- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Oswal Energies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Oswal Energies IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Oswal Energies Limited

Incorporated in 2013, Oswal Energies Limited is an integrated EPC company and manufacturer of process equipment, offering end-to-end solutions from concept to commissioning. It operates through two divisions: the Project Division, handling EPC services for surface facilities, early production facilities, steel pipelines, gas processing plants, and cross-country pipelines; and the Heavy Engineering Division, focused on manufacturing process equipment, skids, and packages. The company’s Gandhinagar, Gujarat facility serves clients including Frontier Petroleum, Vedanta, Synergia Energy, Sun Petrochemicals, Thermax, Fives India, and Koerting Engineering. Since Fiscal 2023, it completed five Project Division EPC contracts worth ₹3,348.64 million and 21 Heavy Engineering contracts valued at ₹991.83 million.

Oswal Energies Limited IPO Overview

Oswal Energies Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on July 19, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a book-building issue comprising a fresh issue of ₹250.00 crore and an offer for sale (OFS) of up to 0.46 crore equity shares. The company’s equity shares are proposed to be listed on both NSE and BSE. While the registrar for the issue is MUFG Intime India Pvt. Ltd., the book running lead manager has not yet been declared. Key IPO details, including dates, price band, and lot size, are yet to be announced. The promoters include Dixit Jitendra Bokadia, Jayant Babulal Bokadia, Ratan Babulal Bokadia, and their HUF entities. Pre-IPO, promoters hold 100% of shares.

Oswal Energies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹250 crore |

| Offer for Sale (OFS) | 0.46 crore equity share |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,76,65,233 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Oswal Energies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Oswal Energies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹13.80 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 73.27% |

| Net Asset Value (NAV) | ₹25.74 |

| Return on Equity (RoE) | 73.27% |

| Return on Capital Employed (RoCE) | 82.42% |

| EBITDA Margin | 22.14% |

| PAT Margin | 15.94% |

| Debt to Equity Ratio | 0.12 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding long-term working capital requirements of the Company | 1771.3 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

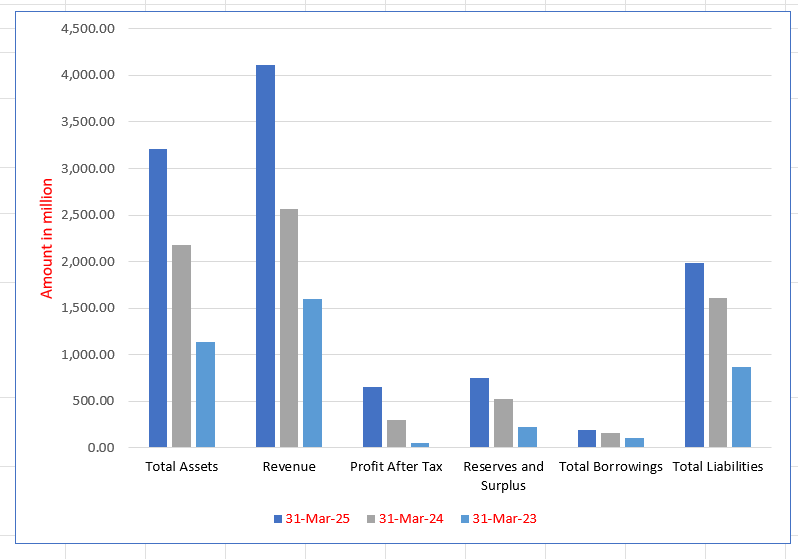

Financial Status of Oswal Energies Limited ( in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 3,214.39 | 2,181.60 | 1,133.91 |

| Revenue | 4,108.74 | 2,560.37 | 1,600.12 |

| Profit After Tax | 657.95 | 300.77 | 53.40 |

| Reserves and Surplus | 750.35 | 525.72 | 225.32 |

| Total Borrowings | 193.15 | 157.33 | 107.31 |

| Total Liabilities | 1,987.39 | 1,612.55 | 872.26 |

SWOT Analysis of Oswal Energies IPO

Strength and Opportunities

- Strong track record in EPC services for upstream and midstream hydrocarbon sectors.

- Proven capability in delivering complex projects in both brownfield and greenfield environments.

- Expertise in modular skids and process packages for various industries.

- Established presence in international markets, including Asia, Europe, and Africa.

- Diverse clientele, including major industry players like Shell, ExxonMobil, and ONGC.

- Focus on clean energy solutions, such as green hydrogen and carbon management.

- Emphasis on safety and quality standards across all projects.

- Strong project management capabilities ensuring on-time delivery.

- Commitment to innovation and continuous improvement in engineering solutions.

Risks and Threats

- Limited presence in downstream oil and gas segments.

- Heavy reliance on the hydrocarbon industry, which may be subject to market fluctuations.

- Potential vulnerability to regulatory changes affecting the oil and gas sector.

- Exposure to geopolitical risks in regions where projects are undertaken.

- Intense competition in the EPC sector, potentially impacting market share.

- High capital expenditure requirements for large-scale projects.

- Dependency on timely project execution to maintain profitability.

- Challenges in adapting to rapidly changing technological advancements.

- Potential environmental concerns related to certain project implementations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Oswal Energies Limited

Oswal Energies Limited IPO Strengths

One-Stop Solution Provider

Oswal Energies Limited provides a comprehensive, one-stop solution for its diverse customer base across various geographies and sectors. As an integrated partner, the company offers an extensive range of specialized services and products, including design, engineering, manufacturing, and project management. This diverse portfolio reduces reliance on individual products and meets different industry need

Strong Project Execution Track Record

Oswal has a proven track record of successfully executing EPC (Engineering, Procurement, and Construction) projects in India’s oil and gas sector. The company has a strong presence in key hydrocarbon basins and has completed complex, multi-disciplinary projects for major clients. This track record demonstrates its engineering capabilities and reinforces its position as a reliable partner in the industry.

Consistent Growth and Prudent Financial Profile

Oswal Energies Limited has a history of consistent financial growth, driven by a strong order book and effective financial management. The company has seen significant growth in revenue and profit margins over the past three fiscal years. Its prudent financial practices, including efficient working capital management, have created a resilient and stable business model.

Timely and High-Quality Project Delivery

Oswal is dedicated to delivering high-quality projects on a turnkey basis, ensuring they are completed on schedule. The company’s in-house manufacturing capabilities, combined with a strong global supply chain and long-standing supplier relationships, give it an advantage in quality control and timely delivery. The company has no record of delivery delays or invoked performance guarantees.

Qualified and Experienced Management Team

Oswal Energies Limited is led by a qualified and experienced management and employee base. The promoters have over 16 years of experience in the EPC industry and heavy equipment manufacturing. The company’s team of engineers and technical specialists brings strong project execution skills and an in-depth understanding of the industry, contributing to its competitive advantage.

More About Oswal Energies Limited

Oswal Energies Limited is an integrated engineering, procurement, and construction (EPC) company and manufacturer of process equipment and packages. With decades of experience and a global presence, the company offers end-to-end solutions from concept to commissioning, serving diverse sectors in the energy segment, including oil and gas, power, and petrochemicals. Its operations are structured into two primary divisions: Project Division and Heavy Engineering Division.

Divisions and Services

Project Division: This division provides customised EPC services across surface facilities, early production facilities, steel pipeline networks, gas processing plants, and cross-country pipelines. Projects typically range from ₹500 million to ₹1,500 million.

Heavy Engineering Division: Focused on manufacturing and supplying process equipment, skids, and packages, this division handles orders ranging from ₹100 million to ₹1,000 million. Products have been supplied domestically and exported to nine countries, including the USA, UAE, Italy, Spain, and South Korea.

Manufacturing Facility: Located in Gandhinagar, Gujarat, the facility has an installed capacity of 2,000 MT annually and maintains ISO 9001:2015, ISO 45001:2018, and ISO 14001:2015 certifications, along with ASME “U” and “U2” stamps, ensuring adherence to the highest quality and safety standards.

Financial and Operational Highlights

- Revenue from Operations (₹ million): Fiscal 2025 – 4,108.74; Fiscal 2024 – 2,560.37; Fiscal 2023 – 1,600.12

- Project Division Contribution: 72.32% in Fiscal 2025

- Heavy Engineering Division Contribution: 27.68% in Fiscal 2025

- Domestic vs Export Revenue: 83.5% domestic, 16.5% export in Fiscal 2025

- Order Book: ₹8,357.70 million as of March 31, 2025

Since Fiscal 2023, Oswal Energies has executed five EPC projects worth ₹3,348.64 million and completed 21 heavy engineering contracts valued at ₹991.83 million. Currently, it has four ongoing EPC projects and three Heavy Engineering projects, with a total value of ₹8,357.70 million.

Leadership and Workforce

Promoters Ratan Babulal Bokadia and Jayant Babulal Bokadia have led the company since 2013, with Dixit Jitendra Bokadia joining in 2018. The senior management team averages over 15 years of experience. As of March 31, 2025, the company employs 285 personnel, including 90 qualified engineers, ensuring strong execution capabilities and technical expertise.

Awards and Achievements

- 2024: Largest upstream project from Cairn (Vedanta Ltd)

- 2023: Maharatna ONGC award for Asia’s first High-Pressure Injection Pilot Project

- 2022: JOILET Refinery project awarded by Exxon Mobil

- Multiple recognitions for safety, excellence, and international acquisitions

Industry Outlook

The Indian Engineering, Procurement, and Construction (EPC) industry, covering oil and gas, power, and petrochemicals, is poised for robust growth. This expansion is driven by infrastructure development, rising energy demand, and industrialisation.

Market Growth and Projections

- EPC Market Size: Estimated at USD 69.28 billion in 2025, projected to reach USD 126.91 billion by 2030, reflecting a CAGR of 12.87%.

- Oil & Gas EPC: Valued at USD 4.79 billion in 2025, with a CAGR of 10.4%.

- Power EPC: Projected to grow from USD 22.4 billion in 2024 to USD 39.1 billion by 2033, at a CAGR of 6.4%.

- Petrochemicals: Market size of USD 58.1 billion in 2024, expected to reach USD 84.4 billion by 2033, growing at a CAGR of 3.8%.

Growth Drivers

- Infrastructure Development: Government initiatives and urbanisation are boosting EPC demand.

- Energy Sector Expansion: Increasing investments in both renewable and conventional energy projects.

- Industrialisation: Rising industrial activities require advanced process equipment and packages.

- Technological Advancements: Adoption of digital tools and automation enhances project efficiency.

Heavy Engineering & Process Equipment

Manufacturers like Oswal Energies Limited are key suppliers of:

- Process Equipment: Essential for oil and gas, power, and petrochemical industries.

- Process Skids: Modular units for efficient installation and operation.

- Process Packages: Integrated solutions for specific industrial applications.

These products form a critical part of the EPC value chain, supporting execution of large-scale projects across domestic and international markets.

How Will Oswal Energies Limited Benefit

- Oswal Energies Limited is well-positioned to capitalise on the strong growth in India’s EPC and heavy engineering sectors, capturing increased project opportunities across oil and gas, power, and petrochemicals.

- Rising infrastructure development and energy sector investments are likely to expand demand for the company’s EPC services, supporting revenue growth.

- The company’s Heavy Engineering Division can benefit from the growing requirement for advanced process equipment, skids, and packages, both domestically and internationally.

- Technological advancements in project execution and automation enhance Oswal Energies’ operational efficiency and competitiveness.

- A strong order book and established relationships with key clients provide stability and recurring business potential.

- Export opportunities to international markets allow the company to diversify revenue streams and gain global exposure.

- Skilled workforce and experienced management enable timely and high-quality project delivery, positioning the company to secure larger and more complex contracts.

- Overall industry growth and supportive government initiatives offer long-term expansion prospects and increased market share potential.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ mn) |

Basic EPS | P/E | RoNW (%) | NAV (₹) |

| Oswal Energies Limited | 10.00 | 4,108.74 | 13.80* | [●] | 73.27% | 25.74 |

| Peer Groups | ||||||

| The Anup Engineering Limited | 10.00 | 7,327.86 | 59.25 | 48.48 | 20.75% | 305.52 |

| Deep Industries Limited | 5.00 | 4,269.93 | (14.08) | (33.30) | (4.83)% | 284.31 |

| Lloyds Engineering Works Limited | 1.00 | 8,457.41 | 0.89 | 9.19 | 20.39% | 5.56 |

| Patels Airtemp (India) Limited | 10.00 | 3,878.16 | 30.18 | 15.98 | 11.00% | 287.79 |

Key Strategies for Oswal Energies Limited

Focus on Modular Engineering Solutions

Oswal Energies Limited aims to enhance its focus on modular engineering solutions, specifically modular process skids. These compact, adaptable, and cost-efficient units offer portability, faster installation, and reduced on-site execution time. By increasing contributions from these solutions, the company intends to sustain and grow its business.

Diversify into Emerging Energy Sectors

The company plans to strategically expand into emerging energy domains, including hydrogen production, waste-to-energy, and thermal energy storage. It also seeks to leverage its expertise to secure EPC projects in the oil and gas downstream sector. This diversification aligns with global energy transition goals and favorable government policies.

Forge Strategic Partnerships

Oswal aims to develop and maintain long-term alliances and partnerships with technology partners. These collaborations enhance the company’s technological capabilities, allowing it to pre-qualify for complex EPC projects. By leveraging its partners’ expertise, Oswal can access new opportunities and strengthen its competitive position.

Expand Geographical Footprint

The company intends to expand its operations both within India and internationally. This includes exploring new opportunities for EPC projects and supplying heavy equipment to new regions, such as Russia and Africa. By leveraging its cost-effective and efficient execution capabilities, Oswal aims to capture significant revenue from these new geographical areas.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Oswal Energies Limited IPO

How can I apply for Oswal Energies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Oswal Energies IPO?

The IPO comprises a fresh issue of ₹250 crore and an offer for sale of 46 lakh shares.

What is the purpose of the IPO?

Proceeds from the fresh issue will fund long-term working capital, while the OFS proceeds go to selling shareholders.

On which exchanges will the shares be listed?

Oswal Energies IPO shares are proposed to be listed on the NSE and BSE mainboard.

Who are the promoters of Oswal Energies Limited?

Promoters include Dixit Jitendra Bokadia, Jayant Babulal Bokadia, Ratan Babulal Bokadia, and their HUF entities.