- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Physicswallah IPO

IPO Details

11 Nov 25

13 Nov 25

₹14,111

137

₹103 to ₹109

NSE, BSE

₹3,480 Cr

18 Nov 25

Physicswallah IPO Timeline

Bidding Start

11 Nov 25

Bidding Ends

13 Nov 25

Allotment Finalisation

14 Nov 25

Refund Initiation

17 Nov 25

Demat Transfer

17 Nov 25

Listing

18 Nov 25

Physicswallah Limited IPO

Physicswallah is a leading edtech company providing test preparation courses for competitive exams like JEE, NEET, and UPSC, along with upskilling programs in data science, analytics, banking, finance, and software development. It delivers services online through social media, its website, and apps, and operates tech-enabled offline and hybrid learning centers. Ranked among India’s top five edtech firms by revenue, it has 13.7 million YouTube subscribers as of July 2025. In FY2025, it recorded 4.13 million online users, 0.33 million offline enrollments, 198 centers, 5,096 faculty, 15,775 employees, 3,582 published books, and an average collection per user of ₹3,682.79

Physicswallah Limited IPO Overview

The PhysicsWallah IPO is a book-built issue worth ₹3,480 crore, comprising a fresh issue of 28.44 crore shares aggregating to ₹3,100 crore and an offer for sale (OFS) of 3.49 crore shares totalling ₹380 crore.

The IPO will open for subscription on November 11, 2025, and close on November 13, 2025. The allotment of shares is likely to be finalised on November 14, 2025, with the company expected to list on the BSE and NSE on November 18, 2025.

The price band for the IPO is fixed between ₹103 and ₹109 per share. The lot size is 137 shares, requiring a minimum investment of ₹14,933 for retail investors (based on the upper price band). For sNII investors, the lot size is 14 lots (1,918 shares) amounting to ₹2,09,062, while for bNII investors, it is 67 lots (9,179 shares) worth ₹10,00,511.

Kotak Mahindra Capital Co. Ltd. is serving as the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar of the issue.

Physicswallah Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 31,92,66,054 shares (aggregating up to ₹3,480.00 Cr) |

| Fresh Issue | 28,44,03,669 shares (aggregating up to ₹3,100.00 Cr) |

| Offer for Sale (OFS) | 3,48,62,385 shares of ₹1 (aggregating up to ₹380.00 Cr) |

| IPO Dates | 11 November 2025 to 13 November 2025 |

| Price Bands | ₹103 to ₹109 per share |

| Lot Size | 137 shares |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,60,79,56,938 shares |

| Shareholding post-issue | 2,89,23,60,607 shares |

Physicswallah IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 137 | ₹14,933 |

| Retail (Max) | 13 | 1,781 | ₹1,94,129 |

| S-HNI (Min) | 14 | 1,918 | ₹2,09,062 |

| S-HNI (Max) | 66 | 9,042 | ₹9,85,578 |

| B-HNI (Min) | 67 | 9,179 | ₹10,00,511 |

Physicswallah Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Physicswallah Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (₹0.86) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (12.50%) |

| Net Asset Value (NAV) | ₹7.73 |

| Return on Equity (RoE) | (127.60%) |

| Return on Capital Employed (RoCE) | (5.15%) |

| EBITDA Margin | (6.69%) |

| PAT Margin | (8.43%) |

| Debt to Equity Ratio | 1.67 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Capital expenditure for fit-outs of new offline and hybrid centers of our Company | 4605.51 |

| Expenditure towards lease payments of existing identified offline and hybrid centers operated by our Company | 5483.08 |

| Capital expenditure for fit-outs of new offline centers of Xylem | 316.48 |

| Lease payments for Xylem’s existing identified offline centers and hostels | 155.20 |

| Investment in our Subsidiary, Utkarsh Classes & Edutech Private Limited for expenditure towards lease payments for Utkarsh Classes’ existing identified offline centers | 336.99 |

| Expenditure towards server and cloud related infrastructure costs | 2001.06 |

| Expenditure towards marketing initiatives | 7100 |

| Acquisition of additional shareholding in our Subsidiary, Utkarsh Classes & Edutech Private Limited | 265 |

| Funding inorganic growth through unidentified acquisitions and general corporate purposes | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

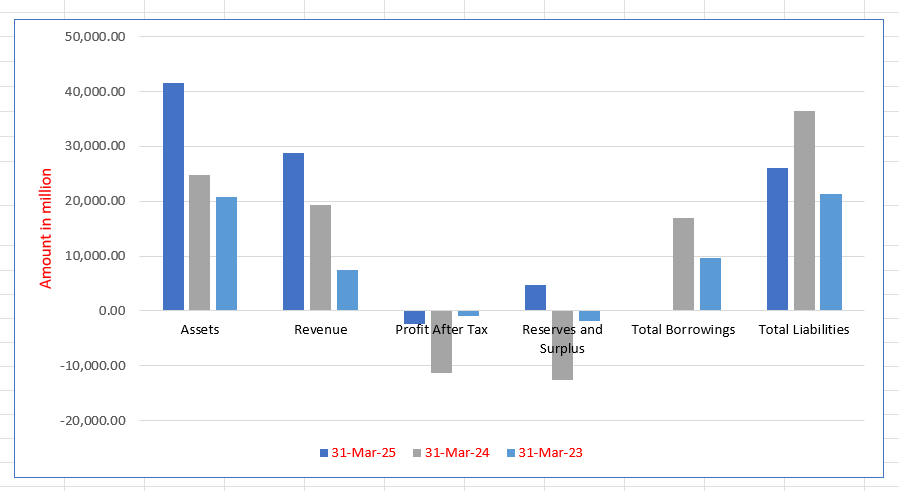

Physicswallah Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 41,563.81 | 24,807.40 | 20,821.76 |

| Revenue | 28,866.43 | 19,407.10 | 7,443.18 |

| Profit After Tax | (2,432.58) | (11,311.30) | (840.75) |

| Reserves and Surplus | 4,717.16 | (12,524.77) | (1,886.39) |

| Total Borrowings | 3.27 | 16,874.00 | 9,561.51 |

| Total Liabilities | 26,028.70 | 36,529.64 | 21,323.43 |

Financial Status of Physicswallah Limited

SWOT Analysis of Physicswallah IPO

Strength and Opportunities

- Strong brand recognition in India's EdTech sector.

- Affordable pricing model, making quality education accessible.

- Extensive reach in tier-2 and tier-3 cities, addressing educational gaps.

- Robust online presence with over 10 million tests, sample papers, and notes.

- Over 120 offline centers across India, enhancing student trust.

- Diverse course offerings across various competitive exams and academic levels.

- Continuous innovation in teaching methods, including live interactive classes and 24x7 doubt-solving sessions.

- Strategic expansion into K-12 education and potential acquisitions to diversify revenue streams.

- Strong financial backing with a valuation of $2.8 billion as of September 2024.

Risks and Threats

- Limited course diversity, focusing mainly on physics and related subjects.

- Heavy reliance on founder Alakh Pandey's personal brand for marketing and trust.

- Intense competition from established EdTech platforms and emerging startups leveraging AI and niche courses.

- Potential scalability challenges in expanding offline centers while maintaining quality.

- Risk of market saturation in existing regions, limiting growth potential.

- Vulnerability to economic downturns affecting discretionary spending on education.

- Regulatory challenges and policy changes in the EdTech sector could impact operations.

- Technological disruptions and the need for constant adaptation to new educational technologies.

- Cultural and language barriers in reaching students from diverse backgrounds.

Live Physicswallah IPO News

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Physicswallah Limited

Physicswallah Limited IPO Strengths

Largest Online Student Community & Rapid User Growth

Physicswallah Limited operates India’s largest online student community, highlighted by its main YouTube channel having approximately 13.7 million subscribers as of July 15, 2025. This community-led approach drove significant growth, with its total number of paid users reaching 4.46 million in Fiscal 2025, reflecting a Compound Annual Growth Rate (CAGR) of 59.19% between Fiscals 2023 and 2025. The company effectively converts this engaged digital following into a robust paying user base.

Affordable Pricing Strategy and Brand Affinity

The company maintains a core mission of increasing education accessibility through affordability, offering some of the most budget-friendly test preparation courses in India for examinations like JEE and NEET. This commitment, coupled with a student-led approach and free content offerings, has cultivated a strong brand affinity. This is demonstrated by “Physics Wallah” having the highest search interest among top-five education players in Fiscal 2025.

Extensive Multi-Channel and Category Presence

Physicswallah Limited offers courses across 13 Education Categories as of March 31, 2025, up from six in Fiscal 2023, catering to students from early education to professional qualifications. Delivery is versatile, encompassing online, hybrid, and a rapidly expanding offline presence with 198 total offline centers as of March 31, 2025, achieving a 165.92% CAGR between Fiscals 2023 and 2025.

Proprietary, Scalable, and AI-Driven Technology

The company utilizes a flexible, proprietary technology-stack, supported by a 598-person team, to enhance the student learning experience at scale. It leverages AI, big data, and machine learning to innovate its offerings, exemplified by tools like “AI Guru,” which provides personalized support, and the “AI Grader,” which grades subjective answers without human intervention, leading to quicker feedback and operational efficiency.

Specialized Faculty and Quality Content Delivery

A large faculty pool of 5,096 members as of March 31, 2025, ensures specialization across multiple academic disciplines and functions, supported by a robust faculty training program. A centralized process develops a vast, up-to-date content library of over 8.20 million question banks, delivered through an engaging, tech-enabled pedagogy that has increased the average engagement time per student to 111 minutes in Fiscal 2025.

Experienced Management and Growth Trajectory

The company is guided by a team of visionary founders, including Alakh Pandey, who has received significant industry recognition, and experienced professional management. This leadership has steered the company to significant financial growth, with revenue from operations growing at a substantial CAGR of 96.93% between Fiscals 2023 and 2025, confirming the effectiveness of its core operational philosophy.

More About Physicswallah Limited

Physicswallah Limited is a leading education company in India offering test preparation courses for competitive examinations, as well as upskilling programs. The company delivers its courses through three main channels:

- Online: via its website, mobile apps, and social media channels.

- Offline (Vidyapeeth centers): tech-enabled physical classrooms where faculty conduct live sessions.

- Hybrid (Pathshala centers): a two-teacher model allowing students to attend live online classes at a physical center with additional faculty support for doubt resolution and revision.

Among the top five education companies in India by revenue, Physicswallah has the largest student community. Its flagship YouTube channel, “Physics Wallah-Alakh Pandey,” had approximately 13.7 million subscribers as of July 2025. Across all 207 YouTube channels, the subscriber base reached 98.8 million as of June 2025, growing at a CAGR of 41.8% between Fiscal 2023 and 2025.

Course Offerings and Accessibility

Physicswallah provides content across 13 education categories, ranging from early education to competitive exams like JEE, NEET, UPSC, GATE, and other government exams. It also offers professional skills programs in areas such as data science, analytics, banking, finance, and software development.

A significant portion of the content is freely available online, with paid courses priced affordably. For instance, one-year JEE and NEET courses like “Arjuna JEE 3.0 2025” and “Lakshya NEET 2025” are offered between ₹2,199 and ₹4,800. This strategy encourages organic growth of the paid user base and fosters brand affinity.

Operational Reach

As of March 31, 2025, the company operated 198 offline centers and had 4.13 million unique online transacting users alongside 0.33 million offline enrollments. It employs 5,096 faculty members, including content developers and question-resolution specialists.

Technology and Pedagogy

Physicswallah leverages AI, big data, and machine learning to enhance learning outcomes. Tools like AI Guru resolve academic queries autonomously, while AI Grader quickly grades subjective answers. The pedagogy emphasizes engaging, interactive classrooms, personalized learning paths, and standardized content delivery across all channels.

Student-Centric Approach

The company focuses on:

- A student community-led model to drive organic growth.

- A flexible technology stack ensuring scalable, accessible, and high-quality content.

- Relevant, continuously updated content to match examination patterns.

- Engaging teaching methodologies with live polls, Q&A sessions, and smart classroom tools.

Founded by Alakh Pandey in 2014, Physicswallah continues to expand its reach and offerings, aiming to make quality education accessible and affordable across India.

Industry Outlook

Market Growth and Projections

The Indian EdTech sector is experiencing significant expansion, driven by technological advancements and a growing demand for accessible education.

- EdTech Market Size: Valued at USD 2.8 billion in 2024, the market is projected to reach USD 33.2 billion by 2033, growing at a CAGR of 28.7%.

- Online Education Market: The online education segment is expected to grow from USD 2.92 billion in 2024 to USD 20.98 billion by 2033, with a CAGR of 24.5%.

- E-learning Services: The e-learning services market generated USD 12.25 billion in 2024 and is anticipated to reach USD 38.5 billion by 2030, expanding at a CAGR of 21.2%.

Growth Drivers

Several factors are propelling the growth of the EdTech industry in India:

- Digital Transformation: Increased internet penetration and smartphone usage have made online education more accessible.

- Government Initiatives: Programs promoting digital learning platforms are creating a supportive ecosystem.

- Demand for Skill Development: Rising need for upskilling and reskilling, particularly in areas like data science, software development, and finance.

- Language Inclusivity: Platforms offering content in regional languages are bridging the education equity gap.

How Will Physicswallah Limited Benefit

- Will capitalize on the growing demand for affordable, accessible education across India.

- Expansion of online, offline, and hybrid channels will increase student reach and enrollment.

- Growing EdTech market and high CAGR provide opportunities for revenue and market share growth.

- Rising need for upskilling and reskilling aligns with Physicswallah’s professional skills offerings.

- Digital transformation and increased internet penetration support scalable delivery of online courses.

- Government initiatives for digital learning will create a favourable regulatory environment.

- Language-inclusive content can help capture regional markets and underserved student segments.

- Use of AI and tech-enabled tools enhances learning outcomes, strengthening brand credibility.

- Strong student community and brand loyalty will drive organic adoption of paid offerings.

- Expansion of offline and hybrid centers will reinforce physical presence and create additional revenue streams.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Physicswallah Limited

Increase Student Engagement and Brand Recall

Physicswallah Limited aims to strengthen its student community by providing engaging, high-quality content through free and paid offerings. Leveraging technology, targeted marketing, and specialized pedagogy, the company focuses on improving learning outcomes, building trust, and enhancing brand recall across its online and offline channels.

Expand and Enhance Offerings Across Education Categories

The company plans to grow its course network and introduce new education categories across multiple languages. By targeting K-12, competitive exams, and post-professional skill development, Physicswallah seeks to cover the entire student learning journey, offering premium and small-cohort courses to meet diverse learning needs.

Develop Multi-Channel Presence

Physicswallah intends to expand offline and hybrid centers strategically, using data insights from its online community to identify high-demand areas. Organic, inorganic, and franchisee approaches are employed to enhance presence while maintaining standardized content delivery and seamless integration across all channels for optimal student outcomes.

Scale Operations and Introduce Value-Added Services

By leveraging network effects, standardized delivery, and a flexible technology stack, the company aims to optimize costs, improve margins, and scale operations. Value-added services like Batch Infinity Pro allow upselling at minimal cost, while larger batch sizes maintain quality and expand student reach.

Pursue Strategic Inorganic Opportunities

Physicswallah focuses on acquiring synergistic businesses to strengthen capabilities and market reach. Through careful target selection and integration, acquisitions like Xylem, Knowledge Planet, Utkarsh Classes, and Guiding Light enable expansion into new regions, multi-lingual courses, civil services, and the Middle East market while maintaining consistent quality and operational efficiency.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Physicswallah Limited IPO

How can I apply for Physicswallah Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of PhysicsWallah Limited IPO?

The IPO is ₹3,480 crore, comprising a fresh issue of ₹3,100 crore and an OFS of ₹380 crore.

On which stock exchanges will PhysicsWallah shares be listed?

The equity shares are proposed to be listed on NSE and BSE post-IPO on 18 November 2025.

Who are the book running lead manager and registrar for the IPO?

Kotak Mahindra Capital Ltd. is the lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

What is the purpose of the IPO proceeds?

Proceeds will fund offline and hybrid centers, marketing, tech infrastructure, acquisitions, and general corporate purposes.

What is the promoter holding before the IPO?

Promoters Alakh Pandey and Prateek Boob hold 96.13% of the company’s shares pre-IPO.