- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Powerica IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Powerica IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Powerica Limited

Powerica Ltd is a leading power solutions provider specialising in diesel generator sets (DG sets) for both primary and backup applications. Its product portfolio covers a wide capacity range from 7.5 kVA to 10,000 kVA, catering to varied industrial needs. The business operates through three divisions: DG sets powered by Cummins engines across low, medium, and high horsepower segments with manufacturing units in Bengaluru, Silvassa, and Khopoli; a wind power division with 11 projects in Gujarat totalling 279.55 MW; and retrofit emission control devices through its associate, Platino Automotive.

Powerica Limited IPO Overview

Powerica Ltd filed its Draft Red Herring Prospectus (DRHP) with SEBI on August 8, 2025, to raise ₹1,400 crore through an Initial Public Offer (IPO). The issue comprises a fresh issue of shares worth ₹700 crore and an offer for sale (OFS) of ₹700 crore. The equity shares are proposed to be listed on NSE and BSE. ICICI Securities Ltd is acting as the book-running lead manager, while MUFG Intime India Pvt. Ltd is the registrar of the issue. Details such as IPO dates, price band, and lot size are yet to be announced. The promoters include Naresh Chander Oberoi, Bharat Oberoi, their family trusts, and associated entities.

Powerica Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1400 crore |

| Fresh Issue | ₹700 crore |

| Offer for Sale (OFS) | ₹700 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Powerica Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Powerica Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.32 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 15.37% |

| Net Asset Value (NAV) | ₹47.57 |

| Return on Equity (RoE) | 17.53% |

| Return on Capital Employed (RoCE) | 27.02% |

| EBITDA Margin | 13.03% |

| PAT Margin | 6.49% |

| Debt to Equity Ratio | 0.24 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Prepayment/repayment of certain outstanding borrowings availed by our Company, in part or full | 5250 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

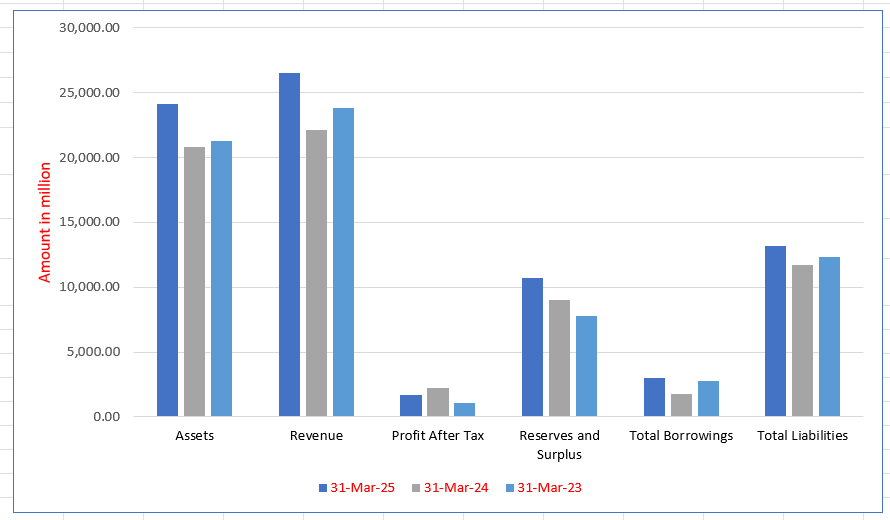

Powerica Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 24,148.30 | 20,849.10 | 21,258.10 |

| Revenue | 26,532.70 | 22,100.00 | 23,782.60 |

| Profit After Tax | 1,668.20 | 2,262.80 | 1,064.50 |

| Reserves and Surplus | 10,709.50 | 8,986.70 | 7,778.80 |

| Total Borrowings | 3,008.00 | 1,775.20 | 2,788.80 |

| Total Liabilities | 13,211.00 | 11,738.20 | 12,331.20 |

Financial Status of Powerica Limited

SWOT Analysis of Powerica IPO

Strength and Opportunities

- Established OEM partnership with Cummins, offering credibility and strong brand alignment

- Decades of experience—since 1984—providing deep industry knowledge and trust

- Diversified offerings: DG sets, MSLG, wind IPP, wind EPC, O&M—lowering dependency on a single revenue stream

- Strong financial risk profile: large net worth, healthy accruals, strong liquidity

- Reduced debt in recent years—showing prudent financial management

- Growing contribution from MSLG and wind EPC segments—higher margins and diversification

- Opportunity to capitalize on rising demand for backup power amid infrastructure and data center expansion in India

- Scope to leverage hybrid genset trend, combining renewables with conventional power

- Strong investor confidence supported by stable credit ratings and outlook

Risks and Threats

- DG-set business is highly cyclical—exposed to economic swings and capital expenditure cycles

- Wind power generation is vulnerable to variability in wind speed and seasonality, affecting PLF

- Exposure to payment risk from state distribution companies, though mitigated by shifts to stronger counterparties

- Outstanding dues from state utilities, though being settled with interest

- DG set demand can weaken during economic downturns—limiting topline growth

- Wind projects’ PLF below P90 levels can affect cash flows and debt servicing

- Competition from strong players like Mahindra, FG Wilson, and Kirloskar in genset market

- Regulatory changes such as stricter emission norms may increase compliance costs

- Fluctuating wind patterns and climate risks could worsen operational volatility

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Powerica Limited IPO

Powerica Limited IPO Strengths

Strategic Partnerships and Technical Expertise

Powerica Limited has established strong alliances with renowned enterprises, a testament to its credibility and technical prowess. These relationships have enhanced the company’s capabilities, allowing it to evolve its Balance of Plant (BoP) technology to meet the specifications of internationally acclaimed OEMs. This demonstrates the enduring confidence of established players in Powerica’s capabilities and commitment to quality.

Strong Technical and Execution Capabilities

The company’s capabilities are built on a foundation of strong technical expertise and execution prowess. With a skilled workforce and cutting-edge technology, it excels in designing, developing, and delivering high-quality products. Powerica employs advanced manufacturing processes, precision engineering, and rigorous quality control measures, ensuring consistency, reliability, and innovation in every product. In its Wind Power Business, an experienced in-house team manages the entire project lifecycle, ensuring cost efficiency and quality control.

Large and Diversified Customer Base

Powerica Limited serves a large and diversified customer base across multiple sectors, including commercial, infrastructure, and government. This diversity reduces its dependence on any single industry, mitigating risks from market fluctuations. In its IPP Wind Power Business, the company has long-term Power Purchase Agreements (PPAs) with financially strong, highly rated counterparties like GUVNL and SECI, ensuring predictable and stable cash flows with low credit risk.

Experienced and Proven Management Team

The company is led by an experienced and proven management team, promoters, and Board of Directors. This leadership brings decades of industry experience, with Naresh Chander Oberoi having over 40 years in the generator set industry. The team’s collective expertise and consistent track record position Powerica well to deliver long-term shareholder value and advance India’s energy transition goals.

Balanced Business Portfolio and Financial Strength

Powerica Limited has a balanced business portfolio that includes both its Generator Set Business and Wind Power Business. This strategic approach optimizes both stability and growth. The Generator Set Business offers significant potential, driven by rising demand in sectors like data centers. The company’s steady cash flow and conservative debt management enable it to support growth while maintaining a strong financial profile.

More About Powerica Limited

Powerica Limited is an integrated power solutions provider with a strong presence in both conventional and renewable energy segments. The company specialises in diesel generator sets (“DG sets”) for primary and standby applications and has maintained a partnership with Cummins India Limited for over four decades.

Generator Set Business

Diesel Generator Sets

- Powerica commenced DG set operations in 1984 and has since expanded its offerings.

- The product portfolio covers capacities from 7.5 kVA to 3,750 kVA, classified into:

- Low Horse Power (LHP): 7.5 kVA – 160 kVA

- Medium Horse Power (MHP): 180 kVA – 500 kVA

- High Horse Power (HHP): Above 500 kVA

- The company sources engines and alternators directly from Cummins under a non-exclusive supply agreement signed in June 2025.

Powerica operates three manufacturing facilities in Bengaluru, Silvassa, and Khopoli. Its strong dealer network includes 19 sales offices and 32 authorised dealers, ensuring nationwide customer support. Clients span across commercial, infrastructure, manufacturing, agriculture, IT/data centres, defence, and rental sectors.

Medium Speed Large Generators (MSLG)

- Introduced in 1996 through a collaboration with HD Hyundai Heavy Industries.

- MSLGs offer capacities from 3,000 kVA to 10,000 kVA, operating at 750 RPM.

- Applications include oil refineries, nuclear power plants, fertiliser units, LNG terminals, steel and cement plants.

- Notable projects include a 63 MW installation for NPCIL and a 10 MW emergency generator project in Australia.

Allied Businesses

Powerica also manufactures:

- Electromagnetic integrated shelters and containers (including defence applications).

- Acoustic enclosures.

- PRISMA control panels and switchboards in collaboration with Schneider Electric.

Wind Power Business

In 2008, Powerica diversified into wind energy as an Independent Power Producer (IPP). As of March 2025, it owns and operates 11 wind projects in Gujarat with a total capacity of 279.55 MW. Additionally, two under-construction projects (104 MW) are expected to enhance installed capacity to 383.55 MW.

Beyond power generation, the company delivers EPC and O&M services for Balance of Plant (BoP), covering over 399 MW of installed capacity for both its own and third-party projects.

Financial Snapshot

For Fiscal 2025, revenue distribution was:

- Generator Set Business: ₹2,255.19 crore (85%)

- Wind Power Business: ₹398.08 crore (15%)

- Total Revenue: ₹2,653.27 crore

Industry Outlook

Diesel Generator (DG Sets) Market in India

The diesel genset industry continues to play a crucial role in India’s power ecosystem, providing reliable backup and primary power solutions across sectors.

- The market size is projected to grow from around USD 1.34 billion in 2025 to nearly USD 1.74 billion by 2030, reflecting a CAGR of 5–6%.

- Broader estimates suggest the segment could reach USD 2.59 billion by 2032, with a CAGR of 7–8%.

- Within this, the prime power genset market is expected to expand at over 8% CAGR, indicating strong demand from industrial and infrastructure sectors.

Growth drivers:

- Urbanisation and commercial infrastructure expansion.

- High demand from telecom, IT/data centres, manufacturing, and construction.

- Critical need for uninterrupted power supply in regions with grid instability.

Challenges include high upfront costs, fuel price volatility, and tightening environmental norms.

Wind Power Market in India

Wind energy has emerged as a key pillar of India’s renewable energy growth strategy.

- Installed capacity stood at ~49 GW in 2024 and is projected to reach 89–128 GW by 2030–33, implying a CAGR of around 11%.

- The market value of the wind sector is expected to rise from USD 9.8 billion in 2024 to over USD 39 billion by 2032, growing at nearly 19% CAGR.

Key drivers:

- Strong government support through renewable targets and auction-based procurement.

- Rising industrial demand for clean and cost-effective energy.

- Increasing investment in large-scale wind projects and hybrid wind-solar systems.

How Will Powerica Limited Benefit

- Expansion of the diesel genset market at a CAGR of 5–8% provides steady demand for Powerica’s core offerings, ensuring recurring revenue from both prime and standby applications.

- Growth in critical sectors such as telecom, IT, data centres, and manufacturing strengthens the company’s customer base and drives long-term contracts.

- Urbanisation and rising infrastructure projects create additional opportunities for deployment of higher-capacity gensets.

- Increasing focus on uninterrupted power in regions with grid instability secures consistent demand for backup solutions.

- Rapid growth in wind power at 11–19% CAGR positions Powerica to capture a larger share in renewable energy, aligning with global decarbonisation goals.

- Strong policy push for renewable capacity expansion enhances the company’s prospects in large-scale wind projects.

- Diversification across diesel and renewable energy markets reduces risk and ensures balanced growth.

Peer Group Comparison

| Name of Company | Face Value

(₹) |

Revenue

(₹ Cr) |

EPS (₹) Basic | NAV (₹) | P/E** | RONW (%) |

| Powerica Limited | 5 | 2,653.27 | 15.26 | 79.80 | [●]* | 15.37% |

| Listed Peers | ||||||

| Cummins India Limited | 2 | 10,390.69 | 72.15 | 272.78 | 48.94 | 26.45% |

| Kirloskar Oil Engines Limited | 2 | 6,349.13 | 33.71 | 212.60 | 26.85 | 15.85% |

| NTPC Green Energy Limited | S | 2,209.64 | 0.67 | 21.88 | 159.93 | 2.58% |

| Acme Solar Holdings Limited | 2 | 1,405.13 | 4.55 | 74.54 | 64.94 | 5.59% |

| Adani Green Energy Limited | 10 | 11,212.00 | 8.37 | 76.62 | 120.02 | 11.90% |

Key Strategies for Powerica Limited

Capitalising on Generator Set Demand

Powerica Limited believes continued economic growth, urbanization, and unreliable power grids will drive increased demand for generator sets in India. The company is strategically positioned to capitalize on this, supplying backup power solutions for diverse sectors, including high-capacity sets for industrial applications and the rapidly expanding electric vehicle charging infrastructure.

Expanding Wind Power Business

The company aims to capitalize on India’s vast wind energy potential and the government’s push for renewables. Powerica is developing wind projects as an independent power producer and through Engineering, Procurement, and Construction contracts. The company also plans to diversify into wind-solar hybrid projects to improve grid stability and reduce costs.

Developing Allied and RECD Businesses

Powerica Limited plans to leverage its experience and relationships to grow its allied and RECD businesses. This includes expanding its presence in the defense sector by supplying specialized EMI shelters and containers. The company’s associate, Platino Automotive, is also investing in advanced Retrofit Emission Control Devices (RECDs) to meet stricter environmental regulations.

Strengthening Strategic Alliances

The company aims to enhance its market position by strengthening alliances with key players like Cummins, Hyundai, and Vestas. These collaborations enable Powerica to offer better products and services, access advanced technologies, and diversify its product and customer base, which helps it stay competitive in a rapidly evolving business landscape.

Evaluating Expansion Opportunities

Powerica Limited is committed to sustained growth by continuously evaluating expansion opportunities. The company conducts thorough market research to target states with favorable renewable energy policies and strong economic growth. Additionally, it remains open to acquiring wind power projects and is leveraging alliances, like the one with GE, to strategically develop new projects.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Powerica Limited IPO

How can I apply for Powerica Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Powerica Limited IPO?

The IPO size is ₹1,400 crore, with equal fresh issue and offer for sale.

How will Powerica Limited utilise the IPO proceeds?

Proceeds will mainly fund debt repayment of ₹525 crore and support general corporate purposes.

When was the Draft Red Herring Prospectus (DRHP) filed with SEBI?

Powerica Limited filed its DRHP with SEBI on August 8, 2025.

On which exchanges will Powerica Limited shares be listed?

Shares of Powerica Limited will be listed on NSE and BSE.