- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pace Digitek IPO

₹14,144/68 shares

Minimum Investment

IPO Details

26 Sep 25

30 Sep 25

₹14,144

68

₹208 to ₹219

NSE, BSE

₹819.15 Cr

06 Oct 25

Pace Digitek IPO Timeline

Bidding Start

26 Sep 25

Bidding Ends

30 Sep 25

Allotment Finalisation

01 Oct 25

Refund Initiation

03 Oct 25

Demat Transfer

03 Oct 25

Listing

06 Oct 25

Pace Digitek Limited

Incorporated in 2007, Pace Digitek Limited is a multi-disciplinary solutions provider primarily focused on telecom passive infrastructure. Through its subsidiary Lineage, it delivers power management and solar solutions, including lithium-ion battery systems for telecom applications. The company is also venturing into Battery Energy Storage Systems (BESS). Its business spans three verticals—Telecom, Energy, and ICT—offering products and turnkey services such as telecom tower erection, solarisation, rural electrification, and smart technology solutions. Pace Digitek operates pan-India and internationally, with a presence in Myanmar and Africa.

Pace Digitek Limited IPO Overview

Pace Digitek IPO is a book-built issue valued at ₹819.15 crores, consisting entirely of a fresh issue of 3.74 crore shares. The subscription opens on September 26, 2025, and closes on September 30, 2025, with allotment expected on October 1 and listing on BSE and NSE scheduled for October 6, 2025. The price band is set between ₹208 and ₹219 per share, with a lot size of 68 shares. Retail investors can apply with a minimum investment of ₹14,892, while sNII and bNII categories require investments of ₹2,08,488 and ₹10,12,656 respectively.The IPO was filed with SEBI on April 3, 2025. The company is promoted by Maddisetty Venugopal Rao, Padma Venugopal Maddisetty, Rajiv Maddisetty, and Lahari Maddisetty. The promoters held 84.07% of the company’s shares before the issue. The post-issue shareholding will reflect the equity dilution, which can be calculated by subtracting the post-issue shareholding from the pre-issue figure

Pace Digitek Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 3,74,04,018 shares (aggregating up to ₹819.15 Cr)

Offer for Sale (OFS): NA |

| IPO Dates | 26 September 2025 to 30 September 2025 |

| Price Bands | ₹208 to ₹219 per share |

| Lot Size | 68 Shares |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 17,84,42,280 shares |

| Shareholding post -issue | 21,58,46,298 shares |

Pace Digitek IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 68 | ₹14,892 |

| Retail (Max) | 13 | 884 | ₹1,93,596 |

| S-HNI (Min) | 14 | 952 | ₹2,08,488 |

| S-HNI (Max) | 67 | 4,556 | ₹9,97,764 |

| B-HNI (Min) | 68 | 4,624 | ₹10,12,656 |

Pace Digitek Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Pace Digitek Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 14.63 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 40.67% |

| Net Asset Value (NAV) | 35.97 |

| Return on Equity | 40.53% |

| Return on Capital Employed (ROCE) | 40.85% |

| EBITDA Margin | 17.41% |

| PAT Margin | 9.44% |

| Debt to Equity Ratio | 0.87 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirement for investment in our Subsidiary, Pace Renewable Energies Private Limited, for setting up battery energy storage systems (BESS) for a project awarded by the Maharashtra State Electricity Distribution Company Limited (MSEDCL) | 6300 |

| General corporate purposes* | [●] |

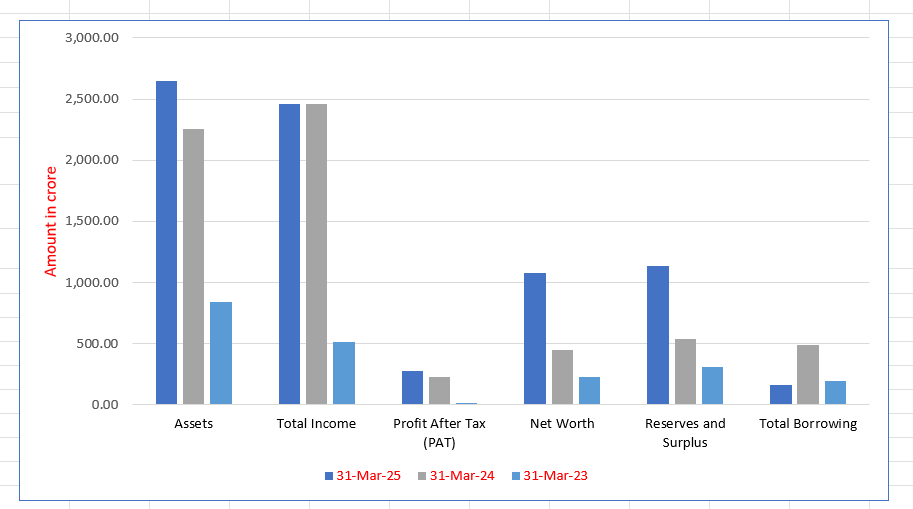

Pace Digitek Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,648.96 | 2,253.87 | 840.15 |

| Total Income | 2,462.20 | 2,460.27 | 514.66 |

| Profit After Tax (PAT) | 279.10 | 229.87 | 16.53 |

| Net Worth | 1,080.33 | 450.06 | 228.79 |

| Reserves and Surplus | 1,134.21 | 534.58 | 313.31 |

| Total Borrowing | 160.70 | 493.19 | 192.11 |

Financial Status of Pace Digitek Limited

SWOT Analysis of Pace Digitek IPO

Strength and Opportunities

- Extensive experience in telecom power and renewable energy sectors.

- Strong global presence in India, Africa, Myanmar, Bangladesh, and the Philippines.

- Comprehensive product portfolio including lithium-ion batteries and hybrid DC power systems.

- Proven track record with over 100,000 products serviced and 25,000+ O&M sites managed.

- ISO-certified manufacturing facilities spanning over 250,000 sqft.

- Strategic acquisition of Lineage Power enhancing DC power system capabilities.

- Engagement in government projects like BharatNet Phase-II, indicating strong public sector ties.

- Diversification into smart city solutions, including surveillance and agritech.

- Robust management team with over 20 years of industry experience.

Risks and Threats

- Declining profitability and net cash accruals below ₹100 crore.

- Stretch in working capital cycle affecting liquidity.

- Vulnerability to geopolitical and climatic challenges in project areas.

- Dependence on telecom sector, leading to sector-specific risks.

- Limited diversification in revenue streams beyond telecom and energy sectors.

- Exposure to foreign exchange risks due to international operations.

- Potential delays in project execution due to logistical challenges.

- Competition from established players in the energy and telecom infrastructure sectors.

- Regulatory changes in telecom and energy sectors could impact operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Pace Digitek Limited IPO

Pace Digitek Limited IPO Strengths

Comprehensive Solutions for India’s Evolving Telecom Infrastructure

Pace Digitek Limited is a fully integrated, end-to-end solutions provider in the telecom tower sector, offering intelligent power systems, turnkey project execution, and lifecycle services. With a strong foothold in passive infrastructure—comprising ~70% of wireless network setup costs—and growing EPC presence, it has adapted to the evolving demands of India’s rapidly expanding telecom and optical fibre markets

Diversified Operations with a Robust Order Book

Pace Digitek Limited began with passive equipment manufacturing and has grown into a multi-segment player across telecom, energy, ICT, and solarisation projects. With backward integration, strategic acquisitions, and expansion into DC systems and ICT, the company now boasts a strong, diverse order book of ₹63,424 million as of September 30, 2024, reflecting sustained revenue growth and operational resilience.

Technically Driven Leadership with Skilled In-House Expertise

Pace Digitek Limited is steered by an experienced Board and technocrat Promoter Maddisetty Venugopal Rao, backed by a qualified senior management team and 1,189 technically proficient employees. With a dedicated R&D centre and skilled in-house project teams, the company drives innovation, enhances execution efficiency, reduces third-party reliance, and maximises returns through its integrated, technically advanced operational structure.

State-of-the-Art Manufacturing Facilities with Growing Production Capabilities

Pace Digitek Limited, through its subsidiary Lineage, operates three advanced manufacturing units in Bengaluru, Karnataka, spanning 200,000 sq. ft. These ISO and CMMi Level 3 certified facilities produce passive infra equipment, lithium-ion battery systems, and soon, BESS. Despite current underutilisation, production has steadily increased, reflecting improved operational efficiency and readiness for future capacity expansion.

Strong Financial Track Record with Consistent Growth

Pace Digitek Limited has demonstrated robust financial and operational performance, marked by steady growth in revenue, EBITDA, and profit after tax over the last three fiscals. With rising margins, improved EPS, and healthy returns on equity and capital employed, the company’s strategic efficiency reflects its ability to sustain profitability while maintaining a solid financial foundation.

More About Pace Digitek Limited

Pace Digitek Limited is a seasoned, multi-disciplinary solutions provider with a primary focus on the telecom passive infrastructure (Passive Infra) sector. With pan-India operations and an international footprint across Myanmar and Africa, the company has steadily evolved from a manufacturer of passive electrical equipment into a diversified infrastructure player.

Evolution and Expansion

- Initially launched as a passive electrical equipment manufacturer, Pace Digitek has since diversified into products, projects, operations & maintenance (O&M), and customised services.

- In FY 2014, it acquired GE Power Electronics India’s business and rights over the ‘Lineage Power’ brand, enabling the full-scale manufacture of direct current systems for telecom applications.

- Since FY 2023, the company has backward integrated product supply via its subsidiary, Lineage Power Private Limited.

- It has been involved in solarizing telecom towers, including the supply and O&M of lithium-ion battery systems, since FY 2013.

Business Verticals

Pace Digitek’s operations are segmented into:

- Telecom:

- Manufacturing passive equipment

- O&M for telecom towers and optical fibre cable (OFC)

- Turnkey projects including tower and OFC network erection

- Energy:

- Solar projects on a build, own and operate model

- EPC-based rural electrification

- Lithium-ion battery system manufacturing

- ICT:

- Smart surveillance systems, classrooms, and kiosks for agriculture

Product & Service Offerings

- Products:

Through Lineage:

- Power management systems, hybrid DC systems, solar charge units, lithium-ion batteries

- Emerging focus on Battery Energy Storage Systems (BESS)

- Services:

- Installation, commissioning, AMC, lifecycle management, and telecom O&M

- Projects:

- Turnkey solutions in telecom, transmission, ICT, and solar sectors

Manufacturing Infrastructure

- Three facilities in Karnataka (two operational, one upcoming by April 2025), covering 200,000 sq. ft.

- ISO and CMMi Level 3 certified for quality, security, and environmental compliance

Clientele and Financial Growth

- Strong client retention: Top 10 customers averaged 10 years of engagement

- Revenue rose from ₹4,056.98 million (FY 2022) to ₹24,344.89 million (FY 2024)

- Profit after tax grew from ₹115.02 million to ₹2,298.71 million over the same period

Leadership and Workforce

Backed by experienced promoters and a dynamic Board, Pace Digitek employs 1,296 permanent staff, including an 18-member R&D team as of February 28, 2025.

Industry Outlook

India’s infrastructure landscape is undergoing a significant transformation, driven by robust growth across sectors such as telecom, energy storage, and information and communication technology (ICT). This evolution presents substantial opportunities for companies like Pace Digitek Limited, which operates at the intersection of these dynamic industries.

Telecom Passive Infrastructure

India’s telecom sector is experiencing rapid expansion, fueled by the proliferation of 5G technology, increased data consumption, and the digitalization of rural areas. The government’s initiatives, including the “Digital India” program, aim to enhance connectivity nationwide, necessitating extensive development of telecom towers and optical fiber networks. This surge in infrastructure demands robust passive components, such as power management systems and hybrid DC solutions, aligning with Pace Digitek’s product offerings.

Lithium-Ion Battery and Energy Storage

The Indian lithium-ion battery market is poised for substantial growth, with projections estimating an increase from USD 5.78 billion in 2025 to USD 16.09 billion by 2030, reflecting a CAGR of 22.72% . This growth is driven by the rising adoption of electric vehicles, the integration of renewable energy sources, and the need for efficient energy storage solutions. The discovery of domestic lithium reserves and government incentives further bolster this sector, providing a conducive environment for manufacturers like Pace Digitek to expand their battery production capabilities.

Solar Energy

India’s commitment to renewable energy is evident through initiatives like the Pradhan Mantri Surya Ghar Muft Bijli Yojana, which aims to provide solar power to approximately 1 crore households . The country’s solar energy market is projected to reach 500 GW of non-fossil power capacity by 2030 . This ambitious target underscores the demand for solar modules, lithium-ion batteries, and related infrastructure, areas where Pace Digitek has established expertise.

Information and Communication Technology (ICT)

India’s ICT sector is expanding rapidly, with the enterprise ICT market expected to grow at a CAGR of over 17% from 2023 to 2028, reaching more than USD 354 billion . This growth is propelled by digital transformation initiatives, increased cloud adoption, and the proliferation of smart solutions. Pace Digitek’s involvement in ICT projects, including smart classrooms and surveillance systems, positions it to capitalize on this upward trend

How Will Pace Digitek Limited Benefit

- Pace Digitek stands to benefit from India’s booming telecom sector, leveraging its strong capabilities in passive infrastructure, tower erection, and OFC network solutions.

- With growing demand for 5G and rural connectivity, its power management systems and hybrid DC units are well-positioned for high adoption.

- Rising lithium-ion battery demand supports the company’s battery manufacturing and solar telecom tower projects, especially after its acquisition of Lineage Power.

- Expansion into solar energy aligns with national goals, boosting prospects for its solar modules and EPC rural electrification ventures.

- As the ICT sector accelerates, its smart classroom, surveillance, and agricultural kiosk projects are poised for scale.

- Its strong backward integration, through Lineage Power, enhances control over supply chains and quality.

- High client retention, revenue growth (6x in two years), and a certified, scalable manufacturing base further strengthen its competitive edge.

- Ongoing investment in R&D and pan-India presence ensure sustained innovation and market responsiveness.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ in Millions) | Basic EPS (₹) | P/E | RoNW (%) | NAV (₹) |

| Pace Digitek Limited | 2 | 24,344.89 | 14.63 | [●] | 40.67 | 35.97 |

| Peer Groups | ||||||

| HFCL Limited | 1 | 44,650.50 | 2.33 | 34.86 | 8.34 | 27.95 |

| Exicom Tele-Systems Limited | 10 | 10,195.98 | 6.70 | 21.88 | 8.86 | 75.65 |

| Bondada Engineering Limited | 10 | 8,007.22 | 23.14 | 16.37 | 27.55 | 83.98 |

Key Strategies for Pace Digitek Limited

Expansion into Battery Energy Storage Systems (BESS)

Pace Digitek Limited, through its subsidiary Lineage, aims to manufacture lithium-ion-based BESS solutions with global-standard certifications, addressing India’s rising renewable energy demands. The company is setting up a 2.5GWh facility in Karnataka, aligned with the country’s sustainable infrastructure development initiatives.

Establishment of Advanced BESS Manufacturing Infrastructure

Pace Digitek is developing a state-of-the-art BESS plant in Karnataka, featuring 12-rack containerized lithium iron phosphate systems. Equipped with PCS, EMS, and multiple safety features, the facility will deliver high-efficiency, long-cycle BESS units tailored for India’s renewable energy and grid stability requirements.

Diversification and Geographical Expansion in Infrastructure Services

Pace Digitek intends to enhance telecom and solar services across India, entering regions like Maharashtra and Jammu & Kashmir. It plans to undertake solar pump projects, participate in the Indian Railways’ KAVACH Project, and expand Passive Infra and BESS offerings in African markets.

Focus on Energy Sector Growth and Backward Integration

To boost energy sector revenue, Pace Digitek targets solar power projects with integrated energy storage. It plans to manufacture solar modules and cells in-house, ensuring complete control over its supply chain and long-term participation in large-scale renewable infrastructure projects under long-term operating models.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Pace Digitek Limited IPO

How can I apply for Pace Digitek Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size and structure of Pace Digitek's IPO?

The IPO comprises a fresh issue of equity shares aggregating up to ₹819.15 crore, with no offer-for-sale component.

How will the IPO proceeds be utilized?

Approximately ₹630 crore will fund capital expenditure for battery energy storage systems and general corporate purposes.

What is the face value of the shares, and where will they be listed?

Each share has a face value of ₹2 and will be listed on NSE and BSE.

What are the investor reservation percentages in the IPO?

The allocation is 50% for qualified institutional buyers, 15% for non-institutional investors, and 35% for retail investors.

Who are the lead manager and registrar for the IPO?

Unistone Capital is the sole book-running lead manager, and MUFG Intime India is the registrar.