to deepen market presence and expand into defence, aerospace, semiconductors, and railways.

Strengthening Global Footprint

Omnitech Engineering Limited serves customers in 22 countries, with most revenue from international markets. Leveraging its Houston warehouse, the company plans new facilities in Europe, the Middle East, and North America to enhance logistics, expand market presence, and accelerate growth in key precision engineering regions.

Capacity Expansion to Support Growth

Omnitech Engineering Limited operates two facilities with 1.73 million annual machining hours at 73.07% utilization. With a strong order book, it is adding new facilities and capabilities, targeting 2.56 million machining hours and 7,200 MTPA fabrication capacity to meet growing demand efficiently.

Strategic Inorganic Expansion

Omnitech Engineering Limited seeks strategic acquisitions and joint ventures to enhance manufacturing capabilities, expand market presence, and access new geographies. The focus remains on synergetic opportunities in aligned end-user industries, guided by strict criteria on quality, scale, expertise, and cultural fit.

Strengthening Financial Position

Omnitech Engineering Limited aims to enhance its financial profile by using ₹1,400 million from the Net Proceeds for repayment or pre-payment of borrowings. This is expected to reduce indebtedness, lower debt servicing costs, and improve leverage, enabling reinvestment and supporting future growth opportunities.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Omnitech Engineering Limited IPO

How can I apply for Omnitech Engineering Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Omnitech Engineering IPO?

The IPO aims to raise ₹850 crore, including ₹520 crore fresh issue and ₹330 crore offer-for-sale.

When will the Omnitech Engineering IPO open for subscription?

The IPO opening and closing dates will be announced after SEBI approval and stock exchange coordination.

What is the price band for the Omnitech Engineering IPO?

The price band will be finalised and disclosed in the red herring prospectus closer to the issue date.

Who are the lead managers and registrar for the IPO?

Equirus Capital and ICICI Securities are the lead managers, while MUFG Intime India is the registrar.

How will the IPO proceeds be utilised?

Proceeds will repay debt, set up new manufacturing units, fund capex, and meet general corporate requirements.