- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Oswal Pumps IPO

₹14/24 shares

Minimum Investment

IPO Details

13 Jun 25

17 Jun 25

₹14

24

₹584 to ₹614

NSE, BSE

₹1 Cr

20 Jun 25

Oswal Pumps IPO Timeline

Bidding Start

13 Jun 25

Bidding Ends

17 Jun 25

Allotment Finalisation

18 Jun 25

Refund Initiation

19 Jun 25

Demat Transfer

19 Jun 25

Listing

20 Jun 25

Oswal Pumps Limited

Founded in 2003, Oswal Pumps Limited manufactures and distributes a wide range of pumps for domestic, agricultural, and industrial use, including solar, submersible, monoblock, pressure, and sewage pumps, along with electric motors, winding wires, cables, and panels. By August 31, 2024, it had completed 26,270 turnkey solar pumping system orders under the PM-KUSUM Scheme across multiple states. Its manufacturing facility in Karnal, Haryana spans 41,076 square meters. The company’s distributor network grew from 473 in 2022 to 636 in 2024, and it exports to 17 countries in Asia-Pacific, the Middle East, and North Africa.

Oswal Pumps Limited IPO Overview

The Oswal Pumps IPO is being conducted through a book building process. It includes a fresh issue worth ₹1,000 crore along with an offer for sale of 1.13 crore shares. The subscription period for the IPO opens on June 13, 2025, and closes on June 17, 2025. The allotment is expected to be finalized on June 18, 2025. Following this, Oswal Pumps shares are planned to be listed on both the BSE and NSE, with a tentative listing date set for June 20, 2025. The price band for the IPO is yet to be announced. The book running lead managers for the IPO are IIFL Capital Services Limited, Axis Capital Limited, CLSA India Private Limited, JM Financial Limited, and Nuvama Wealth Management Limited. MUFG Intime India Private Limited (Link Intime) is appointed as the registrar for the issue. For more detailed information, refer to the Oswal Pumps IPO Draft Red Herring Prospectus (DRHP).

Oswal Pumps Limited IPO Details

| Particulars | Details |

| IPO Date | 13 June 2025 to 17 June 2025 |

| Listing Date | 20 June 2025 |

| Face Value | ₹1 per share |

| Issue Price Band | ₹ TBD per share |

| Lot Size | TBD Shares |

| Fresh Issue | ₹1000 crore |

| Offer for Sale | 1,13,12,000 shares of ₹1 (aggregating up to ₹[.] Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE BSE |

| Share Holding Pre Issue | 9,94,82,300 shares |

| Share Holding Post Issue | TBD |

Oswal Pumps Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Oswal Pumps Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | TBD | TBD | TBD |

| Retail (Max) | TBD | TBD | TBD |

| HNI (Min) | TBD | TBD | TBD |

Oswal Pumps Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue |

Oswal Pumps Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 9.82 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 88.73% |

| Net Asset Value (NAV) | 16.10 |

| Return on Equity | 88.73% |

| Return on Capital Employed (ROCE) | 81.85% |

| EBITDA Margin | 19.79% |

| PAT Margin | 12.83% |

| Debt to Equity Ratio | 0.42 |

Objectives of the Proceeds

- Funding certain capital expenditure of our Company: ₹893.692 million

- Investment in our wholly-owned subsidiary, Oswal Solar, in the form of debt or equity, for funding the setting up of new manufacturing units at Karnal, Haryana: ₹4,191.633 million

- Pre-payment/repayment, in part or full, of certain outstanding borrowings availed by our Company: ₹2,350.004 million

- Investment in our wholly-owned subsidiary, Oswal Solar, in the form of debt or equity, for repayment/prepayment of borrowings, in full or part, of Oswal Solar: ₹260.005 million

- General corporate purposes

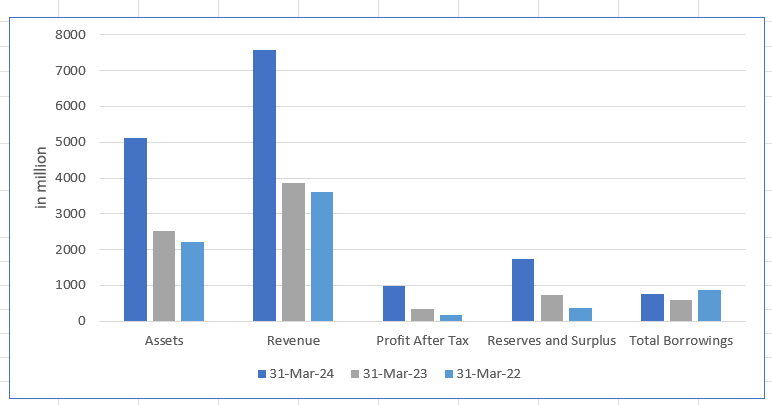

Key Financials (in ₹ million)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 5112.83 | 2522.98 | 2218.37 |

| Revenue | 7585.71 | 3850.36 | 3603.84 |

| Profit After Tax | 976.65 | 341.99 | 169.29 |

| Reserves and Surplus | 1734.19 | 732.18 | 378.19 |

| Total Borrowings | 754.22 | 592.84 | 875.40 |

SWOT Analysis of Oswal Pumps IPO

Strength and Opportunities

- Vertically integrated manufacturing enhances cost control and quality.

- Strong presence in major agricultural states like Haryana, Maharashtra, Uttar Pradesh, and Rajasthan.

- Beneficiary of government schemes like PM-KUSUM, boosting demand for solar pumps.

- Expanding export footprint to 17 countries in Asia-Pacific, Middle East, and North Africa.

Risks and Threats

- High customer concentration risk, with ~71% of sales from two customers.

- Operations are working capital intensive, with a high inventory holding period.

- Susceptibility to raw material price volatility affecting profitability.

- Intense competition from both organized and unorganized players in the pump industry.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Oswal Pumps Limited

Oswal Pumps Limited IPO Strengths

- Among India’s largest, fastest-growing solar pump suppliers under PM Kusum Scheme, driving sustainable growth through eco-friendly technology.

- The company follows a vertically integrated model, manufacturing pumps, solar modules, and BOS components in-house for cost efficiency.

- The company offers a diverse portfolio of pumps, motors, and solar modules under the ‘Oswal’ brand, tailored to varied specifications and end-user needs across agriculture, residential, and industrial sectors, helping expand market reach and build strong brand recall.

- The company holds a strong presence in Haryana and growing reach across key agricultural states in India.

- Extensive network of 636 distributors and institutional ties driving strong and diversified customer outreach.

- Experienced promoters and leadership team with deep industry, legal, energy, and financial expertise.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue FY24 (₹ million) | EPS Basic (₹) | NAV (₹) | P/E (x) | RoNW (%) |

| Oswal Pumps Limited | 1.00 | 7,585.71 | 9.82 | 16.10 | NA | 88.73% |

| Peer Groups | ||||||

| Kirloskar Brothers Limited | 2.00 | 40,011.99 | 43.84 | 216.47 | 37.57 | 22.30% |

| Shakti Pumps (India) Limited | 10.00 | 13,707.39 | 76.91 | 377.19 | 57.08 | 24.15% |

| WPIL Limited | 1.00 | 16,644.04 | 17.72 | 127.56 | 25.53 | 18.78% |

| KSB Limited | 2.00 | 22,472.38 | 59.97 | 74.81 | 14.94 | 17.07% |

| Roto Pumps Limited | 2.00 | 2,744.96 | 12.55 | 61.88 | 45.29 | 21.95% |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Oswal Pumps Limited IPO

How can I apply for Oswal Pumps Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When will the Oswal Pumps IPO open for subscription?

The Oswal Pumps IPO opens on 13 June 2025 and closes on 17 June 2025.

What is the total issue size of the Oswal Pumps IPO?

The IPO comprises a fresh issue of ₹1,000 crore and an offer for sale of 1.13 crore shares.

On which stock exchanges will Oswal Pumps be listed?

Oswal Pumps shares will be listed on both the BSE and NSE.

Who are the lead managers for the Oswal Pumps IPO?

Lead managers include IIFL, Axis Capital, CLSA India, JM Financial, and Nuvama Wealth Management.