- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Prasol Chemicals IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Prasol Chemicals IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Prasol Chemicals Limited IPO

Prasol Chemicals Limited is a prominent player in the specialty chemicals industry with over three decades of operational experience. The company manufactures a diverse portfolio of over 150 specialty chemicals, including acetone-based and phosphorous-based products, which serve critical applications across pharmaceuticals, agrochemicals, paints, lubricants, and home & personal care. Operating two manufacturing facilities in Maharashtra with a combined capacity of 87,914 MT per annum, Prasol boasts a strong global footprint, exporting to 69 countries and serving over 1,100 customers, including several marquee names. Its focus on robust R&D and sustainable practices underpins its market position.

Prasol Chemicals Limited IPO Overview

Prasol Chemicals Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on October 14, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Building Issue with a total size of ₹500.00 crores, comprising a fresh issue of shares worth ₹80.00 crores and an Offer for Sale (OFS) of ₹420.00 crores.

The equity shares are proposed to be listed on both the NSE and BSE. Dam Capital Advisors Ltd. has been appointed as the book running lead manager, while KFin Technologies Ltd. will act as the registrar of the issue. Key details such as IPO dates, price bands, and lot size are yet to be announced. For more information, refer to the Prasol Chemicals IPO DRHP.

The IPO has a face value of ₹2 per share and is being offered under a fresh capital-cum-OFS structure. The total issue size aggregates up to ₹500.00 crores, with the fresh issue contributing ₹80.00 crores and the OFS comprising ₹420.00 crores. The issue type is a bookbuilding IPO, with the shares planned to be listed on both BSE and NSE. Prior to the issue, Prasol Chemicals Ltd. has a total shareholding of 5,80,00,000 shares.

Prasol Chemicals Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹500.00 Crores |

| Fresh Issue | ₹80.00 Crores |

| Offer for Sale (OFS) | ₹420.00 Crores |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,80,00,000 shares |

| Shareholding post-issue | TBA |

Prasol Chemicals IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Prasol Chemicals Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Prasol Chemicals Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.51 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 11.86% |

| Net Asset Value (NAV) | ₹63.35 |

| Return on Equity (RoE) | 12.57% |

| Return on Capital Employed (RoCE) | 14.95% |

| EBITDA Margin | 8.67% |

| PAT Margin | 4.30% |

| Debt to Equity Ratio | 0.23 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment or pre-payment of certain outstanding borrowings | 600.00 |

| General corporate purposes | [●] |

*Note: The amount for general corporate purposes is to be determined upon finalisation of the Offer Price.

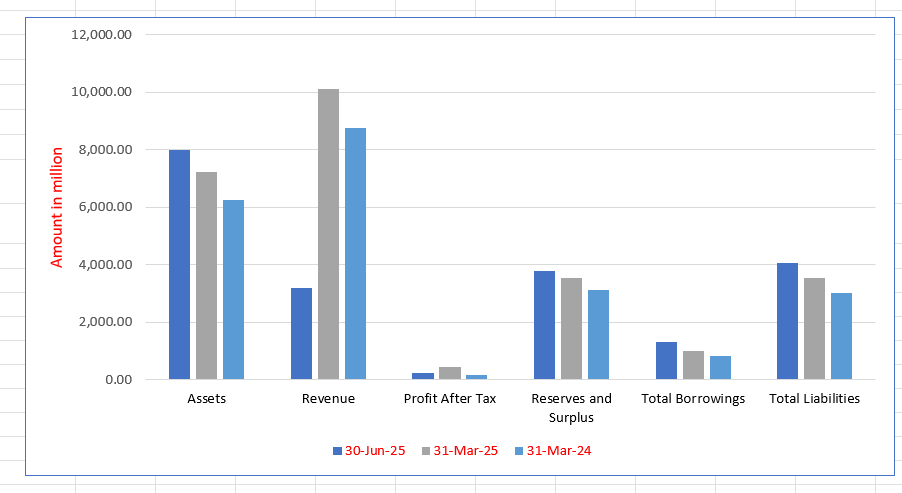

Prasol Chemicals Limited Financials (in ₹ million)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 7,981.78 | 7,230.87 | 6,263.57 | 6,925.41 |

| Revenue | 3,195.60 | 10,124.94 | 8,765.65 | 9,300.82 |

| Profit After Tax | 243.37 | 435.69 | 181.31 | 485.88 |

| Reserves and Surplus | 3,801.09 | 3,558.70 | 3,142.35 | 2,976.17 |

| Total Borrowings | 1,300.90 | 1,015.80 | 830.54 | 1,860.21 |

| Total Liabilities | 4,064.68 | 3,556.17 | 3,005.22 | 3,833.24 |

Financial Status of Prasol Chemicals Limited

SWOT Analysis of Prasol Chemicals IPO

Strength and Opportunities

- Diverse product portfolio of over 150 specialty chemicals.

- Established global presence with exports to 69 countries.

- Strong and diversified customer base of over 1,100 clients.

- Well-established R&D capabilities with a pipeline of 40 products.

- Long-standing relationships with marquee customers.

- Backward and forward integration capabilities.

- Government certifications like 3 Star Export House and AEO.

- Experienced and qualified leadership team.

- Opportunity from the "China Plus One" supply chain shift.

- Growing demand from end-user industries like pharmaceuticals and agrochemicals.

Risks and Threats

- Lower profitability margins compared to some peers.

- Dependence on the performance of the new Mahad facility.

- Vulnerability to fluctuations in raw material prices.

- High working capital requirements due to inventory and receivables.

- Intense competition from global and domestic players.

- Regulatory risks associated with chemical manufacturing and exports.

- Historical volatility in financial performance.

- Geopolitical risks impacting international trade.

- Currency exchange rate fluctuation risks.

- Potential for operational disruptions at manufacturing facilities.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Prasol Chemicals Limited

Prasol Chemicals Limited IPO Strengths

Diverse and Extensive Product Portfolio

Prasol Chemicals Limited possesses a robust and diversified product portfolio comprising over 150 specialty chemicals. This includes key acetone-based and phosphorous-based products, allowing it to cater to a wide array of industries such as pharmaceuticals, agrochemicals, and performance chemicals, thereby reducing dependency on any single market segment.

Strong Global Distribution Network

The company has established a formidable global footprint, exporting its products to 69 countries across six continents. Certified as a 3 Star Export House, Prasol Chemicals Limited leverages a robust distribution network, including sales personnel in key international hubs and consignment stockists, ensuring a wide market reach and resilience against regional economic downturns.

Well-Established R&D Capabilities

Prasol Chemicals Limited benefits from strong in-house Research and Development capabilities driven by a dedicated team of 18 professionals. Its R&D facility is equipped to handle complex chemical reactions, which has led to the successful commercialization of 13 new products since 2022 and a pipeline of 40 more, fostering continuous innovation and customer-specific solutions.

Long-Standing Customer Relationships

The company has cultivated long-standing, trusted relationships with a diversified base of over 1,100 customers, including several marquee names. These relationships, some spanning over a decade, provide significant revenue visibility, enhance customer stickiness, and create opportunities for cross-selling and up-selling the company’s expanding product portfolio.

More About Prasol Chemicals Limited

Prasol Chemicals Limited is a significant manufacturer in the Indian specialty chemicals landscape, with a history spanning over three decades. The company has carved a niche for itself by producing complex, value-added chemicals that serve as critical inputs for a multitude of global industries.

Product Portfolio and Application Industries

The company’s extensive portfolio of over 150 products is strategically categorized. Its key offerings include:

- Acetone-based Specialty Chemicals: Contributing 47.74% to FY25 revenue, these are used in products like diacetone alcohol and mesityl oxide.

- Phosphorous-based Specialty Chemicals: Accounting for 34.47% of FY25 revenue, these include derivatives like phosphorus pentasulphide.

- Other Specialty Chemicals: This category includes surfactants, esters, and polymers.

These products are essential ingredients in end-use segments collectively referred to as PICA (Paints, Inks, Construction, & Adhesives), Pharmaceuticals, Agrochemicals, and Home & Personal Care.

Manufacturing and Infrastructure

Prasol operates two manufacturing facilities in Maharashtra:

- Khopoli Facility: Spread over 1,18,004 sq. meters.

- Mahad Facility: Spanning 79,423 sq. meters. The combined aggregate production capacity stands at 87,914 MT per annum. The company also has access to additional land at both locations, providing significant headroom for future expansion and capacity debottlenecking.

Customer Base and Global Reach

The company’s marquee clientele includes Alembic Pharmaceuticals, Lubrizol India, Rossari Biotech, Clean Science, and Gharda Chemicals, among others. Its “3 Star Export House” certification and membership in CHEMEXCIL underscore its export prowess. Prasol has also secured important international registrations like European REACH and K-REACH, facilitating smoother market access.

Sustainability and Awards

Prasol is committed to sustainable operations, evidenced by its ‘zero liquid discharge’ policy and initiatives to convert waste streams into value-added products. It has received a high score from EcoVadis and awards like the “Make in India Partnering” Award from Rallis India and the “Safe-Tech” Award for its Mahad facility.

Industry Outlook

The global chemicals industry, valued at approximately USD 5.9 trillion in 2024, is a cornerstone of the world economy. The specialty chemicals segment, within this larger industry, is particularly dynamic.

Growth Trajectory and Market Size

The global specialty chemicals market was valued at USD 1,190 billion in 2024. It is projected to grow at a healthy CAGR of 8%, reaching nearly USD 1,748 billion by 2029. This growth is fueled by rising demand for customized, high-performance chemical solutions across downstream sectors.

Key Growth Drivers

- “China Plus One” Strategy: Global companies are diversifying their supply chains away from China due to rising costs and regulatory pressures. India, with its cost-competitive labour and growing manufacturing capabilities, is a prime beneficiary. India’s average daily wage is significantly lower than China’s, making it an attractive alternative for chemical production.

- Expanding End-User Industries: The demand for specialty chemicals is directly linked to the growth of key sectors such as:

- Pharmaceuticals: Need for advanced intermediates and APIs.

- Agrochemicals: Demand for crop protection chemicals and adjuvants.

- Performance Chemicals: Growth in lubricant additives and mining chemicals.

- PICA Sector: Steady demand from paints, construction, and adhesives.

Indian Market Context

The Indian chemical industry is well-positioned to capture a larger share of the global market. Government initiatives like production-linked incentive (PLI) schemes and a strong domestic manufacturing base are creating a favorable ecosystem. The industry is expected to see sustained investments, making it a sunrise sector for the Indian economy.

How Will Prasol Chemicals Limited Benefit

- Benefit from the global “China Plus One” trend, positioning it as a reliable alternative supplier for international customers seeking to de-risk their supply chains.

- Leverage its existing diverse product portfolio and R&D strength to capture a larger wallet share from its established global customer base.

- Capitalize on the projected 8% CAGR in the global specialty chemicals market to drive volume growth and expand its market presence.

- Utilize its government certifications and international registrations (REACH, K-REACH) to seamlessly enter and compete in regulated global markets.

- Increase penetration in high-growth end-user industries like pharmaceuticals and agrochemicals, where its products are critical intermediates.

- Enhance profitability through operational efficiencies and better absorption of fixed costs as capacity utilization at its Mahad facility ramps up.

- Pursue strategic acquisitions or technology partnerships to complement organic growth and enter new product segments within the expansive specialty chemicals space.

- Exploit its strong export distribution network and consignment stockist model to service smaller international customers with just-in-time deliveries, improving customer service and loyalty.

Peer Group Comparison

| Name of Company | Face Value (₹) | EPS (₹) | NAV (₹) | P/E (Diluted) | RoNW (%) |

| Prasol Chemicals Limited | 2 | 7.51 | 63.35 | [●] | 11.86% |

| Peer Group | |||||

| Aarti Industries Limited | 5 | 9.12 | 154.62 | 41.37 | 6.07% |

| Atul Limited | 10 | 164.37 | 1,923.24 | 36.83 | 9.22% |

| Laxmi Organics Limited | 2 | 4.07 | 68.84 | 52.23 | 6.13% |

| Vinati Organics Limited | 1 | 39.09 | 269.45 | 43.10 | 15.42% |

| Privi Speciality Chemicals Ltd | 10 | 47.30 | 286.19 | 51.27 | 17.95% |

| Yasho Industries Limited | 10 | 5.32 | 348.09 | 306.58 | 1.71% |

| Excel Industries Limited | 5 | 67.87 | 1,263.83 | 16.85 | 5.66% |

Key Strategies for Prasol Chemicals Limited

Capacity Expansion and Debottlenecking

Prasol Chemicals Limited plans to debottleneck and expand production capacities at its Khopoli and Mahad facilities to cater to anticipated demand growth. This strategy focuses on increasing output for key products like diacetone alcohol and phosphorous pentasulphide without significant capital expenditure, leveraging existing land bank to enhance operational scalability and market responsiveness.

Enhanced R&D and Product Innovation

The company will intensify its R&D focus to develop complex chemistries, support import substitution, and drive forward and backward integration. This involves expanding its application testing labs and commercializing new products, particularly for markets like mining and lubricant additives, to deepen customer engagement and improve value addition and margins.

Pursuing Inorganic Growth Opportunities

Prasol Chemicals Limited intends to pursue strategic acquisitions, technology licensing, and joint ventures to complement organic growth. This strategy aims to rapidly acquire new capabilities, enter adjacent product segments, and strengthen its overall manufacturing and technological footprint in the global specialty chemicals sector.

Geographic Expansion and Customer Wallet Share

The strategy involves deepening its global footprint by leveraging its direct marketing and distributor network. Prasol Chemicals Limited aims to increase wallet share with existing customers by becoming a preferred supplier and cross-selling its portfolio, while also using its international presence in Shanghai, London, Houston, and Rotterdam to onboard new clients.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Prasol Chemicals Limited IPO

How can I apply for Prasol Chemicals Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size for the Prasol Chemicals IPO?

The lot size and the minimum investment required will be announced closer to the IPO date.

What is the face value of Prasol Chemicals' shares?

The face value of Prasol Chemicals Limited’s equity shares is ₹2 per share.

Where will Prasol Chemicals shares be listed?

The equity shares will be listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Is the Prasol Chemicals IPO a fresh issue?

It is a composite issue with a fresh issue of ₹80 crores and an Offer for Sale (OFS) of ₹420 crores by existing shareholders.