- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pajson Agro India IPO

₹1,34,400/1,200 shares

Minimum Investment

IPO Details

11 Dec 25

15 Dec 25

₹1,34,400

1,200

₹112 to ₹118

BSE

₹74.45 Cr

18 Dec 25

Pajson Agro India IPO Timeline

Bidding Start

11 Dec 25

Bidding Ends

15 Dec 25

Allotment Finalisation

16 Dec 25

Refund Initiation

17 Dec 25

Demat Transfer

17 Dec 25

Listing

18 Dec 25

Pajson Agro India Limited

Incorporated in 2021, Pajson Agro India Limited processes raw cashew nuts into cashew kernels and sells them domestically and internationally. The company markets bulk and retail products under its white-label brand Royal Mewa. By-products like cashew husk and shells are sold for industrial and agricultural use. Its 295,990 sq. ft. processing facility in Visakhapatnam, Andhra Pradesh, handles shelling, peeling, cleaning, grading, and packaging. Operating in 18 states and 3 Union Territories, the company employs 465 permanent staff. It leverages promoter expertise, modern machinery, and strong distribution networks to ensure product quality and market reach.

Pajson Agro India Limited IPO Overview

Pajson Agro India IPO is a book building issue aggregating up to ₹74.45 Crore, entirely through a fresh issue of 63,09,600 shares. The IPO opens for subscription on 11 December 2025 and closes on 15 December 2025. Retail investors can apply in lots of 2,400 shares, requiring a minimum investment of ₹2,83,200, while HNIs can apply in multiples of 3 lots (3,600 shares) and above. The allotment is expected on 16 December 2025, with refunds and demat credits on 17 December 2025. The IPO will list on BSE SME on 18 December 2025. Smart Horizon Capital Advisors Pvt. Ltd. is the lead manager, Bigshare Services Pvt. Ltd. is the registrar, and Giriraj Stock Broking Pvt. Ltd. is the market maker.

Pajson Agro India Limited IPO Details

| Particulars | Details |

| IPO Date | 11 December 2025 to 15 December 2025 |

| Listing Date | 18 December 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹112 to ₹118 per share |

| Lot Size | 1,200 Shares |

| Total Issue Size | 63,09,600 shares (aggregating up to ₹74.45 Cr) |

| Fresh Issue | 63,09,600 shares (aggregating up to ₹74.45 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 1,74,99,995 shares |

| Share Holding Post Issue | 2,38,09,595 shares |

| Market Maker Portion | 3,57,600 shares |

Pajson Agro India Limited IPO Reservation

| Investor Category | Shares Offered |

| Market Maker | 3,57,600 (5.67%) |

| QIB | 29,54,400 (46.82%) |

| NII (HNI) | 9,00,000 (14.26%) |

| Retail | 20,97,600 (33.24%) |

| Total | 63,09,600 (100%) |

Pajson Agro India Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 2 | 2,400 | ₹2,83,200 |

| Retail (Max) | 2 | 2,400 | ₹2,83,200 |

| S-HNI (Min) | 3 | 3,600 | ₹4,24,800 |

| S-HNI (Max) | 7 | 8,400 | ₹9,91,200 |

| B-HNI (Min) | 8 | 9,600 | ₹11,32,800 |

Pajson Agro India Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 85% |

| Post-Issue | 62.47% |

Pajson Agro India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 11.67 (Pre-IPO), 11.92 (Post-IPO) |

| Price/Earnings (P/E) Ratio | 10.11 (Pre-IPO), 9.90 (Post-IPO) |

| Return on Net Worth (RoNW) | 46.18% |

| Net Asset Value (NAV) | 25.26 |

| Return on Equity | 60.05% |

| Return on Capital Employed (ROCE) | 48.21% |

| EBITDA Margin | 16.16% |

| PAT Margin | 10.90% |

| Debt to Equity Ratio | 0.33 |

Objectives of the Proceeds

- Capital expenditure for second cashew processing facility at Vizianagaram, Andhra Pradesh – ₹57.00 Cr

- General corporate purposes – Amount not specified

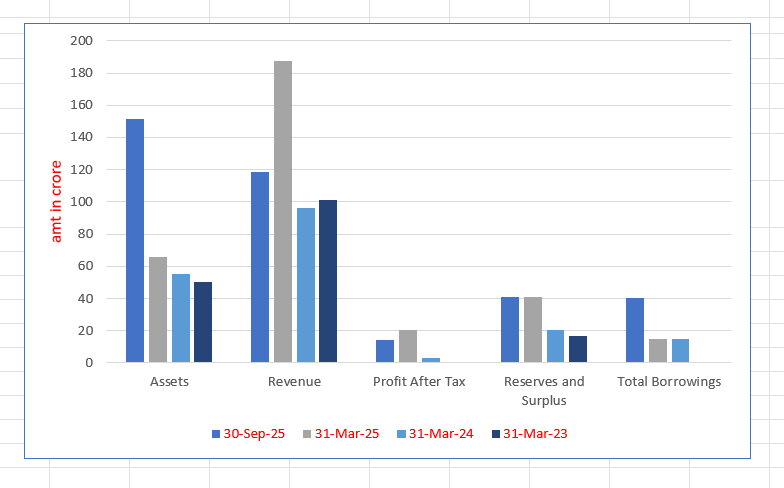

Key Financials (in ₹ crore)

| Particulars | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 151.63 | 65.73 | 55.39 | 50.17 |

| Revenue | 118.37 | 187.28 | 96.04 | 101.13 |

| Profit After Tax | 14.20 | 20.42 | 3.35 | 0.02 |

| Reserves and Surplus | 40.90 | 40.71 | 20.29 | 16.94 |

| Total Borrowings | 40.04 | 14.57 | 14.57 | 0.00 |

SWOT Analysis of Pajson Agro India IPO

Strength and Opportunities

- Strategically located modern processing facility

- In-house packaging and quality control unit

- Experienced promoter and management team

- Strong wholesaler network and customer loyalty

- Diverse product portfolio including Royal Mewa brand

- Growing demand for processed cashew in India and abroad

Risks and Threats

- Dependence on raw cashew supply fluctuations

- High competition in domestic and international markets

- Export regulations may impact growth

- Price volatility of cashew nuts can affect margins

- Operational risks from machinery or labor issues

- Regulatory compliance and certification challenges

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Pajson Agro India Limited

IPO Strengths of Pajson Agro India Limited

- Experienced promoters with strong expertise in cashew processing industry.

- Strategically located modern processing and packaging facility in Andhra Pradesh.

- Established brand presence with Royal Mewa and wide distribution network.

- Diverse product portfolio including retail, bulk, and by-products.

- Strong financial growth with increasing revenue and PAT over past years.

- Rising domestic and international demand for processed cashew kernels.

Peer Comparison (As on 31 March 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV per share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Pajson Agro India Ltd. | 11.67 | 11.67 | 25.26 | — | 46.18 | — |

| Peer Group | ||||||

| Krishival Foods Limited | 6.08 | 6.08 | 63.55 | 78.00 | 9.56 | 7.56 |

| Prospect Consumer Products Ltd. | 4.19 | 4.19 | 44.98 | 17.00 | 8.95 | 1.61 |

| Aelea Commodities Limited | 0.57 | 0.57 | 50.21 | 292.98 | 1.13 | 3.34 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Pajson Agro India IPO

How can I apply for Pajson Agro India IPO?

You can apply via HDFC SKY using UPI-based ASBA for easy online subscription.

What is the minimum investment for retail investors?

Retail investors must invest at least ₹2,83,200 for 2,400 shares at the upper price band.

When will the IPO allotment be finalized

Allotment is expected to be finalized on 16 December 2025 by BSE SME.

What is the lot size for HNI investors?

HNI investors can apply in multiples of 3 lots (3,600 shares) or more for the IPO.