- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Premier Industrial Corporation IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Premier Industrial Corporation IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Premier Industrial Corporation Limited

Premier Industrial Corporation Limited manufactures and supplies a wide range of electrical and industrial products. It is among the few companies operating in both powder and wire segments of the welding consumables industry. The company serves diverse sectors with durable, high-performance components, maintaining a strong focus on quality and customer satisfaction. Its product range includes ferro alloys, metals, chemicals, mineral powders, and various alloy wires. As of March 31, 2025, it operates five manufacturing facilities with a total annual capacity exceeding 27,000 MTPA.

Premier Industrial Corporation Limited IPO Overview

Premier Industrial Corporation Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Built Issue of 2.79 crore equity shares, comprising a fresh issue of up to 2.25 crore shares and an offer for sale of up to 0.54 crore shares. The equity shares are proposed to be listed on NSE and BSE. Unistone Capital Pvt. Ltd. is the book-running lead manager, while MUFG Intime India Pvt. Ltd. serves as the registrar. Details such as IPO dates, price bands, and lot size are yet to be announced. The promoters of the company include Arvind Chhotalal Morzaria, Dilip Chhotalal Morzaria, Subhash Chhotalal Morzaria, Lalit Navinchandra Morzaria, Smeet Morzaria, Meet Arvind Morzaria, and Anand Dilip Morzaria, holding 100% of the shares before the issue.

Premier Industrial Corporation Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 2.79 crore equity shares |

| Fresh Issue | 2.25 crore equity shares |

| Offer for Sale (OFS) | 0.54 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 7,99,60,698 shares |

| Shareholding post-issue | TBA |

Industrial Corporation IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Premier Industrial Corporation Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Premier Industrial Corporation Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.41 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.89% |

| Net Asset Value (NAV) | ₹24.75 |

| Return on Equity (RoE) | 29.73% |

| Return on Capital Employed (RoCE) | 25.98% |

| EBITDA Margin | 16.93% |

| PAT Margin | 10.75% |

| Debt to Equity Ratio | 0.52 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements of the Company towards Proposed Facility at Raigad, Maharashtra | 512.26 |

| Financing of capital expenditure requirements of the Company towards Proposed Expansion at Wada Unit | 589.61 |

| Funding the working capital requirements of the Company | 670 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

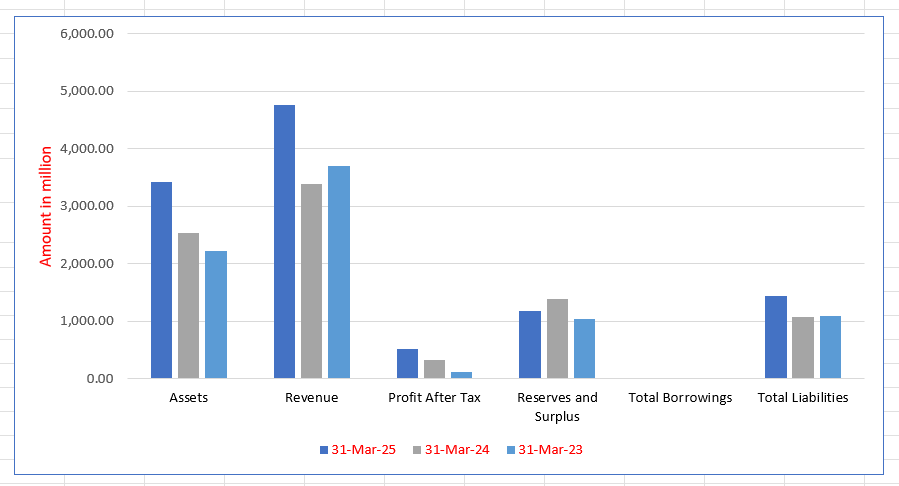

Premier Industrial Corporation Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,418.76 | 2,539.96 | 2,229.46 |

| Revenue | 4,763.89 | 3,394.88 | 3,706.45 |

| Profit After Tax | 512.26 | 335.68 | 126.69 |

| Reserves and Surplus | 1,179.03 | 1,383.69 | 1,049.37 |

| Total Borrowings | 1,029.50 | 830.94 | 913.86 |

| Total Liabilities | 1,440.13 | 1,072.28 | 1,096.10 |

Financial Status of Premier Industrial Corporation Limited

SWOT Analysis of Premier Industrial Corporation IPO

Strength and Opportunities

- Strong presence in both powder and wire segments.

- Diverse product portfolio including ferro alloy powders, metal powders, and alloy wires.

- Operates multiple manufacturing facilities with substantial production capacity.

- Expanding domestic and export markets for welding consumables.

- Benefits from India’s growing infrastructure and industrialisation.

- Opportunity to venture into advanced welding wires for aerospace and defence sectors.

- Potential to utilise IPO proceeds for business expansion and capacity enhancement.

- Rising global demand for speciality wires such as nickel-based and stainless steel variants.

- Scope to capture higher market share through government-led “Make in India” initiatives.

Risks and Threats

- High dependency on volatile raw material prices.

- Intense competition from larger global players.

- Relatively newer company in the organised welding consumables sector.

- Exposure to cyclical trends in end-user industries like construction and engineering.

- Requires continuous investment in technology and quality improvement.

- Margin pressure from unorganised local manufacturers.

- Increasing regulatory and environmental compliance costs.

- Foreign exchange fluctuations impacting imported raw materials.

- Technological disruptions like automation reducing demand for consumables.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Premier Industrial Corporation Limited

Premier Industrial Corporation Limited IPO Strengths

Tailored and Expanding Product Portfolio

Premier Industrial Corporation Limited (PICL) offers a specialized product portfolio of powders and wires customized to specific customer requirements and diverse industrial applications. The company’s over four decades of industry experience allows it to consistently adapt and expand its range, as evidenced by the 152 new SKUs introduced in the last three fiscals, demonstrating a strong capability for rapid product development.

Advanced and Strategically Located Manufacturing Facilities

PICL operates five manufacturing facilities with an aggregate installed capacity of 23,703 MTPA for powders and 4,194 MTPA for wires as of March 31, 2025. The strategic location of the four Maharashtra units near key industry hubs and ports provides PICL with logistical and cost advantages for efficient customer delivery. These advanced, ISO 9001:2015 certified facilities ensure quality production at scale.

Enduring Customer and Supplier Relationships

The corporation maintains long-standing relationships with both domestic and global customers and suppliers, evidenced by its high repeat customer rate (over 70% of customers and 85% of revenue in Fiscal 2025). This association, built on quality and customization, ensures revenue visibility and cross-selling opportunities. The strong supplier network also provides PICL with competitive pricing and supply chain resilience.

Strong Financial Performance and Internal Growth

PICL has demonstrated robust financial growth, primarily funded through internal accruals. The company’s Profit After Tax (PAT) grew at a CAGR of 59.31% from Fiscal 2023 to Fiscal 2025, reaching ₹512.26 million. This performance is supported by a consistent improvement in profit margins and key indicators, with Return on Equity (ROE) at 29.73% and a low Debt-to-Equity Ratio of 0.52 in Fiscal 2025.

Experienced Leadership and Professional Management

The company benefits from qualified and experienced Promoters who have been associated with the welding consumables business since 1979, providing crucial strategic vision and industry expertise. This leadership is supported by a professional management team with diverse experience. This collective depth of knowledge, combined with a low employee attrition rate, is key to operational continuity and sustained competitiveness.

More About Premier Industrial Corporation Limited

Premier Industrial Corporation Limited stands among the few companies in India that operate in both powder and wire categories of the welding consumables industry. According to the CRISIL Report, the company offers the widest range of metal, ferro alloy, chemical, and mineral-based powders among its peers. During Fiscal 2025, it contributed approximately 8% (4.9 KTPA) of the total domestic demand for metal and ferro alloy powders, underscoring its growing market presence.

Diverse Product Portfolio

- The company’s offerings include ferro alloy, metal, chemical, and mineral powders, along with low and non-alloy, stainless steel, and nickel-based alloy wires.

- These products are essential components in the welding consumables value chain, serving key industries such as construction, infrastructure, energy, automotive, aerospace, shipbuilding, and heavy engineering.

Strong Growth and Industry Position

- As per CRISIL, Premier Industrial Corporation has been one of the fastest-growing players between fiscals 2020–2025, achieving a revenue CAGR of 20%, surpassing competitors like Diffusion Engineers (16%).

- The company recorded an EBITDA CAGR of 31.4% and a PAT CAGR of 32.6%, both higher than the peer averages.

- Its Operating Profit Margin (OPM) rose from 8.7% in FY23 to 16.8% in FY25, while the Net Profit Margin (NPM) increased from 3.4% to 10.7%, reflecting operational efficiency and strong financial discipline.

Legacy and Operations

- The business traces its origins to 1979, initially operating as a partnership firm before being incorporated as a public limited company in 2007.

- Premier Industrial Corporation currently operates five manufacturing facilities across Maharashtra and Tamil Nadu, with a combined installed capacity of 27,897 MTPA.

- The company serves over 1,000 domestic customers and exports to 31 countries, including the USA, Australia, Russia, Indonesia, Malaysia, and South Africa.

Future Outlook

Premier Industrial Corporation plans to expand production capacity with new facilities at Khalapur, Raigad, and Wada, Maharashtra. Guided by experienced promoters—Arvind, Dilip, and Subhash Morzaria, along with the second-generation leadership—the company continues to enhance its product capabilities and global footprint.

Industry Outlook

The Indian welding consumables market is experiencing strong growth, driven by rapid industrialisation and expanding manufacturing activity. Valued at around USD 1,248 million in 2024, the market is projected to reach USD 2,100 million by 2033, growing at a CAGR of approximately 6% during 2025–2033. Globally, the welding consumables sector is also witnessing steady progress, expected to rise from USD 13.4 billion in 2022 to about USD 19.95 billion by 2032, indicating a CAGR of around 5.3%.

Growth Drivers

- Infrastructure Investments: India’s large-scale infrastructure development in construction, energy, and shipbuilding sectors continues to boost demand for welding consumables such as powders and wires.

- Automotive and Manufacturing Expansion: Increasing production and exports in the automotive and heavy machinery sectors are fuelling the requirement for specialised welding materials.

- Technological Advancements: The growing use of robotic, laser, and automated welding technologies is driving demand for high-quality wires and metal powders.

- Government Initiatives: The ‘Make in India’ programme and export-focused policies are encouraging local manufacturing and global competitiveness.

Relevant Product Segments

For manufacturers involved in metal powders, ferro-alloy powders, and alloy wires, the market outlook remains highly positive. The Indian metal powder segment, integral to welding consumables, was valued at about USD 305.9 million in 2024 and is expected to grow to USD 510.4 million by 2033, recording a CAGR of nearly 7%. Within welding consumables, stick electrodes, solid wires, flux-cored wires, and SAW wires dominate the market, with solid and flux-cored wires seeing rapid adoption due to their versatility and efficiency.

How Will Premier Industrial Corporation Limited Benefit

- Premier Industrial Corporation Limited is well positioned to benefit from the expanding Indian welding consumables market, projected to grow at around 6% CAGR, with increased demand for both powders and wires.

- Its dual presence in powder and wire categories enables the company to capture opportunities from multiple high-growth industrial segments.

- The expected 7% CAGR in metal and ferro-alloy powders directly aligns with its core product range, enhancing revenue potential.

- Rising infrastructure projects and industrial automation will increase the need for durable, high-performance welding materials, strengthening demand for its products.

- The company’s focus on quality, innovation, and export capability supports long-term competitiveness in both domestic and global markets.

- Expanding facilities in Khalapur and Wada will help meet growing capacity requirements and improve operational scalability.

- Government initiatives promoting manufacturing and exports further reinforce its growth prospects and market leadership.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Premier Industrial Corporation Limited

Expansion for Wire Product Demand

Premier Industrial Corporation Limited (PICL) plans to expand its Wada Unit capacity by 5,000 MTPA to 9,194 MTPA for wire products. This strategy capitalizes on the structural shift in the Indian welding consumables market toward wire consumption, strengthening PICL’s competitive position by enhancing capacity, improving economies of scale, and catering to a larger customer base.

New Facility for Powder Product Capacity

PICL intends to establish a new 15,000 MTPA powder manufacturing unit at Khalapur, Maharashtra, utilizing ₹512.26 million from net proceeds. This expansion directly addresses the high capacity utilization of its current four powder units and positions the company to meet the anticipated 8.5%-9.5% CAGR growth in demand for metal and ferro alloy powders, thereby boosting profitability.

Global Market Expansion

The corporation aims to further expand its international footprint from the current 31 countries to regions like Vietnam, Ukraine, and Germany, targeting higher-margin opportunities. PICL will leverage warehousing in the USA, trade fairs, and its proven ability to meet global specifications to diversify revenue and capitalize on global supply chain realignments, such as the US-China trade tensions.

Backward Integration for Efficiency

PICL’s strategy involves implementing backward integration at the Wada Unit to captively manufacture critical raw materials like ferro chrome low carbon and ferro molybdenum. This measure will allow PICL to better control raw material quality and availability, reduce reliance on external suppliers, improve cost efficiency, minimize supply failure risks, and secure a competitive advantage.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Premier Industrial Corporation Limited IPO

How can I apply for Premier Industrial Corporation Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Premier Industrial Corporation Limited IPO?

It is a Book-Build Issue of 2.79 crore equity shares, including both fresh issue and offer for sale.

How many shares are being offered in the IPO?

The IPO includes 2.25 crore fresh equity shares and 0.54 crore shares under offer for sale.

On which exchanges will the IPO be listed?

The equity shares of Premier Industrial Corporation Limited will be listed on BSE and NSE.

Who are the lead manager and registrar for the IPO?

Unistone Capital Pvt. Ltd. is the lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

What are the main objectives of the IPO issue?

Funds will be used for capacity expansion at Raigad and Wada, working capital, and general corporate purposes.