- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pranav Constructions IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Pranav Constructions IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Pranav Constructions Limited

Pranav Constructions Limited is a prominent redevelopment company in Mumbai, focusing on affordable, mid-range, and aspirational homes. Specialising in pure-play redevelopment, it operates across key western suburbs such as Vile Parle, Santacruz, and Bandra. The company ensures transparency and compliance with municipal and RERA approvals. With a reputation for timely project completion, strong execution, and a customer-centric approach, PCPL has earned trust in the real estate market. The company also emphasises environmental sustainability and aims for green building certification for its projects.

Pranav Constructions Limited IPO Overview

Pranav Constructions, a Mumbai-based real estate developer, has filed a draft with SEBI on 4 March 2025 to raise funds through an initial public offering (IPO) for redevelopment projects and debt repayment. The IPO includes a fresh issuance of equity shares worth Rs 392 crore and an offer-for-sale of 28.56 lakh shares by existing shareholders. BioUrja India Infra will sell 23.07 lakh shares, while promoter Ravi Ramalingam will offer 5.49 lakh shares. The promoters hold 63.35% of the company, with public shareholders holding the rest. The company may raise up to Rs 78 crore in a pre-IPO round.

Pranav Constructions Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹392 crore

Offer for Sale (OFS): 0.29 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,71,71,170 shares |

Pranav Constructions IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Pranav Constructions Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.66 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 64.93% |

| Net Asset Value (NAV) | 10.30 |

| Return on Equity | 64.93% |

| Return on Capital Employed (ROCE) | 28.62% |

| EBITDA Margin | 13.35% |

| PAT Margin | 8.85% |

| Debt to Equity Ratio | 1.18 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding costs for government approvals, additional FSI, and compensation for alternate accommodation and hardship related to under-construction and upcoming redevelopment projects. | 2237.5 |

| Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the Company. | 740 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

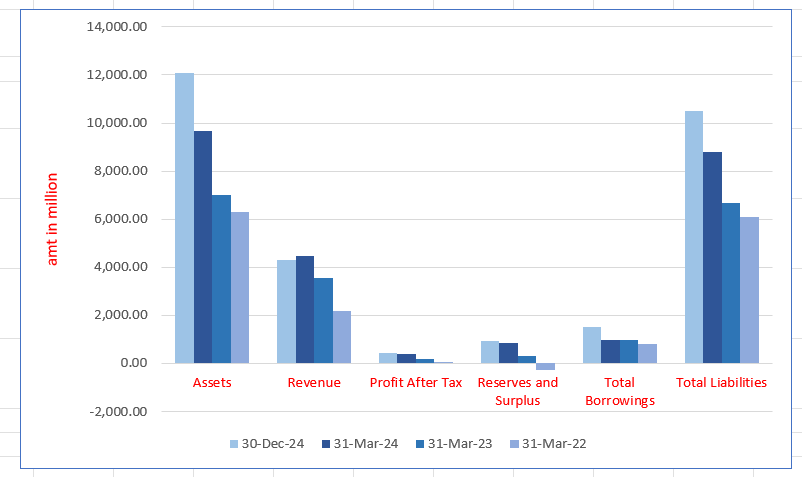

Pranav Constructions Limited Financials (in million)

| Particulars | 30 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 12,083.89 | 9668.04 | 7026.61 | 6278.26 |

| Revenue | 4305.89 | 4474.83 | 3552.59 | 2187.93 |

| Profit After Tax | 430.45 | 396.17 | 203.47 | 36.13 |

| Reserves and Surplus | 932.91 | 847.02 | 301.59 | (292.39) |

| Total Borrowings | 1498.79 | 993.35 | 976.92 | 801.90 |

| Total Liabilities | 10,520.27 | 8784.39 | 6690.03 | 6095.67 |

Financial Status of Pranav Constructions Limited

SWOT Analysis of Pranav Constructions IPO

Strength and Opportunities

- Strong brand recall in the Western Suburbs.

- Established track record in timely project delivery.

- Demonstrated growth in financial performance.

- Expertise in redevelopment with multiple ongoing projects.

- Extensive portfolio of completed and upcoming redevelopment projects.

- Customer-centric approach with after-sale support.

- Experience in navigating the regulatory environment.

- Strong execution capabilities with in-house expertise.

- Strategic expansion into micro-markets, increasing market share.

Risks and Threats

- Dependency on the real estate market's cyclical nature.

- Regulatory challenges in redevelopment projects.

- Competition from other established real estate developers.

- Risk of project delays due to unforeseen circumstances.

- Increased construction costs affecting profit margins.

- Delays in obtaining necessary permits and approvals.

- Changes in government policies impacting project feasibility.

- External economic conditions impacting housing demand.

- Dependency on a small geographic region for revenue generation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Pranav Constructions Limited IPO

Pranav Constructions Limited IPO Strengths

- Leading Real Estate Developer in the Western Suburbs

The company stands as a prominent real estate player in the Western Suburbs, having launched 1,503 units and 27 MCGM redevelopment projects, ranking 1st for the highest combined supply in the region between CY21 and CY24. It consistently ranks among the top 5 for completed and under-construction projects, with a significant market share in areas like Malad and Santacruz. With 26 completed, 11 under construction, and 21 upcoming projects, the company has established a strong foothold in various micro-markets.

- Demonstrated Project Execution Capabilities & In-House Functional Expertise

Pranav Constructions Limited adopts an integrated redevelopment model, showcasing in-house expertise for each project phase. From tendering and pre-construction to construction and post-construction, the company ensures timely project delivery. With dedicated teams for business development, architecture, legal compliance, construction management, and sales, it has consistently executed projects within the stipulated timelines, demonstrating expertise across every redevelopment stage.

- Capital-Efficient Business Model with High Barriers to Entry

The company employs a capital-efficient business model by entering Redevelopment agreements with Co-operative Housing Societies, minimising upfront investments and reducing lead time for title clearance. This approach allows multiple projects to be undertaken simultaneously, enhancing profitability while maintaining low capital expenditure and financing costs.

- Customer-Centric Brand with Strong Stakeholder Management

The company has established itself as a trusted brand in the Western Suburbs, focusing on constructing economical, mid, and aspirational homes. With a proven track record in timely project completion and strong stakeholder relationships, it ensures customer satisfaction throughout the purchase cycle, driving brand recall and continued growth in redevelopment projects.

- Consistent Financial Performance and Growth

The company has showcased a strong track record of financial performance with significant growth in recent years. It achieved a 463.16% increase in profit after tax from Fiscal 2022 to 2023 and a 94.71% growth from Fiscal 2023 to 2024. Additionally, revenue from operations grew by 62.37% year-on-year from Fiscal 2022 to 2023, followed by a 25.96% increase from Fiscal 2023 to 2024.

More About Pranav Constructions Limited

Pranav Constructions is a leading real estate company primarily focused on redevelopment projects in the Western Suburbs of Mumbai. With a proven track record of completing over 27 MCGM redevelopment projects, they specialise in creating economical, mid, mass, and aspirational homes. The company has built a strong reputation for timely project delivery and high-quality execution.

Strong Market Position

The company ranks first for having the highest supply of MCGM redevelopment projects launched between CY21 and CY24 in the MCGM region. As of December 2024, Pranav Constructions has 58 redevelopment projects across Mumbai, including 26 completed projects, 11 under construction, and 21 upcoming projects. Their focus on the Western Suburbs and integrated redevelopment model has allowed them to dominate this segment.

Robust Redevelopment Model

Pranav Constructions has a capital-efficient approach by entering into redevelopment agreements with cooperative housing societies. This method helps in reducing initial financial outlay and project lead times. They manage all stages of redevelopment in-house, from tendering and pre-construction to construction and post-construction.

Experienced Leadership

Founded in 2012, Pranav Constructions is led by experienced promoters, Pranav Kiran Ashar, with 21 years in real estate, and Ravi Ramalingam, with 16 years in finance. Together with a skilled management team, they provide strategic direction and ensure the smooth execution of growth plans.

This integrated approach, coupled with a focus on customer satisfaction and strong stakeholder relationships, has cemented Pranav Constructions as a trusted and reliable brand in the Mumbai real estate market.

Industry Outlook

The Indian real estate industry has shown remarkable resilience and growth in recent years, particularly driven by the housing and redevelopment sectors. The industry is expected to grow at a CAGR of around 9-11% over the next five years, with the residential segment, including redevelopment projects, being a key growth driver.

Growth Prospects

- The government’s focus on affordable housing and urban redevelopment is expected to boost the sector.

- Increased urbanisation and rising middle-class incomes will contribute to a strong demand for both affordable and aspirational homes.

- Redevelopment projects, especially in metropolitan areas like Mumbai, will see significant growth as cities continue to expand.

Key Growth Drivers

- Government schemes like PMAY (Pradhan Mantri Awas Yojana) for affordable housing.

- High demand for residential properties in metro cities.

- Rising investment in infrastructure development such as metro rail and improved transport links.

Market Size & Key Figures

- The Indian real estate market size is expected to reach $1 trillion by 2030.

- The residential sector is projected to contribute to 80% of the market.

- In Mumbai’s Western Suburbs, redevelopment projects continue to dominate, with developers like Pranav Constructions leading the way in the MCGM region.

Products in Focus

- Redevelopment projects for cooperative housing societies are a strong focus area.

- Emphasis on economical, mid, and aspirational homes aligns with the growing demand in urban areas.

How Will Pranav Constructions Limited Benefit

- Pranav Constructions will benefit from the growing demand for redevelopment projects driven by urbanisation and government support for affordable housing.

- Their strong position in Mumbai’s Western Suburbs allows them to lead the market in MCGM redevelopment projects.

- With a capital-efficient model, Pranav Constructions can expand rapidly without high financial outlays.

- The company’s in-house project execution capabilities ensure timely delivery and maintain a reputation for high-quality work.

- Experienced leadership and a skilled management team will drive strategic growth and efficient operations.

- Their focus on a broad range of housing options caters to diverse consumer needs, ensuring continued demand.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (in ₹ million) | EPS (₹) | NAV (₹) | P/E | RONW (%) | EPS

(₹) |

| Pranav Constructions Limited | 10 | 4,474.83 | 4.66 | 4.66 | 10.30 | [●] | 64.93 |

| Peer Groups | |||||||

| Keystone Realtors Limited | 10 | 22,222.50 | 9.85 | 9.82 | 157.54 | 52.12 | 6.38% |

| Godrej Properties Limited | 5 | 30,356.20 | 26.09 | 26.08 | 370.53 | 76.16 | 7.63% |

| Macrotech Developers Limited | 10 | 1,03,161.00 | 16.03 | 15.99 | 176.32 | 74.79 | 10.27% |

| Suraj Estate Developers Ltd | 5 | 4,122.14 | 19.39 | 19.39 | 116.37 | 17.27 | 22.97% |

| Kolte-Patil Developers Limited | 10 | 13,714.80 | (9.12) | (9.12) | 96.78 | (28.39) | (8.37)% |

| Arkade Developers Limited | 10 | 6,347.37 | 8.09 | 8.09 | 21.29 | 18.07 | 2.11% |

Key insights

- Face Value: The face value represents the nominal value of each share. Pranav Constructions, Keystone Realtors, and Macrotech Developers have a face value of ₹10, while Godrej Properties and Suraj Estate Developers are ₹5. This indicates consistency in the industry, though varying face values may affect investor perceptions. Kolte-Patil Developers and Arkade Developers also have a ₹10 face value.

- Revenue: Revenue is crucial for assessing a company’s market performance. Macrotech Developers leads with ₹1,03,161 million in revenue, significantly outpacing others like Pranav Constructions (₹4,474.83 million) and Suraj Estate Developers (₹4,122.14 million). Keystone Realtors (₹22,222.50 million) and Godrej Properties (₹30,356.20 million) showcase strong market positioning with notable revenues.

- Earnings Per Share: EPS provides insight into profitability per share. Godrej Properties leads with ₹26.09, followed by Macrotech Developers (₹16.03). Pranav Constructions shows a modest ₹4.66, while Kolte-Patil Developers report negative EPS at (₹9.12), indicating financial difficulties.

- Net Asset Value: NAV reflects the value of a company’s assets per share. Godrej Properties has the highest NAV at ₹370.53, showing robust asset value. Macrotech Developers follows with ₹176.32. Pranav Constructions and Keystone Realtors show moderate NAV, while Kolte-Patil Developers report a negative NAV, signalling asset depreciation.

- Price to Earnings Ratio: The P/E ratio indicates how much investors are willing to pay for ₹1 of earnings. Godrej Properties has a high P/E of 76.16, suggesting strong growth expectations. Macrotech Developers (74.79) and Keystone Realtors (157.54) show high valuation multiples, whereas Pranav Constructions has a relatively low P/E of 10.30.

- Return on Net Worth: RONW measures a company’s ability to generate profit from its equity base. Macrotech Developers has the highest RONW of 10.27%, reflecting efficient use of equity. Suraj Estate Developers (22.97%) and Keystone Realtors (6.38%) show moderate returns, while Kolte-Patil Developers report a negative RONW of (28.39%), indicating challenges in generating returns.

- Earnings Per Share: EPS is a critical metric for investors to assess earnings per share of the company. Suraj Estate Developers leads with ₹19.39, significantly higher than others. Kolte-Patil Developers has a negative EPS of (₹9.12), reflecting a loss. Other companies like Macrotech and Godrej Properties show reasonable EPS values, indicating healthy profits.

Key Strategies for Pranav Constructions Limited

- Focus on Redevelopment and Expanding in Other MCGM Regions

Pranav Constructions aims to continue focusing on redevelopment opportunities, particularly in the MCGM region. The limited land availability in Mumbai has led to a surge in redevelopment potential, especially in the western and eastern suburbs, where demand is high for new housing options.

- Asset-Light Business Model for Capital Efficiency

Pranav Constructions employs an asset-light business model, focusing on capital efficiency by entering redevelopment agreements with Co-operative Housing Societies. This approach reduces initial financial outlays and enables the company to deploy capital towards quick and efficient construction, enhancing project returns.

- Technology Upgradation to Drive Operational Efficiency

Pranav Constructions plans to upgrade its technology and methodologies to improve operational efficiency and deliver quality redevelopment projects. The company will implement advanced construction technologies like building information modelling and quality control software to optimise project timelines and reduce costs.

- Enhance and Leverage the ‘PCPL’ Brand

Pranav Constructions aims to enhance the recognition and trust of its ‘PCPL’ brand through strategic branding initiatives. By investing in marketing, consumer engagement, and digital campaigns, the company plans to strengthen its brand presence and ensure customer satisfaction, driving long-term success.

- Focus on Environmentally-Friendly Solutions

Pranav Constructions is committed to incorporating green building practices in all redevelopment projects. The company plans to use sustainable materials, improve energy efficiency, and focus on waste management. By obtaining green building certifications, Pranav Constructions will contribute to environmental sustainability in the real estate sector.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Pranav Constructions Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size and structure of Pranav Constructions Limited's IPO?

The IPO comprises a fresh issue of equity shares worth ₹392 crore and an offer for sale of 28.56 lakh shares by existing shareholders.

How will Pranav Constructions utilize the funds raised from the IPO?

The funds will be used for funding redevelopment expenses, repaying debt, acquiring future projects, and general corporate purposes.

Who are the selling shareholders in the offer for sale?

The offer for sale includes up to 23.07 lakh shares by BioUrja India Infra Private Limited and up to 5.49 lakh shares by promoter Ravi Ramalingam.

What is the face value of each equity share in the IPO?

Each equity share in the IPO has a face value of ₹10.

Which stock exchanges will list Pranav Constructions' shares post-IPO?

Post-IPO, Pranav Constructions’ shares will be listed on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).