- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

OnEMI Technology Solutions IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

OnEMI Technology Solutions IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

OnEMI Technology Solutions Limited (Kissht)

OnEMI Technology Solutions Private Limited, incorporated on 18 June 2016, is a tech-enabled lender in India offering digital loans via its mobile app for consumption and business needs. Operating under the brands Kissht and Ring, it provides credit and EMI-based payment solutions to online and offline merchants. Loan disbursement, KYC, and EMI collections are managed by its NBFC partner, Si Creva Capital Services. As of March 31, 2025, the company had 53.23 million registered users, 9.16 million customers, and 1,278 employees.

OnEMI Technology Solutions Limited (Kissht) IPO Overview

OnEMI Technology Solutions Ltd. submitted its Draft Red Herring Prospectus (DRHP) to SEBI on August 18, 2025, aiming to raise funds via an Initial Public Offer (IPO). The IPO will be a Book Building issue, comprising a fresh issue worth ₹1,000.00 crores and an Offer for Sale (OFS) of up to 0.89 crore equity shares. The company plans to list its shares on NSE and BSE. JM Financial Ltd. will act as the book running lead manager, while Kfin Technologies Ltd. will serve as the registrar. Key details such as IPO dates, price bands, and lot size are yet to be announced.

OnEMI Technology Solutions Limited (Kissht) Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹1000 crore |

| Offer for Sale (OFS) | 0.89 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,40,91,080 shares |

| Shareholding post-issue | 11,86,61,750 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

OnEMI Technology Solutions Limited (Kissht) IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

OnEMI Technology Solutions Limited (Kissht) IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹33.09 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 17.74% |

| Net Asset Value (NAV) | ₹187.58 |

| Return on Equity (RoE) | 17.74% |

| Return on Capital Employed (RoCE) | 8.68% |

| EBITDA Margin | 28.52% |

| PAT Margin | 11.97% |

| Debt to Equity Ratio | 1.50 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Augmenting the capital base of our Subsidiary, Si Creva, to meet its future capital requirements arising out of the growth of our Subsidiary, Si Creva’s, business | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

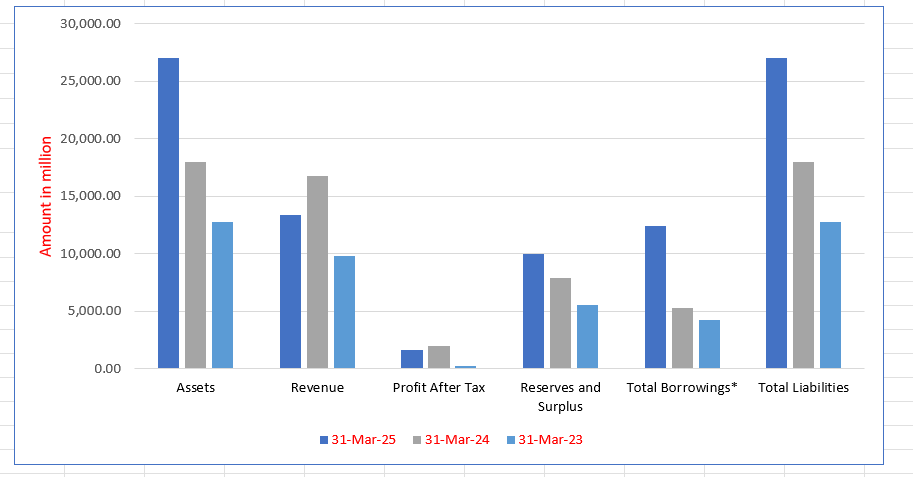

OnEMI Technology Solutions Limited (Kissht) Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 27,011.04 | 17,965.25 | 12,752.00 |

| Revenue | 13,374.65 | 16,744.46 | 9,844.57 |

| Profit After Tax | 1,606.21 | 1,972.90 | 276.67 |

| Reserves and Surplus | 9,953.15 | 7,944.96 | 5,561.73 |

| Total Borrowings* | 12,382.43 | 5,274.96 | 4,284.45 |

| Total Liabilities | 27,011.04 | 17,965.25 | 12,752.00 |

Financial Status of OnEMI Technology Solutions Limited (Kissht)

SWOT Analysis of OnEMI Technology Solutions IPO

Strength and Opportunities

- Strong AUM growth and profitability; PAT rose significantly from FY23 to FY25

- Rapid disbursement and user-friendly digital loan process via mobile app

- Expanding secured lending, including loans against property with AI-driven approvals

- Advanced data analytics and ML for risk and delinquency insights

- Backing from marquee investors enhances market credibility

- High app ratings, over 9 million customers and more than 53 million downloads

- IPO filing can raise capital and visibility for further expansion

- Customer-centric approach with focus on empathy, clear communication and robust data protection

- Strong digital ecosystem supporting e-commerce, BNPL, and personal finance segments

Risks and Threats

- Regulatory scrutiny and evolving digital-lending guidelines could constrain operations

- Mixed customer reviews highlight inconsistencies in approval turnaround and trust issues

- Competitive BNPL/fintech market with many rivals vying for share

- Non-performing asset risks if borrower creditworthiness assessment is flawed

- User concerns about interest rates and transparency may impact loyalty

- Offline reach still limited despite growing service scope

- Dependence on co-lending and partners may expose the company to external risks

- Increasing regulatory compliance costs could erode margins

- Rising competition from traditional banks entering the digital lending space

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About OnEMI Technology Solutions Limited (Kissht)

OnEMI Technology Solutions Limited (Kissht) IPO Strengths

Strong Risk Management and Underwriting

OnEMI Technology Solutions Limited (Kissht) has a robust risk management framework that integrates machine learning and AI. Their proprietary models use over 7,000 variables related to consumption and online activity to assess borrower creditworthiness, leading to a 23.26% decline in applications in Fiscal 2025 that otherwise would have been approved by traditional credit bureaus. This data-first approach enables them to scale into previously underserved borrower segments.

Advanced Fraud and Credit Risk Models

Kissht’s fraud and credit risk models use over 200 triggers from multiple sources, including facial recognition and identity triangulation, to detect and prevent fraud with high precision. They leverage over 400 key variables and have been early adopters of ML-based underwriting since 2019. Their systems are continuously learning and adapting, with over 34 specialized sub-models for accurate, tailored credit decisions.

Efficient Multi-Channel Customer Acquisition

The company employs a diversified multi-channel customer acquisition strategy, with a mix of online and offline methods. As of March 31, 2025, they had 53.23 million registered users. The strategy is centered on digital marketing (48.69% of the mix), merchant partnerships (24.38%), e-commerce collaborations, and organic growth, resulting in a low overall customer acquisition cost.

Scalable and Automated Collections

Kissht’s collections strategy is built on insights from historical repayment patterns and application activity. They use an in-house automated collections system (ACS) that employs predictive analytics and geo-optimization tools to manage delinquency. Their large-scale field and tele-calling teams work in conjunction with the automated system to ensure effective and timely recovery actions.

Robust Technology Infrastructure

OnEMI Technology Solutions Limited has a technology-first approach, with a comprehensive, scalable, and secure lending platform that integrates AI and cloud-native infrastructure across the entire lending lifecycle. Their modular architecture allows them to respond to evolving customer expectations, and they have an end-to-end ownership of their core lending infrastructure, including their Lead Generation System, Loan Origination System, and Collections System.

More About OnEMI Technology Solutions Limited (Kissht)

OnEMI Technology Solutions Limited (Kissht), established with a mission to democratize credit for India’s underserved and new-to-credit consumers, has emerged as a pioneering force in the digital lending space. Powered by its NBFC subsidiary, Si Creva Capital Services, the company combines regulatory compliance with innovation, offering diverse loan products ranging from small-ticket personal loans to secured offerings like Loans Against Property (LAP).

Milestones & Metrics

Founded in 2015 by Ranvir Singh and Krishnan Vishwanathan, the platform has scaled rapidly. As of March 2025, OnEMI had over 53 million registered users, served about 9.16 million customers, and managed assets under management (AUM) exceeding ₹4,000 crore.

Its financial performance in FY 2025 included revenues of approximately ₹1,350 crore and a profit after tax of around ₹160 crore—a sharp increase from previous years.

Product Portfolio

Kissht delivers:

- Personal and business loans with quick approval, minimal documentation, and online processing

- Loans Against Property (LAP), introduced by March 2025, leveraging AI for swift, low-doc approvals within 24 hours

Its user experience is enhanced through instant approvals, flexible repayment, competitive rates, and a fully paperless process.

RING, a complementary brand, provides:

- Instant, zero-documentation loans via digital KYC and direct bank disbursements—designed for younger, tech-savvy borrowers.

Strategic Growth & Investments

OnEMI enjoys strong backing from marquee investors such as Vertex Ventures, Brunei Investment Agency, and Endiya Partners. In 2022, it raised $80 million to expand offerings, including the launch of RING. Its brand visibility further grew when cricket legend Sachin Tendulkar joined as brand ambassador in 2024.

Culture & Vision

OnEMI fosters an inclusive, innovation-driven work culture with flexible arrangements, health benefits, and strong employee recognition. Its core vision is to make financial inclusion a reality by empowering Indian households with accessible, trustworthy credit.

Industry Outlook

Indian Digital Lending & Consumer Credit (2025–2030)

Growth Trajectory

- The digital consumer lending market in India is projected to nearly triple by 2030, reaching over USD 720 billion, with an estimated CAGR of ~22%.

- Specifically, the personal loans segment is forecasted to grow from USD 135.7 billion in 2024 to USD 556.3 billion by 2033, registering a robust 15.7% CAGR.

Buy Now Pay Later (BNPL) Growth

- The BNPL market—a key product category for Kissht—is expected to expand from USD 30.9 billion in 2025 to USD 78.5 billion by 2030, at a high 20.5% CAGR.

- Alternatively, some forecasts project a CAGR of 9.8–11.7% through 2030–2032, with market size estimates ranging from USD 21.95 billion (2025) to USD 35–45 billion by 2032–33.

Growth Drivers

- Gen Z and Millennials are driving digital lending; digital platforms are expected to account for 5% of India’s retail loans by FY2028 (up from 1.8% in FY2022), with digital lending growing at an estimated 40% CAGR.

- FinTech NBFCs disbursed a record 10.9 crore personal loans totaling ₹1.06 lakh crore in FY2024-25—highlighting fintech’s expanding credit footprint.

- The sector is set for a festive season resurgence, as regulatory easing restores confidence in unsecured lending growth.

Risks & Constraints

- Household debt has surged to nearly 43% of GDP, while savings have dropped to a 50-year low—raising concerns about future stress from over-indebtedness.

- Rising default rates in personal loans and micro-credit, especially among over-leveraged borrowers, are prompting lenders to tighten provisioning

How Will OnEMI Technology Solutions Limited (Kissht) Benefit

- Positioned strongly in India’s fast-growing digital consumer lending market, Kissht can capitalize on a projected 22% CAGR by 2030.

- With personal loans expected to expand at 15.7% CAGR, the company’s tech-enabled personal lending solutions align well with rising consumer demand.

- The surge in BNPL adoption offers direct growth potential for Kissht, whose digital products mirror the preferences of younger borrowers.

- Expanding Gen Z and Millennial credit appetite supports its core customer base of new-to-credit and underserved users.

- Increased reliance on fintech NBFCs for credit distribution enhances Kissht’s reach and scalability.

- Regulatory easing in unsecured lending could unlock higher loan disbursements and improved margins.

- Technology-first models and AI-driven underwriting help mitigate risks from rising defaults.

- Its brand visibility, strengthened by investor confidence and marquee endorsements, positions Kissht as a trusted credit partner.

Peer Group Comparison

| Name of the company | Total Income (in million) | Face Value (₹) | P/E | EPS | ROE (%) | NAV (₹) |

| OneEMI Technology Solutions Limited | 13,526.88 | 1 | TBD | 33.09 | 17.74% | 187.58 |

| Peer Group | ||||||

| Bajaj Finance Limited | 6,97,247.80 | 1 | 32.73 | 26.89 | 19.19% | 155.60 |

| Cholamandalam Investment & Finance | 2,61,527.60 | 2 | 29.31 | 50.72 | 19.71% | 281.45 |

| HDB Financial Services Limited | 1,63,002.80 | 10 | 27.26 | 27.40 | 14.72% | 198.80 |

| SBI Cards & Payment Services Limited | 1,86,371.50 | 10 | 39.61 | 20.15 | 14.82% | 144.86 |

Key Strategies for OnEMI Technology Solutions Limited (Kissht)

Platform Expansion Through Product Diversification

OnEMI Technology Solutions Limited (Kissht) is focused on expanding its financial services platform by diversifying its product portfolio. The company is committed to building an integrated platform that supports long-term growth by expanding into secured lending, specifically loans against property (LAP), and is also diversifying into non-lending products like health insurance and savings products.

Enhancing Customer Experience with AI and Technology

OnEMI is leveraging technology, including machine learning and generative AI, to improve its digital lending platform. By deploying AI-driven onboarding and voice assistants, the company aims to enhance the customer experience, streamline the loan application process, and minimize application drop-offs. Additionally, intelligent AI bots are being used for collections to improve recovery rates.

Achieving Superior Profitability and Growth

The company aims to achieve profitability at scale by optimizing its cost of funds and maximizing operational leverage. This involves diversifying its funding ecosystem and leveraging its existing infrastructure. By pursuing strategic growth and improving its credit ratings, OnEMI plans to gain access to better interest rates and increase its assets under management (AUM).

Deepening Customer Relationships

OnEMI is focused on building and strengthening relationships with its existing customer base to acquire high-quality new customers. It aims to broaden its reach through diverse sourcing channels like fintech aggregators and digital marketplaces. By utilizing advanced analytics and data-driven marketing, the company plans to personalize communication and deepen customer engagement to drive app downloads and loan applications.

Continuous Improvement of Credit Models

OnEMI is committed to continuously enhancing its credit underwriting models to drive growth and profitability. The company intends to sustain improvements in its underwriting and risk models, leading to higher approval rates and more competitive loan offers. These enhancements are expected to directly contribute to the expansion of its AUM and allow it to effectively re-engage and approve customers who were previously denied.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On OnEMI Technology Solutions Limited (Kissht) IPO

How can I apply for OnEMI Technology Solutions Limited (Kissht) IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the OnEMI Technology IPO?

The IPO includes a fresh issue of ₹1,000 crore and OFS of 0.89 crore shares.

Where will the OnEMI Technology IPO shares be listed?

The equity shares are proposed to be listed on both BSE and NSE mainboards.

Who are the lead manager and registrar for the IPO?

JM Financial Ltd. is the lead manager, and KFin Technologies Ltd. is the issue registrar.

What will OnEMI use the IPO proceeds for?

₹750 crore will strengthen subsidiary Si Creva’s capital base; balance is for general corporate purposes