- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pine Labs IPO

₹14,070/67 shares

Minimum Investment

IPO Details

07 Nov 25

11 Nov 25

₹14,070

67

₹210 to ₹221

NSE, BSE

₹3,899.91 Cr

14 Nov 25

Pine Labs IPO Timeline

Bidding Start

07 Nov 25

Bidding Ends

11 Nov 25

Allotment Finalisation

12 Nov 25

Refund Initiation

13 Nov 25

Demat Transfer

13 Nov 25

Listing

14 Nov 25

Pine Labs IPO

Pine Labs, founded in 1998 and headquartered in Noida, India, is a leading merchant commerce platform offering point-of-sale (POS) solutions, payment processing, and merchant financing services. It supports businesses of all sizes with digital payment technologies and value-added services. Its offerings include smart POS devices accepting cards, UPI, mobile wallets, and EMIs; Buy Now Pay Later solutions; short-term merchant financing; loyalty programs and digital gift cards; and e-commerce payment tools. Serving 915,731 merchants as of December 2024, Pine Labs works with top brands like Amazon Pay, Flipkart, and LG Electronics, and partners with banks including HDFC, Axis, and ICICI. It has evolved into a comprehensive fintech platform driving India’s cashless, digital retail economy.

Pine Labs Limited IPO Overview

Pine Labs IPO is a book-built issue valued at ₹3,899.91 crores, comprising a fresh issue of 9.41 crore shares worth ₹2,080.00 crores and an offer for sale of 8.23 crore shares aggregating to ₹1,819.91 crores. The IPO will open for subscription on November 7, 2025, and close on November 11, 2025. The allotment is expected to be finalised on November 12, 2025, with the company’s shares scheduled to list on both the BSE and NSE on November 14, 2025. The price band for the Pine Labs IPO is fixed between ₹210.00 and ₹221.00 per share, with a lot size of 67 shares. For retail investors, the minimum investment required is ₹14,807 (based on the upper price band). The lot size for sNII investors is 14 lots, equivalent to 938 shares, requiring an investment of ₹2,07,298, while for bNII investors, it is 68 lots or 4,556 shares, amounting to ₹10,06,876. Axis Capital Ltd. serves as the book-running lead manager for the issue, and Kfin Technologies Ltd. is the registrar.

Pine Labs Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue | 17,64,66,426 shares (aggregating up to ₹3,899.91 Cr) |

| Fresh Issue | 9,41,17,647 shares (aggregating up to ₹2,080.00 Cr) |

| Offer for Sale (OFS) | 8,23,48,779 shares of ₹1(aggregating up to ₹1,819.91 Cr) |

| IPO Dates | 7 November 2025 to 11 November 2025 |

| Price Bands | ₹210 to ₹221 per share |

| Lot Size | 67 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,05,41,46,853 shares |

| Shareholding post-issue | TBA |

Pine Labs IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 67 | ₹14,807 |

| Retail (Max) | 13 | 871 | ₹1,92,491 |

| S-HNI (Min) | 14 | 938 | ₹2,07,298 |

| S-HNI (Max) | 67 | 4,489 | ₹9,92,069 |

| B-HNI (Min) | 68 | 4,556 | ₹10,06,876 |

Pine Labs IPO Timeline

| Event | Date |

| IPO Open Date | Friday, November 7, 2025 |

| IPO Close Date | Tuesday, November 11, 2025 |

| Tentative Allotment | Wednesday, November 12, 2025 |

| Initiation of Refunds | Thursday, November 13, 2025 |

| Credit of Shares to Demat | Thursday, November 13, 2025 |

| Tentative Listing Date | Friday, November 14, 2025 |

Pine Labs Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Pine Labs Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹(2.23) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (9.18%) |

| Net Asset Value (NAV) | ₹24.30 |

| Return on Equity (RoE) | (9.16%) |

| Return on Capital Employed (RoCE) | (3.04%) |

| EBITDA Margin | 13.22% |

| PAT Margin | (13.54%) |

| Debt to Equity Ratio | 2.87 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment / prepayment, in full or in part, of certain borrowings availed of by the Company and certain Subsidiaries | 5320 |

| Investment in certain of our Subsidiaries, namely Qwikcilver Singapore, Pine Payment Solutions, Malaysia and Pine Labs UAE for expanding presence outside India | 600 |

| Investment in IT assets, expenditure towards cloud infrastructure, technology development initiatives and procurement of DCPs | 7600 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

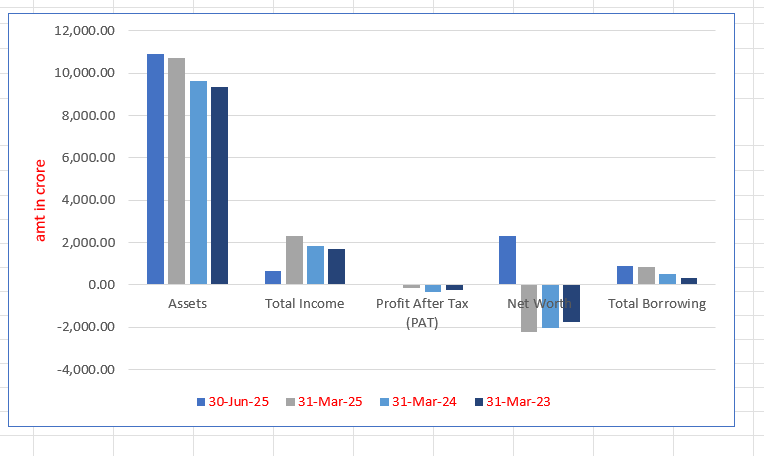

Pine Labs Limited Financials (in crore)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 10,904.32 | 10,715.74 | 9,648.56 | 9,363.21 |

| Total Income | 653.08 | 2,327.09 | 1,824.16 | 1,690.44 |

| Profit After Tax (PAT) | 4.79 | -145.49 | -341.90 | -265.15 |

| Net Worth | 2,327.55 | -2,244.27 | -2,035.24 | -1,764.77 |

| Total Borrowing | 888.74 | 829.49 | 532.92 | 329.51 |

Financial Status of Pine Labs Limited

SWOT Analysis of Pine Labs IPO

Strength and Opportunities

- Established as a leading fintech firm in India and Southeast Asia.

- Processes over ₹13 billion in payments annually, indicating strong market presence.

- Offers a comprehensive suite of payment solutions, including POS terminals, BNPL services, and loyalty programs.

- Strong partnerships with global financial institutions like Visa, Mastercard, and PayPal.

- Diversified revenue streams beyond transaction fees, including tech solutions and gift cards.

- Capitalizing on the growing digital payments and e-commerce sectors in India and Southeast Asia.

- Expansion into international markets, reducing dependence on the Indian market.

- Increasing adoption of Buy Now, Pay Later (BNPL) services, presenting growth opportunities.

- Strategic collaborations enhancing product offerings and market reach.

Risks and Threats

- Faces intense competition from established fintech firms and startups.

- Experiences widening net losses despite revenue growth, with FY23 losses reaching ₹62.26 crore.

- High reliance on the Indian market, exposing the company to local economic fluctuations and regulatory changes.

- Regulatory challenges in the evolving fintech landscape, especially in markets like India and Southeast Asia.

- Integration challenges from recent acquisitions, potentially leading to operational inefficiencies.

- Vulnerability to cybersecurity risks due to handling sensitive financial data.

- Exposure to economic downturns in key markets, potentially affecting transaction volumes and revenue.

- Risks from technological disruptions and rapid advancements in payment technologies.

- Potential challenges in maintaining profitability amidst rising operational costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Pine Labs Limited IPO

Pine Labs Limited IPO Strengths

Ecosystem Integration

Pine Labs Limited unites merchants, consumer brands, enterprises, and financial institutions, fostering a dense and interconnected ecosystem. By engaging multiple participants, the platform enhances transaction volumes and data-driven solutions. Each added partner strengthens network effects, offering seamless commerce experiences, attracting more participants, and generating monetization opportunities across all ecosystem constituents, showing consistent growth since 2022.

Platform Scale and Profitability

Pine Labs Limited operates a scalable digital infrastructure and transaction platform, processing billions of transactions annually. The platform demonstrates strong growth in revenue and contribution margins, with a consistent increase in gross transaction value. Its diversified offerings, from gift card issuances to digital affordability solutions, drive profitability and position the company as a leading in-store and online payments provider in India.

Deep Partnerships

Pine Labs Limited has cultivated enduring relationships with marquee merchants, consumer brands, enterprises, and financial institutions. These long-term partnerships span over a decade, with expanding multi-product engagement, loyalty solutions, and analytics. Its ecosystem includes major retailers, banks, fintech firms, and technology companies, reflecting the company’s ability to maintain deep engagement, foster trust, and create symbiotic, mutually beneficial collaborations.

Full-Stack, Cloud-Based Technology Platform

Pine Labs Limited employs a flexible, cloud-native technology platform designed for scale, speed, and security. Its API-first, modular architecture ensures rapid integration, high availability, and operational resilience. The platform supports international operations, customizable merchant solutions, and secure transactions, adhering to industry standards like PCI-DSS and ISO 27001, enabling a reliable and adaptable ecosystem for global commerce.

Innovation and New Solutions

Pine Labs Limited consistently develops innovative commerce solutions tailored to ecosystem needs. From in-store cloud-based payments to omni-channel offerings, prepaid distribution, and affordability solutions, its platform integrates multiple services efficiently. Strategic acquisitions, including Qwikcilver and Setu, expand capabilities. Its focus on technology-driven innovation ensures new features, robust security, and scalable solutions across merchants, enterprises, and financial institutions.

Experienced Management Team

Pine Labs Limited is guided by a professional and entrepreneurial management team with extensive experience in fintech, payments, technology, and e-commerce. The leadership drives innovation, integrates acquired teams, and nurtures a culture of growth and entrepreneurship. Their diverse expertise enables the company to scale operations across ecosystems and international markets while maintaining operational excellence and strategic vision

More About Pine Labs Limited

Pine Labs Limited is a payments and commerce solutions company that operates an ecosystem of merchants, consumer brands, enterprises, and financial institutions across India and select international markets. As of December 31, 2024, the company served over 915,000 merchants and 666 consumer brands, with a customer base that spans various industries, including retail, e-commerce, restaurants, healthcare, and government organizations.

Platforms and Offerings

Pine Labs categorizes its offerings into two main platforms:

- Digital Infrastructure and Transaction Platform: This platform provides in-store and online infrastructure, integrated affordability solutions, value-added services (VAS), and transaction processing. In the nine months ending on December 31, 2024, the platform processed a total gross transaction value (GTV) of ₹7,148.26 billion.

- Issuing and Acquiring Platform: This technology enables consumer brands and enterprises to create prepaid products and allows financial institutions to issue various financial instruments, such as credit, debit, and forex cards. As of December 31, 2024, Pine Labs had cumulatively issued over 3.2 billion prepaid cards and supported more than 28 issuers with over 71 million card accounts.

Merchant-Centric Solutions

Merchants are central to the company’s business model. As of December 31, 2024, Pine Labs had 915,731 merchants, and its solutions are designed to help them digitize their operations and enhance efficiency. Key benefits for merchants include:

- Comprehensive Payment Solutions: The technology simplifies the checkout process by consolidating multiple payment methods (including cards, wallets, and UPI) on a single digital checkout point (DCP) or online gateway.

- Consumer Acquisition and Retention: Pine Labs’ platforms provide tools to help merchants grow their sales. For example, its affordability solutions drive sales by connecting merchants with credit partners who offer installment plans and other financial incentives to consumers.

- Operational Efficiencies: The platform integrates with merchant billing software, ERP, and CRM systems to streamline back-office operations and automate reconciliation.

- Customizable Technology: Merchants can extend the functionality of their stores by downloading and deploying business software applications from Pine Labs’ marketplace, which offers more than 300 apps for managing activities like ordering, inventory, and GST support.

Industry Outlook

Market Size and Growth

- Digital Payments: The Indian digital payments market is projected to reach USD 42.61 billion by 2033, growing at a CAGR of 23.2% from 2025 .

- Card Payments: India’s card payments market is expected to almost triple from $262.1 billion in 2022 to $728.2 billion in 2027, driven by rising consumer spending .

- Real-Time Payments: The real-time payments market is forecasted to reach USD 34.63 billion by 2030, advancing at a 21.48% CAGR .

Key Growth Drivers

- Unified Payments Interface (UPI): UPI continues to be a dominant force in India’s digital payments landscape, accounting for over 75% of retail digital payments in India .

- Government Initiatives: Programs like Digital India and Jan Dhan have significantly contributed to the adoption of digital payments.

- Fintech Innovation: The rise of digital wallets, QR codes, and embedded B2B payment solutions has further accelerated market growth.

Pine Labs’ Position and Offerings

Pine Labs’ platforms cater to both merchants and financial institutions:

- Digital Infrastructure and Transaction Platform: Provides in-store and online infrastructure, integrated affordability solutions, value-added services, and transaction processing.

- Issuing and Acquiring Platform: Enables the creation of prepaid products and the issuance of various financial instruments, such as credit, debit, and forex cards.

With over 915,000 merchants and 666 consumer brands served as of December 31, 2024, Pine Labs is well-positioned to capitalize on the industry’s growth.

How Will Pine Labs Limited Benefit

- Pine Labs stands to benefit from the rapid expansion of India’s digital payments market, projected to reach USD 42.61 billion by 2033, providing a larger customer base for its transaction and merchant solutions.

- The surge in card payments, expected to grow from $262.1 billion in 2022 to $728.2 billion in 2027, aligns with Pine Labs’ issuing and acquiring platform, enabling higher volumes of prepaid, credit, and debit card issuance.

- Increasing adoption of UPI and real-time payments offers opportunities for Pine Labs to enhance its digital infrastructure, expand in-store and online payment processing, and integrate new value-added services.

- Government initiatives promoting digital financial inclusion, such as Digital India and Jan Dhan, facilitate Pine Labs’ merchant acquisition and expansion into underserved regions.

- Continuous fintech innovation, including digital wallets and embedded B2B solutions, allows Pine Labs to offer advanced affordability and loyalty solutions, boosting merchant engagement and transaction volume.

Peer Group Comparison

Here’s a clean table version of the comparison with listed peers based on the data you provided:

| Name of the Company | Revenue (₹ Million) | Face Value (₹) | P/E Ratio | EPS Basic (₹) | RoNW (%) | NAV (₹) |

| Pine Labs Limited | 13,410.14 | 1 | [●] | (2.23) | (9.18%) | 24.30 |

| India Listed Peers | ||||||

| One97 Communications Limited (“Paytm”) | 99,778.00 | 1 | N.M. | (22.00) | (10.82%) | 209.29 |

| Zaggle Prepaid Ocean Services Limited | 7,755.98 | 1 | 104.76 | 4.06 | 14.11% | 46.98 |

| Global Listed Peers | ||||||

| Adyen N.V. | 178,886.98 | 0.96 | 71.57 | 2,161.92 | 25.09% | 9,746.88 |

| Shopify Inc. | 600,100.00 | NA | 8.50 | 8.50 | 1.53% | 599.25 |

| Block, Inc. | 1,862,827.96 | 0.00 | 1,701.70 | 1,701.70 | 0.05% | 2,579.75 |

| Marqeta, Inc. | 57,474.54 | 0.01 | N.M. | (35.70) | (16.42%) | 203.15 |

Key Strategies for Pine Labs Limited

Expand and Scale Existing Offerings

Pine Labs Limited aims to scale its current offerings by investing in its Digital Infrastructure and Transaction Platform and Issuing and Acquiring Platform. The company focuses on cross-selling, enhancing in-store and online infrastructure, affordability, VAS, and transaction processing, while expanding into new sectors and serving small and mid-market merchants.

Broaden and Deepen Partnership Ecosystem

Pine Labs Limited plans to strengthen its ecosystem by adding merchants, consumer brands, enterprises, and financial institutions. Through direct sales and field teams, it seeks to expand partnerships, integrate third-party software, and provide agnostic commerce services that bundle in-house and external solutions.

Invest in Technology Platform

Pine Labs Limited continues to invest in IT assets, cloud infrastructure, DCP procurement, and advanced technology development. It focuses on R&D, AI-powered insights, and innovative financial products to enhance its existing offerings and build new solutions for merchants, enterprises, and financial institutions.

Expand Internationally

Pine Labs Limited intends to grow globally, targeting selective markets including Southeast Asia, UAE, the US, and Australia. It plans to onboard clients for its Issuing and Acquiring Platform and extend affordability solutions internationally through strategic partnerships.

Pursue Strategic Acquisitions and Investments

Pine Labs Limited will selectively acquire or invest in businesses to enhance competitiveness, acquire new technologies, expand offerings, and strengthen market presence. Past acquisitions like Qwikcilver, Fave, Mosambee, and Setu support its inorganic growth strategy and platform expansion for merchants and enterprises.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Pine Labs Limited IPO

How can I apply for Pine Labs Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue type of Pine Labs IPO?

Pine Labs IPO is a book-building issue with a fresh issue and an offer for sale (OFS).

Where will Pine Labs shares be listed?

The equity shares are proposed to be listed on both NSE and BSE mainboards.

What is the face value of Pine Labs shares?

Each equity share of Pine Labs has a face value of ₹1 per share.

Who are the lead managers and registrar for the IPO?

Axis Capital Ltd. is the book running lead manager and Kfin Technologies Ltd. is the registrar.