- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Park Medi World IPO

₹14,168/92 shares

Minimum Investment

IPO Details

10 Dec 25

12 Dec 25

₹14,168

92

₹154 to ₹162

NSE, BSE

₹920 Cr

17 Dec 25

Park Medi World IPO Timeline

Bidding Start

10 Dec 25

Bidding Ends

12 Dec 25

Allotment Finalisation

15 Dec 25

Refund Initiation

16 Dec 25

Demat Transfer

16 Dec 25

Listing

17 Dec 25

Park Medi World Limited

Park Medi World Limited traces its origins to 1981 when its Founder and Chairman, Dr. Ajit Gupta, began his medical career by setting up a clinic in South Delhi, aiming to provide high-quality, accessible, and affordable healthcare. In 2005, he founded Park Hospital in West Delhi, which was later integrated into the company in 2011. The company adopted a cluster-based expansion strategy to enhance operational efficiency and scale. Dr. Ankit Gupta, the Managing Director, now leads the group, upholding its legacy while introducing advanced medical technologies.

Park Medi World Limited IPO Overview

Park Medi World IPO is a book-built issue worth ₹920.00 crores, comprising a fresh issue of 4.75 crore shares aggregating ₹770.00 crores and an offer for sale of 0.93 crore shares aggregating ₹150.00 crores. The IPO will open for subscription from December 10, 2025, and close on December 12, 2025, with allotment expected to be finalised on December 15, 2025. The shares are set to list on the BSE and NSE, with a tentative listing date of December 17, 2025. The price band for the issue has been fixed between ₹154.00 and ₹162.00 per share, and the minimum application lot size is 92 shares. Retail investors will need to invest a minimum of ₹14,904 (based on the upper price), while the lot size for small non-institutional investors (sNII) is 14 lots (1,288 shares) amounting to ₹2,08,656, and for big non-institutional investors (bNII), it is 68 lots (6,256 shares) amounting to ₹10,13,472. Nuvama Wealth Management Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar of the issue.

Park Medi World Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹770 crores

Offer for Sale (OFS): ₹150 crores Total: ₹920 crores |

| IPO Dates | December 10, 2025 to December 12, 2025 |

| Price Bands | ₹154 to ₹162 per share |

| Lot Size | 92 shares per lot |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding Pre-Issue | 38,43,99,990 shares |

| Shareholding Post-Issue | 43,19,30,854 shares |

Park Medi World IPO Important Dates

| Event | Date |

| IPO Open Date | Wed, Dec 10, 2025 |

| IPO Close Date | Fri, Dec 12, 2025 |

| Tentative Allotment | Mon, Dec 15, 2025 |

| Initiation of Refunds | Tue, Dec 16, 2025 |

| Credit of Shares to Demat | Tue, Dec 16, 2025 |

| Tentative Listing Date | Wed, Dec 17, 2025 |

Park Medi World IPO Lots

| Application | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 92 | ₹14,904 |

| Retail (Max) | 13 | 1,196 | ₹1,93,752 |

| S-HNI (Min) | 14 | 1,288 | ₹2,08,656 |

| S-HNI (Max) | 67 | 6,164 | ₹9,98,568 |

| B-HNI (Min) | 68 | 6,256 | ₹10,13,472 |

Park Medi World Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Park Medi World Limited IPO Valuation Overview

| KPI | Value |

| ROE | 20.68% |

| ROCE | 17.47% |

| Debt/Equity | 0.61 |

| RoNW | 20.08% |

| PAT Margin | 15.30% |

| EBITDA Margin | 26.71% |

| Price to Book Value | 6.09 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or in part, of certain outstanding borrowings availed by the Company and certain of Subsidiaries | 4100 |

| Funding capital expenditure for development of new hospital and expansion of existing hospital by certain Subsidiaries, Park Medicity (NCR) and Blue Heavens, respectively | 1100 |

| Funding capital expenditure for purchase of medical equipment by our Company and certain Subsidiaries, Blue Heavens and Ratangiri | 700 |

| Unidentified inorganic acquisitions and General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

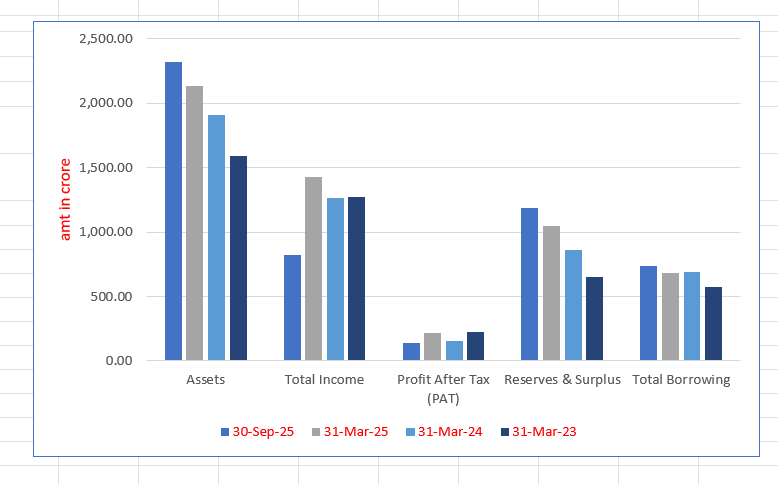

Park Medi World Limited Financials (in crore)

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,320.93 | 2,133.70 | 1,912.10 | 1,592.82 |

| Total Income | 823.39 | 1,425.97 | 1,263.08 | 1,272.18 |

| Profit After Tax (PAT) | 139.14 | 213.22 | 152.01 | 228.19 |

| Reserves & Surplus | 1,187.77 | 1,049.40 | 858.63 | 653.09 |

| Total Borrowing | 733.91 | 682.07 | 686.71 | 575.68 |

Financial Status of Park Medi World Limited

SWOT Analysis of Park Medi World IPO

Strength and Opportunities

- Strong presence in North India with 13 hospitals and 3,000 beds.

- Largest private hospital chain in Haryana, enhancing regional dominance.

- Accreditations from NABH and NABL, ensuring quality standards.

- Diverse specialties including cardiology, oncology, and neurology.

- Focus on affordable healthcare, attracting a broad patient base.

- Implementation of advanced technologies like robot-assisted surgeries.

- Plans for IPO could provide capital for further growth and modernization.

- Recognition as Best Cancer Hospital in Delhi NCR, enhancing reputation.

- Experienced management team with a focus on strategic growth.

Risks and Threats

- High dependence on inpatient revenue, limiting diversification.

- Exposure to regulatory risks due to government-imposed pricing controls.

- Intense competition from established hospital chains like Fortis and Max Healthcare.

- Limited brand recognition beyond North India, affecting national expansion.

- Potential challenges in maintaining service quality during rapid expansion.

- Dependence on generic medicines may impact treatment perceptions.

- Economic downturns could affect patients' ability to afford private healthcare.

- Operational challenges in managing a widespread hospital network.

- Potential risks associated with healthcare data security and patient privacy.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Park Medi World Limited IPO

Second Largest Private Hospital Chain in North India and Largest in Haryana

Park Medi World Limited is the second largest private hospital chain in North India with 3,000 beds and the largest in Haryana with 1,600 beds as of September 2024. Since its incorporation in 2011, it has expanded through organic growth and acquisitions, adopting a cluster-based approach for operational efficiency. The network includes 13 NABH-accredited multi-specialty hospitals across North India, equipped with advanced medical facilities and dedicated ICU beds, trauma centers, and transplant approvals. Leveraging regional expertise, Park Medi World aims to meet the growing demand for quality, affordable healthcare while capitalizing on market growth and economies of scale

Delivering High-Quality, Affordable Healthcare with Diverse Specialties

Park Medi World Limited is committed to providing affordable, high-quality healthcare to diverse patients, mainly from lower and middle-class segments. Leveraging advanced medical technology, robotics, and economies of scale, it offers over 30 specialty services. Efficient cost management and innovation enable superior patient outcomes while maintaining profitability and expanding access across its hospital network.

Proven Expertise in Hospital Acquisitions and Integration

Park Medi World Limited has successfully acquired and integrated seven hospitals across North India, adding 1,650 beds to its network. These strategic acquisitions expanded its geographic presence, boosted revenues, and strengthened profitability. The company standardizes operations and aligns cost structures to maintain quality care and efficiency, with acquired hospitals consistently contributing over 50% to revenue, EBITDA, and profits.

Strong Operational and Financial Performance with Diversified Payor Mix

Park Medi World Limited consistently delivers robust operational and financial results by focusing on high-quality care, patient volume growth, and cost efficiency. Leveraging asset ownership and economies of scale, it achieves strong profitability and a diversified revenue base from government schemes, insurance, and individual patients, maintaining one of the lowest costs per bed among peers.

Doctor-Led Professional Management Team with Extensive Industry Experience

Park Medi World Limited’s leadership, led by founder Dr. Ajit Gupta and senior management with over 20 years of medical and financial expertise, drives its success. Their combined experience across medicine, finance, and operations has been key to establishing the company as a leading hospital chain in North India with strong brand equity.

More About Park Medi World Limited

Park Medi World Limited is recognised as the second-largest private hospital chain in North India, with a total planned bed capacity of 3,000 beds as of September 30, 2024. It also holds the distinction of being the largest private hospital chain in Haryana, offering 1,600 beds across the state

Network and Accreditations

The company operates a network of 13 NABH-accredited multi-super specialty hospitals under the ‘Park’ brand. Among these:

- 7 hospitals are NABL accredited

- 8 hospitals are in Haryana

- 1 hospital in New Delhi

- 2 hospitals each in Punjab and Rajasthan

These hospitals provide over 30 super-specialty and specialty services, including neurology, urology, internal medicine, gastroenterology, general surgery, orthopaedics, and oncology. As of September 2024, the network comprises 891 doctors and 1,912 nurses.

Journey and Expansion Strategy

Founded by Dr. Ajit Gupta, who began his medical journey in 1981, the first Park Hospital was set up in New Delhi in 2005 and later transferred to the company in 2011. Key developments include:

- Hospital expansions in Gurugram (2012, 2019) and Panipat (2016)

- Acquisitions across Faridabad, Karnal, Ambala, Behror, Palam Vihar, Sonipat, and Mohali

The company’s cluster-based approach enhances operational efficiencies and economies of scale. Notably, acquired hospitals contributed:

- 54.24% of revenue

- 47.32% of EBITDA

- 56.30% of profit after tax (H1 FY2025)

Current Infrastructure and Future Plans

- 805 ICU beds and 63 operating theatres

- Oxygen generation plants at all facilities

- Two cancer units with linear accelerators

- Three iMARS institutes offering advanced robotic surgeries

Expansion Plans

- Ambala: Expansion from 250 to 450 beds with an onco-radiation facility by October 2027

- Panchkula: 300-bed hospital by April 2026

- Rohtak: 250-bed hospital by December 2026

- Gorakhpur: 400-bed hospital under a 30-year operations and management agreement, starting April 2026

- Resolution plan submitted by subsidiary Blue Heavens to acquire Febris Multi Specialty Hospital, New Delhi

Leadership

- Dr. Ajit Gupta, Founder and Chairman, with over 25 years in the medical field

- Dr. Ankit Gupta, Managing Director, with over 20 years of experience, leading the organisation’s transformation into a trusted healthcare brand

Industry Outlook

Market Size & Growth

- The Indian healthcare sector is projected to reach $638 billion by 2025, up from $372 billion in 2023, marking a 17.5% CAGR over the past decade.

- The hospital segment, constituting 80% of the healthcare market, was valued at $98.98 billion in 2023 and is expected to grow at an 8% CAGR, reaching $193.59 billion by 2032.

Key Growth Drivers

- Rising Non-Communicable Diseases (NCDs): NCDs account for 63% of deaths in India, increasing demand for specialized care.

- Medical Tourism: India’s medical tourism market is valued at $7.69 billion in 2024, projected to reach $14.31 billion by 2029, driven by cost-effective treatments and quality care.

- Government Initiatives: Programs like Ayushman Bharat aim to provide health coverage to over 500 million people, enhancing access to healthcare services.

- Technological Advancements: Integration of AI, telemedicine, and digital health records is transforming healthcare delivery.

Hospital Infrastructure & Expansion

- Bed Capacity Expansion: ICRA projects the addition of over 4,000 beds in FY2025 and another 3,400 beds in FY2026 by major hospital chains.

- Tier 2 & 3 City Focus: Investments are increasing in smaller cities to bridge the urban-rural healthcare divide.

Digital Health & Innovation

- Telemedicine Growth: The telemedicine market is expected to reach $5.4 billion by 2025, growing at a 31% CAGR. HealthTech Sector: Projected to grow significantly, reaching ₹4.2 lakh crore over the next decade, driven by consumer-facing applications and enterprise solutions

How Will Park Medi World Limited Benefit

- Positioned to capitalise on India’s projected $638 billion healthcare market by 2025.

- Poised to benefit from the hospital sector’s 8% CAGR, expected to reach $193.59 billion by 2032.

- Expansion aligns with increasing demand for specialised care driven by rising non-communicable diseases.

- Strong presence in Tier 2 and Tier 3 cities supports government push for rural healthcare access.

- Investment in telemedicine and robotic surgery matches sector-wide digital health growth.

- NABH and NABL accreditations enhance trust amid growing medical tourism valued at $7.69 billion.

- Capacity growth aligns with projected addition of 7,400 hospital beds across India by FY2026.

- Technological infrastructure supports India’s booming ₹4.2 lakh crore healthtech ecosystem.

- Leverages government schemes like Ayushman Bharat for increased patient inflow and affordability.

- Leadership experience and focused expansion strategy position it for long-term scalability and brand strength.

Peer Group Comparison

| Name of Company | Face Value (₹) | P/E | Total Income (₹ million) | EPS (₹) | NAV (₹) | RONW (%) |

| Park Medi Limited | 2 | TBD | 12,630.84 | 3.95 | 21.23 | 18.81% |

| Peer Groups | ||||||

| Apollo Hospitals Enterprise Limited | 5 | 99.46 | 1,91,655 | 62.50 | 481.60 | 12.98% |

| Fortis Healthcare Limited | 10 | 79.38 | 69,312 | 7.93 | 101.50 | 7.82% |

| Narayana Hrudalaya Limited | 10 | 40.30 | 50,934 | 38.86 | 141.03 | 27.39% |

| Max Healthcare Institute Limited | 10 | 90.53 | 55,841 | 10.89 | 86.51 | 12.58% |

| Krishna Institute of Medical Sciences Limited | 2 | 66.14 | 25,112 | 7.75 | 45.69 | 16.96% |

| Global Health Limited | 2 | 68.90 | 33,498 | 17.80 | 107.77 | 16.53% |

| Jupiter Lifeline Hospitals Ltd | 10 | 52.10 | 10,955 | 28.65 | 178.30 | 15.11% |

| Yatharth Hospital & Trauma Care Services Limited | 10 | 27.01 | 6,862 | 14.46 | 101.84 | 13.09% |

Key Strategies for Park Medi World Limited

Expanding Hospital Network in North India

Park Medi World Limited focuses on growing its hospital network in North India through acquisitions and organic growth. It targets facilities with 200+ beds, aiming for strategic locations to improve healthcare access and efficiency, leveraging the region’s rising demand for quality, affordable healthcare services.

Growth into Adjacent Markets

The company plans to extend its presence into neighbouring markets by establishing hospitals near existing locations. This cluster approach enhances brand strength, operational efficiency, and economies of scale. Expansion into Uttar Pradesh exemplifies this strategy, with operations starting soon at a 400-bed hospital in Gorakhpur.

Scaling Operations and Enhancing Efficiencies

Park Medi World Limited aims to boost occupancy and operational scale by investing in advanced technology, clinical programs, and skilled medical staff. The company emphasises robotic surgeries and specialty services, improving patient outcomes and broadening treatment options, while targeting middle-class patients and expanding insurance and international patient coverage.

Attracting and Retaining Skilled Medical Professionals

A core strategy involves attracting and retaining experienced doctors and clinicians through continuous training, leadership development, and international collaborations. The company supports its medical staff with advanced tools, global best practices, and professional development programs to maintain high-quality healthcare standards across its hospitals.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

Park Medi World Limited

How can I apply for Park Medi World Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size and structure of the Park Medi World IPO?

The IPO aims to raise ₹1,260 crore, including a ₹960 crore fresh issue and a ₹300 crore offer-for-sale by the promoter.

How will the IPO funds be utilized?

Funds will be used for debt repayment, new hospital development, medical equipment purchase, and general corporate purposes.

What is the expected timeline for the IPO?

Park Medi World IPO opens for subscription on Dec 10, 2025 and closes on Dec 12, 2025. The allotment for the Park Medi World IPO is expected to be finalized on Dec 15, 2025. Park Medi World IPO will list on BSE, NSE with a tentative listing date fixed as Dec 17, 2025.

What is the retail investor allocation in the Park Medi World IPO?

The IPO allocates 35% to retail investors, 50% to Qualified Institutional Buyers (QIBs), and 15% to High Net-Worth Individuals (HNIs).