- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Oswal Cables IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Oswal Cables IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Oswal Cables Limited IPO

Oswal Cables is a prominent manufacturer of high-voltage conductors and cables, offering solutions up to 765 kV for power transmission, renewable energy, railways, and industrial applications. Its diverse product range includes standard and advanced conductors, aerial bunched, low-voltage energy, and railway signalling cables, manufactured up to 4 cores and sizes ranging from 1.5 sq. mm to 1,000 sq. mm. The company adheres to international standards such as ASTM, BIS, and DIN, with products tested by reputed labs. With exports to 28 countries and supplies across 22 Indian states, it operates two modern manufacturing units in Jaipur and Telangana.

Oswal Cables Limited IPO Overview

Oswal Cables Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book-Build Issue, comprising a fresh issue of equity shares worth ₹300 crore and an offer for sale (OFS) of up to 2.22 crore equity shares. The equity shares are proposed to be listed on both the NSE and BSE. Pantomath Capital Advisors Pvt. Ltd. is the Book Running Lead Manager, and MUFG Intime India Pvt. Ltd. is the registrar to the issue. Key details, including the IPO price band, lot size, and issue dates, are yet to be announced. The offer will be a fresh capital-cum-offer for sale, with a face value of ₹5 per share. As per the DRHP status, the company filed with SEBI on Tuesday, September 30, 2025. The promoters of Oswal Cables Ltd. are Puneet Talera and Gaurav Talera, who collectively held 32.26% of the company’s equity prior to the issue. The post-issue promoter holding will be determined based on equity dilution following the IPO. The company’s pre-issue shareholding stands at 18.90 crore equity shares.

Oswal Cables Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹300 crore |

| Offer for Sale (OFS) | 2.22 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 18,90,00,000 shares |

| Shareholding post-issue | TBA |

Oswal Cables IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Oswal Cables Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Oswal Cables Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.58 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.42% |

| Net Asset Value (NAV) | ₹5.74 |

| Return on Equity (RoE) | 27.42% |

| Return on Capital Employed (RoCE) | 30.10% |

| EBITDA Margin | 9.23% |

| PAT Margin | 4.66% |

| Debt to Equity Ratio | 1.09 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements for setting up a new project | 1861.57 |

| Repayment/pre-payment, in part or full, of certain borrowings availed by our Company | 400 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

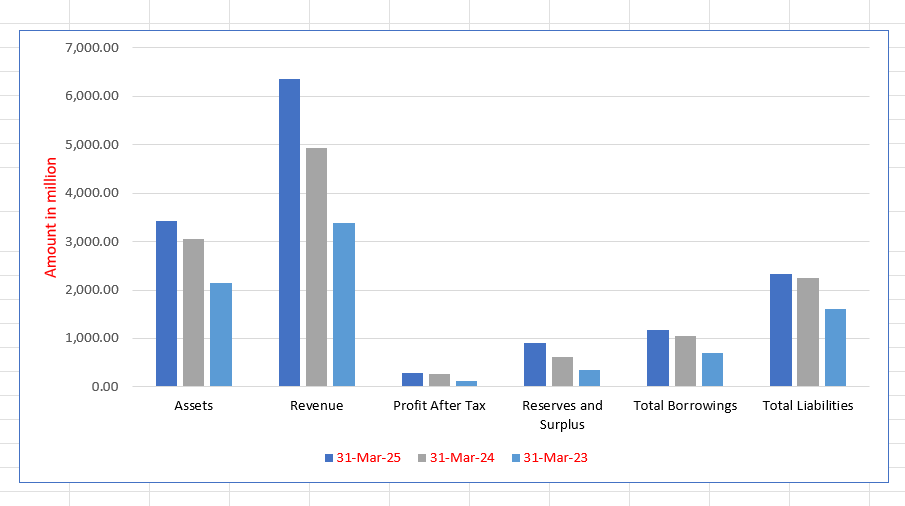

Oswal Cables Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,424.98 | 3,047.28 | 2,137.36 |

| Revenue | 6,354.66 | 4,929.53 | 3,373.72 |

| Profit After Tax | 296.28 | 267.63 | 111.95 |

| Reserves and Surplus | 905.80 | 609.52 | 341.05 |

| Total Borrowings | 1,184.27 | 1,043.21 | 695.50 |

| Total Liabilities | 2,339.18 | 2,257.76 | 1,616.31 |

Financial Status of Oswal Cables Limited

SWOT Analysis of Oswal Cables IPO

Strength and Opportunities

- Established in 1971, with over 50 years in the industry.

- Operates state-of-the-art manufacturing plants in Jaipur and Hyderabad.

- Diverse product portfolio, including cables, conductors, and transformers.

- Strong export presence, particularly in Latin America and Africa.

- Significant order book of INR 1,500 Cr, indicating robust demand.

- Active in renewable energy with solar and wind power initiatives.

- ISO 9001:2000 certified, ensuring adherence to quality standards.

- Focus on product line expansion, adding over 10 products in the last 5 years.

- Beneficiary of government schemes like PM-KUSUM, boosting demand for solar cables.

Risks and Threats

- Limited visibility due to being an unlisted public company.

- Faces intense competition from both organized and unorganized players.

- Potential supply chain disruptions affecting production timelines.

- Exposure to fluctuations in raw material prices.

- Dependency on government policies and infrastructure spending.

- Regulatory challenges in international markets.

- Vulnerability to geopolitical tensions affecting export markets.

- Potential delays in project execution due to EPC segment complexities.

- Environmental regulations impacting manufacturing processes.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Oswal Cables Limited

Oswal Cables Limited IPO Strengths

Comprehensive Product Range and Quality

Oswal Cables Limited offers a comprehensive and customized product portfolio, including conductors and energy/specialty cables up to. Its products adhere to global standards like ASTM and IEC, and are type-tested by accredited labs, validating performance and quality for customer approvals. The company also provides after-sales service and technical support.

High Barriers to Entry

The company benefits from high industry entry and exit barriers, stemming from stringent customer qualification, supplier registration, and audit processes. Achieving approved supplier status with large government and institutional customers, and obtaining costly international certifications (like UL, IEC) for its high-voltage products, creates a strong competitive advantage.

De-risked and Diversified Business Model

Oswal Cables Limited operates a de-risked business model through extensive diversification. Its products serve varied end-use applications (Energy, Renewables, Mobility) and it maintains a broad geographical reach across 28 countries and 22 Indian states/union territories. The company also balances its customer base and sources raw materials from over 100 diverse domestic and global suppliers.

Longstanding Customer and Supplier Relationships

The company has cultivated longstanding relationships with key customers, evidenced by a high rate of repeat business, which contributed over 84% to revenue in Fiscal 2025, ensuring better revenue visibility. It also maintains a well-established supply chain, procuring from over 358 suppliers, with over 70% of raw materials sourced from its top ten long-term partners.

Continuous Financial Performance and Control

Oswal Cables Limited has demonstrated continuous, efficient financial performance, with its EBITDA and PAT recording CAGRs of and over the last three Fiscals. In Fiscal 2025, it achieved the highest RoE of and the highest Fixed Assets Turnover Ratio, demonstrating significant working capital efficiency among its listed peers.

Commitment to Sustainable Manufacturing

The company shows a strong commitment to sustainable manufacturing and ESG standards. It operates a significant of renewable energy capacity (wind and solar) and generates total energy about of its consumption. The company has also implemented an integrated management system for quality, environment (ISO 14001), and occupational health and safety (ISO 45001).

Experienced Management and Promoter Team

Oswal Cables Limited is led by an experienced team with deep domain knowledge and industry tenure spanning over five decades and three generations. The promoters are supported by a Whole-time Director with over 45 years of experience, ensuring a blend of long-term sector expertise, agility, and fresh perspectives for strategic growth.

More About Oswal Cables Limited

Oswal Cables Limited is an integrated manufacturer of high-voltage conductivity products, catering to critical energy infrastructure, including transmission and distribution networks, renewable energy integration, railways, and industrial applications. Over the past five decades, the company has demonstrated robust financial growth, positioning itself among the top ten cable and conductor companies in India by turnover.

Product Portfolio and Capabilities

The company offers a diverse range of products, including:

- Standard and advanced conductors

- Aerial bunched cables

- Low-voltage energy cables

- Railway signalling cables

- Service drop and concentric cables

Oswal Cables manufactures conductors and cables with up to four cores, sizes ranging from 1.5 sq. mm to 1,000 sq. mm, and strand counts from 7 to 127. Its diversified portfolio allows it to serve as a comprehensive solution provider for the energy transmission and distribution industry.

Financial Performance

The company has achieved significant growth in key financial metrics:

- EBITDA and PAT grew at a CAGR of 49.73% and 63.08%, respectively, over the last three fiscals

- Highest RoE of 27.42% and second-highest RoCE of 30.10% in Fiscal 2025 among peers

- Leading Fixed Assets Turnover Ratio and Inventory Turnover Ratio, reflecting strong working capital efficiency

Global and Domestic Presence

Oswal Cables commenced exports in 1992 and now serves 28 countries across five continents. Key regions include North America, Africa, the Middle East, and Asia, with significant involvement in government projects in Mozambique. Domestically, it has supplied products across 22 states and union territories, with exports contributing 34–54% of total revenue over the past three years.

Manufacturing and Sustainability

The company operates manufacturing units in Jaipur (Bagru) and Medak (Telangana), spanning 25,278 square meters, with a combined installed capacity of 28,200 KMPA for cables and 23,000 MTPA for conductors. Its units are equipped for end-to-end manufacturing with flexible machinery to meet diverse customer requirements.

Sustainability initiatives include four windmills (4 MW) and one solar plant (5 MW), alongside rooftop solar panels generating energy exceeding 200% of the company’s consumption. Oswal Cables has also installed solar capacity under the PM-KUSUM scheme to promote renewable energy in agriculture.

Quality and Certifications

The company’s products meet international standards such as ASTM, BIS, BS, DIN, and NFC. Units are ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certified. Several products are type-tested by CPRI, ERDA, and Kinectrics, while the Jaipur unit is UL audited for exports to the USA.

Strategic Expansion

Since its incorporation in 1971, Oswal Cables has continuously expanded its product range, capacities, and geographic presence. Future plans include adding medium voltage underground cables, solar DC cables, and building wires, while further enhancing installed capacity to meet growing domestic and international demand.

Industry Outlook

The Indian wires and cables industry is poised for robust growth, driven by infrastructure development, urbanization, and the expansion of renewable energy projects. This growth trajectory presents significant opportunities for manufacturers like Oswal Cables Limited, which specializes in high-voltage conductors and cables.

Market Size and Growth Projections

- Current Market Size: Valued at approximately USD 9.32 billion in 2024.

- 2025 Forecast: Projected to reach USD 10.01 billion.

- 2032 Projection: Expected to grow to USD 17.08 billion, reflecting a CAGR of 7.94% during the forecast period.

Growth Drivers

- Infrastructure Development: Ongoing urbanization and industrialization are increasing the demand for reliable power transmission and distribution systems.

- Renewable Energy Integration: The push towards renewable energy sources necessitates advanced cables for efficient energy transmission.

- Government Initiatives: Programs like ‘Make in India’ and ‘PM-KUSUM’ are encouraging domestic manufacturing and renewable energy adoption.

- Export Opportunities: Indian manufacturers are benefiting from global shifts, such as increased demand for competitive alternatives to other exporting countries.

Segment-wise Outlook

High-Voltage Cables

- Market Size: The global high-voltage cable market was valued at USD 26.8 billion in 2024 and is projected to reach USD 70.8 billion by 2034, growing at a CAGR of 11.4%.

- Indian Market: India is expected to grow at a CAGR of 14.3% through 2035 in the high-voltage cable market.

Distribution Transformers

- Market Size: Estimated at USD 1.8 billion in 2025, with projections to reach USD 2.76 billion by 2030, growing at a CAGR of 8.98%.

- Demand Drivers: Increasing energy demand in residential areas and investments in power infrastructure are significant contributors.

Strategic Implications for Oswal Cables

Oswal Cables, with its diverse product portfolio—including standard and advanced conductors, aerial bunched cables, low-voltage energy cables, railway signaling cables, and service drop cables—stands to benefit from these industry trends. The company’s focus on high-voltage conductors aligns well with the growing demand in the high-voltage cable segment. Additionally, its commitment to sustainability through renewable energy initiatives positions it favorably in an increasingly eco-conscious market.

How Will Oswal Cables Limited Benefit

- Can capitalize on the growing demand for high-voltage conductors driven by India’s infrastructure and renewable energy expansion.

- Positioned to increase market share in both domestic and international high-voltage cable segments.

- Ability to leverage its diversified product portfolio to serve multiple end-use industries, including energy transmission, railways, and industrial applications.

- Strong manufacturing capabilities enable rapid scaling to meet large orders and evolving customer requirements.

- Sustainability initiatives and renewable energy investments enhance brand reputation and align with government policies.

- Existing export networks allow the company to benefit from rising global demand and competitive positioning.

- Advanced quality certifications and compliance with international standards increase eligibility for high-value tenders.

- Long-term relationships with customers and suppliers reduce business risk and support steady revenue growth.

- Strategic presence near key infrastructure projects provides a competitive advantage in securing contracts.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Oswal Cables Limited

Expanding Capacity and Product Portfolio

Oswal Cables Limited plans to significantly expand its manufacturing capacity for existing and new products, including medium-voltage and solar DC cables. This proposed project will increase aggregate cable capacity to 151,200 KMPA, enabling them to serve new customers and penetrate upcoming growth sectors like renewables and power infrastructure.

Expanding Value Chain Presence

The company intends to expand its value chain by pursuing backward integration. Specifically, it is in the process of acquiring land to set up facilities for in-house processing of aluminum and copper rods, which are key raw materials. This integration will enhance supply chain flexibility, improve manufacturing efficiency, and allow quicker response to market fluctuations.

Strategic Growth Initiatives

Oswal Cables Limited is actively seeking strategic partnerships, joint ventures, and inorganic acquisitions with multinational companies. The goal is to collaborate on product development, technology exchange, and setting up manufacturing facilities. The company also aims to acquire companies in India and overseas markets across Asia, Africa, and Latin America to expand its market presence.

Enhancing Presence in Renewable Energy

The strategy includes enhancing the company’s presence in the renewable energy sector. It plans to leverage its market experience by offering pre-tender technical support and services for solar projects, including design and compliance guidance. This approach aims to build stronger customer partnerships and capitalize on the significant growth in renewable energy capacity, especially in key states where its units are located.

Continued Focus on Sustainability

The company will maintain a continued focus on sustainability by implementing energy-efficient practices and utilizing green building standards for its Proposed Project, including installing rooftop solar panels. It also plans to obtain CBAM-related and ISO 14001 certifications to align with global carbon compliance and enhance its credibility with institutional customers for tender eligibility.

Widening Product and Customer Base

Oswal Cables Limited plans to widen its product and customer/supplier base by adding new offerings like medium-voltage underground cables and solar DC cables. These products will open up new end-use applications in sectors such as urban infrastructure and mobility, allowing the company to deepen existing relationships and forge new ones across its supply chain.

Expanding Geographical Footprint

The company is focused on expanding its geographical footprint, particularly leveraging demand from Africa, South America, North America, and the Middle East. It will identify new customers in existing export markets and develop new relationships in unentered geographies, potentially by setting up local offices, to diversify its revenue and effectively manage regional economic risks.

Focus on Deleveraging and Financial Flexibility

Oswal Cables Limited intends to focus on deleveraging and enhancing financial flexibility by utilizing a portion of its Net Proceeds to repay/pre-pay existing loans, aiming for approximately ₹400.00 million. This move will rationalize its debt-to-equity ratio, reduce debt servicing costs, and improve its financial profile for future investment and growth opportunities.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Oswal Cables Limited IPO

How can I apply for Oswal Cables Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Oswal Cables Limited IPO?

The IPO includes a fresh issue of ₹300 crore and an Offer for Sale of 2.22 crore shares.

Where will Oswal Cables shares be listed?

The equity shares are proposed to be listed on NSE and BSE.

Who are the lead manager and registrar for the IPO?

Pantomath Capital Advisors is the book running lead manager, and MUFG Intime India is the registrar.

How will the IPO proceeds be utilised?

Funds will be used for capital expenditure, repayment of borrowings, and general corporate purposes.

What is the face value of Oswal Cables IPO shares?

The face value of each equity share is ₹5, with the issue price band yet to be announced.