- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Patel Retail IPO

₹13,746/58 shares

Minimum Investment

IPO Details

19 Aug 25

21 Aug 25

₹13,746

58

₹237 to ₹255

NSE, BSE

₹242.76 Cr

26 Aug 25

Patel Retail IPO Timeline

Bidding Start

19 Aug 25

Bidding Ends

21 Aug 25

Allotment Finalisation

22 Aug 25

Refund Initiation

25 Aug 25

Demat Transfer

25 Aug 25

Listing

26 Aug 25

Patel Retail Limited IPO

Patel Retail Limited operates a supermarket chain mainly in tier-III cities and suburban areas, offering food, FMCG, general merchandise, and apparel. Established with its first “Patel’s R Mart” in Ambernath, Maharashtra, the company runs 43 stores covering 1,78,946 sq. ft. It boosts margins and brand visibility through private labels like Patel Fresh, Indian Chaska, Blue Nation, and Patel Essentials. Supported by three manufacturing facilities, including the Kutch cluster, Patel Retail manages processing, packaging, and storage. Its stores cater to daily needs and bulk purchases, with most sales from Maharashtra and Gujarat.

Patel Retail Limited IPO Overview

Patel Retail IPO is a book-built issue worth ₹242.76 crores, comprising a fresh issue of 0.85 crore shares aggregating ₹217.21 crores and an offer for sale of 0.10 crore shares totaling ₹25.55 crores. The IPO opens for subscription on 19 August 2025 and closes on 21 August 2025, with allotment expected on 22 August 2025. It is set to list on BSE and NSE around 26 August 2025. The price band is ₹237 to ₹255 per share, with a lot size of 58 shares, requiring a minimum retail investment of ₹13,746. For sNII, the minimum is 14 lots (812 shares) amounting to ₹2,07,060, and for bNII, 68 lots (3,944 shares) totaling ₹10,05,720. Fedex Securities Pvt. Ltd. is the book running lead manager, and Bigshare Services Pvt. Ltd. is the registrar.

Patel Retail Limited IPO Details

| Particulars | Details |

| IPO Date | 19 August 2025 to 21 August 2025 |

| Listing Date | 26 August 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹237 to ₹255 per share |

| Lot Size | 58 Shares |

| Total Issue Size | 95,20,000 shares (aggregating up to ₹242.76 Cr) |

| Fresh Issue | 84,67,000 shares (aggregating up to ₹215.91 Cr) |

| Offer for Sale | 10,02,000 shares (aggregating up to ₹25.55 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 2,48,82,528 shares |

| Share Holding Post Issue | 3,34,00,528 shares |

| Market Maker Portion | Not specified |

Patel Retail Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 30% of the Net Offer |

| Retail | Not less than 45% of the Net Offer |

| NII (HNI) | Not less than 25% of the Net Offer |

Patel Retail Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 58 | ₹14,790 |

| Retail (Max) | 13 | 754 | ₹1,92,270 |

| S-HNI (Min) | 14 | 812 | ₹2,07,060 |

| S-HNI (Max) | 67 | 3,886 | ₹9,90,930 |

| B-HNI (Min) | 68 | 3,944 | ₹10,05,720 |

Patel Retail Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 97.99% |

| Post-Issue | 70.01% |

Patel Retail Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) Pre-Issue | ₹10.16 |

| Earnings Per Share (EPS) Post-Issue | ₹7.57 |

| Price/Earnings (P/E) Ratio Pre-Issue | 25.10 |

| Price/Earnings (P/E) Ratio Post-Issue | 33.69 |

| Return on Net Worth (RoNW) | 19.02% |

| Net Asset Value (NAV) | ₹54.08 |

| Return on Equity | 19.02% |

| Return on Capital Employed (ROCE) | 14.43% |

| EBITDA Margin | 7.61% |

| PAT Margin | 3.08% |

| Debt to Equity Ratio | 1.34 |

Objectives of the Proceeds

- Repayment/prepayment of certain borrowings availed by the Company – ₹59 crore

- Funding of working capital requirements of the Company – ₹115 crore

- General corporate purposes – Amount not disclosed

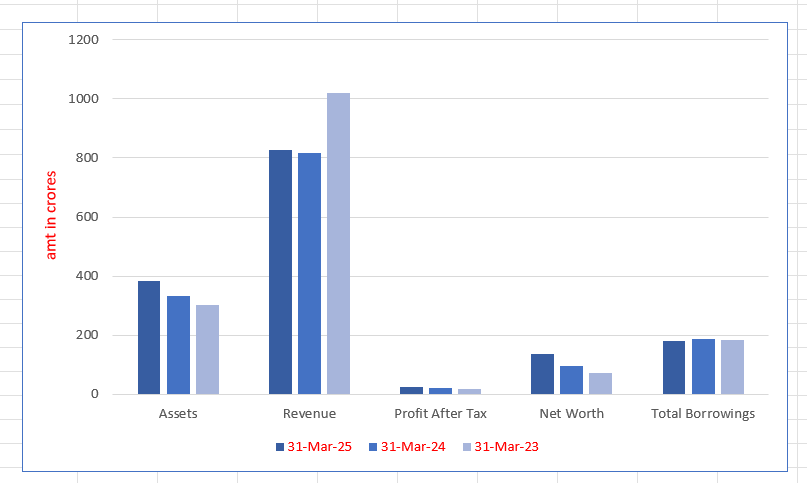

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 382.86 | 333.02 | 303.12 |

| Revenue | 825.99 | 817.71 | 1,019.80 |

| Profit After Tax | 25.28 | 22.53 | 16.38 |

| Net Worth | 134.57 | 94.40 | 71.87 |

| Total Borrowings | 180.54 | 185.75 | 182.81 |

SWOT Analysis of Patel Retail IPO

Strength and Opportunities

- Strong knowledge of product assortment and inventory control via IT

- Expanding store footprint with unique acquisition and ownership model.

- Integrated logistics network with own fleet of 18 trucks.

- Diverse product portfolio and private label offerings.

- Strategically located manufacturing facilities.

Risks and Threats

- High dependence on Maharashtra and Gujarat markets

- Debt-to-equity ratio may impact financial flexibility

- Competitive pressure from large organised retail chains.

- Fluctuations in commodity prices affecting margins.

- Regulatory changes impacting FMCG and retail sectors.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Patel Retail Limited IPO

Patel Retail Limited IPO Strengths

- Strong expertise in product assortment and inventory management using advanced IT systems.

- Consistent expansion through unique store acquisition strategy and ownership model.

- Efficient logistics and distribution supported by a fleet of eighteen company trucks.

- Wide-ranging and diversified portfolio of products catering to multiple customer needs.

- Manufacturing facilities strategically located to optimise production and distribution efficiency

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Patel Retail | 10.30 | 10.30 | 54.08 | – | 19.02 | – |

| Peer Groups | ||||||

| Vishal Mega Mart | 1.40 | 1.36 | 13.92 | 104.73 | 9.87 | 11.23 |

| Avenue Supermarts | 41.61 | 41.50 | 329.27 | 102.33 | 12.64 | 12.94 |

| Spencers Retail | -27.33 | -27.37 | -73.40 | – | -37.24 | -0.78 |

| Osia Hyper Retail | 1.46 | 1.46 | 23.85 | 8.73 | 4.97 | 0.52 |

| Aditya Consumer Marketing | -2.62 | -2.62 | 14.14 | – | -18.51 | 3.00 |

| Sheetal Universal | 8.12 | 8.12 | 38.27 | 15.58 | 21.44 | 3.32 |

| Kovilpatti Lakshmi Roller Flour Mills | 1.27 | 1.27 | 73.92 | 101.61 | 1.72 | 1.77 |

| KN Agri Resources | 14.76 | 14.76 | 140.60 | 17.01 | 10.50 | 1.79 |

| Madhusudhan Masala | 10.93 | 10.93 | 64.73 | 12.92 | 16.04 | 2.20 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Patel Retail Limited IPO

How can I apply for Patel Retail Limited IPO?

You can apply via HDFC Sky using the UPI-based ASBA application process.

What is the lot size and minimum investment for Patel Retail IPO?

The lot size is 58 shares, requiring a minimum investment of ₹14,790.

When will Patel Retail Limited IPO list on the stock exchange?

The IPO is tentatively scheduled to list on 26 August 2025.

What is the price band for Patel Retail Limited IPO?

The price band is set at ₹237 to ₹255 per share.