- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Orient Cables IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Orient Cables IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Orient Cables (India) Limited

Orient Cables specialises in networking cables and passive networking equipment, offering a diverse portfolio divided into three segments: Networking Cables and Solutions, Specialty Power and Optical Fibre Cables and Solutions, and Other Allied Products. Its offerings cater to industries such as broadband, telecom, data centres, renewable energy, smart building automation and security, system integration, FMEG, and automotive. As of March 31, 2025, the company has an installed capacity of 794,976 kms of cables and is expanding into E-beam Irradiated Specialty Cables, Solar Junction Boxes, Tethered Drone Systems, and Harnesses and Power Cords

Orient Cables (India) Limited IPO Overview

Orient Cables (India) Ltd. has submitted its Draft Red Herring Prospectus (DRHP) to SEBI, proposing to raise ₹700 crores through an Initial Public Offer (IPO). The issue includes a fresh issue of shares worth ₹320 crores and an offer for sale (OFS) of ₹380 crores. The company’s equity shares are set to be listed on both NSE and BSE. IIFL Capital Services Ltd. will act as the book running lead manager, while Kfin Technologies Ltd. has been appointed as the registrar. Details regarding IPO dates, price band, and lot size are yet to be announced. Interested investors can refer to the DRHP for more information.

Orient Cables (India)Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹700 crore |

| Fresh Issue | ₹320 crore |

| Offer for Sale (OFS) | ₹380 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,20,35,000 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Orient Cables (India) Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Orient Cables (India) Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.22 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 34.58% |

| Net Asset Value (NAV) | ₹17.71 |

| Return on Equity (RoE) | 34.58% |

| Return on Capital Employed (RoCE) | 36.46% |

| EBITDA Margin | 10.17% |

| PAT Margin | 6.41% |

| Debt to Equity Ratio | 0.63 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements of the Company towards purchase of machinery, equipment and civil works at their manufacturing facilities | 915 |

| Repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by our Company | 1555 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

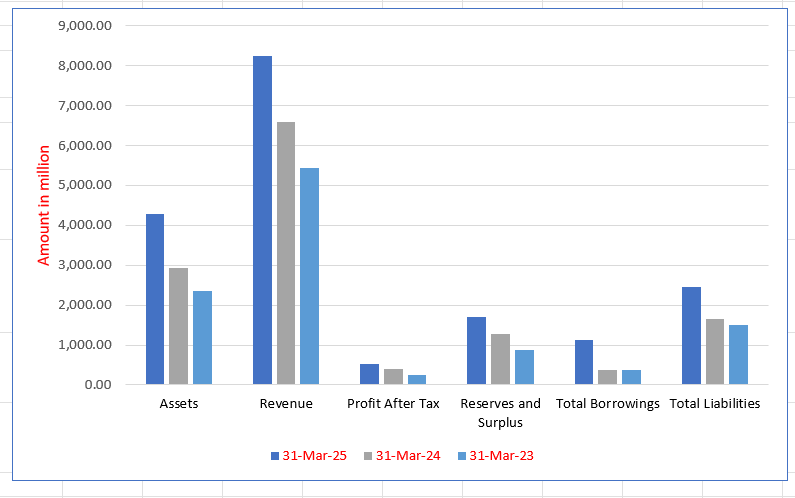

Orient Cables (India) Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,271.88 | 2,932.18 | 2,365.83 |

| Revenue | 8,249.58 | 6,577.67 | 5,436.78 |

| Profit After Tax | 532.91 | 400.69 | 259.59 |

| Reserves and Surplus | 1,704.68 | 1,265.23 | 865.38 |

| Total Borrowings | 1,134.49 | 367.31 | 372.97 |

| Total Liabilities | 2,465.16 | 1,656.75 | 1,490.25 |

Financial Status of Orient Cables (India)Limited

SWOT Analysis of Orient Cables IPO

Strength and Opportunities

- Established manufacturing facilities in Bhiwadi, Rajasthan, with high-speed extrusion lines and robotic assembly.

- Extensive product portfolio including networking, optical fiber, power, and solar cables, catering to diverse industries.

- Strong focus on quality assurance with a dedicated team and adherence to international standards like UL, BIS, and ISO.

- Ongoing investment in R&D to innovate and improve existing products, enhancing competitive advantage.

- Strategic location near NCR ICDs facilitates efficient export logistics, reducing delivery times and costs.

- Upcoming IPO aims to raise funds for expansion and debt reduction, potentially strengthening financial position.

- Commitment to sustainability and environmental responsibility aligns with global industry trends and consumer preferences.

- Robust domestic market presence with established relationships in sectors like telecommunications and power.

- Potential for growth in renewable energy sectors, particularly solar, as demand for sustainable solutions increases.

Risks and Threats

- Dependence on imported raw materials may expose the company to supply chain disruptions and currency fluctuations.

- Intense competition from both domestic and international cable manufacturers can pressure market share and margins.

- Limited brand recognition outside of India may hinder expansion into new international markets.

- Exposure to fluctuations in commodity prices, particularly copper, which can affect production costs.

- Potential regulatory changes in export-import policies could impact international business operations.

- Challenges in scaling operations while maintaining quality standards could affect brand reputation.

- Economic downturns or reduced infrastructure spending can lead to decreased demand in key sectors.

- Vulnerability to geopolitical tensions that may disrupt supply chains or affect export markets.

- Overreliance on a limited number of key clients could pose risks if relationships deteriorate.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Orient Cables (India) Limited

Orient Cables (India) Limited IPO Strengths

Strong Market Position in a High-Barrier Industry

Orient Cables (India) Limited is a top-five player in India’s networking cables sector, holding approximately 22% market share as of Fiscal 2025. The company’s standing is fortified by its comprehensive product range and its presence in a market with high entry barriers due to stringent quality standards and long customer onboarding processes.

Diversified and Customized Product Portfolio

The company manufactures a wide array of customized cables and solutions for telecommunications and IT, including networking, specialty power, and optical fiber cables. This diverse portfolio, which is tailored to customer specifications, positions the company as a one-stop-shop for passive networking solutions, allowing it to capitalize on growth in sectors like broadband and data centers.

Enduring Customer Relationships

Orient Cables has cultivated long-term relationships with a marquee client base, including major telecom companies. With high customer retention and a track record of meeting stringent technical specifications, the company has secured a competitive advantage, which provides revenue visibility and facilitates the cross-selling of new products.

Strategic Manufacturing and Innovation

The company’s strategically located facilities in Bhiwadi, Rajasthan, are a key strength. These facilities are supported by strong vertical integration, which includes in-house processing of copper and PVC manufacturing. This focus on vertical integration, coupled with a commitment to product innovation and stringent quality controls, enables Orient Cables to optimize costs and maintain high-quality standards.

Experienced Leadership and Professional Management

The company benefits from a hands-on management team with extensive domain expertise. The experienced promoters and senior management are actively involved in strategic decision-making, product development, and business operations. Their collective experience has been crucial in the company’s growth and its ability to anticipate and respond to evolving market trends.

More About Orient Cables (India) Limited

Orient Cables (India) Limited is a manufacturing company with nearly two decades of expertise in networking cables and passive networking equipment. The company serves high-growth sectors, including broadband, telecom, data centres, renewable energy, smart building automation and security, system integration, FMEG, and automotive. Its product portfolio is divided into three primary segments:

- Networking Cables and Solutions

- Specialty Power and Optical Fibre Cables and Solutions

- Other Allied Products

The company offers customized products to meet specific customer requirements, enhancing its appeal to marquee clients.

Market Positioning

According to the 1Lattice Report, Orient Cables is among India’s top five networking cable companies, holding approximately 22% market share in Fiscal 2025. Being one of the youngest players with a comprehensive product range, it increased its market share from 16% in Fiscal 2022. Its revenue CAGR from Fiscal 2023 to Fiscal 2025 was an impressive 23.18%, outpacing the industry average of 11.48%. The company also leads peers in ROE and ROCE while maintaining low net working capital days, reflecting efficient capital utilization.

Manufacturing and Product Innovation

To meet growing demand, Orient Cables has expanded its manufacturing capacity to 794,976 km of cables as of March 31, 2025. The company focuses on continuous product customization and development, including:

- E-Beam Irradiated Specialty Cables

- Solar Junction Boxes

- Tethered Drone Systems

- Harnesses and Power Cords

These products cater to renewable energy, data centres, E-mobility, FMEG, defence, aerospace, and railway sectors.

Customer Base and International Presence

Orient Cables primarily serves large telecom providers, OEMs, and resellers. It maintains long-standing relationships with top customers, some exceeding eight years. The company also exports to countries including UAE, Qatar, USA, Australia, New Zealand, Nepal, Singapore, and the Netherlands. Export revenue grew at a CAGR of 9.7% from Fiscal 2023 to Fiscal 2025.

Research, Development, and Leadership

The company’s R&D and quality departments drive innovation through pilot manufacturing, testing, and global certifications such as ETL, UL, CPR, and CE. Its management team, led by Promoter Vipul Nagpal with over 19 years of industry experience, along with a skilled workforce of 1,497 employees, positions the company to capitalize on future growth opportunities

Industry Outlook

The Indian wires and cables industry is poised for substantial growth, driven by technological advancements, infrastructure development, and expanding end-user sectors.

Market Size and Growth

- The Indian wires and cables market was valued at approximately USD 17.27 billion in 2023 and is projected to reach USD 24.48 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.1% .

- The optical fiber cables segment is experiencing significant expansion, with projections indicating a growth from USD 1.73 billion in 2024 to nearly USD 7.5 billion by 2032, reflecting a CAGR of 20.11% .

- The structured cabling market is also on an upward trajectory, expected to grow from USD 739.9 million in 2024 to USD 1.5 billion by 2030, at a CAGR of 12.8% .

Growth Drivers

- Infrastructure Development: Ongoing investments in smart grid projects and the upgradation of power transmission and distribution systems are pivotal in driving market growth .

- Telecommunication Expansion: The increasing demand for high-speed internet and data services, coupled with government initiatives and investments in telecom infrastructure, are propelling the telecom cable market .

- Renewable Energy Projects: India’s ambitious renewable energy targets necessitate the deployment of specialized cables, such as solar cables, to support the growing energy sector.

Market Trends

- The industry is witnessing a shift towards high-performance cables, including low-smoke zero-halogen (LSZH) and flame-retardant cables, to meet stringent safety standards.

- There is a growing emphasis on the adoption of automation and smart technologies in manufacturing processes, enhancing efficiency and product quality.

- Companies are increasingly focusing on sustainability, with initiatives aimed at reducing the environmental impact of cable production and promoting the use of recyclable materials.

How Will Orient Cables (India) Limited Benefit

- Orient Cables (India) Limited is well-positioned to capitalize on the growing demand for high-speed broadband and telecom infrastructure, increasing its market share in networking cables.

- The rapid expansion of the optical fiber segment presents opportunities for the company’s specialty and optical fiber cables, driving higher revenues and exports.

- Investments in renewable energy projects create demand for solar cables and other customized power solutions, aligning with the company’s expanding product portfolio.

- Rising adoption of structured cabling and high-performance cables, such as LSZH and flame-retardant types, enables Orient Cables to offer technologically advanced solutions to premium clients.

- Automation and smart manufacturing trends allow the company to optimize production efficiency, reduce costs, and maintain consistent product quality.

- Sustainability initiatives and eco-friendly manufacturing align with global standards, strengthening the company’s brand reputation domestically and internationally.

- Increasing infrastructure and industrial growth across India provide long-term demand stability, supporting consistent revenue growth.

Peer Group Comparison

| Name of the Company | Face Value (₹) | EPS (Basic) (₹) | NAV (₹) | P/E | RoNW (%) |

| Orient Cables (India) Limited | 15.22 | 5.22 | 17.71 | [●] | 34.58% |

| Peer Groups | |||||

| RR Kabel Limited | 5 | 27.57 | 190.37 | 48.79 | 15.65% |

| Polycab India Limited | 10 | 134.34 | 658.58 | 50.07 | 22.54% |

| Finolex Cables Limited | 2 | 45.82 | 359.31 | 21.11 | 13.42% |

| Havells India Limited | 12 | 23.48 | 133.04 | 65.49 | 18.63% |

| KEI Industries Limited | 2 | 75.55 | 605.50 | 50.39 | 15.59% |

| Paramount Communications Limited | 22.85 | 2.85 | 23.51 | 20.43 | 12.95% |

| Birla Cable Limited | 10 | 1.63 | 84.42 | 110.17 | 1.94% |

| Sterlite Technologies Limited | 2 | (2.54) | 40.79 | N/M | (5.23)% |

Key Strategies for Orient Cables (India) Limited

Further Capitalizing on Market Position

Orient Cables (India) Limited plans to leverage its strong market position in networking cables and optical fibre to capitalize on robust industry growth. The company aims to expand its market share by introducing new, high-margin products and increasing production capacity to meet rising demand.

Diversifying Product Portfolio

The company is focused on diversifying its specialized product portfolio through innovation, targeting high-growth and emerging areas. This includes expanding into the FMEG sector with products like power strips, and manufacturing high-performance Electron Beam (E-beam) irradiated cables, EV charging assemblies, and solar junction boxes.

Expanding Geographical Footprint

Orient Cables (India) Limited intends to enhance its geographical presence by expanding into new international markets such as Europe, Australia, and the US. The company will use a tailored approach for each region, leveraging existing relationships with multinational customers to increase volumes and improve margins.

Enhancing Operational Efficiency and Capacity

The company aims to enhance its operational efficiency and expand capacity to meet growing domestic and international demand. This includes strategic investments in new machinery, civil infrastructure, and technology upgrades, such as implementing an E-beam irradiated cable plant and improving in-house processes.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs Orient Cables (India) Limited

How can I apply for Orient Cables (India) Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Orient Cables IPO?

The IPO is ₹700.00 Cr, including ₹320.00 Cr fresh issue and ₹380.00 Cr offer for sale.

What is the purpose of the IPO proceeds?

Proceeds will fund machinery purchases, repay borrowings, and support general corporate purposes.

On which stock exchanges will Orient Cables be listed

The equity shares are proposed to be listed on both BSE and NSE mainboards.

Who are the lead managers and registrar for this IPO?

IIFL Capital Services Ltd. is the lead manager and Kfin Technologies Ltd. is the registrar.