- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

PNGS Reva Diamond Jewellery IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

PNGS Reva Diamond Jewellery IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

PNGS Reva Diamond Jewellery Limited

P N Gadgil & Sons (PNGS) is a jewellery brand engaged in selling a wide range of pieces made from precious metals like gold and platinum, adorned with diamonds and other precious or semi-precious stones. In February 2025, the company launched a sub-brand called Reva, focused on offering elegant yet affordable diamond jewellery. The Reva line features pure diamond pieces in modern, customisable designs, with prices starting from ₹10,000. Launched just before Valentine’s Day, it was promoted with waived making charges to attract customers. As of March 31, 2025, PNGS operated 33 stores across 25 cities in Maharashtra, Gujarat, and Karnataka, covering a total of 599.15 Running Feet. Their product range includes diamond rings, earrings, bracelets, pendant sets, and necklace sets, all crafted in hallmarked gold.

PNGS Reva Diamond Jewellery Limited IPO Overview

The PNGS Reva Diamond Jewellery IPO is a book-building issue of fresh capital, with the number of shares and price band yet to be announced. The IPO dates and listing details are currently pending, while the allotment is expected to be finalised soon. The face value of each share is ₹10, and the issue will be listed on both BSE and NSE. The IPO will be managed by Smart Horizon Capital Advisors Private Limited as the book-running lead manager, and Bigshare Services Pvt Ltd will act as the registrar to the issue.

As outlined in the Draft Red Herring Prospectus (DRHP), the issue involves fresh capital only, with no offer for sale. Before the issue, the company’s total shareholding stood at 2,18,66,400 shares, with promoters holding 87.45%. The promoters of PNGS Reva Diamond Jewellery Limited include P.N. Gadgil & Sons Limited, Govind Vishwanath Gadgil, and Renu Govind Gadgil. The DRHP was filed with SEBI on June 18, 2025, and provides detailed information regarding the offer and company background.

PNGS Reva Diamond Jewellery Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹450 crores

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,18,66,400 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

PNGS Reva Diamond Jewellery Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

PNGS Reva Diamond Jewellery Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 35.21 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 59.36% |

| Net Asset Value (NAV) | 45.82 |

| Return on Equity (RoE) | 59.4% |

| Return on Capital Employed (ROCE) | 80.5% |

| EBITDA Margin | 41.81% |

| PAT Margin | 23.04% |

| Debt to Equity Ratio | 0.37 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding expenditure towards setting-up of 15 New Stores | 2865.64 |

| Marketing and promotional expenses related to the launch of the 15 New Stores, aimed at enhancing local brand awareness and visibility of our flagship brand, “Reva”, in their respective areas | 354.75 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

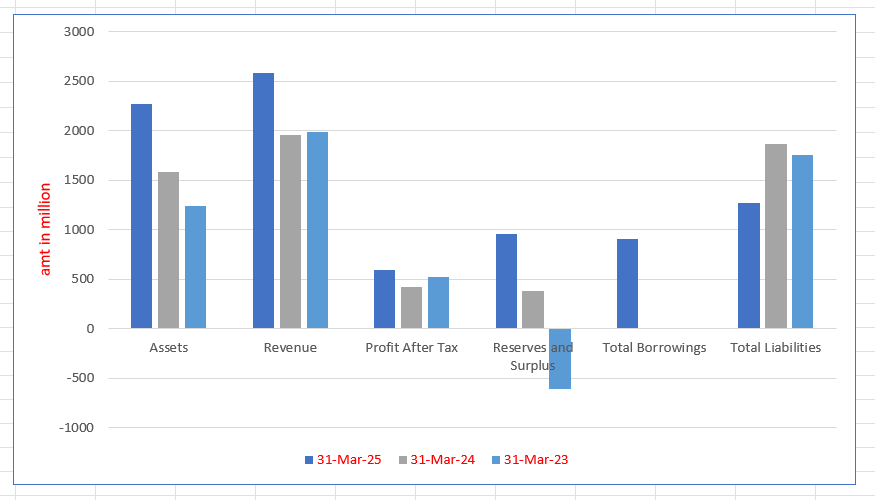

PNGS Reva Diamond Jewellery Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2268.35 | 1583.28 | 1239.26 |

| Revenue | 2581.83 | 1956.34 | 1988.48 |

| Profit After Tax | 594.74 | 424.14 | 517.47 |

| Reserves and Surplus | 953.32 | 376.40 | (607.42) |

| Total Borrowings | 906.50 | – | – |

| Total Liabilities | 1266.43 | 1868.24 | 1759.43 |

Financial Status of PNGS Reva Diamond Jewellery Limited

SWOT Analysis of PNGS Reva Diamond Jewellery IPO

Strength and Opportunities

- Legacy brand born from over 190yearold PNGS heritage.

- Strong financial metrics: ROE ~78.9%, ROCE ~59.5%, PAT margin ~30.8%.

- Zero debt until recent IPO, current debttoequity ~0.9×

- IPO funds of ₹450 crore to support aggressive retail expansion to 15 new exclusive stores by FY 2028.

- Brand strategy blending tradition and modern design appeals to urban and millennial consumers.

- Strong presence across 25 cities in Maharashtra, Gujarat and Karnataka with multi-store formats.

- Opportunity to tap growing organised retail diamond segment projected to grow at a CAGR of 16–17%.

- Rising domestic consumption driven by growing incomes and urbanisation.

- Ability to scale digital and e-commerce marketing with IPO marketing allocation of ₹35 crore.

- Inherited design craftsmanship and brand authenticity from PNG heritage.

Risks and Threats

- New independent entity since December 2024, still building separate brand recognition.

- High dependence on parent promoter group operations and systems.

- Limited scale: revenue ~₹258 crore, smaller than established peers.

- Fierce competition from well-known brands like Tanishq, CaratLane, Bluestone.

- Volatility of diamond and metal prices compresses margins.

- Intense price competition from unorganised sector with 58% market share.

- Regulatory and compliance burden increasing, especially with traceability and hallmarking standards.

- Threat from synthetic and lab-grown diamond alternatives gaining consumer traction.

- Risk of over-expansion due to execution challenges in new store rollouts.

- Consumer brand expectations shifting rapidly; failure to adapt may affect relevance.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About PNGS Reva Diamond Jewellery Limited

PNGS Reva Diamond Jewellery Limited IPO Strengths

Legacy and Brand Value Drive Market Position

PNGS Reva Diamond Jewellery Limited leverages the legacy of P.N. Gadgil & Sons, along with decades of promoter experience, to strengthen its market presence. Their trusted relationships, operational infrastructure, and established reputation enable customer loyalty, supply chain efficiency, and expansion. This heritage empowers Reva to grow while maintaining a distinct and modern brand identity.

Experienced Leadership Ensures Strategic Growth

Led by industry veterans including Govind Gadgil and Amit Modak, PNGS Reva benefits from decades of experience in retail, finance, and jewellery. Their skilled Board and management team oversee operations, build long-term value, and guide expansion. The leadership’s diverse expertise ensures sound decision-making, efficient operations, and a clear path to sustainable growth.

Regional Presence Enhances Efficiency and Trust

With operations across Tier-1 to Tier-3 cities in Maharashtra, Gujarat, and Karnataka, PNGS Reva taps into regional customer preferences and festive demand. This focused presence allows operational efficiencies in logistics, inventory, and store management. The localised approach fosters brand loyalty, community trust, and reputation, enabling scalable growth with lower costs and strategic precision.

Diverse Product Portfolio Meets Dynamic Tastes

PNGS Reva offers jewellery across a wide price range and product categories, from daily wear to wedding collections. Designs incorporate precious stones, modern trends, and traditional aesthetics. In-house designers and Karigars create unique pieces, while customisation options ensure personalised service. This diversity supports consistent customer relevance, revenue growth, and evolving market positioning.

Customisation and High-Value Jewellery Build Prestige

By offering customised and premium jewellery, PNGS Reva caters to affluent consumers and major life occasions like weddings. Each design is crafted with artisanal expertise and personalisation options. This high-value segment enhances customer loyalty, average order value, and brand prestige, positioning the company as a trusted provider of bespoke, culturally significant jewellery.

Robust Inventory and Quality Controls Safeguard Growth

PNGS Reva operates with strong governance, a centralised ERP system, barcode tracking, and regular audits. Inventory is secured, insured, and monitored for seasonal demand. Quality assurance measures ensure BIS and IGI certification standards. Transparent documentation, certified gemstones, and secured logistics enhance customer trust and support scalable, high-integrity business expansion across all touchpoints.

More About PNGS Reva Diamond Jewellery Limited

A Legacy Transformed: From P.N. Gadgil to PNGS Reva

PNGS Reva Diamond Jewellery Limited is a retail-centric jewellery company offering an extensive portfolio of diamond and gemstone-studded pieces set in gold and platinum. Branded under “Reva”, the company emphasises a contemporary take on traditional craftsmanship, allowing customisation that appeals to a wide spectrum of consumers.

- The company was established following a Business Transfer Agreement dated January 31, 2025, through which its Corporate Promoter, P.N. Gadgil & Sons Limited, divested its diamond business via slump sale.

- This strategic transition enabled PNGS Reva to emerge as an independent entity while retaining a 190+ year legacy in the jewellery trade.

Retail Model Rooted in Legacy Infrastructure

PNGS Reva operates under a Franchisee Agreement dated February 1, 2025, allowing access to the retail setup of P.N. Gadgil & Sons Limited.

- This includes infrastructure such as billing systems, logistics, retail space, and utilities.

- Their stores function primarily under two models:

- FOCO (Franchise Owned Company Operated): Company handles inventory and operations.

- FOFO (Franchise Owned Franchise Operated): Inventory is transferred to the promoter, who retails under the Reva brand.

As of March 31, 2025, the company had 33 stores across 25 cities in Maharashtra, Gujarat, and Karnataka, totalling 599.15 Running Feet in retail space.

Product Range Designed for Every Customer

The company offers a wide assortment of jewellery:

- Diamond Rings, Earrings, Necklaces, Mangalsutras, and Bangles

- Plain Platinum Jewellery: Including rings, bracelets, and chains

- Semi-Precious Collections

- Price range starts at ₹20,000 and goes up to ₹40,00,000, offering something for every buyer—entry-level or luxury.

The design process is split between:

- In-house creations by a team of two designers

- Collaborations with third-party manufacturers and Karigars (craftsmen)

Marketing with a Modern Touch

PNGS Reva integrates traditional and digital channels:

- Online presence: Through www.onlinepng.com

- Digital marketing: Via WhatsApp, Instagram, OTT platforms, and cinemas

- Offline advertising: Newspapers, hoardings, television, and radio

As of March 31, 2025, their marketing team comprised 53 members, with a spend of ₹14.21 million in FY25.

Financial Highlights & Sourcing Strategy

- In FY23, FY24, and FY25, 99.75%, 99.69%, and 99.64% of revenue came from ornament sales.

- Stock-in-trade purchases from domestic manufacturers accounted for ₹1,392.64 million, ₹1,663.63 million, and ₹1,971.41 million, respectively.

- The company does not import raw materials but sources finished products within India.

Quality Assurance and Customer Trust

PNGS Reva upholds stringent quality practices:

- Diamonds used are E-F/F-G colour, VVS clarity, certified by IGI and GIA

- All gold jewellery is hallmarked

- Customers receive proper documentation, enhancing transparency and trust

Vision for Expansion

- The company plans to open 15 brand-exclusive stores by FY28, all company-owned.

- These stores will further strengthen the Reva brand’s visibility and customer base in new markets.

Experienced Leadership Driving Growth

The company benefits from the leadership of:

- Govind Gadgil (45+ years of experience)

- Renu Gadgil (13+ years of experience)

They share common control over the promoter entity and bring strategic vision rooted in legacy. Directors such as Amit Yeshwant Modak and Aditya Amit Modak are instrumental in modernising the brand’s operations.

Industry Outlook

India’s gems and jewellery industry is poised for significant growth, fuelled by rising disposable incomes, evolving consumer preferences, and a strong tradition of ornamentation. The sector includes gold, diamonds, platinum, and coloured gemstone jewellery—segments in which PNGS Reva Diamond Jewellery operates through its branded diamond and gemstone-studded pieces.

Strong Growth Projections with Rising Demand

- The Indian gems and jewellery market was valued at USD 78.5 billion in 2023.

- It is expected to grow at a CAGR of 8.5% between 2024 and 2030, reaching USD 140 billion by 2030.

- Growth is driven by:

- Urbanisation and rise in middle-class consumers

- Increasing demand for branded, hallmarked, and certified jewellery

- Shifting preference from investment-led to fashion and design-led purchases

Diamond Jewellery Market: Design and Customisation Take Centre Stage

- The Indian diamond jewellery market was valued at ₹1.45 trillion (USD 17.5 billion) in FY24.

- It is forecasted to grow at a CAGR of 9-10% over the next five years.

- Demand is supported by:

- Growing millennial and Gen Z interest in bespoke and contemporary designs

- Weddings and special occasions continuing to drive high-value purchases

- Rising preference for platinum and solitaire-based collections

Retail Jewellery: Organised Players Capture Market Share

- Organised retail penetration in jewellery has grown from 22% in 2019 to 35% in 2024, expected to hit 45-50% by 2030.

- Franchised and brand-exclusive outlets like PNGS Reva are increasingly preferred for their transparency, certification, and variety.

- FOCO and FOFO models are gaining traction, offering scalable retail expansion with brand control.

Key Growth Drivers for the Sector

- Government policies like:

- Mandatory hallmarking

- Reduction in import duty on cut and polished diamonds

- Surge in digital transformation with omnichannel retailing

- Increasing global demand and export potential, especially in the diamond cutting and polishing segment.

How Will PNGS Reva Diamond Jewellery Limited Benefit

- Positioned to leverage the expanding ₹1.45 trillion diamond jewellery market through its focus on custom, design-led offerings.

- Rising demand for branded and certified jewellery enhances customer trust, aligning with PNGS Reva’s core product value.

- The shift toward fashion-forward purchases over investment-led buying supports their innovative and modern design strategy.

- Increasing retail penetration, from 22% in 2019 to a projected 50% by 2030, favours branded outlets like PNGS Reva’s franchise-based model.

- Adoption of FOCO and FOFO models facilitates cost-effective, scalable growth with brand consistency across locations.

- Mandatory hallmarking and reduced import duties on cut and polished diamonds improve product compliance and pricing.

- Growth in omnichannel retailing supports PNGS Reva’s digital expansion efforts, enhancing customer engagement and accessibility.

- Booming global demand for polished diamonds opens export potential for long-term business scalability.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for PNGS Reva Diamond Jewellery Limited

Expanding Through Brand-Exclusive Stores

PNGS Reva plans to open 15 brand-exclusive stores to strengthen market position and increase revenue. These company-owned outlets will ensure brand consistency, superior customer service, and operational control. By selecting strategic locations and maximising store efficiency, the company aims to expand its footprint, enhance visibility, and deliver sustainable value to stakeholders and customers.

Enhancing Brand Visibility Through Targeted Marketing

PNGS Reva will intensify promotional efforts around its flagship brand through ₹354 million in marketing spend, primarily for the 15 upcoming stores. Digital platforms like WhatsApp, Instagram, Google, and OTT will be key. These campaigns aim to increase brand awareness, attract footfall, and support market expansion by engaging new and existing customers effectively.

Boosting Revenues in Existing Stores

PNGS Reva focuses on increasing bill volumes and footfall in existing stores by strengthening digital outreach and in-store experiences. Revenue grew by nearly 30% between FY23 and FY25. Continued efforts in WhatsApp and social media marketing, combined with curated store displays and personalised service, aim to further enhance customer engagement and sales.

Strengthening Digital Presence for Growth

To capture India’s growing online consumer base, PNGS Reva plans to expand its digital presence through the website of P.N. Gadgil & Sons and its own e-commerce platform. This strategy enables brand discovery, supports customer acquisition, and provides valuable insights for retail expansion, while also enriching customer experience through personalised online engagement and promotions.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On PNGS Reva Diamond Jewellery Limited IPO

How can I apply for PNGS Reva Diamond Jewellery Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the PNGS Reva IPO?

PNGS Reva is targeting a ₹450 crore IPO, entirely through fresh equity shares, each with ₹10 face value.

What will the IPO proceeds be used for?

Proceeds include ₹286.56 crore for 15 new stores, ₹35.40 crore for marketing, and the rest for corporate purposes.

What allocation shares go to retail, institutional, and NII investors?

At least 75% to QIBs, 15% to noninstitutional investors, and 10% reserved for retail individuals.

How many stores does PNGS Reva currently operate?

As of March 31, 2025, PNGS Reva operates 33 shops-in-shop across 25 cities in Maharashtra, Gujarat, and Karnataka.

How has PNGS Reva performed financially recently?

In FY25, revenue rose about 32% to ₹258.18 crore, while profit grew nearly 40% to ₹59.47 crore.