- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Paramesu Biotech IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Paramesu Biotech IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Paramesu Biotech Limited

Paramesu Biotech Limited (PBL), established in 2011, is a leading manufacturer of Maize-based speciality products, catering to diverse industries such as Food, Pharma, Paper, Textiles, Animal Nutrition, and Adhesives. With a strong international presence, PBL supplies its innovative products to various countries, offering tailored solutions to meet the unique needs of global markets. The company operates a state-of-the-art manufacturing facility backed by stringent quality control measures, ensuring high performance and reliability in every product.

Paramesu Biotech Limited IPO Overview

Paramesu Biotech IPO is a bookbuilding issue of ₹600.00 crore, consisting of a fresh issue of ₹520.00 crore and an offer for sale of ₹80.00 crore. The IPO dates are yet to be announced, and the allotment is expected to be finalized on [.]. The price band for the IPO is also yet to be declared. Pantomath Capital Advisors Pvt Ltd is the book-running lead manager for the IPO, and Bigshare Services Pvt Ltd is appointed as the registrar.

The IPO will be listed on BSE and NSE. The face value of each share is ₹5, while details regarding the issue price band and lot size are yet to be disclosed. The total issue size aggregates up to ₹600.00 crore. The fresh issue will aggregate up to ₹520.00 crore, and the offer for sale will aggregate up to ₹80.00 crore, comprising shares of ₹5 each.

The DRHP was filed with SEBI on Tuesday, November 12, 2024, and SEBI approval was received on Friday, February 28, 2025. The promoters of Paramesu Biotech are Unimark Business Solutions Private Limited, Speedfast Tracom Limited, Ananada Swaroop Adavani, Mani Swetha Tetali, and Himabindu Tetali. The company’s shareholding before the IPO stands at 92.19%, and the post-issue shareholding will be updated once the equity dilution is calculated

Paramesu Biotech Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹520 crore |

| Offer for Sale: ₹80 crore | |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Financial Status of Paramesu Biotech IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Paramesu Biotech Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Paramesu Biotech Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 1.54 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 23.30% |

| Net Asset Value (NAV) | 6.59 |

| Return on Equity | 23.30% |

| Return on Capital Employed (ROCE) | 18.13% |

| EBITDA Margin | 12.19% |

| PAT Margin | 6.41% |

| Debt to Equity Ratio | 1.19 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the capital expenditure requirement for setting up of new plant of 1200 TPD in Mohasa – Babai, District Narmadapuram, Madhya Pradesh | 3.300 |

| Repayment/ Pre-payment, in part or full of certain borrowings | 850 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

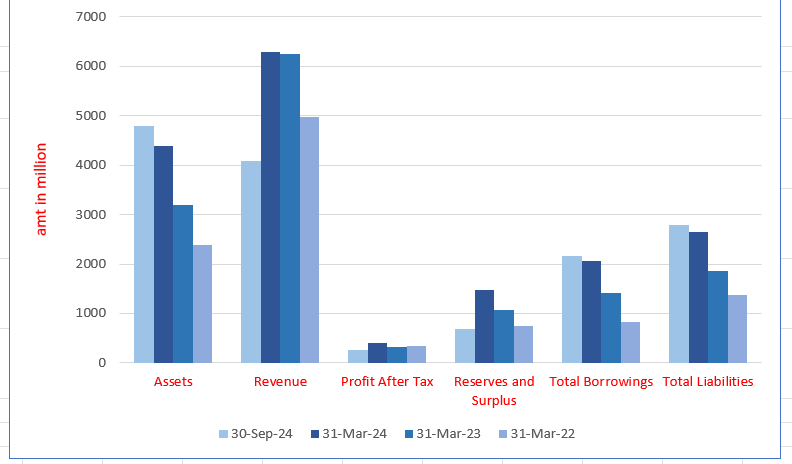

Paramesu Biotech Limited Financials (in millions)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4794.43 | 4396.80 | 3191.68 | 2388.77 |

| Revenue | 4093.94 | 6292.85 | 6253.44 | 4966.03 |

| Profit After Tax | 268.50 | 403.37 | 325.24 | 339.65 |

| Reserves and Surplus | 688.10 | 1468.65 | 1067.03 | 746.88 |

| Total Borrowings | 2161.75 | 2058.84 | 1405.64 | 819.79 |

| Total Liabilities | 2784.06 | 2655.17 | 1862.07 | 1379.31 |

Financial Status of Paramesu Biotech Limited

SWOT Analysis of Paramesu Biotech IPO

Strength and Opportunities

- Offers a wide range of maize-based speciality products catering to various industries, enhancing the market reach and customer base.

- Serves reputed clients like ITC Limited and Emami Paper Mills, reflecting strong industry relationships and trust.

- Successfully commissioned a new unit for producing Malto Dextrin Powder and Liquid Glucose, diversifying product offerings and revenue streams.

- Led by promoters with over three decades of industry experience, ensuring strategic direction and operational efficiency.

- Achieved high capacity utilisation rates, indicating effective use of resources and operational excellence.

- Supplies products to various countries, enhancing brand recognition and global market penetration.

- Focuses on sustainable practices, appealing to environmentally conscious consumers and industries.

- Invests in state-of-the-art manufacturing facilities, improving product quality and production efficiency.

- The Indian corn starch market is projected to grow at a CAGR of 4% during 2020-2025, indicating a positive industry trend.

- Demonstrated steady growth in total operating income and improved profitability margins, indicating strong financial health.

- Proximity to maize-growing regions in Andhra Pradesh provides easy access to raw materials, reducing transportation costs.

Risks and Threats

- Relies on maize, a seasonal crop, leading to potential supply chain disruptions and price volatility.

- Maintains a moderately leveraged capital structure, which may limit financial flexibility and increase debt servicing costs.

- Faces intense competition from numerous unorganised and organised players, potentially affecting market share and pricing power.

- Exposure to fluctuations in maize prices due to factors like weather conditions and government policies, impacting profitability.

- Operates in a working capital-intensive industry, requiring substantial inventory and receivables management.

- Subject to government controls and regulations in procurement and sales of agricultural commodities, affecting operational flexibility.

- Vulnerable to economic downturns that can reduce demand across key industries like food and pharmaceuticals.

- Manufacturing facility located in Andhra Pradesh, which may limit market access and increase logistics costs for distant markets.

- Exposure to environmental factors affecting maize cultivation, such as climate change and natural disasters, impacts raw material availability.

- Increased debt levels due to expansion projects, potentially affecting financial stability and increasing interest obligations.

- Potential market saturation in certain product segments, limiting growth opportunities and requiring innovation

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Paramesu Biotech Limited IPO

Paramesu Biotech Limited Overview

Paramesu Biotech Limited is one of the largest manufacturers of maize-based speciality products in India, with an installed capacity of 800 TPD. The company offers a diverse range of products, including native maize starch, modified maize starches, liquid glucose, maltodextrin powder, and co-products like germs, gluten, fibre, corn steep liquor, and enriched fibre. Paramesu Biotech is recognised for its high capacity utilisation rate of 93.09% (FY 2024), positioning it among the top performers in its industry.

Product Portfolio and Specialisation

The company is one of the few in India specialising in various types of modified starches, such as dextrin, pre-gelatinised starch, thin-boiled starch, cationic starch, oxidised starch, and spray starch. These products serve multiple industries, including food, animal nutrition, paper, and other industrial applications.

Strategic Location and Facilities

Paramesu Biotech operates from its Devarapalli facility in Andhra Pradesh, strategically located near maize harvesting regions and major transport routes. The proximity to the Vizag port enhances its export capabilities, especially in Southeast Asia. The Devarapalli facility spans 2.63 million square feet (60.29 acres) and is certified under various international quality management systems, including ISO 9001:2015, ISO 14001:2015, and FSSC 22000:2018.

Market Reach and Export Growth

The company has established a strong presence in both domestic and international markets, with products sold in 14 states, 4 union territories, and over 10 countries in Southeast Asia and the Middle East. Paramesu Biotech is a Two-Star Export House under the Indian Ministry of Commerce.

Customer Base and Retention

Paramesu Biotech’s customer base includes prominent names such as Emami Paper Mills, Singhania Foods International, and Lotus Essential SDN BHD. The company maintains a history of high customer retention, supported by successful project execution and consistent product quality.

Diversified Sales Channels Ensuring Global Reach

Paramesu Biotech Limited effectively reaches a wide array of customers through its diversified sales channels, catering to both domestic and international markets. The company serves the following customer segments:

- Manufacturers of End Products: These customers use Paramesu’s products as raw materials or ingredients in their final products, such as:

- Confectionery and bakery product manufacturers

- Pharmaceutical formulation manufacturers

- Edible oil manufacturers

- Animal nutrition product manufacturers

- Adhesive and paper product manufacturers

- Manufacturers of Ingredients/Agents/Excipients: These clients create ingredients for end products that consumers eventually use.

- Distributors/Traders: These are stockists who distribute Paramesu’s products to end users or ingredient manufacturers.

Domestic and Export Sales Breakdown

- Domestic Sales:

- ₹3,132.76 million (76.86% of total revenue in FY 2024)

- ₹4,944.23 million (78.75% of total revenue in FY 2023)

- ₹5,108.06 million (81.87% of total revenue in FY 2022)

- Export Sales:

- ₹943.18 million (23.14% of total revenue in FY 2024)

- ₹1,334.24 million (21.25% of total revenue in FY 2023)

- ₹1,131.23 million (18.13% of total revenue in FY 2022)

Broad Product Range and Industry Applications

Paramesu Biotech offers a variety of maize-based speciality products tailored to different industries. These include:

- Starch and Modified Starch: Used in textiles, food, paper, packaging, and pharmaceuticals.

- Co-products: Such as animal feed, poultry feed, probiotics, and edible oils.

- Derivatives: Liquid glucose and maltodextrin are used in the food, FMCG, and pharmaceutical sectors.

Manufacturing Facility

The manufacturing facility, located in Devarapalli, Andhra Pradesh, benefits from its proximity to major maize-producing regions and key transport routes. Its closeness to Vizag port enhances access to Southeast Asian markets, boosting international presence.

Devarapalli Facility Capacity and Utilisation:

- Fiscal 2022: Installed Capacity: 1,75,000 TPA; Actual Utilisation: 1,60,587 TPA; Capacity Utilisation: 91.76%

- Fiscal 2023: Installed Capacity: 1,75,000 TPA; Actual Utilisation: 1,65,515 TPA; Capacity Utilisation: 94.58%

- Fiscal 2024: Installed Capacity: 2,09,500 TPA; Actual Utilisation: 1,95,015 TPA; Capacity Utilisation: 93.09%

- September 30, 2024: Installed Capacity: 1,28,000 TPA; Actual Utilisation: 1,19,475 TPA; Capacity Utilisation: 93.34%

Industry Outlook

Maize Consumption Trends and Future Outlook

Global maize consumption is projected to reach 1.36 billion tons by 2032, driven by rising incomes and increasing demand for animal nutrition, especially in Southeast Asia. Feed usage globally will rise to 59%, while India’s feed demand is expected to grow to ~58% by 2032.

Key Trends and Growth Drivers for Maize Production & Consumption

Population Growth & Changing Diets

- India’s population (~143.8 crores as of March 2024) accounts for ~17.7% of the global total and is projected to reach ~167 crores by 2050.

- Maize, a versatile cereal, has the potential to support India’s food security by meeting the growing population’s dietary needs.

- Demand for maize-based products is rising due to increased use in food, textiles, and paper industries.

- Changing lifestyles have boosted the consumption of processed foods, cereals, and maize-derived ingredients, expanding maize demand.

Growing Demand from the Animal Nutrition Sector

- India is the third-largest global egg producer, with poultry and aquaculture growing at 8-10% annually.

- Rising incomes and a growing middle class are fueling poultry demand, increasing the need for maize-based animal nutrition.

- Export markets also demand maize for cattle and poultry feed, driving production growth.

Increased Demand from the Biofuel Sector

- Biofuels, like ethanol, are increasingly produced using maize alongside sugarcane and rice.

- To meet ethanol and poultry feed demand, maize output needs to increase by 10 million tons in the next five years.

Addressing Environmental Challenges

- Expanding maize cultivation is crucial to meet rising global food demand while mitigating land and water resource degradation.

- Climate change and land mismanagement pose challenges to maize production, necessitating sustainable farming practices.

Growth Drivers for Maize Starch and Derivatives Industry in India

Key Production Advantages

- India ranks as the 4th largest maize producer globally and cultivates non-GMO maize, enhancing export appeal for starch manufacturing.

- About 10-13% of Indian maize production is allocated to starch manufacturing.

Cost Efficiency

- Domestic maize availability ensures low raw material procurement costs compared to maize-importing countries.

- Cheaper labour costs further reduce overall production expenses.

Export Leadership

- India accounts for 17.3% (value) and 27.1% (volume) of global maize starch exports (2023).

- Companies like Gujarat Ambuja Exports and Sanstar Ltd are expanding production capacities to meet growing demand.

Rising Domestic and Global Demand

- Maize-derived ingredients are increasingly used in food, beverage, pharmaceutical, adhesive, paper, textile, and animal nutrition industries.

- Expanding ethanol and animal feed sectors may challenge maize availability for starch production.

Global and Indian Native Starch Industry

The global native maize starch market, valued at USD 30,818M in 2024E, is projected to reach USD 36,874M by 2029F. North America leads consumption, while APAC is growing rapidly, driven by food and industrial applications.

Global Native Starch Industry: Drivers & Opportunities

- Demand for Convenience Foods: Urbanisation boosts ready-to-eat food demand, driving starch usage.

- Natural Ingredient Preference: Consumers seek clean-label, non-GMO, and organic starch products.

- Broader Applications: Advanced uses in adhesives, biomaterials, and fortified foods fuel growth.

Indian Native Starch Industry Overview

- Market Growth:

- Estimated CAGR: 4.48% (2024E-2029F).

- Current market value (2024E): USD 1,991 million.

- Key Features:

- Primary product: Native maize starch.

- Composition: Polymeric carbohydrates (amylose and amylopectin).

- Characteristics: White, odourless, fine powder.

- Applications:

- Food & Beverage: Thickener, stabiliser, and gelling agent.

- Industrial Uses: Pharmaceuticals, paper, textiles, adhesives, and chemicals.

- Regional Production:

- Major hubs: Gujarat, Maharashtra, Karnataka, Andhra Pradesh.

- Facilities with capacities of 500-1000 TPD.

- Market Drivers:

- Increasing demand for convenience and packaged foods.

- Cost advantage due to local raw materials and labour.

- Challenges:

- Competition from other starch sources (potato, tapioca).

- Seasonal variability in maize supply.

- Future Outlook:

- Rising exports and new biopolymer applications promise continued growth.

Overview of the Indian Modified Starches Industry

- Market Valuation:

- Estimated at USD 1,301 Million in 2024E, projected to reach USD 1,731 Million by 2029F.

- Volume is projected at ~2.44 Million tons in 2024E, growing at a CAGR of 5.54% until 2029F.

- Market Dynamics:

- Highly price-sensitive despite growth potential.

- Dominated by domestic players like Sukhjit Starch, BlueCraft Agro, and Sahyadri Starch.

- Applications:

- Modified starch serves as a texturiser, thickener, stabiliser, and emulsifier.

- Widely used in food products, paper, pharmaceuticals, and industrial applications.

- Offers advantages like texture consistency, shelf-life stability, and waste reduction.

- Geographic Consumption:

- North India: ~34% (0.83 Million tons in 2024E).

- South and West India: 0.68 Million and 0.71 Million tons, respectively.

- East India: Nascent market with 0.22 Million tons consumption.

- Industry-Wise Use:

- Paper Industry: Largest segment (~55.8%, 1.36 Million tons in 2024E).

- Textile Industry: Contributed 13.5% (0.33 Million tons).

- Food & Beverage Industry: Accounted for ~10.1% (0.25 Million tons).

- Pharmaceuticals: Minor usage (~0.8%, 0.02 Million tons).

- Future Prospects:

- Anticipated demand growth in food and beverage segments, especially spreads, sauces, and snacks.

- Increasing applications in adhesives, textiles, and pharmaceuticals

How Will Paramesu Biotech Limited Benefit?

- Rising Demand from the Animal Nutrition Sector

Paramesu Biotech Limited, with its diverse maize-based products, will benefit from the growing demand for animal feed, especially poultry and aquaculture. As India’s poultry sector expands, the company’s animal nutrition offerings will see increased demand, enhancing its revenue streams and market position.

- Growing Maize Consumption in India

With India’s maize consumption set to rise significantly by 2032, Paramesu Biotech stands to gain from the expanding domestic market. As a major supplier of maize-based products, the company is well-positioned to meet the growing demand for food, industrial applications, and biofuels.

- Export Market Expansion

The increasing global demand for maize-based products, especially from Southeast Asia and the Middle East, will benefitParamesu Biotech. The company’s strategic location near Vizag port enhances its export capabilities, positioning it to capture a larger share of the international market for starch and derivatives.

- Biofuel Demand Growth

As the biofuel sector expands, Paramesu Biotech’s maize-based ethanol production is set to benefit from the increasing demand for biofuels like ethanol. The company’s ability to scale up maize production aligns with global biofuel trends, boosting its prospects in this growing market segment.

- Cost Efficiency and Competitive Advantage

With local maize sourcing, Paramesu Biotech enjoys cost advantages over countries that rely on imports. The company’s ability to produce non-GMO maize-based products at competitive prices strengthens its position in the global market, providing an edge in cost-sensitive industries like food and pharmaceuticals.

- Diversification into Modified Starches

As demand for modified starches rises in food, paper, and industrial applications, Paramesu Biotech’s expertise in producing a range of modified starches positions it for growth. The increasing need for functional ingredients in packaged foods will further boost its sales, especially in emerging markets.

- Environmental Sustainability Initiatives

Paramesu Biotech is poised to benefit from the growing emphasis on sustainable production practices. With the global push for reducing environmental impact, the company’s focus on efficient maize cultivation and production aligns well with market demands for eco-friendly and sustainable products.

- Rising Demand for Convenience Foods

Urbanisation and the growing preference for convenience foods will increase the demand for maize-based ingredients. Paramesu Biotech, with its strong portfolio of native maize starch and derivatives, is well-positioned to capitalise on this trend, especially in the fast-growing food and beverage sector.

- Expanding Role of Maize in Textile and Paper Industries

The increasing demand for starch in industrial applications such as textiles and paper will provide Paramesu Biotech with new growth opportunities. As the textile industry grows, the company’s modified and native starch products will be crucial in meeting the rising need for quality raw materials.

- Support from Government Policies for Agribusiness

Government policies promoting agriculture and food security will benefitParamesu Biotech. With maize being a critical crop for food security in India, favourable policies aimed at boosting production and exports will enable Paramesu Biotech to expand its production capacity and enhance its market presence.

Peer Group Comparison

| Name of the Company | Face Value per Equity Share (₹) | Total Income (₹ million) | EPS (Basic & Diluted) (₹) | PAT Margin (%) | NAV (₹ per share) | P/E | RoNW (%) |

| Paramesu Biotech Limited | 5.00 | 6,292.85 | 1.54 | 6.41 | 6.59 | [●]# | 23.30 |

| Peer-Group | |||||||

| Sanstar Limited | 2.00 | 10,816.83 | 4.75 | 6.17 | 15.37 | 24.82 | 30.92 |

| Gujarat Ambuja Exports Limited | 1.00 | 50,714.20 | 7.54 | 6.82 | 60.37 | 16.38 | 12.49 |

| Gulshan Polyols Limited | 1.00 | 13,901.82 | 2.85 | 1.28 | 94.65 | 71.67 | 3.01 |

| Sukhjit Starch and Chemicals Limited | 5.00* | 13,850.33 | 15.99 | 3.61 | 160.88 | 15.67 | 9.94 |

Key Insight

- Face Value per Equity Share: Paramesu Biotech Limited’s face value is ₹5, aligning with industry standards like Sukhjit Starch. Sanstar and Gujarat Ambuja have lower face values of ₹2 and ₹1, respectively. These differences in face value do not affect earnings but indicate share division preferences.

- Total Income: Paramesu Biotech’s total income stands at ₹6,292.85 million, significantly lower than its peers like Gujarat Ambuja (₹50,714.20 million). This reflects its relatively smaller scale of operations, suggesting growth opportunities as it expands capacity and market reach.

- EPS: With an EPS of ₹1.54, Paramesu trails behind its peers. Sukhjit Starch leads at ₹15.99, indicating higher profitability per share. This gap underscores the potential for Paramesu to improve earnings as its operations scale.

- PAT Margin: Paramesu’s PAT margin is 6.41%, slightly higher than Sanstar (6.17%) but below Gujarat Ambuja (6.82%). Gulshan Polyols lags at 1.28%. A healthy margin shows Paramesu’s competitive edge in cost efficiency despite smaller operations.

- NAV: Paramesu’s NAV is ₹6.59, lower than all peers, with Sukhjit Starch leading at ₹160.88. This indicates Paramesu’s limited asset base relative to its equity but highlights the scope for NAV growth post-expansion.

- Price-to-Earnings Ratio (P/E): While Paramesu’s exact P/E isn’t disclosed, its peers vary widely, from Sukhjit’s 15.67 to Gulshan Polyols’ 71.67. Lower P/E ratios often indicate better valuation. Paramesu’s ratio will reveal its market competitiveness.

- Return on Net Worth (RoNW): At 23.30%, Paramesu’s RoNW outperforms most peers except Sanstar (30.92%). This metric reflects strong profitability relative to equity and showcases efficient resource utilisation, even as it operates on a smaller scale.

Paramesu Biotech Limited IPO Strengths

- Leadership in Maize-Based Speciality Products

Paramesu Biotech Limited ranks among India’s largest manufacturers of maize-based speciality products, featuring a diverse portfolio including native and modified starches, liquid glucose, and maltodextrin. The company’s high barriers to entry stem from capital-intensive setups, stringent quality standards, and robust supply chain capabilities. Equipped with advanced facilities and certifications, Paramesu is poised for growth with a planned expansion to increase capacity to 2,000 TPD.

- Diversified Customer Base Across Industries

Paramesu Biotech Limited serves a broad spectrum of industries, from food and pharmaceuticals to textiles and adhesives, through its wide-ranging maize-based products. The company’s exports to over 10 countries underscore its global reach. By specialising in modified starches and derivatives, Paramesu ensures adaptability to market demands, leveraging innovation to de-risk its business model while addressing growing industry needs domestically and internationally.

- Strategic Manufacturing Location

Strategically positioned in Andhra Pradesh, Paramesu Biotech Limited’s Devarapalli facility benefits from proximity to key ports and maize-growing belts, ensuring cost-effective raw material procurement and distribution. With advanced storage infrastructure, sustainable groundwater resources, and ample land for expansion, the facility supports uninterrupted operations. These advantages position Paramesu as a competitive leader in the maize-based speciality product industry, optimising resources while fostering environmental sustainability.

- Demonstrated Track Record of Consistently Building Capabilities and Infrastructure

Paramesu Biotech Limited has consistently expanded its manufacturing infrastructure, growing capacity from 160 TPD in 2015 to 800 TPD in 2023 at its 2.63 million sq. ft. facility in Deverapalli, Andhra Pradesh. With 93.34% capacity utilisation as of September 2024, strategic investments in modernisation and technology have established Paramesu as an industry leader, creating significant barriers to entry for competitors.

- Financial Performance and Growth

Paramesu Biotech Limited has achieved sustained financial growth, with revenue increasing at a CAGR of 12.63% and profit after tax growing at 8.98% from Fiscal 2022 to 2024. Exports also grew at a CAGR of 10.90%. These results reflect the company’s operational excellence, strategic initiatives, and strong financial position, reinforcing its reputation as a reliable and profitable leader in the maize-based speciality products industry.

- Long-standing Relationships with Customers

Paramesu Biotech Limited has nurtured strong, long-term relationships with its customers, serving over 500 clients annually in the last three fiscals, with 246 placing repeat orders consistently. Its customer-centric approach, focus on quality, and diverse product offerings have ensured loyalty. With a broad client base spanning industries like food, pharma, and adhesives, Paramesu continues to drive growth through trust and tailored solutions.

Key Insights from Financial Performance

- Assets: As of 30th September 2024, the company’s assets amounted to 4794.43. Over the previous year, assets grew consistently, from 2388.77 in March 2022 to 4396.80 by March 2024. This increase reflects strategic investments and growth.

- Revenue: Revenue has seen a noticeable fluctuation. It peaked at 6292.85 in March 2024, down from 6253.44 in March 2023. However, it decreased to 4093.94 by September 2024, indicating a drop in sales during the first half of the current fiscal year.

- Profit After Tax: PAT decreased slightly to 268.50 as of September 2024 from 403.37 in March 2024. In the earlier years, the PAT showed consistent values, with 325.24 in March 2023 and 339.65 in March 2022, reflecting some margin pressures.

- Reserves and Surplus: Reserves and Surplus dropped significantly to 688.10 in September 2024 from 1468.65 in March 2024. The decline, from 1067.03 in March 2023, suggests that the company utilised reserves, likely for funding expansion or managing operational costs.

- Total Borrowings: Total borrowings increased to 2161.75 in September 2024, compared to 2058.84 in March 2024. Borrowings were significantly lower at 819.79 in March 2022, and have been increasing steadily, indicating potential debt financing for growth or expansion.

- Total Liabilities: Total liabilities grew from 1379.31 in March 2022 to 2784.06 by September 2024. The rise in liabilities reflects a pattern of increased financial obligations, primarily due to rising borrowings and a growing cost structure, impacting the company’s debt management

Other Financial Details

- Cost of Materials Consumed: The cost of materials consumed has shown a significant fluctuation over the years, peaking at ₹4,641.70 million in FY 2024. This indicates substantial raw material consumption relative to operational growth.

- Employee Benefits Expenses: Employee benefits expenses reflect a steady increase, peaking at ₹167.26 million in FY 2024. The rise in personnel costs may indicate growth in employee compensation, recruitment, or retention strategies.

- Finance Costs: These costs have shown a decline, reducing to ₹103.92 million in FY 2024 from ₹152.55 million in FY 2023. This suggests more efficient management of borrowing or reduced interest expenses during the period.

- Depreciation and Amortisation Expense: These expenses have remainedrelatively stable over the years. A slight dip in FY 2024 to ₹56.95 million reflects a reduced need for asset depreciation due to prior capital investments.

- Other Expenses: They have remained high, reaching ₹558.17 million in FY 2024. This category includes various operating costs, which may encompass utilities, maintenance, and miscellaneous operational expenditures, contributing to the overall financial burden.

Key Strategies for Paramesu Biotech Limited

- Augmenting Capacity with a New Manufacturing Facility

Paramesu Biotech Limited plans to enhance its production capacity by establishing a new manufacturing facility in Madhya Pradesh. This facility spread across 109.80 acres, will produce native starch and co-products, increasing capacity by 1,200 TPD. This strategic expansion, expected to commence by April 2026, aims to meet rising demand, optimise efficiency, and strengthen market presence.

- Expanding Global Presence and Strengthening Domestic Markets

To diversify its customer base, Paramesu Biotech Limited intends to expand into new international markets, including Europe and Africa, while deepening penetration in the Middle East and domestic markets. Through dedicated sales teams and increased capacity from the proposed Madhya Pradesh facility, the company seeks to tap growing demand, enhance competitiveness, and capture emerging opportunities.

- Increasing Revenue from Derivative and Value-Added Products

Paramesu Biotech Limited aims to boost its revenue by focusing on high-margin derivative and value-added products like liquid sorbitol, dextrose monohydrate, and baking powders. By expanding its product portfolio and targeting new geographic markets, the company plans to capture market share, address evolving customer needs, and improve profit margins in the growing derivatives segment.

- Enhancing Production Efficiencies and Streamlining Costs

Paramesu Biotech Limited is committed to improving production efficiencies through process automation, energy-efficient practices, and advanced technology adoption. Initiatives like a 3.95 MW co-generation plant and automated systems have reduced costs and increased productivity. These measures ensure consistent quality, minimise downtime and maintain the company’s competitive edge in a dynamic market.

- Deleveraging and Strengthening Financial Flexibility

Paramesu Biotech Limited plans to reduce its debt burden and improve its debt-to-equity ratio to enhance financial stability. By focusing on efficient resource allocation and prudent fiscal management, the company seeks to achieve greater operational flexibility, support long-term growth, and deliver sustainable value to stakeholders.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the Paramesu Biotech IPO issue size?

The Paramesu Biotech IPO has an issue size of ₹600 crore, which includes a new issue of ₹520 crore and an offer for sale of ₹80 crore.

When will the Paramesu Biotech IPO open?

The opening date for the Paramesu Biotech IPO is yet to be announced. Updates on the IPO timeline, including the opening, will be provided soon.

What is the price range for Paramesu Biotech IPO?

The price range for the Paramesu Biotech IPO has not been disclosed yet. Investors should wait for the official announcement for more details.

Which stock exchanges will list Paramesu Biotech IPO?

The Paramesu Biotech IPO will be listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) following its successful public offering.

Who is the promoter of Paramesu Biotech Ltd.?

The sole promoter of Paramesu Biotech Ltd. is Unimark Business Solutions Pvt., holding an 82.01% stake in the company, which will sell shares through the Offer for Sale (OFS).

What is the face value of a share in the IPO?

The face value of each share in the Paramesu Biotech IPO is ₹5. Investors can purchase shares based on the determined price range upon IPO launch