- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Parijat Industries India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Parijat Industries India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Parijat Industries India Limited

Parijat Industries (India) Limited is a leading agrochemical company headquartered in India with a presence across 65 countries, including Asia, Europe, West Africa, and North America. Its diverse product range covers insecticides, fungicides, herbicides, bactericides, biostimulants, specialty fertilisers, plant growth regulators, and technical-grade ingredients. The company holds 283 domestic and 512 international registrations and distributes 90 branded products through 5,433 Indian channel partners. It manufactures technicals via Crimsun Organics in Tamil Nadu and formulations in Ambala and Vadodara, serving prominent domestic and global clients.

Parijat Industries India Limited IPO Overview

Parijat Industries (India) Limited filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on September 25, 2025, to raise funds through an Initial Public Offering (IPO). The proposed IPO is a Book-Build Issue comprising a fresh issue of equity shares worth ₹160 crore and an Offer for Sale (OFS) of up to 2.04 crore equity shares. The company’s equity shares are proposed to be listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). While the book-running lead manager is yet to be announced, Kfin Technologies Limited has been appointed as the registrar to the issue. Further details such as the IPO price band, lot size, and issue opening and closing dates will be disclosed in due course. The face value of each share is ₹5, and the IPO involves a combination of fresh capital and an OFS. Prior to the issue, Parijat Industries has a total shareholding of 5,92,79,174 shares. The promoters of the company include Keshav Anand, Sharat Anand, Vikram Anand, Shivraj Anand, and Uday Raj Anand, who collectively held 64.91% of the company’s shares before the IPO.

Parijat Industries India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹160 crore |

| Offer for Sale (OFS) | 2.04 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,92,79,174 shares |

| Shareholding post-issue | TBA |

Parijat Industries India IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Parijat Industries India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Parijat Industries India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹9.23 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.92% |

| Net Asset Value (NAV) | ₹35.60 |

| Return on Equity (RoE) | 18.60% |

| Return on Capital Employed (RoCE) | 21.06% |

| EBITDA Margin | 12.40% |

| PAT Margin | 5.09% |

| Debt to Equity Ratio | 0.89 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or part, of certain borrowings availed by the Company, including payment of interest accrued thereon; and | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

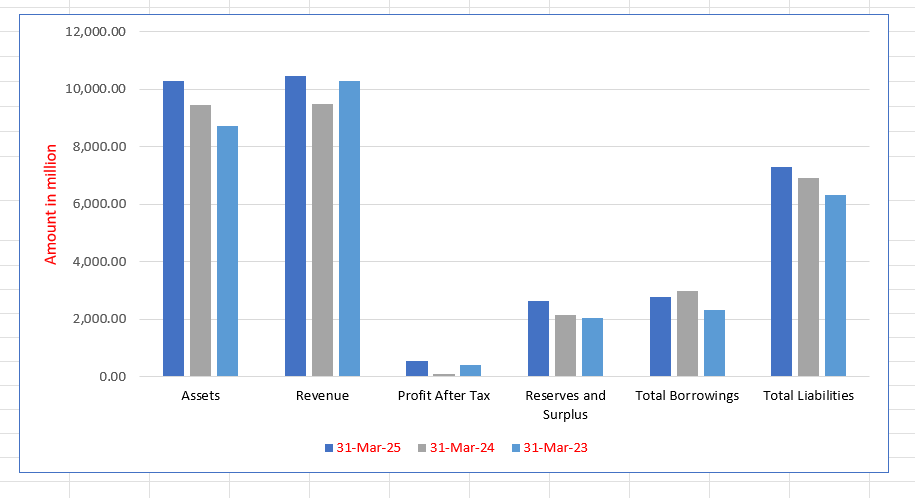

Parijat Industries India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 10,300.03 | 9,438.51 | 8,712.17 |

| Revenue | 10,453.39 | 9,497.74 | 10,285.03 |

| Profit After Tax | 540.26 | 98.35 | 424.02 |

| Reserves and Surplus | 2,645.24 | 2,163.04 | 2,049.60 |

| Total Borrowings | 2,767.54 | 2,981.08 | 2,316.52 |

| Total Liabilities | 7,313.87 | 6,922.22 | 6,318.19 |

Financial Status of Parijat Industries India Limited

SWOT Analysis of Parijat Industries India IPO

Strength and Opportunities

- Established presence in over 60 countries, enhancing global reach and market intelligence.

- Diversified product portfolio including insecticides, fungicides, herbicides, and plant growth regulators, catering to various crops.

- Strong R&D infrastructure with advanced laboratories and a dedicated team for continuous product development and quality assurance.

- Recognition with multiple awards, including the Global Indian Company of the Year and Social Responsibility Excellence Award, underscoring commitment to excellence and sustainability.

- Strategic focus on both domestic and international markets, balancing risks and leveraging opportunities across regions.

- Adoption of sustainable practices and community welfare initiatives, enhancing brand image and stakeholder trust.

- Robust manufacturing capabilities with a state-of-the-art facility in Ambala, Haryana, ensuring quality production standards.

- Experienced leadership with a long-standing presence in the agrochemical industry, providing strategic direction and stability.

- Commitment to innovation and technological advancements, positioning the company for future growth in the agrochemical sector.

Risks and Threats

- Intense competition from established agrochemical companies, potentially impacting market share and margins.

- High working capital requirements due to substantial inventory holding and extended receivable periods.

- Exposure to agrochemical industry risks such as dependency on monsoon patterns and susceptibility to counterfeit products.

- Vulnerability to regulatory changes and compliance challenges in both domestic and international markets.

- Fluctuating raw material costs and currency exchange rates affecting profitability.

- Potential environmental concerns related to the use of certain agrochemicals, impacting public perception.

- Challenges in scaling operations to meet growing global demand without compromising quality.

- Dependence on the cyclical nature of agriculture, affecting demand for agrochemical products.

- Potential impact of climate change on agricultural patterns, influencing product demand and effectiveness.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Parijat Industries India Limited

Parijat Industries India Limited IPO Strengths

Research and Development-Driven Manufacturing

Parijat Industries India Limited possesses in-house R&D and manufacturing capabilities across the product lifecycle, providing vertical integration for key products. This allows the company enhanced strategic control over operations, ensuring consistent quality, cost efficiency, and a focus on innovation. The company’s structured R&D, supported by accredited labs, research farms, and specialized personnel, underpins its product development, testing, and quality control efforts.

Diverse Customer Base and Robust Distribution

The company benefits from a diverse customer base that includes major agrochemical manufacturers and overseas distributors, built upon its expansive portfolio and emphasis on consistent quality and brand recognition. Its domestic reach is supported by a sizeable and geographically distributed channel of over 5,400 partners across 20 states, alongside a co-marketing model, which collectively ensures effective market penetration.

Strategic Market Leadership in Niche Categories

Parijat Industries strategically focuses on differentiated offerings in product categories and geographies with high industry barriers. This strategy, underpinned by proprietary and patented formulations, has led to early-mover advantage and less competitive pressure. The company has a notable presence in challenging export markets, including Russia and West Africa, securing a difficult-to-replicate market position for sustainable growth.

Multi-Generational and Experienced Leadership

Parijat Industries benefits from the continuity and stability of a multi-generational leadership team with cumulative industry experience spanning over 86 years. The Promoters, including next-generation leaders with advanced academic qualifications, drive the company’s transition toward branded products and technological growth. This leadership is supported by a qualified and experienced management team and a large, technically proficient workforce.

More About Parijat Industries India Limited

Parijat Industries India Limited is a leading India-headquartered agrochemical company with a significant multinational presence. The company focuses on the development, manufacture, and distribution of innovative agrochemical formulations, offering products across plant protection and plant nutrition categories. Its portfolio includes insecticides, fungicides, bactericides, herbicides, bio-stimulants, specialty fertilizers, and plant growth regulators. Additionally, the company produces technical grade active ingredients (“Technicals”) for use in formulation manufacturing.

As of March 31, 2025, Parijat Industries’ global operations span 65 countries across Asia, Europe, West Africa, and North America. Its domestic business complements international operations, serving India with 283 product registrations across 20 states and distributing branded products under 90 brands. The company also engages in corporate sales of Technicals and bulk formulations, co-marketing its proprietary products through other brands. Key domestic clients include Mankind Agritech, Rallis India, IFFCO MC Crop Science, Coromandel International, Bayer Cropscience, and Dhanuka Agritech.

International Business

The company exports branded formulations to markets with complex regulatory approval processes, creating high entry barriers for new players. Parijat Industries holds 512 product registrations internationally and uses multiple go-to-market strategies:

- National-level distributors in countries such as Egypt, Canada, Myanmar, and Morocco, leveraging owned or registered trademarks.

- Seven foreign subsidiaries distributing through sub-national dealers in strategic markets like Russia, Mali, Togo, and Tanzania.

- Direct exports of Technicals to corporate clients in select regions including the United States and Russia.

History and Milestones

Founded by Keshav Anand and Vikram Anand, the promoters have been engaged in chemical trading since 1986. Their prior ventures, including Parijat Agencies and Triumph Pesticides, enabled early exports for several Indian agrochemical companies. Triumph Pesticides was later renamed Parijat Industries (India) Limited, following the amalgamation with Parijat Agencies in 2008.

Parijat Industries was the first Indian company to register and manufacture several technical products, including Fipronil, Pyriproxyfen, Chlorfenapyr, Imazamox, Mesotrione, and Metamifop, providing an early-mover advantage in formulations.

Manufacturing and R&D

The company operates three manufacturing units in India, supported by seven in-house R&D laboratories. Its Cuddalore Unit produces Technicals, while Ambala and Vadodara units focus on formulations. Patents include 10 domestic and 10 international product patents, with several applications pending. Notable industry-first products include “VELEKTIN” for fall armyworm, “AADAT” combining insecticidal and fungicidal ingredients, and herbicide combinations such as “DAHAN” and “VOSTRIX.”

Leadership and Governance

Parijat Industries benefits from multi-generational leadership. Founding promoters and second-generation leaders Uday Raj Anand and Shivraj Anand guide the company’s strategic shift toward branded formulations. With expertise in financial management, global markets, and technological innovation, the leadership ensures cohesive operations, employee welfare, and sustainable growth.

Industry Outlook

The Indian agrochemical industry is riding a strong growth wave, driven by rising crop intensification, greater farm mechanisation, and expanding exports. It was valued at around USD 11.2 billion in FY 2024-25, and is projected to reach USD 14.5 billion by FY 2027-28, implying a healthy CAGR of approximately 9%.

Growth Drivers

- The government’s focus on higher farm productivity and food security is driving agrochemical demand.

- India’s relatively low agrochemical consumption (kg/hectare) compared with global averages indicates significant room for growth.

- Rising global demand and Indian manufacturers’ cost competitiveness support export expansion; herbicides have shown strong export growth (around 20% CAGR in recent years).

- Within product types, advanced formulations such as nano-nutrient specialties, high-value plant growth regulators, and technical-grade ingredients are gaining prominence and offering higher margins.

Segment‐Specific Trends (Relevant for Formulations & Technicals)

- The crop protection segment—including insecticides, herbicides, and fungicides—was estimated at USD 6.4 billion in 2024, and is forecast to reach about USD 9.8 billion by 2033, with a CAGR of around 4.6%.

- Fertilisers and plant-nutrition products continue to dominate market share, accounting for more than 55% of agrochemical revenues. However, higher-growth opportunities lie in bio-stimulants, plant growth regulators (PGRs), and specialty inputs.

- The technical-grade active ingredient market is expanding in line with exports, supported by India’s regulatory expertise, cost efficiency, and manufacturing competence.

Outlook

Overall, companies engaged in branded formulations and technical-grade manufacturing—particularly in insecticides, herbicides, fungicides, PGRs, and bio-stimulants—are well-positioned for future growth. They can benefit from domestic expansion through improved crop treatment rates and from global opportunities through export competitiveness. While challenges such as raw-material dependency and intense competition persist, the sector’s medium-term outlook remains positive, underpinned by government initiatives, technology adoption, and the structural under-penetration of agrochemicals in India.

How Will Parijat Industries India Limited Benefit

- Parijat Industries India Limited stands to gain from the agrochemical sector’s 9% projected CAGR, aligning with its strong presence in both domestic and international crop protection markets.

- Its established product portfolio of insecticides, herbicides, fungicides, and bio-stimulants directly matches the high-growth segments driving industry expansion.

- The company’s capability to manufacture technical-grade active ingredients positions it well to leverage rising global demand and export opportunities.

- Government initiatives promoting sustainable farming and advanced formulations will support Parijat’s innovation-focused R&D pipeline.

- Increasing mechanisation and awareness among farmers will drive higher usage of branded formulations, benefiting Parijat’s extensive distribution network across 20 Indian states.

- With over 500 global product registrations, Parijat is well-placed to capitalise on stringent regulatory barriers in foreign markets.

- The growing focus on eco-friendly and cost-efficient agrochemicals complements Parijat’s strategy of sustainable, technology-led manufacturing.

Peer Group Comparison

| Name of Company | Face Value (₹ Per Share) | Revenue from Operations (₹ in millions) | EPS (₹) | P/E | NAV as at March 31, 2025 (₹ per share) | RONW (%) |

| Basic | Diluted | |||||

| Parijat Industries (India) Limited* | 5.00 | 10,453.39 | 9.23 | 9.13 | [●] | 35.60 |

| Peer Group | ||||||

| Sumitomo Chemical India Limited | 10.00 | 31,485.24 | 10.13 | 10.13 | 59.19 | 58.12 |

| Bayer Cropscience Limited | 10.00 | 54,734.00 | 126.38 | 126.38 | 42.34 | 634.25 |

| Dhanuka Agritech Limited | 2.00 | 20,351.52 | 65.55 | 65.55 | 23.78 | 311.17 |

| Rallis India Limited | 1.00 | 6,629.40 | 6.43 | 6.43 | 52.05 | 97.90 |

Key Strategies for Parijat Industries India Limited

Strengthening Portfolio Innovation and Proprietary Product Development

Parijat Industries India Limited aims to expand its proprietary formulations and branded portfolio by investing in advanced R&D, product differentiation, and process innovation. Through margin analysis, patent protection, and early-mover strategies, the company focuses on developing high-margin, niche agrochemical products with limited competition and strong global relevance.

Investing in Product Development Infrastructure and R&D Talent

Parijat Industries India Limited plans to establish a consolidated R&D centre in Ambala, Haryana, integrating formulation development, entomology, and plant pathology under one roof. By expanding specialised teams and non-chemical crop solution research, the company strengthens innovation, field testing, and global trial capabilities for sustainable agricultural advancements.

Expanding Manufacturing Capabilities to Commercialise Innovations

To support its innovation pipeline, Parijat Industries India Limited is enhancing its manufacturing capacity, reducing import reliance, and focusing on process patents for Technicals. The upcoming Saykha, Gujarat unit and partnerships with third-party manufacturers will improve cost efficiency, supply resilience, and the commercialisation of complex proprietary formulations.

Expanding in Key Overseas Markets

Parijat Industries India Limited is deepening its international footprint through market prioritisation, subsidiary establishment, and retail expansion in high-potential regions like Africa, Russia, and Latin America. The company focuses on strategic tenders, corporate collaborations, and selective acquisitions to strengthen its branded formulation sales and export-led growth.

Deepening Domestic Market Presence

Parijat Industries India Limited seeks to expand its domestic distribution through Project Vistar, enhancing its channel partner network and retailer outreach across under-penetrated states. By deploying digital engagement tools, dynamic QR-based programmes, and retailer-focused initiatives, the company aims to strengthen brand visibility and farmer-led demand generation.

Diversifying Go-to-Market Strategies in India

The company intends to diversify its domestic sales approach by launching a second brand line under Leeds LifeSciences India Private Limited. This new, technology-driven product range will target direct retailer and farmer engagement, while expanding co-marketing partnerships with fertiliser companies and emerging agrochemical enterprises in India.

Strengthening Marketing, Brand Building, and Farmer Outreach

Parijat Industries India Limited is intensifying marketing and brand-building efforts through farmer outreach programmes, field demonstrations, and expert endorsements. By increasing visibility campaigns and education initiatives, the company promotes new and upcoming products while fostering trust and awareness among farmers and distributors across its key operational markets.

Investing in Technology for Efficiency and Scale

To enhance operational efficiency, Parijat Industries India Limited is adopting advanced digital technologies across manufacturing, sales, and marketing. Initiatives like “Parijat Wallet” and “Parijat Udaan” leverage automation, QR-based engagement, and drone spraying solutions, empowering farmers, optimising distribution, and driving scalable, technology-led business growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Parijat Industries India Limited IPO

How can I apply for Parijat Industries India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Parijat Industries (India) Limited launching through its IPO?

Parijat Industries is launching a Book-Build IPO comprising a fresh issue of ₹160 crore and an Offer for Sale.

When was the Parijat Industries IPO DRHP filed with SEBI?

The Draft Red Herring Prospectus (DRHP) was filed with SEBI on September 25, 2025.

On which exchanges will Parijat Industries IPO be listed?

The company’s equity shares are proposed to be listed on both NSE and BSE.

What are the key objectives of the Parijat Industries IPO?

The IPO proceeds will primarily be used for repayment or pre-payment of borrowings and general corporate purposes.

Who are the promoters of Parijat Industries (India) Limited?

The promoters include Keshav Anand, Sharat Anand, Vikram Anand, Shivraj Anand, and Uday Raj Anand.