- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pride Hotels IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Pride Hotels IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Pride Hotels Limited IPO

Incorporated in 1983, Pride Hotels Ltd is an Indian hospitality brand that owns, operates, and manages hotels under “Pride Hotels and Resorts.” It has 34 properties with 2,723 rooms across 32 cities, including 7 owned and 27 managed hotels. Operating four sub-brands—Pride Plaza, Pride Premier, Pride Elite, and Biznotel by Pride—the company caters to business, leisure, and pilgrim travelers. It also generates revenue through F&B outlets, banquets, spas, retail, and events, serving corporates like SpiceJet, Adani, and Air India, and partnering with travel platforms such as MakeMyTrip and Booking.com.

Pride Hotels Limited IPO Overview

Pride Hotels Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, to raise funds through an Initial Public Offer (IPO). The IPO will follow a book-building route and comprises a fresh issue worth ₹260.00 crores along with an offer for sale (OFS) of up to 3.92 crore equity shares. The company proposes to list its shares on both the NSE and BSE. Motilal Oswal Investment Advisors Ltd. has been appointed as the book running lead manager, while Kfin Technologies Ltd. will serve as the registrar for the issue. Key details such as the IPO dates, price band, and lot size are yet to be announced. Prior to the IPO, Pride Hotels has a total of 18,55,91,970 shares outstanding.

The promoters of the company include Sureshchand Premchand Jain, Satyen Suresh Jain, Meena Sureshchand Jain, A.S.P. Enterprises Pvt Ltd, Kopra Estate Pvt Ltd, Pride Plaza (I) Pvt Ltd, and The Executive Inn Ltd, holding 99.82% of the equity before the issue. The IPO will consist of a combination of fresh capital and an offer for sale, with a face value of ₹5 per share. Further details regarding the IPO can be found in the Pride Hotels IPO DRHP.

Pride HotelsLimited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹260 crore |

| Offer for Sale (OFS) | 3.92 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 18,55,91,970 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Pride Hotels Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Pride Hotels Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.50 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 20% |

| Net Asset Value (NAV) | ₹22.50 |

| Return on Equity (RoE) | 12.71% |

| Return on Capital Employed (RoCE) | 19.18% |

| EBITDA Margin | 47.07 |

| PAT Margin | 26.16% |

| Debt to Equity Ratio | 0.04 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure towards renovation of existing hotels | |

| Repayment and prepayment in full of part of certain borrowings | |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

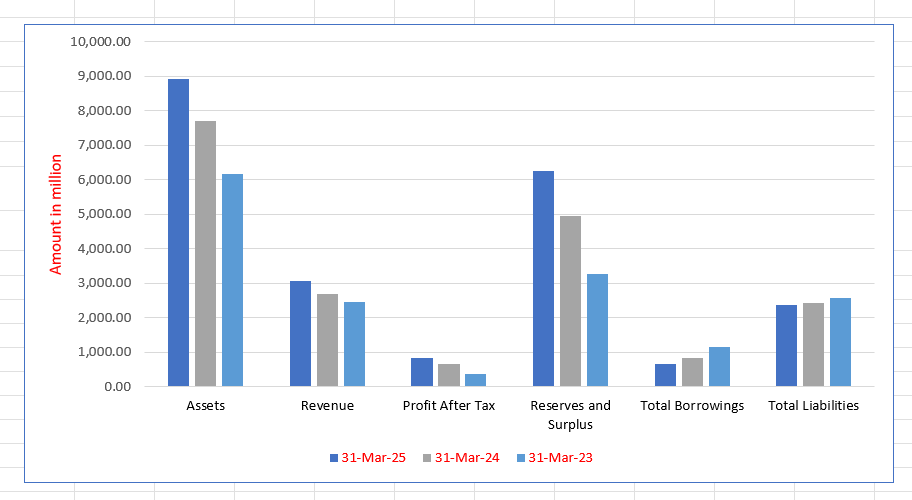

Pride Hotels Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 8,933.03 | 7,698.68 | 6,159.13 |

| Revenue | 3,056.20 | 2,700.44 | 2,461.91 |

| Profit After Tax | 835.05 | 660.30 | 376.63 |

| Reserves and Surplus | 6,260.40 | 4,966.65 | 3,278.18 |

| Total Borrowings | 651.35 | 831.81 | 1,156.62 |

| Total Liabilities | 2,363.31 | 2,422.71 | 2,571.63 |

SWOT Analysis of Pride Hotels IPO

Strength and Opportunities

- Strong multibrand portfolio covering upscale to midscale guests.

- Presence across many Indian cities and regions, enabling geographical diversification.

- Assetlight model via management contracts reduces capital intensity.

- Strong brand legacy with Indian hospitality focus appealing to business and leisure travellers.

- Improving debt metrics and comfortable gearing thanks to cost optimisation.

- Opportunity to capitalise on rising domestic travel demand and weddings/MICE events.

- Expansion into tierII/III cities opens growth potential in underpenetrated markets.

- Diversified revenue streams (rooms, F&B, events, spas) boost resilience.

- Strong push towards talent development and female representation strengthens workforce diversity.

Risks and Threats

- Moderate scale of operations relative to larger hotel chains.

- High dependence on a few key properties for substantial revenues.

- Liquidity remains stretched with limited undrawn working capital.

- Competitive pressure from domestic and international hotel chains.

- Revenue and profitability vulnerable to exogenous shocks like pandemics or natural disasters.

- Brand reputation risk if service quality or guest experience declines.

- Execution risk for new projects and management contracts—delays or cost overruns may hurt growth.

- Reliance on third party owners for managed hotels could lead to risks of nonrenewal or termination.

- Supply of new hotel rooms in India could increase, limiting pricing power.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Pride Hotels Limited

Pride Hotels Limited IPO Strengths

Pan-India Reach and Diversified Portfolio

Pride Hotels Limited boasts a Pan-India presence with a strategically located and diversified portfolio of 34 operational hotels and resorts, comprising 2,723 keys as of the Draft Red Herring Prospectus. Its operations span four sub-brands across the upscale, upper midscale, and midscale segments, positioning the company as the fourth largest family-promoted domestic chain and the sixth largest in its segments in terms of chain-owned inventory as of June 30, 2025.

Full-Service Customized Properties

The company offers full-service hotels designed to meet diverse customer needs with customized properties. These include a variety of rooms (from Superior to Suites) and comprehensive amenities like over 50 F&B outlets, banquets, spas, and wellness centers. This diversified offering, which includes dedicated efforts for solo women travelers, attracts a broad clientele, thereby diversifying the revenue base and mitigating risks from industry seasonality.

Strategic Location Identification

Pride Hotels Limited possesses a core strength in accurately identifying property locations with high growth potential, leveraging over 38 years of market experience. This expertise allows the company to secure accessible, central locations in key business, leisure, and pilgrimage markets. This early-mover advantage, as seen in locations like Ahmedabad’s SG Highway, ensures properties are positioned for sustained demand and cultivate brand loyalty as surrounding areas develop.

Strong Brand Legacy and Indian Ethos

Operating under the well-recognized “Pride Hotels and Resorts” brand, the company has a strong legacy of over three decades in the Indian hospitality sector. The brand philosophy, “Truly Indian. Traditionally Luxurious,” integrates Indian culture into the guest experience through traditional welcomes, local artwork, regional music, and authentic regional Indian cuisines, appealing to a broad and diverse client base across its four sub-brands.

Asset-Light Model and Turnaround Expertise

The company employs an asset-light business model through its Managed Portfolio (27 hotels, 1,587 keys as of the DRHP date), which minimizes capital investment while expanding brand reach and enhancing total income. Furthermore, Pride Hotels Limited has a track record of acquiring and turning around underperforming properties, leveraging its management expertise to maintain low capital costs and drive robust financial performance, as evidenced by high PAT margins.

Focus on Operational Efficiency

Pride Hotels Limited prioritizes operational efficiencies and active asset management. This includes centralized procurement for cost savings, diligent monitoring of the Guest Satisfaction Index (GSI), and the adoption of renewable green energy solutions. Strategic asset management, like refurbishment and repurposing of spaces, along with consistent brand-building through campaigns such as “India Dekho with Pride,” collectively enhances service quality, brand visibility, and overall profitability.

More About Pride Hotels Limited

Pride Hotels Limited is a homegrown Indian hospitality brand with over 38 years of experience in owning, developing, operating, and managing a diversified chain of hotels and resorts under the “Pride Hotels and Resorts” banner. The company operates through two models: ownership of hotels (including via group companies) and hotel management agreements with third-party owners. As of the Draft Red Herring Prospectus, the company’s portfolio comprised 2,723 keys across 34 operational hotels, including seven owned hotels with 1,136 keys and 27 managed hotels with 1,587 keys. Among family-promoted hotel groups, Pride Hotels is the fourth largest domestic chain and ranks sixth in India in terms of owned inventory in the upscale, upper midscale, and midscale segments.

Growth and Milestones

Since commencing operations in 1987 with its first hotel in Pune, Pride Hotels has expanded to 32 cities across India, acquiring hotels in Ahmedabad, Nagpur, Chennai, and Kolkata, and building new properties in Bengaluru and New Delhi. In 2008, the company adopted an asset-light model through management contracts. Over the years, it has strategically diversified across business, leisure, and pilgrimage destinations.

Brand Portfolio

Pride Hotels operates under four distinct sub-brands:

- Pride Plaza: Upscale hotels catering to business, leisure, and social events in cities like Delhi, Ahmedabad, Jaipur, and Kolkata.

- Pride Premier: Upper midscale hotels focusing on accessibility and personalized service in regional hubs such as Nagpur, Pune, Indore, and Mussoorie.

- Pride Elite: Midscale hotels targeting leisure travelers in scenic and culturally significant locations, including Haridwar, Dwarka, and Daman.

- Biznotel by Pride: Midscale properties aimed at business travelers and transit guests in cities like Surat, Vadodara, and Bharuch.

Revenue Streams and Operations

Pride Hotels derives revenue from both room and non-room services, including F&B outlets, banquets, spas, fitness centers, retail, and event management. The company operates over 50 F&B outlets and 90 banquet halls with a combined area of approximately 350,000 square feet, capable of hosting events for 10 to 3,000 guests. Its client base spans major corporates such as SpiceJet, Adani, Air India, and travel partners including MakeMyTrip, Booking.com, and Cleartrip, providing diversified and stable revenue channels.

Strategic Positioning

The company’s owned hotels are located in top markets contributing nearly 47% of air traffic and 36% of hotel inventory supply. Prime locations, such as Pride Plaza Aerocity in New Delhi, Pride Premier Pune, and Pride Plaza Ahmedabad, highlight the focus on gateway connectivity and business travel. Pride Hotels also maintains a strong pipeline of 21 hotels under development and 11 additional properties under letters of intent, ensuring growth across business, leisure, and pilgrimage segments.

Industry Outlook

The Indian hospitality industry is undergoing a significant transformation, underpinned by strong domestic travel demand and a revival in business events. In FY2024, the overall market revenue reached approximately US$281.8 billion, with national occupancy around 68%, average daily rate (ADR) about US$97, and revenue per available room (RevPAR) near US$66.

Growth Prospects & Key Figures

- Forecasts suggest revenues could reach US$541.7 billion by 2030, implying a compound annual growth rate (CAGR) of circa 14% from 2025 to 2030.

- Another estimate projects a market size of US$798.95 billion by 2033 (from US$243.56 billion in 2024), yielding a CAGR of about 14.1% for 2025–2033.

- Specific to hotel rooms, demand is expected to grow at about 9.7% CAGR through FY2028, while roomsupply growth will lag (~2.5% CAGR), creating a favourable demandsupply gap.

Growth Drivers

- Rising domestic travel (leisure, weddings, pilgrimage) and increasing business/MICE (meetings, incentives, conferences, exhibitions) activity are central growth drivers.

- Improved air connectivity, infrastructure development, and government tourism initiatives, such as tax incentives and increased investments, also bolster the sector.

- Shift in consumer behaviour: greater demand for midscale to upscale branded hotels, stronger interest in destination stays, tierII/III city expansions, and branded leisure concepts.

Outlook for Hotel Operations (Rooms and NonRooms)

- For the hotel segments relevant to branded chains (upscale, upper midscale, midscale), occupancy is estimated to rise to 7075% in the near term, and ADRs are expected to increase as demand outpaces new supply.

- Nonroom revenue streams, including food & beverages, banquets, spas, and event spaces, will continue to gain importance, supported by social events, weddings, and corporate gatherings.

- The assetlight management/contract model is likely to dominate growth strategies as hotel chains seek lower capital intensity and faster footprint expansion.

Challenges & Key Considerations

- While demand is strong, margin pressure remains due to rising operating costs, the need for skilled manpower, and fragmented regulatory landscapes across states.

- Oversupply in some markets and intense competition, especially in midscale and transit segments, may moderate growth in certain locations.

How Will Pride Hotels Limited Benefit

- Pride Hotels Limited is well-positioned to capitalise on the growing domestic travel and leisure demand, especially across tier-II and tier-III cities.

- The company’s diversified portfolio across upscale, upper midscale, and midscale segments allows it to capture demand from multiple customer segments, including business, leisure, and pilgrim travelers.

- Increasing occupancy and higher ADR trends in the hospitality sector are likely to improve the revenue and profitability of Pride Hotels’ owned and managed properties.

- Growth in non-room revenues, including F&B, banquets, spas, and event services, provides additional income streams and reduces reliance on room revenue.

- Expansion through asset-light management contracts enables faster scaling with lower capital intensity, increasing operational efficiency and reach.

- Strong brand recognition and a national presence in key business, leisure, and pilgrimage markets allow Pride Hotels to capture both domestic and inbound travel demand.

- Strategic locations near airports, business hubs, and popular destinations enhance the company’s ability to attract corporate and high-value customers.

- The rising trend of destination weddings, corporate events, and social gatherings presents significant ancillary revenue opportunities.

- Overall, the industry’s robust CAGR and favourable demand-supply gap support Pride Hotels’ long-term growth strategy.

Peer Group Comparison

| Name of Company | Face Value (₹ per share) | P/E – Based on Diluted EPS | EPS – Basic (₹) | EPS – Diluted (₹) | RoNW (%) | NAV (₹ per share) | Revenue from Operations (₹ million) |

| Pride Hotels Limited | 5.00 | 4.50 | 4.50 | 4.50 | 20.00% | 22.50 | 3,056.20 |

| Peer Group | |||||||

| Indian Hotels Company Limited | 1.00 | 57.83 | 13.40 | 13.41 | 7.96% | 79.70 | 83,345.40 |

| ITC Hotels Limited | 1.00 | 77.69 | 3.05 | 3.05 | 5.74% | 53.36 | 35,598.10 |

| EIH Limited | 2.00 | 33.15 | 11.82 | 11.82 | 16.83% | 73.15 | 27,431.46 |

| Schloss Bangalore Limited | 10.00 | 212.97 | 1.97 | 1.97 | 0.82% | 209.70 | 13,005.73 |

| Lemon Tree Hotels Limited | 10.00 | 69.88 | 2.48 | 2.48 | 14.91% | 20.60 | 12,860.78 |

| Apeejay Surrendra Park Hotels Limited | 1.00 | 40.24 | 3.92 | 3.92 | 6.51% | 60.17 | 6,314.50 |

| Kamat Hotels (India) Limited | 10.00 | 19.85 | 15.96 | 15.61 | 7.03% | 92.79 | 3,569.70 |

| Royal Orchid Hotels Limited | 10.00 | 29.33 | 17.23 | 17.23 | 20.08% | 86.27 | 3,194.70 |

Key Strategies for Pride Hotels Limited

Strengthening and Expanding the Brand Portfolio

The company plans to cultivate a robust portfolio by enhancing its four core brands and launching the upper-upscale ‘Pride Luxe’ brand. This includes using performative marketing and strengthening the ‘Pride Privilege’ loyalty program to boost direct bookings, brand awareness, and customer retention across the upscale to midscale segments.

Pan-India Network Expansion Strategy

Pride Hotels will expand its hotel network through an asset-light Managed Portfolio model, deepening its presence in existing high-growth markets and entering new geographies. It aims to develop a cluster-based strategy in underpenetrated Southern and Eastern India, while selectively pursuing strategic, turnaround-potential Owned Portfolio opportunities.

Capacity Expansion and Upgradation

The strategy involves expanding capacity and upgrading facilities at selected properties to capitalize on local economic growth and meet evolving customer preferences. This includes key renovation projects, increasing the number of keys at properties like Nagpur, and adding premium amenities such as larger banquet halls, spas, and fitness centers to boost market positioning and asset value.

Consolidating the Food & Beverage Portfolio

Pride Hotels intends to consolidate and strengthen its F&B portfolio by ensuring each property features at least one of its proprietary dining brands (e.g., Casablanca, Puran Da Dhaba). This move aims to standardize quality, drive brand recall, enhance cross-selling, and consistently increase the valuable non-room revenue stream.

Continuous Operational Efficiency Improvement

The company will improve operational metrics (ADR, RevPAR) by investing in new technology (e.g., cloud-based systems) and strengthening data analytics for personalized services and dynamic pricing. It will also upgrade procurement, improve staff productivity, and deploy sustainable measures to lower costs and enhance overall efficiency.

Exploring Lease Models and Inorganic Growth

Pride Hotels will diversify its expansion strategy by introducing a third model: long-term hotel leasing, complementing its Owned and Managed Portfolios. This capital-light approach, alongside evaluating inorganic growth opportunities through acquisitions, will accelerate market entry, achieve scale rapidly, and strengthen its presence in key locations.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Pride Hotels Limited IPO

How can I apply for Pride Hotels Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Pride Hotels Limited IPO about?

Pride Hotels IPO is a Book Build Issue to raise funds via fresh issue and offer for sale.

How much is the company raising through the IPO?

The IPO proposes a fresh issue of ₹260 crore and an offer for sale of up to 3.92 crore shares

Where will Pride Hotels IPO shares be listed?

The equity shares are planned to be listed on the NSE and BSE for public trading.

Who are the lead manager and registrar for the IPO?

Motilal Oswal Investment Advisors Ltd. is the lead manager, and Kfin Technologies Ltd. acts as the registrar.

What are the main objects of the IPO proceeds?

Proceeds will fund hotel renovations, repay borrowings, and support general corporate purposes for business growth.