- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Open Free Demat Account Online

Open a Demat Account and Get a Free Trading Account with 0* Brokerage Charges for the First 30 Days

By signing up I certify terms, conditions & privacy policy

By signing up I certify terms, conditions & privacy policy

How to Open Demat Account Online

Open Demat Account Online for FREE

Verify mobile number

Enter your personal details

Complete the KYC process

Get Demat account details and start Investing

Why Open Demat Account with HDFC Sky

Zero Account Opening Charges

Open Demat account for free & Start your investment journey.

Zero Maintenance Charges

Enjoy seamless investing with ₹0 annual fees for first year.

From the House of HDFC

A legacy of trust - discount broking app by HDFC Securities.

₹20 Brokerage on ETFs

Invest in ETFs with ₹20 brokerage for delivery and intraday - simple, smart, seamless.

Research based Recommendations

Make smarter moves with insights backed by expert research.

₹0* Brokerage for 30 Days

Trade for 30 days with zero* brokerage, backed by HDFC Securities

Free Trading & Demat Account

Save more from day one with a free trading and demat account.

Zero Account Opening Charges

Open Demat account for free & Start your investment journey.

Zero Maintenance Charges

Enjoy seamless investing with ₹0 annual fees for first year.

From the House of HDFC

A legacy of trust - discount broking app by HDFC Securities.

₹20 Brokerage on ETFs

Invest in ETFs with ₹20 brokerage for delivery and intraday - simple, smart, seamless.

Research based Recommendations

Make smarter moves with insights backed by expert research.

₹0* Brokerage for 30 Days

Trade for 30 days with zero* brokerage, backed by HDFC Securities

Free Trading & Demat Account

Save more from day one with a free trading and demat account.

Open 3 in 1 Account

Click HereDocuments Required To Open A Demat Account

PAN Card

Mandatory for all Demat account openings

Proof of Identity

Aadhar card, passport, voter ID, or driving license are common acceptable forms.

Proof of Address

Aadhar card, passport, voter ID, utility bill, or bank statement are acceptable.

Bank Account Statement or Cancelled Cheque

This confirms your bank details.

Passport-sized Photograph

A recent photo is required

What is a Demat Account?

A Demat account is your digital gateway to investing in the stock market, allowing you to securely hold shares, bonds, mutual funds, and other financial instruments in electronic form. Whether you’re a first-time investor or looking to streamline your portfolio, opening a Demat account with a trusted platform like HDFC Sky offers convenience, safety, and zero* brokerage for the first 30 days making it an ideal starting point for your investment journey.

Features of Demat Account

When you decide to open Demat account, you must understand different Demat account features that make this account appealing:

- Electronic Storage: All your securities are stored in digital format, eliminating the need for physical certificates.

- Easy Transfers: You can transfer securities from one Demat account to another with just a few clicks.

- Corporate Benefits: Dividends, bonuses, and other corporate actions are automatically credited to your account.

- Loan Facility: You can use your Demat holdings as collateral to avail loans from financial institutions.

- Consolidated View: Get a comprehensive view of all your investments in one place.

- Online Access: Manage your portfolio anytime, anywhere through internet banking or mobile apps.

- Reduced Risks: No worries about loss, theft, or damage of physical certificates.

- Faster Settlements: Quicker processing of buy and sell orders compared to physical shares.

You could also link your existing bank account to your Demat account for direct payment transfers. This integration can reduce paperwork and delays, creating a more efficient experience. These elements together lead many investors to consider using a Demat account application.

How to Open a Free Demat Account Online?

Here is a guide to opening a free Demat account from the comfort of your home:

- Choose a Depository Participant (DP): Select a reliable DP like HDFC Sky, which offers free Demat account opening.

- Visit the DP’s Website: Go to the official website of HDFC Sky or download the HDFC Sky app from your relevant app store.

- Sign-up: Sign up by entering your email ID, address, and mobile number. Verify your details with the OTP to complete the registration.

- Fill the Online Application: Provide your personal details, including your name, address, PAN number, Aadhaar number, and bank account information. You will also have the option to select a nominee for your Demat account.

- Upload Documents: Submit scanned copies of the necessary documents for KYC verification, such as your PAN card, Aadhaar card, and a cancelled cheque or bank statement.

- Select the Exchange: Select your preferred exchange (NSE or BSE) and trading segments (derivative, commodity, currency, equity trading). For F&O trading, upload salary slips, bank statements of the last 6 months, or the latest ITR.

- E-Sign the Agreement: To authenticate your details, digitally sign the application form. HDFC Sky offers an e-signing option.

- Account Activation: Upon successful verification, your Demat account will be activated, and you will receive your account details.

- Fund Your Account: Transfer an initial amount to start trading.

Following the above would allow you to open a free demat account quickly as all the steps can be completed in a few minutes.

Benefits of Opening Demat Account

Many individuals choose to open a trading account along with a Demat account for seamless transactions. Here are the key benefits of opening a Demat account:

- Convenience: Manage all your investments in one place, accessible 24/7.

- Safety: Eliminate risks associated with physical certificates like loss, theft, or damage.

- Cost-Effective: Reduce paperwork and associated costs of handling physical shares.

- Quick Transactions: Execute trades faster, leading to better opportunities in the market.

- Easy Portfolio Tracking: Monitor your investments and their performance in real-time.

- Seamless Corporate Actions: Receive dividends, bonuses, and other benefits directly in your account.

- Flexibility: Hold a variety of securities like shares, bonds,ETFs, and mutual funds in one account.

- Loan Against Securities: Use your Demat holdings as collateral for loans.

- Paperless IPO Applications: Apply for Initial Public Offerings (IPOs) directly through your Demat account.

- Transparency: Get a clear view of all your transactions and holdings, aiding in better financial planning.

HDFC Sky offers a free trading account or a free brokerage Demat account, although some features and charges may vary. Read further to know about other charges you may incur while using the HDFC Sky app

Documents Required for Opening Demat Account Online

You need to provide the following documentsfor KYC verification: To comply with KYC norms, ensure you have the following documents ready:

- Proof of Identity: PAN card (mandatory).

- Proof of Address: Aadhaar card, passport, or a recent utility bill.

- Bank Account Details: A cancelled cheque or a recent bank statement.

- Photographs: Recent passport-sized photographs.

- Income Proof: For F&O trading – salary slip, bank statement of last 6 months, or latest ITR

- Digital Signature: Captured through the app

Having these documents in digital format will expedite the online application process. Remember, the exact list may vary slightly depending on the DP you choose. If you choose a zero brokerage Demat account, the same set of documents required for Demat account is applicable.

What are Charges Applicable for Demat Account?

While you can open a trading account for free with many brokers, there are some Demat account charges associated with maintaining and operating this account. Let’s have a look at the charges for a Demat account with HDFC Sky:

- Account Opening Charges: ₹0 (Free account opening)

- Brokerage on ETF: ₹0 Brokerage on ETFs for 30 days*

- Annual Maintenance Charges (AMC): ₹0 for the first year, thereafter ₹20 per month

- Transaction Charges: Flat ₹20 per order for all intraday and delivery trades

- Margin Trading Facility (MTF): Interest rate of 12% per annum. 0% for first 30 days

- Dematerialization Charges:₹50 per share certificate, plus courier charges.

- Pledge Invocation:₹20 per transaction.

- Other Charges: May include DP charges, statutory levies, and taxes as applicable

What are the Eligibility Criteria for Opening Demat Account Online?

Demat account eligibility criteria in India are as follows:

- Age: You must be at least 18 years old to open a Demat account in your name.

- Residency: Both resident Indians and Non-Resident Indians (NRIs) can open Demat accounts.

- Valid Documents: You should have valid KYC documents, as mentioned in the documents section.

- PAN Card: A valid PAN card is mandatory for opening a Demat account.

- Bank Account: An active bank account in your name is required for fund transfers.

- Mobile Number and Email: A valid mobile number and email ID for communication and verification.

There are no specific income criteria for opening a basic Demat account. However, brokers may have additional financial requirements for trading derivatives or using margin facilities.

Why Open a Demat Account with HDFC Sky?

HDFC Sky focuses on safety and streamlined processes, features that may appeal to anyone exploring modern ways to handle securities. Choosing HDFC Sky for your Demat account comes with several advantages:

- Trusted Brand: HDFC is a well-established name in the Indian financial sector, ensuring reliability and security.

- User-Friendly Platform: HDFC Sky offers an intuitive interface for easy trading and portfolio management.

- Competitive Charges: Enjoy competitive brokerage rates and account maintenance charges.

- Research Support: Access to high-quality research reports and market analysis to make informed decisions.

- Customer Support: Reliable customer service to address your queries and concerns promptly.

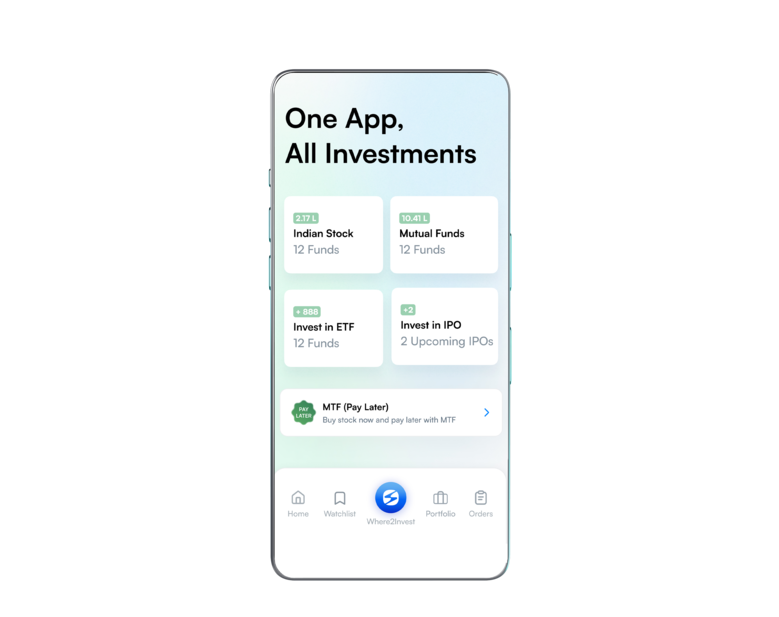

- Diverse Investment Options: Trade in stocks, mutual funds, bonds, and more from a single platform.

- Advanced Trading Tools: Access to advanced charting tools and real-time market data.

- Mobile Trading: Manage your investments on the go with the HDFC Sky mobile app.

Learn More About Demat Account

Demat Account 6m

What is the Difference Between Demat and Trading Account & How to Open Demat and Trading Accounts?

Customer Stories

The testimonials from our clients highlight exceptional experience we deliver. Explore the testimonials to see why we are the preferred choice for investors and traders alike.

Sahil More

Trading on HDFC SKY

Abhishek Gharat

Trading on HDFC SKY

Mahesh R Nair

Trading on HDFC SKY

FAQs on Demat Account Opening

How do I open a Demat account?

You can open a Demat account by approaching a brokerage firm like HDFC Sky, and submit required documents, and complete the KYC process.

What is the difference between a Demat and a trading account?

A Demat account holds your securities in electronic form, while a trading account is used to buy or sell securities on the stock market.

How can I track the performance of my investments in the Demat account?

HDFC SKY provides a user-friendly dashboard that allows you to closely monitor the performance of your investment portfolio. This dashboard offers real-time market data, detailed transaction histories, and comprehensive reports, empowering you to make informed decisions and track the growth of your wealth over time

Is Demat account a zero balance account?

Most demat accounts require a minimum balance or annual maintenance charges. However, some brokers offer zero-balance demat accounts with certain conditions. Check with your chosen DP for specific details.

Who can open a Demat account?

Any Indian resident or NRI above 18 years of age with valid KYC documents can open a Demat account online or offline. Minors can also have accounts operated by their guardians.

Is a Demat account compulsory for availing a systematic investment plan?

No, a Demat account is not mandatory for SIPs in mutual funds. However, it can be beneficial for managing your investments if you plan to invest in stocks as well.

What is a Demat account used for?

A Demat account is used to hold shares, bonds, government securities, mutual funds, and other financial instruments in electronic form. It facilitates easy buying, selling, and transferring of securities.

What are the Types of Account that I can Open?

You can open three types of accounts: Regular Demat Account, Basic Services Demat Account (BSDA) for small investors, and Repatriable Demat Account for NRIs.

Can an NRI Open Demat Account?

Yes, NRIs can open Demat accounts in India. They need to choose between a repatriable and non-repatriable account based on their requirements.

How can I open a 3-in-1 account with HDFC SKY?

To open a 3-in-1 account that links your savings, Demat, and trading accounts, you must be an Indian resident aged 18 or above. The process is fully digital and requires completing KYC using your PAN, Aadhaar, bank details, a recent photograph, a digital signature, and income proof if you plan to trade in derivatives.

Can I apply for IPOs using a Demat Account?

Yes, you can apply for IPOs directly through your Demat account. This makes the process paperless and more convenient.

How to transfer physical shares to a Demat account?

Submit your physical share certificates to your DP along with a Dematerialisation request form. The DP will process the request and credit the shares to your Demat account.

How to know your Demat account number?

Your Demat account number is typically mentioned on your account statement. You can also find it by logging into your trading platform or contacting your DP.

What is the minimum amount required to open a Demat Account?

There’s no minimum amount required to open a Demat account.

Can I open two/multiple Demat Accounts?

Yes, you can open multiple Demat accounts with different DPs. However, each account will have its own charges and maintenance requirements.

How to open an online/paperless Demat Account?

You will need to fill out an online form and upload Aadhaar, PAN, and address proofs for eKYC. Some providers hold video-based checks. Once approved, login details are shared, enabling immediate digital access.

Do I require a Demat Account for SIP?

No, a Demat account is not mandatory for SIPs in mutual funds. You can track units through statements from the asset management company or distributor. However, it’s required if you want to invest in stocks or equity-linked savings schemes (ELSS).

How to check Demat Account balance?

You can check your Demat account balance by logging into your trading platform, checking your account statement, or using HDFC Sky’s mobile app.

Can I open a Demat Account without opening a Trading Account?

Yes, you can open a standalone Demat account without a trading account. However, to buy or sell securities, you will need a linked trading account. Some investors keep a Demat only for off-market transfers or corporate actions. This structure means you hold assets without executing regular buy or sell trades.

Can a Demat Account be opened in the name of Joint Holders?

Yes, you can open a joint Demat account with up to three holders. The operating instructions can be set as per your preference. Changes or transactions usually require signatures from all parties. Joint Demat accounts simplify the management of jointly owned investments and combined tracking.

What are the charges for opening a Demat Account?

Many brokers offer free Demat account opening. However, there may be annual maintenance charges and transaction fees. Always check the complete fee structure.

What documents are required to open a Demat Account?

Typically, you need proof of identity (PAN card), proof of address, bank account details, and photographs. Some DPs may require additional documents.

How long does it take to open a Demat Account?

With online processes, a Demat account can be opened within 1-2 working days, provided all your documents are in order and verified quickly. Delays occur when documents are incomplete or verification issues arise. Most platforms aim for speedy approvals to help you begin soon.

Can I open a minor Demat account for my child?

A parent or guardian can open a Demat account for a minor by providing the child’s PAN if available and birth certificate copies. The account will be operated by a guardian until the minor turns 18. At this point, the account shifts to the child’s name, giving them control over future trades.

Can I link my Demat and Trading Account?

Yes, linking your Demat and trading accounts is common and convenient. Linking these accounts makes your transactions more seamless. Shares you buy through the trading account move automatically to your Demat. When you sell, they are deducted from your holdings. This integrated approach reduces manual steps and helps you coordinate buying, selling, and storing without juggling separate processes.

Can I close my Demat account online?

Most DPs require you to submit a physical account closure form. However, some providers offer an online account closure form. You log in, clear any pending dues, and submit the request. If you have remaining shares, you move them to another account first. After verification, the provider marks your account closed. This sequence keeps your holdings and documents in proper order.

What happens if my Demat account remains inactive for a long time?

If your account remains inactive for a long period (usually 1-2 years), it may be frozen, which limits transactions until reactivated. You could be asked to complete updated KYC or provide identity confirmations. Your securities remain safe despite inactivity, although annual charges may continue. Reactivation generally involves verifying details and settling any pending fees to restore normal functionality.

Can I change my registered mobile number and email in my Demat account?

Linking these accounts makes your transactions more seamless. Shares you buy through the trading account move automatically to your Demat. When you sell, they are deducted from your holdings. This integrated approach reduces manual steps and helps you coordinate buying, selling, and storing without juggling separate processes.