- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

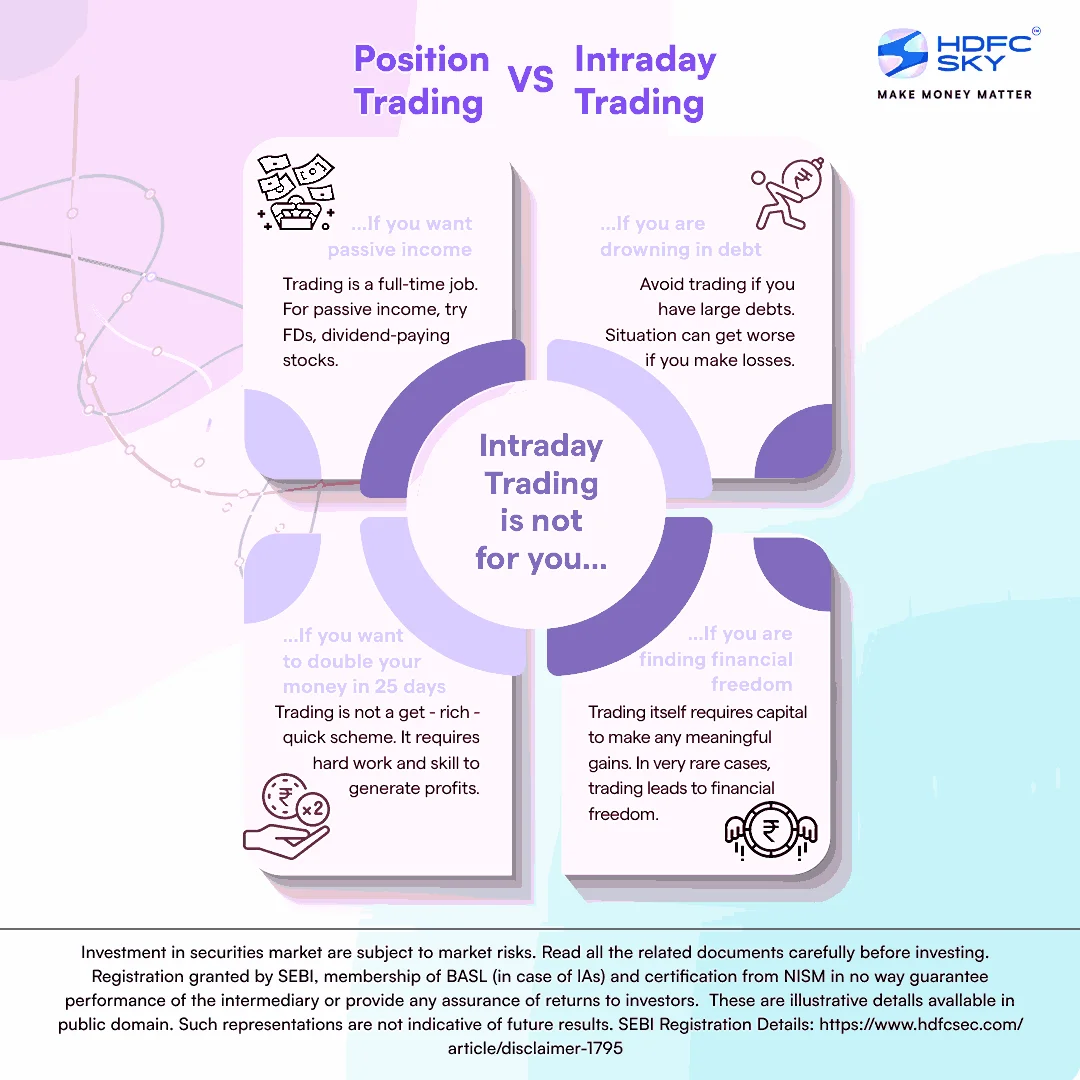

Positional Trading vs Intraday Trading

By HDFC SKY | Updated at: Apr 11, 2025 12:22 PM IST

Earlier in this course, we looked at the two basic styles of trading – positional trading (10.6) and intraday trading (9.1). In this chapter, we will understand the key differences between the two.

Before we move on, let’s quickly refresh our memory on the two styles.

Intraday trading, also called day trading, is the practice of buying and selling stocks on the same day. In contrast, positional trading is a slightly longer-term strategy where a trader holds a position from a few days to a few months.

Approach

Intraday trading: Day traders look to benefit from price movements in stocks during the day. The position must be closed by the end of that trading session. If you forget to square off, the trading system automatically closes all open positions by 3.15 pm. It will place a market order in the direction opposite of your trade at 3.15 pm.

Positional trading: Positional traders aim to profit from an event. They are not bound by a time frame and can hold a position for as long as they want. This is typically from a few days to a few months.

Scope

Intraday trading: Day traders can both long and short a stock. Hence, a day trader can benefit when the stock goes up, down or sideways.

Positional trading: Retail traders can’t short stocks in the cash segment if they hold them for over a session. Hence, positional traders can only benefit if they expect the price to go up.

Techniques

Intraday trading: Day traders rely more on technical analysis and less on fundamentals. This is because the difference between the market price and the intrinsic value (if any) can take multiple days, months or even years to converge.

Positional trading: Positional traders can use technical and fundamental analysis at the same time. They can use fundamental analysis to determine the outcome of an event and deploy technical analysis to identify entry and exit price points for any stock.

Risk

Intraday trading: Stock prices are more volatile in the short-term than long-to-medium term. This is because, in the short term, they are more reactive to external factors than their fundamentals. Hence, predicting daily price action is extremely difficult. Therefore, day trading requires a high appetite for risk.

Positional trading: Positional trading is significantly less risky than intraday trading. This is because they are not bound by time, protecting them from daily price fluctuations. Moreover, research, including financial and fundamental analysis of a company, its peers and the economy in general, can help them make reasonable assumptions about the direction of the stock.

Capital requirement

Intraday trading: Day trading can be done on limited capital. Depending on the broker, day traders can benefit from the margin facility. We have discussed margin and how it works in previous chapters. It is covered in detail in chapter 14.1.

Positional trading: Positional trading in the cash segment requires more capital. Some full-time brokers provide margin facilities for positional trading. However, it is more expensive than day trading and puts a cap on the holding period (typically T+90).