- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pair Trading

By HDFC SKY | Updated at: May 13, 2025 03:24 PM IST

Summary

Pair trading strategy involves taking long and short positions simultaneously in two securities with a high positive correlation. This strategy is based on making profits regardless of market direction by buying shares of one company and simultaneously selling stocks of another with similar characteristics, fundamentals and historical correlation.

han expected and the stock prices may even move in the opposite direction if the fundamentals change drastically. In such cases, the strategy may not work as expected.

Moreover, it is difficult to identify the pairs or stocks with such a high level of statistical correlation between them.

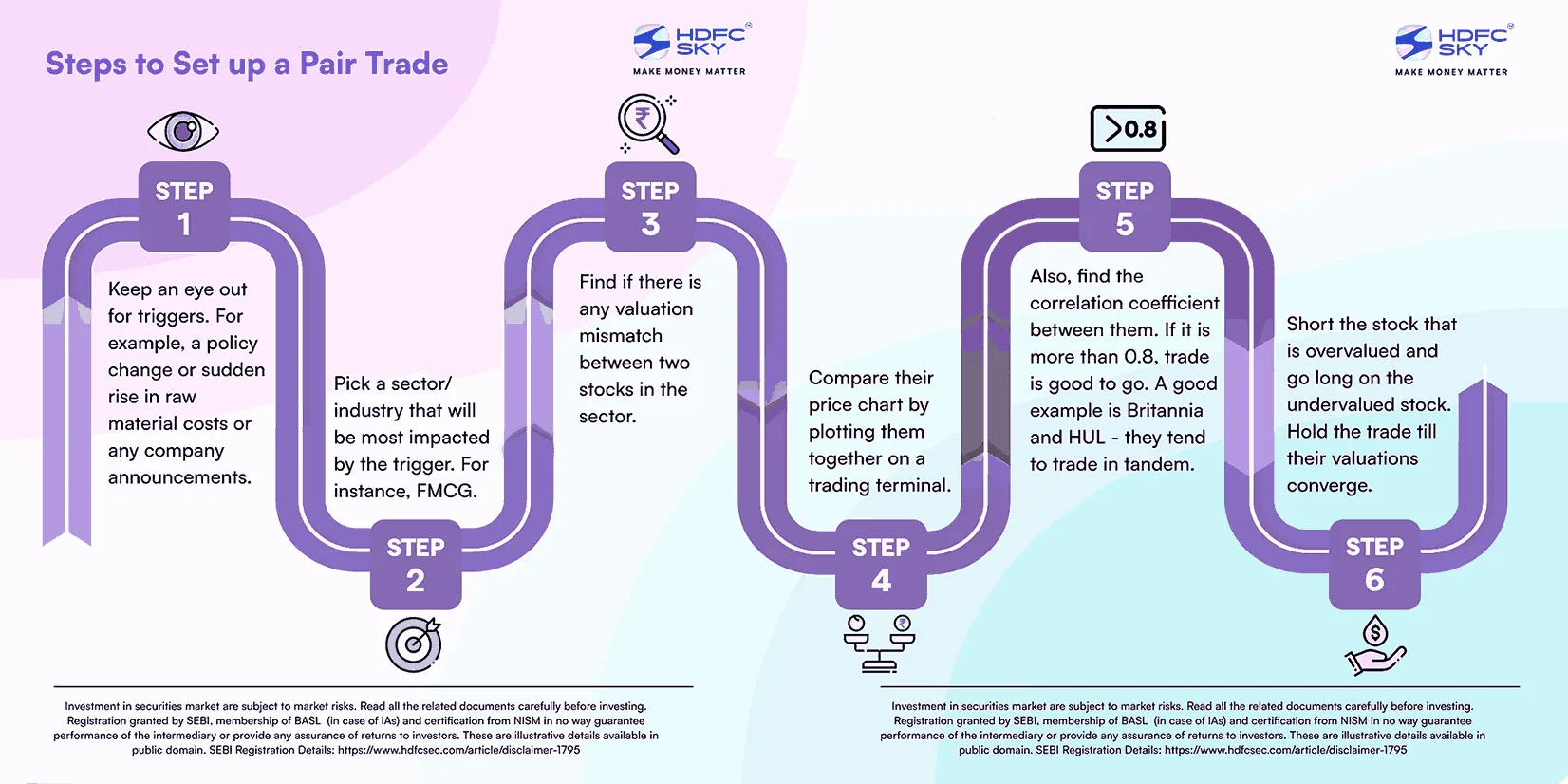

The two securities or stocks to trade in the pair trading strategy should have similar characteristics and high correlation, which is the key driver of profit in this strategy. One of the two stocks should be underperforming and the other should be outperforming. Moreover, one of the stocks must be undervalued and another overvalued.

How does a Pair Trading strategy work?

Suppose A and B are two companies in the same sector/industry and have a high correlation. The share prices of both the companies demonstrate trend movements in the same direction. The growth prospects of the sector are high. However, the shares of A seem undervalued and have underperformed the industry average, while the shares of B are trading above the industry average and are overvalued.

Here, a trader using the pair strategy will take a long position on the undervalued shares, which is A, on expectations that the price will rise and will simultaneously short sell the overvalued stock, which is B, hoping that the price will correct. This helps the trader to maintain a market-neutral position and gain profit regardless of the market direction.

The rationale behind this strategy is to minimize the risk of potential loss from either one of the stocks if it reverses its price action in an unfavorable direction. Here, it is believed that when there is a divergence between two stocks that have a high correlation, their prices will eventually revert and move in their original trend in sync with each other.

In the pair trade strategy, the trader can, at first, make profits from buying the undervalued stock and selling the overvalued stock. When the prices of the stocks go back to their original or historical trend of correlation, the trader can then profit from the convergence of the prices.

As mentioned earlier, it is important to have a high statistical correlation between the pairs – the two stocks. This value is measured between -1 and 1. Most pair traders look for a correlation of at least a positive 0.80.

There are certain reasons behind such behavior of the stock prices. Both the stocks are from the same sector/industry and possess similar fundamentals. Hence, they tend to move in line with each other and in line with the sectoral trend. However, when the price of one stock diverges from the trend or moves in a different direction, it is likely to be because of company-specific reason and this divergence would be short-lived. Ultimately, after some time, both the stocks return to their original long-term trend and move in the same direction in sync with each other.

Advantages & Disadvantages

Like other trading strategies, pair trading also has its own advantages and disadvantages.

One of the biggest advantages of this strategy is that it is a market-neutral strategy and hence, traders can make profits without worrying about the direction of the overall broader market.

The trader gains when the pair performs on the expected lines, and he is also able to minimize the potential losses. The stocks bought and sold are from the same sector. The two opposite positions compensate each other and act as a hedging strategy that benefits from any sharp price movements in either direction.

It is important to note that while using the pair trading strategy, the amount or value at which the shares are bought should be equal to that of other shares sold. Here, the volumes are not taken into consideration for trade.

There are also certain risks in the strategy. The divergence in the stock prices may last longer than expected and the stock prices may even move in the opposite direction if the fundamentals change drastically. In such cases, the strategy may not work as expected.

Moreover, it is difficult to identify the pairs or stocks with such a high level of statistical correlation between them.