- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Orkla India IPO

IPO Details

29 Oct 25

31 Oct 25

₹13,900

20

₹695 to ₹730

NSE, BSE

₹1,667.54 Cr

06 Nov 25

Orkla India IPO Timeline

Bidding Start

29 Oct 25

Bidding Ends

31 Oct 25

Allotment Finalisation

03 Nov 25

Refund Initiation

03 Nov 25

Demat Transfer

04 Nov 25

Listing

06 Nov 25

Orkla India Limited

Orkla India Limited is a leading Indian food company offering a wide range of products—breakfast to dinner, snacks, beverages, and desserts. It owns iconic brands like MTR Foods, Eastern Condiments, and Rasoi Magic. With over 400 products and 2.3 million units sold daily (FY25), it has a strong presence in southern India and exports to 42 countries. Orkla manufactures across 9 Indian facilities and international locations. Its distribution spans 843 distributors and 1,800 sub-distributors across 28 states and 5 union territories.

Orkla India Limited IPO Overview

Orkla India Ltd. is launching a book-built IPO worth ₹1,667.54 crore, entirely through an Offer for Sale (OFS) of 2.28 crore shares. The IPO will open for subscription on 29 October 2025 and close on 31 October 2025, with allotment expected to be finalised on 3 November 2025. The shares are set to be listed on BSE and NSE, with a tentative listing date of 6 November 2025.

The price band for the IPO is fixed between ₹695 and ₹730 per share, and the minimum lot size for an application is 20 shares. Retail investors will need a minimum investment of ₹14,600 based on the upper price band. For small non-institutional investors (sNII), the minimum lot size is 14 lots (280 shares), amounting to ₹2,04,400, while for big non-institutional investors (bNII), it is 69 lots (1,380 shares), amounting to ₹10,07,400.

The IPO is managed by ICICI Securities Ltd. as the book-running lead manager, with Kfin Technologies Ltd. serving as the registrar of the issue.

Orkla India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: NA

Offer for Sale (OFS): 2.28 crore shares |

| IPO Dates | 29–31 October 2025 |

| Price Bands | ₹695 – ₹730 per share |

| Lot Size | 20 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 13,69,89,230 shares |

| Shareholding post-issue | 13,69,89,230 shares |

Orkla India IPO Lots

| Application | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 20 | 14,600 |

| Retail (Max) | 13 | 260 | 1,89,800 |

| S-HNI (Min) | 14 | 280 | 2,04,400 |

| S-HNI (Max) | 68 | 1,360 | 9,92,800 |

| B-HNI (Min) | 69 | 1,380 | 10,07,400 |

Orkla India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Orkla India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 18.7 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.8% |

| Net Asset Value (NAV) | 135.3 |

| Return on Equity | 13.8% |

| Return on Capital Employed (ROCE) | 32.7% |

| EBITDA Margin | 16.6% |

| PAT Margin | 10.7% |

| Debt to Equity Ratio | – |

Objectives of the IPO Proceeds

- Being entirely an OFS issues, the IPO proceeds will entirely go to the selling shareholders and the company will not use the proceeds for corporate purpose

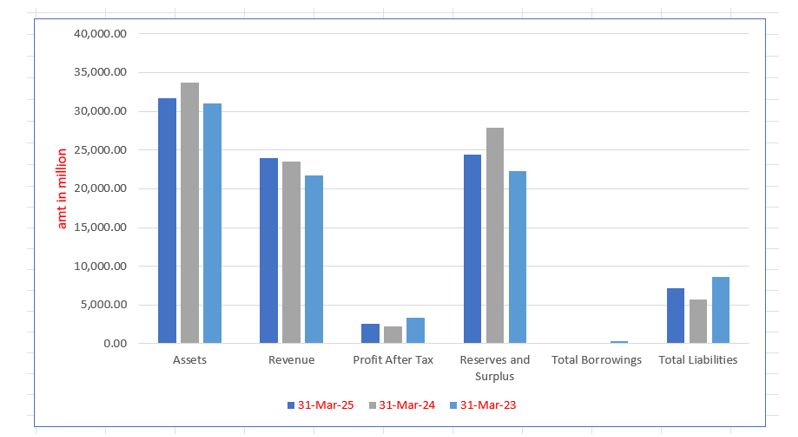

Orkla India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 31,713.0 | 33,751.9 | 31,019.6 |

| Revenue | 23,947.1 | 23,560.1 | 21,724.8 |

| Profit After Tax | 2556.9 | 2263.3 | 3391.3 |

| Reserves and Surplus | 24,458.0 | 27,933.5 | 22,272.8 |

| Total Borrowings | – | 37.7 | 349.9 |

| Total Liabilities | 7118.0 | 5681.4 | 8623.5 |

Financial Status of Orkla India Limited

SWOT Analysis of Orkla India IPO

Strength and Opportunities

- Strong heritage brands with high consumer recall.

- Welldiversified food portfolio across categories.

- Strategic IPO planned via DRHP to unlock investor value.

- Focus on highgrowth segments like snacks and ready meals.

- Expanding exports to multiple countries enhancing reach.

- Portfolio restructuring supports capital reallocation.

- Promising Indian packaged food market tailwinds.

- Growing readytoeat and convenience foods demand.

- Potential international expansion (e.g. US launch plans).

- Operational efficiencies driving improved EBIT margins.

Risks and Threats

- Geographic concentration limits diversification.

- Volatility in key input costs affects margins.

- Segment performance uneven—some underperforming units.

- Cash flow pressure despite revenue growth.

- Intense competition from regional and global FMCG players.

- Overreliance on promotional spend to maintain volume.

- Regulatory and food safety compliance costs.

- ESG/ sustainability risks from supply chain scrutiny.

- Macroeconomic headwinds and rising consumer cost pressure.

- Environmental regulation tightening operational cost lines.

Live Orkla India IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Orkla India Limited

Orkla India Limited IPO Strengths

Category Market Leader with the Ability to Build and Scale Household Food Brands Through an In-Depth Understanding of Local Consumer Tastes

Orkla India Limited has emerged as a market leader in South India’s packaged spices segment by leveraging deep consumer insights and regional preferences. Through its brands MTR and Eastern, the company offers regionally tailored products that reflect authentic local flavours. By preserving brand identity, modernising design, and utilising strong distribution, it has significantly scaled household reach and market share across Karnataka, Kerala, Andhra Pradesh, and Telangana.

Multi-Category Food Company with a Focus on Product Innovation

Orkla India Limited drives innovation through regionally inspired offerings, leveraging its Cuisine Centres of Excellence and expert chefs. Products like MTR Minute Fresh, 3-Minute Breakfast, and Wok N Roll showcase its adaptability. With a 35-member development team, the company balances taste, trends, and cost-efficiency using flexible production and market-driven strategies.

Extensive Distribution Infrastructure with Deep Regional Network and Wide Global Reach

Orkla India Limited operates a vast distribution network across India and exports to over 40 countries. With strong regional penetration in Karnataka and Kerala, presence in major e-commerce platforms, and advanced digital sales tools, it ensures high retail availability. MTR and Eastern products reach 9 out of 10 households in key markets.

Efficient, Large-Scale Manufacturing with Stringent Quality Control and a Robust Supply Chain

Orkla India Limited operates nine advanced manufacturing units with 182,270 TPA capacity, supported by IoT and SCADA-enabled systems. A flexible mix of in-house and contract manufacturing ensures efficiency, speed, and quality. Globally certified, the company maintains high food safety standards, optimised logistics, and tech-driven warehousing for seamless supply chain operations.

Experienced and Tenured Management Team Supported by Strong Global Parentage

Orkla India Limited is led by a seasoned leadership team with diverse expertise across FMCG, finance, and strategy, supported by a workforce of 2,621. Backed by parent company Orkla ASA, the team drives innovation, inclusivity, and sustainable growth. Access to Orkla’s global Centres of Excellence enhances operations, governance, and long-term capabilities.

Capital Efficient Business Model with a Track Record of Delivering Profitable Growth

Orkla India Limited has demonstrated consistent revenue growth, expanding margins, and strong profitability. With disciplined capital allocation, robust working capital management, and high cash conversion, the company ensures sustained performance. Backed by consumer loyalty and operational efficiency, it ranks among the fastest-growing players in the spices and convenience foods category.

More About Orkla India Limited

Diverse Food Portfolio Rooted in Indian Tradition

Orkla India Limited is a multi-category Indian food company with a rich legacy spanning decades. Its extensive product offerings cater to every meal occasion—from breakfast and lunch to snacks, beverages, and desserts. The company operates under two iconic brands, MTR and Eastern, which are synonymous with authentic South Indian flavours.

Market Leadership

According to the Technopak Report, Orkla India ranked among the top four companies in revenue from operations in the spices and convenience foods segment in FY2024.

- Key Product Categories:

- Spices: Blended (e.g., Sambar, Chicken, Rasam masalas) and pure spices (e.g., Chilli, Turmeric, Coriander).

- Convenience Foods: Ready-to-cook and ready-to-eat products like Rava Idli mix, Dosa mix, and 3-Minute Poha.

- Scale: Over 400 products; 2.3 million units sold daily on average in FY2025.

Strong Regional and Global Presence

With deep roots in South India, particularly Karnataka and Kerala, MTR and Eastern enjoy high household penetration.

- Domestic Market:

- Widespread presence in Andhra Pradesh, Telangana, and Kerala.

- Over 843 distributors and 1,800 sub-distributors across 28 states and five union territories.

- Exports:

- Products sold in over 40 countries including the GCC, US, and Canada.

- FY2025 exports: ₹4,861.7 million (20.6% of total revenue).

- Eastern has led branded spice exports from India for 24 consecutive years.

Manufacturing and Innovation

Orkla India operates nine owned manufacturing units with a capacity of 182,270 TPA, supported by 21 contract manufacturers globally.

- Strategic plant locations reduce logistics costs and enhance supply chain efficiency.

- Facilities are certified for food safety (BRCGS, ISO 22000).

Backed by Global Parent – Orkla ASA

As a subsidiary of Orkla ASA (Norway), Orkla India benefits from world-class corporate governance, innovation hubs, and sustainability practices. Orkla ASA operates in over 100 countries with renowned brands and a legacy of over 370 years.

Industry Outlook

Indian Packaged Food Industry – A Rapidly Expanding Sector

India’s packaged food industry is witnessing robust growth, driven by urbanisation, rising incomes, and evolving consumption habits. In 2023, the industry was valued at around USD 116.9 billion, and it is expected to reach USD 175.6 billion by 2031, growing at a CAGR of 7%.

Growth Drivers:

- Increasing demand for convenient, ready-to-eat or cook options.

- Rising awareness of food safety and hygiene.

- Penetration of modern retail and e-commerce.

- Higher consumption among urban working populations.

Spices Market – Traditional Core with Global Reach

India is the world’s largest producer and exporter of spices. The Indian spices market was valued at INR 2,00,000+ crore in 2024 and is projected to grow at a CAGR of 6–7% till 2030.

Key Trends:

- Shift from loose to branded, packaged spices.

- Growth in blended masalas tailored to regional tastes.

- Increasing exports of value-added spice products.

- Preference for natural, preservative-free ingredients.

Convenience Foods – Meeting Modern Lifestyles

The ready-to-cook and ready-to-eat segment is expanding rapidly. The market was worth approximately INR 3,194 billion in FY2022 and continues to grow at 11% CAGR.

Demand Factors:

- Busy lifestyles and time-poor consumers.

- Rise in single and nuclear households.

- Growing popularity of instant mixes and traditional ready meals.

How Will Orkla India Limited Benefit

- Strong alignment with growing demand for packaged, ready-to-eat and ready-to-cook products.

- Well-established brands like MTR and Eastern cater to evolving consumer preferences for convenience.

- Increasing shift toward branded spices supports growth in its core spice business.

- Rising exports of value-added food products benefit its global distribution footprint.

- Urbanisation and nuclear family trends boost demand for its instant mixes and traditional meals.

- Presence in South India allows deep penetration in high-consumption regions.

- Backing from Orkla ASA enables product innovation and global standards in quality.

- Expansion in modern retail and e-commerce channels widens reach across India.

- Higher focus on food safety and hygiene complements its packaged product offerings.

- Strong manufacturing capabilities and supply chain readiness position it to scale quickly with market growth.

Peer Group Comparison

| Name of the Company | Total Income

(₹ million) |

Face Value (₹) | EPS (Basic) (₹) | EPS (Diluted) (₹) | P/E | RoNW (%) | NAV

(₹) |

| Orkla Limited | 24,552.4 | 1 | 18.7 | 18.7 | [●] | 13.8 | 135.3 |

| Peer Group | |||||||

| Tata Consumer Products Ltd. | 178,115.5 | 1 | 13.1 | 13.1 | 85.9 | 6.4 | 202.1 |

Key Strategies for Orkla India Limited

Strengthen Core Market Penetration

Orkla India Limited aims to grow in its core southern markets by driving household penetration and increasing product usage. It leverages localised branding, regional campaigns, and predictive selling tools to boost purchase frequency, compete with unorganised players, and improve presence across retail outlets with tailored assortments.

Expand Distribution Reach

Orkla India Limited plans to widen its distribution network by onboarding new distributors in current geographies and entering new rural and semi-urban areas. Strategic mapping at district and town levels enables efficient resource allocation and sharper market execution, supporting deeper coverage and sales growth.

Accelerate Digital and Modern Trade Channels

To capture rising demand via digital platforms, Orkla India Limited is strengthening its presence across modern trade, e-commerce, and quick commerce channels. By enhancing digital distribution capabilities and integrating predictive selling, it aims to improve efficiency and serve tech-savvy, convenience-driven consumers effectively.

Grow International Footprint

Orkla India Limited continues expanding globally, focusing on diaspora-rich regions like the GCC, North America, and emerging markets. Through a phased approach—seed, grow, and commit—it builds sustainable presence, tailoring products like Arabic masalas to local tastes and engaging multi-distributor models for scalability.

Expand and Innovate Product Portfolio

Orkla India Limited focuses on launching innovative convenience foods and expanding blended spice offerings. It develops products like 3-Minute Breakfasts and Asian ranges under new sub-brands to meet evolving preferences, while addressing demand for authentic, easy-to-prepare meals that appeal to both Indian and global consumers.

Enhance Operational and Capital Efficiencies

To improve margins and cash flow, Orkla India Limited is optimising manufacturing, outsourcing low-value products, and digitising supply chains. By reducing process losses, enabling IoT-based production tracking, and streamlining inventory with predictive technologies, it aims to boost profitability and ensure leaner operations across its network.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Orkla India Limited IPO

How can I apply for Orkla India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

Is the Orkla India IPO a fresh issue or an offer for sale?

The IPO is a pure Offer for Sale of up to 2.28 crore shares, with no fresh issue.

Will Orkla India receive any proceeds from the IPO?

No — all proceeds go to selling promoters; the company itself gets no IPO funds.

How many shares are being offered in the IPO?

Up to 22,843,004 equity shares of face value ₹1 each are on offer.

On which stock exchanges will Orkla India list?

Orkla India shares will be listed on both the BSE and NSE.

Who are the promoters selling in this IPO?

Promoters include Orkla ASA and its subsidiaries, mainly Orkla Asia Pacific Pte Ltd.